Commercial enterprises are. Production cooperatives

In accordance with Article 50 of the Civil Code, all legal entities in the Russian Federation are divided into and non-commercial.

The purpose of commercial organizations is to make a profit and distribute it among all participants.

The list of types of commercial organizations is closed. These include:

1) business companies and partnerships;

2) unitary, state;

3) production cooperatives.

Non-profit organizations are created Non-profit organizations do not aim to make a profit. They have the right to exercise but the profit cannot be distributed among the participants, it is spent in accordance with the purposes for which the organization was created. During the creation commercial organization a bank account, an estimate and a personal balance sheet must be formed. The list of non-profit organizations specified in the Code is not exhaustive.

So what legal entities are non-profit organizations?

Non-profit organizations include:

1) Religious, public organizations and associations.

Carry out activities in accordance with the purposes for which they were created. Participants are not liable for the obligations of organizations, and those, in turn, for the obligations of members;

2) Non-Profit Partnerships- Established by citizens or legal entities persons and based on the principle of membership non-profit organizations, to assist the members of the organization in the implementation of activities that are aimed at achieving the goals;

3) The form of a non-profit organization is also an institution - an organization funded by the owner, which was created to carry out managerial and other functions of a non-profit nature. If the property of the institution is insufficient, the owner shall bear subsidiary liability for obligations.

4) Autonomous non-profit organizations. They are created to provide services in the field of education, culture, healthcare, sports, and other services on the basis of property contributions.

5) Non-profit organizations include various kinds of foundations. The Foundation is an organization that does not have membership, pursuing charitable, social, cultural goals and created on the basis of property contributions. It has the right to engage in entrepreneurial activities to achieve the goals of creation.

6) Associations and unions. They are created by commercial organizations in order to coordinate entrepreneurial activity and protection of property interests.

7) Non-profit organizations also include consumer cooperatives - associations (voluntary) of citizens and legal entities created to meet material and other needs on the basis of pooling property shares.

Each of the forms of a non-profit organization has its own characteristics that meet the goals of its creation.

Creation of a non-profit organization.

Registration takes place within 2 months. It is necessary to prepare documentation for registration:

Information about the address of the location;

Application for registration, notarized;

Constituent documents;

Decision to establish a non-profit organization;

State fees.

The non-profit organization has been established since state registration, after which it can carry out its activities. Such an organization does not have a term of activity, so it may not re-register. In case of liquidation of a non-profit organization, payments are made to all creditors, and the remaining funds are spent on the purposes for which the organization was created.

The Civil Code of the Russian Federation classifies legal entities into commercial and non-profit organizations.

Commercial organizations- These are legal entities that pursue profit as the main goal of their activities.

Non-Profit Organizations- these are legal entities that do not have profit making as such a goal and do not distribute the profit received among the participants. commercial organizations, with the exception of unitary enterprises and other organizations provided for by law, are endowed with general legal capacity (Article 49 of the Civil Code of the Russian Federation) and can carry out any type of entrepreneurial activity not prohibited by law, if the constituent documents of such commercial organizations do not contain an exhaustive (complete) a list of activities that the relevant organization is entitled to engage in. Unitary enterprises, as well as other commercial organizations for which the law provides for special legal capacity (banks, insurance organizations and some others), are not entitled to make transactions that contradict the goals and subject of their activities, defined by law or other legal acts. Such transactions are void. Transactions made by other commercial organizations, contrary to the goals of activity, specifically limited in their constituent documents, may be recognized by the court as invalid in the cases provided for in Article 173 of the Civil Code.

Another classification of legal entities, provided for by the Civil Code of the Russian Federation, is based on the peculiarities of the rights of the founders (participants) of a legal entity to the property of a legal entity. Legal entities in respect of which their participants have rights of obligation include business partnerships and companies, production and consumer cooperatives. Legal entities, on the property of which their founders have the right of ownership or other real right, include state and municipal unitary enterprises and owner-funded institutions. Legal entities in respect of which their founders (participants) do not have property rights (neither real nor liability rights) include public and religious organizations, charitable and other foundations, associations of legal entities.

A. Commercial organizations

The Civil Code of the Russian Federation exhaustively defines the types of commercial organizations. These include:

business partnerships and companies,

state and municipal unitary enterprises,

production cooperatives .

Business partnerships and companies

Business partnerships and companies recognized as commercial organizations with shares (contributions) of founders (participants) authorized (reserve) capital. TO business partnerships relate:

general partnerships,

limited partnerships (limited partnerships).

TO business companies relate:

joint-stock company,

Limited Liability Company,

additional liability company.

Participants in general partnerships and general partners in limited partnerships may be:

individual entrepreneurs,

and/or commercial organizations.

Participants of business companies and investors in limited partnerships may be:

citizens

and legal entities.

State bodies and bodies of local self-government are not entitled to act as participants in economic companies and investors in limited partnerships, unless otherwise provided by law. Institutions financed by owners may be participants in economic companies and investors in partnerships with the permission of the owner, unless otherwise provided by law. The law may prohibit or restrict the participation of certain categories of citizens in business partnerships and companies, with the exception of open joint-stock companies. TO common features of business partnerships and companies relate:

Division of authorized (share) capital into shares (shares).

A contribution to property may be money, securities, other things or property rights or other rights having a monetary value. Monetary valuation of the contribution of a participant in a business company is made by agreement between the founders (participants) of the company and, in cases provided for by law, is subject to independent expert verification.

The same type of management structure, the supreme governing body in which is the general meeting of participants.

Business partnerships and companies may be founders (participants) of other business partnerships and companies, with the exception of cases provided for by the Civil Code of the Russian Federation and other laws.

Rights and obligations of participants

General partnership - a partnership, the participants of which (general partners), in accordance with the agreement concluded between them, are engaged in entrepreneurial activities on behalf of the partnership and are liable for its obligations with their property (Article 69 of the Civil Code of the Russian Federation). The liability of participants in a full partnership is joint and several-subsidiary. Faith partnership(limited partnership) - a partnership in which, along with participants carrying out entrepreneurial activities on behalf of the partnership and liable for the obligations of the partnership with their property (general partners), there are one or more participants - contributors (limited partners) who bear the risk of losses associated with the activity partnerships, within the limits of the amounts of contributions made by them and do not take part in the implementation of entrepreneurial activities by the partnership. A general partnership and a limited partnership are created on the basis of a memorandum of association. Limited Liability Company- a company founded by one or more persons, the authorized capital of which is divided into shares of the sizes determined by the constituent documents; participants in a limited liability company are not liable for its obligations and bear the risk of losses associated with the activities of the company, to the extent of the value of their contributions. The founding documents of a limited liability company are:

memorandum of association,

If a company is founded by one person, its founding document is the charter. The number of participants in a limited liability company must not exceed 50 participants. Otherwise, it is subject to transformation into a joint-stock company within a year, and after the expiration of this period - to liquidation by judicial procedure, if the number of its participants does not decrease to the limit established by law. The supreme body of a limited liability company is general meeting its members. The charter of a company may provide for the formation of a board of directors (supervisory board) of the company. An executive body (collegiate and (or) sole) is created in a limited liability company, which carries out the current management of its activities and is accountable to the general meeting of its participants. The sole management body of the company may also be elected from among its members. The legal status of limited liability companies is regulated by federal law dated February 8, 1998 No. 14-FZ “On Limited Liability Companies”13. Overview of questions judicial practice on cases related to the activities of limited liability companies, is given in the Decree of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 9, 1999 No. 90/14 “On Certain Issues of the Application of the Federal Law “On Limited Liability Companies”14.

Additional Liability Company- it is a company established by one or more persons, the authorized capital of which is divided into shares of the sizes determined by the constituent documents; the participants in such a company jointly and severally bear subsidiary liability for its obligations with their property in the same multiple for all to the value of their contributions, determined by the constituent documents of the company. In case of bankruptcy of one of the participants, his liability for the obligations of the company is distributed among the other participants in proportion to their contributions, unless a different procedure for the distribution of responsibility is provided for by the constituent documents of the company. The rules on a limited liability company apply to an additional liability company.

Joint-stock company - a company whose authorized capital is divided into a certain number of shares; participants of a joint-stock company (shareholders) are not liable for its obligations and bear the risk of losses associated with the activities of the company, to the extent of the value of their shares. The main feature of a joint-stock company is the division of the authorized capital into shares. Shares can only be issued by a joint-stock company. The legal status of joint-stock companies is regulated by federal laws No. 208-FZ of December 26, 1995 “On Joint-Stock Companies”15, of July 19, 1998 No. 115-FZ “On the Peculiarities of the Legal Status of Joint-Stock Companies of Employees (Public Enterprises)”16. An overview of judicial practice in cases related to the activities of joint-stock companies is given in Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003 N 19 "On Certain Issues of Application of the Federal Law "On Joint-Stock Companies".

Types of joint-stock companies:

Public corporation;

Closed Joint Stock Company;

Joint Stock Company of Workers (People's Enterprise).

Unlike an open joint stock company closed joint stock company is not entitled to conduct an open subscription to the shares issued by him or otherwise offer them for purchase to an unlimited number of persons. Shareholders of a closed joint stock company have the pre-emptive right to acquire shares sold by other shareholders of this company. The number of participants in a closed joint stock company must not exceed 50 participants. Joint Stock Company of Workers (People's Enterprise)- a joint-stock company whose employees own a number of shares of a people's enterprise, the nominal value of which is more than 75 percent of its authorized capital. Subsidiary business company - this is a business company in respect of which another (main) business company or partnership, by virtue of the predominant participation in its authorized capital, or in accordance with an agreement concluded between them, or otherwise has the ability to determine the decisions made by such a company. A subsidiary company is not liable for the debts of the main company (partnership). The parent company (partnership), which has the right to give instructions to the subsidiary, including under an agreement with it, instructions that are mandatory for it, is jointly and severally liable with the subsidiary for transactions concluded by the latter in pursuance of such instructions. Dependent business company- a business company in respect of which another (predominant, participating) company has more than:

or twenty percent of the charter capital of a limited liability company.

A business company that has acquired more than twenty percent of the voting shares of a joint-stock company or twenty percent of the charter capital of a limited liability company is obliged to immediately publish information about this in the manner prescribed by laws on business companies.

Production cooperative (artel) is a voluntary association of citizens on the basis of membership for joint production or other economic activities (production, processing, marketing of industrial, agricultural and other products, performance of work, trade, consumer services, provision of other services), based on their personal labor and other participation and association of its members (participants) of property share contributions. The law and constituent documents of a production cooperative may provide for the participation of legal entities in its activities.

To the main features of a production cooperative include the following:

the production cooperative is based on the principles of membership,

is a commercial organization

represents not only the association of the property of the participants, but also the association of personal labor participation,

distribution of profits depends on labor participation,

the minimum number of participants is five members,

members of a production cooperative shall bear subsidiary liability for the obligations of the cooperative in the amount and in the manner prescribed by the law on production cooperatives and the charter of the cooperative.

The legal status of production cooperatives is regulated by federal laws of May 8, 1996 No. 41-FZ “On production cooperatives”18, of December 8, 1995 No. 193-FZ “On agricultural cooperation”19. State and municipal unitary enterprises is a commercial organization that is not endowed with the right of ownership of the property assigned to it by the owner. The property of a unitary enterprise is indivisible and cannot be distributed among contributions (shares, shares), including among employees of the enterprise. Types of unitary enterprises: 1. Unitary enterprise based on the right of economic management. The enterprise is not entitled to dispose of immovable property without the consent of the owner. The owner of the property of an enterprise based on the right of economic management is not liable for the obligations of the enterprise. 2. Unitary enterprise based on law operational management(state-owned enterprise) A unitary enterprise is not entitled to dispose of both movable and immovable property without the consent of the owner. In this case, the owner may withdraw excess, unused or misused property. The owner of the property of a state-owned enterprise bears subsidiary liability for the obligations of such an enterprise if its property is insufficient. The legal status of unitary enterprises is regulated by the Federal Law of November 14, 2002 No. 161-FZ “On State and Municipal Unitary Enterprises”.

B. Non-Profit Organizations

non-profit organization is an organization that does not have profit making as the main goal of its activities and does not distribute the profit received among the participants. Non-profit organizations can be created in the form of:

public or religious organizations (associations),

non-profit partnerships

institutions,

autonomous non-profit organizations,

social, charitable and other funds,

associations and unions,

as well as in other forms stipulated by federal laws.

Non-profit organizations can be created to achieve the following goals: social, charitable, cultural, educational, scientific and managerial, as well as to protect the health of citizens, development physical culture and sports, meeting the spiritual and other non-material needs of citizens, protecting the rights, legitimate interests of citizens and organizations, resolving disputes and conflicts, providing legal assistance, as well as for other purposes aimed at achieving public benefits.

consumer cooperative- a voluntary association of citizens and legal entities on the basis of membership in order to meet the material and other needs of the participants, carried out by combining property share contributions by its members. Members of a consumer cooperative are obliged, within three months after the approval of the annual balance sheet, to cover the resulting losses through additional contributions. In case of failure to fulfill this obligation, the cooperative may be liquidated in court at the request of creditors. Members of a consumer cooperative jointly and severally bear subsidiary liability for its obligations within the limits of the unpaid part of the additional contribution of each of the members of the cooperative. Income received by a consumer cooperative from entrepreneurial activity is distributed among its members. The legal status of consumer cooperatives is regulated by the Federal Law of July 11, 1997 No. 97-FZ “On Amendments and Additions to the Law Russian Federation"On consumer cooperation in the Russian Federation"21 and other regulatory legal acts. Public and religious organizations - voluntary associations of citizens united in the manner prescribed by law on the basis of their common interests to satisfy spiritual or other non-material needs. Public and religious organizations (associations) have the right to carry out entrepreneurial activities corresponding to the goals for which they were created. Participants (members) of public and religious organizations (associations) do not retain the rights to property transferred by them to these organizations in ownership, including membership fees. Participants (members) of public and religious organizations (associations) are not liable for the obligations of these organizations (associations), and these organizations (associations) are not liable for the obligations of their members. The legal status of these organizations is regulated by federal laws of September 26, 1997 No. 125-FZ "On freedom of conscience and religious associations", of January 12, 1996 No. 7-FZ "On non-profit organizations", of May 19, 1995 No. 82-FZ "On public associations" and other regulatory legal acts. Fund - a non-profit organization without membership established by citizens and (or) legal entities on the basis of voluntary property contributions and pursuing social, charitable, cultural, educational or other socially useful goals. The property transferred to the foundation by its founders (founder) is the property of the foundation. The founders are not liable for the obligations of the fund they have created, and the fund is not liable for the obligations of its founders. The foundation uses the property for the purposes determined by the charter of the foundation. The Foundation has the right to engage in entrepreneurial activities that correspond to these goals and are necessary to achieve the socially useful goals for which the Foundation was created. In order to carry out entrepreneurial activities, foundations have the right to create business companies or participate in them. The Foundation is required to publish annual reports on the use of its assets. The decision to liquidate the foundation can only be taken by the court upon the application of interested persons. The Fund may be liquidated in the following cases:

if the property of the fund is not enough to achieve its goals and the probability of obtaining the necessary property is unrealistic;

if the goals of the fund cannot be achieved and the necessary changes to the goals of the fund cannot be made;

in case of deviation of the fund in its activities from the goals provided for by the charter;

in other cases provided by law.

institution is a non-profit organization created by the owner to carry out managerial, socio-cultural or other functions of a non-profit nature and financed in whole or in part by this owner. The property of the institution is assigned to it on the basis of the right of operational management. The institution is responsible for its obligations with the funds at its disposal. In case of their insufficiency, the subsidiary responsibility for the obligations of the institution shall be borne by its owner. The institution is not entitled to dispose of both movable and immovable property. This is the owner's prerogative. However, the institution has the right to engage in independent activities that generate income and dispose of them independently. For the purpose of coordinating their entrepreneurial activities, as well as representing and protecting common property interests, commercial organizations may, by agreement among themselves, create associations in the form of associations or unions, being non-profit organizations. If, by decision of the participants, the association (union) is entrusted with conducting entrepreneurial activities, such an association (union) is transformed into an economic company or partnership, or may create a business company for the implementation of entrepreneurial activities or participate in such a company. Non-profit organizations may voluntarily unite into associations (unions) of non-profit organizations. Association (union) non-profit organization is a non-profit organization. Members of an association (union) retain their independence and the rights of a legal entity. The association (union) is not responsible for the obligations of its members. Members of an association (union) bear subsidiary liability for the obligations of this association (union) in the amount and in the manner prescribed by its constituent documents. Members of an association (union) have the right to use its services free of charge. A member of an association (union) has the right, at its own discretion, to withdraw from the association (union) at the end of the financial year. In this case, a member of the association (union) bears subsidiary liability for its obligations in proportion to its contribution within two years from the date of withdrawal. A member of an association (union) may be expelled from it by decision of the remaining members. Non-profit partnership - it is a membership-based non-profit organization established by citizens and (or) legal entities to assist its members in carrying out activities aimed at achieving social, charitable, cultural, educational, scientific and other goals. Autonomous non-profit organization- this non-profit organization is recognized as a non-profit organization without membership, established by citizens and (or) legal entities on the basis of voluntary property contributions for the purpose of providing services in the field of education, healthcare, culture, science, law, physical culture and sports and other services. Property transferred to an autonomous non-profit organization by its founders (founder) shall be the property of the autonomous non-profit organization. The Civil Code of the Russian Federation does not contain an exhaustive list of non-profit organizations that can be created in other forms provided for by federal legislation.

The main criterion by which legal entities are classified in Russian legislation, established in Art. 50 of the Civil Code, which considers commercial and non-profit organizations.

Both groups are full-fledged participants in civil circulation. However, there are significant differences between them, which determine the special legal status of each.

The concept and main features of commercial organizations

The law does not contain the concept of a commercial organization, close to scientific, but its main features are formulated in Art. 48, 49 of the Civil Code, as well as in parts 1 and 2 of Art. 50 GK.

Signs of commercial organizations:

- The main objectives of the activities of such legal entities are to make a profit. This means that the charter of the organization must contain a corresponding provision. Officials may pay attention to its presence or absence during registration. His absence serves as a basis for denial of it.

- Commercial organizations, as a rule, have a general legal capacity. This means that such legal entities have legal grounds to engage in any kind of non-prohibited activity. The exception is municipal and state unitary enterprises. They can carry out activities within the framework of the purposes for which they were created. Legislation governing the position of market participants in various sectors of the economy may also impose restrictions. Examples can be found in financial sector. Organizations performing the functions of banks or insurance companies may not engage in other activities.

- Mandatory state registration. Only after that entity becomes a member of civil circulation.

The concept of a commercial organization

The characteristic of commercial organizations according to the main features allows us to formulate the concept of this legal entity.

A commercial organization should be understood as a legal entity, main goal which is the extraction of profit, capable, as a rule, of carrying out any activity not prohibited by legal norms.

The concept and main features of non-profit organizations

The above articles of the Civil Code contain a description of commercial and non-profit organizations. This classification makes it possible to distinguish the latter by a number of features.

- The main distinguishing feature is the purpose of establishing non-profit organizations. Such a structure performs other functions than a commercial legal entity and they are not related to making a profit. Humanitarian, social, political and other aspirations can serve as goals.

- Nonprofit organizations have limited legal capacity. It is determined by the purpose of creation. At the same time, entrepreneurial functions that meet this requirement are also possible.

- Another sign is the inability to distribute profits among the founders. If there is one, it serves as an additional financial basis for achieving the goals for which such an organization was created.

- Special organizational and legal forms. As in the case of commercial legal entities, there is a closed list that defines the types of these organizations.

- To start activities, state registration is required. V individual cases it is much more complex and involves a greater number of necessary actions. An example is the registration of political parties carried out in the Ministry of Justice.

The concept of a non-profit organization

The provisions of the law that characterize these legal entities make it possible to derive the most complete concept.

Non-profit organizations should be understood as duly registered legal entities of certain organizational and legal forms, the goals of which are to achieve results in the public, humanitarian, political and other spheres that are not related to making a profit, capable of performing functions within the specified framework and not distributing the received financial resources between founders.

How to distinguish a for-profit organization from a non-profit?

Such a classification of legal entities can be carried out according to their main features.

The characteristics of for-profit and non-profit organizations paint a clear picture of how one differs from the other.

Differences can be found in the text founding document. Comparison of their initial sections will help establish the goals of creating organizations. The difference will be in the presence or absence of profit making as the main one.

However, not every citizen has access to documents of organizations. In this case, types of organizational and legal forms will help. It is by their name that the organization can be classified as commercial or non-commercial.

Forms of commercial organizations

The list of types of commercial organizations is given in Part 2 of Art. 50 GK. These include:

- Economic companies. This is the most common form. Among them there are joint-stock companies, including public and non-public (PJSC and CJSC, respectively) and limited liability companies.

- production cooperatives. Their peak came in the perestroika years. However, today it is a rare type of commercial organization.

- Economic partnerships, which are even rarer than production cooperatives.

- Business partnerships.

- Municipal and state unitary enterprises.

- Peasant (farming) farms.

Forms of non-profit organizations

The legislation provides for a large number of forms of such legal entities (part 3 of article 50 of the Civil Code). Therefore, it is easier to act by elimination method.

Non-commercial organizations should include all legal entities that are not related to commercial ones. In practice, there are often such forms as political parties, foundations, public organizations, consumer cooperatives, homeowners associations, bar associations and formations.

A non-profit organization (NPO) is an organization that does not have profit making as its main goal and does not distribute the profits among its participants.

Commercial organizations are those whose activities are based on making a profit and distributing the profits among the participants. The list of possible types of commercial organizations is closed (that is, it does not allow additions) and is given in the Civil Code of the Russian Federation. This does not mean at all that the activities of such organizations are unprofitable; all profits must be spent on the purpose of establishing such non-profit organizations.

When choosing between a commercial and non-commercial organization, the future participant must assess the scope of his rights and obligations. The obligations of the participant should include economic responsibility for the results of the activities of a commercial organization. Modern sociology conditionally divides social groups civil society into three sectors: public, commercial and non-commercial.

Many NGOs (for example, scientific, cultural organizations) conduct their activities only on grants and do not turn to other sources of funding. There is an opinion that non-profit organizations perform more effectively social functions than the state. There are more than thirty types/forms of non-profit organizations in the Russian Federation. The main forms of non-profit organizations are established by the Civil Code of the Russian Federation in paragraph 6 of Chapter 4, and the Federal Law "On Non-Profit Organizations".

Types of non-commercial legal entities

The state or local self-government body may act as one or more founders of a non-profit organization, but the state is not the sole founder. That is why commercial legal entities “live” their lives, and non-commercial ones theirs, due to the nature of their occurrence.

Commercial legal entities are created to make a profit in the course of their activities and distribute this profit among their participants. It is this difference, or profit, that serves as the main purpose of doing business for commercial organizations. Everything related to the legal capacity of a legal entity applies to commercial organizations.

An important difference from non-profit organizations is the obligatory presence of a commercial legal entity. brand names. As for the location of a commercial organization, it is determined by the location of the permanent executive body.

The general rule for all legal entities regarding branches and representative offices is that the latter are not legal entities. persons, but are separate divisions.

Commercial legal entities can be created by any subjects of civil law, or by the state. This is the main difference from commercial organizations. The legal capacity of a non-profit legal entity, as, indeed, of all other legal entities, arises upon its creation, that is, at the time of state registration.

A non-profit organization must have a name that indicates its organizational and legal form and the nature of its activities. If the name is registered in accordance with the established procedure, then the non-commercial legal entity has the exclusive right to use it. The location of a non-commercial legal entity is determined by the place of its registration.

A non-commercial legal entity is an organization that does not set itself the goal of distributing profits among its participants, but has a priority of goals that are not related to material gain. This is the fundamental difference in the nature of the emergence of legal entities and one of the criteria for their classification.

Two subjects of law - a legal entity and an individual. Find out absolutely everything about the difference between an individual and a legal entity on our portal. They have the right to carry out entrepreneurial activities, but the profit cannot be distributed among the participants, it is spent in accordance with the purposes for which the organization was created.

Non-profit organizations do not aim to make a profit. 17. Non-profit organizations do not include: 1) individual institutions operating in the fields of culture, art, education, etc. 6) Associations and unions. They are created by commercial organizations in order to coordinate business activities and protect property interests.

Popular today:

Business entities are individuals (individual entrepreneurs) and legal entities(commercial and non-commercial organizations).

Individual entrepreneurs- These are individuals engaged in entrepreneurial activities without forming a legal entity, registered in accordance with the established legislative procedure.

Topic tests

An individual entrepreneur is characterized by full property liability for all obligations.

Entity- an organization that has separate property, can acquire civil rights and obligations on its own behalf, act as a plaintiff and defendant in an arbitration court.

All legal entities are divided into commercial and non-commercial organizations.

Organizations are commercial whose activities are based on making a profit and distributing the profits received among the participants. And organizations that do not have profit as such a goal are non-commercial.

Commercial organizations include business partnerships, business companies, production cooperatives, state and municipal enterprises. In turn, business partnerships are subdivided into general partnerships and limited partnerships (limited partnerships). Business companies are divided into joint-stock companies (open and closed), limited liability companies, companies with additional liability. State and municipal enterprises are subdivided into enterprises based on the right of economic management and on the right of operational management (unitary and state-owned).

To non-profit organizations include consumer cooperatives, institutions, public organizations, religious organizations and associations, charitable and other foundations.

Organizational and legal forms of entrepreneurship

Organizational and legal form of an economic entity - a form of an economic entity recognized by the legislation of any country, which fixes the method of fixing and using property by an economic entity and its legal status and goals of activity arising from this.

Individuals as business entities.

Most of the citizens - individuals involved in commercial transactions. But not all of them can be recognized as business entities. A significant part of citizens participate in trade operations as consumers who purchase goods and services for personal needs. Consumers are not professional participants in commodity circulation. In trade turnover, they are recognized as a weak, unprotected party. Not applicable to them. general principles commercial relations, such as work for profit, and others. PD subjects include only such participants economic relations for which the production and sale of goods and services are a source of income. Can be distinguished several groups of individuals professionally engaged in PD.

These include, first of all, all FLs that have received the status individual entrepreneur. Article 23 of the Civil Code of the Russian Federation connects the possibility of performing PD with the registration of an individual entrepreneur as an individual entrepreneur. Lack of registration entails liability, including criminal liability (Article 171 of the Criminal Code of the Russian Federation). Bringing to responsibility for illegal entrepreneurship, however, does not exempt from liability under civil contracts that are concluded by individual entrepreneurs who carry out PD without state registration.

commercial organization

A citizen who actually carries out entrepreneurial activity “is not entitled to refer, in relation to transactions concluded by him, to the fact that he is not an entrepreneur,” Article 23 points out. The rules of the Civil Code of the Russian Federation and other regulatory acts that regulate the activities of legal entities are applied to entrepreneurial activity of citizens. unless otherwise expressly follows from the law, otherwise legal act or essence of the relationship.

The second group of FL, carrying out PD does not need state registration as an individual entrepreneur. An exception is currently made for such activities as private security and detective activities and the activities of private notaries. These persons have the right to work on the basis of a license or certificate provided for by the Fundamentals of Legislation on Notaries and the Federal Law on private security and detective activities.

The third group is formed by officials of organizations who are legal representatives of legal entities. They act on behalf of the organization and their actions on its behalf are identified with the actions of the organization. feature legal status of legal entities is that FIs acquire rights and obligations not for themselves, but for the organization by their actions. Article 53 of the Civil Code of the Russian Federation stipulates the obligation officials act conscientiously and reasonably in the interests of the organization headed. At the request of the founders of legal entities, they are obliged to compensate for losses caused to the legal entity by unlawful actions. However, the amount of personal responsibility of officials is determined by the founders themselves in the memorandum of association, charter, contract with the head. In some cases, their personal liability is established by law. An example is the Code of Administrative Offenses, which establishes the administrative responsibility of both legal entities and officials for violation various kinds legislation, article 199 of the Criminal Code of the Russian Federation establishes the responsibility of officials for non-payment of taxes by an organization on a large scale, etc.

Rights and obligations for the organization during trading activities acquire not only officials, but also ordinary wage-earners directly performing trading operations and making other transactions. They form fourth group FL, involved in trading transactions. These include salespeople, cashiers, freight forwarders, sales and supply department employees who are authorized to enter into contracts on behalf of the organization. Sellers and cashiers carry out trading operations either in accordance with an employment contract, or by order of the head. The powers of employees of the commercial departments of the enterprise must be confirmed by a power of attorney certified by the signature of the head and the seal of the enterprise. Their actions as a whole, as well as the actions of officials, are recognized as the actions of the organization. But in some cases, personal liability for violations is also established.

This responsibility may be established by internal acts of the enterprise or by law. For example, Article 7 of the Federal Law on the use of cash registers establishes the personal responsibility of the seller for failure to issue cash receipt, while missing or malfunctioning cash register viewed as violations of the organization.

Fifth group FL - professional businessmen, form sales representatives . Unlike employees they act on behalf of the organization not on the basis of employment contract, but on the basis of a civil contract (order, commission, agency, etc.). Their powers and scope of responsibility are determined by the contract. With regard to commercial representatives, the Civil Code of the Russian Federation does not establish mandatory registration as an individual entrepreneur. But article 184 states that they are obliged to "execute the instructions given to them with the diligence of an ordinary entrepreneur." This indicates that activities under commercial representation agreements are recognized as entrepreneurial, and, therefore, require state registration. In some cases, even more stringent requirements are imposed on resellers than on independent individual entrepreneurs. Brokers and dealers on stock exchanges must not only register, but also obtain licenses and certificates, without which their activities are considered illegal.

All PEs who are professionally involved in PD must have the appropriate legal personality, i.e. they should be capable and possess legal capacity required for the respective commercial activities. Questions capacity merchants are resolved in a civil procedure, which is the subject of articles 26 to 30 of the Civil Code of the Russian Federation. In accordance with the provisions of Articles 175-177, transactions made by incapacitated citizens are recognized as invalid in accordance with the established procedure.

Business entities

The concept of a business entity means a person who carries out at his own peril and risk independent activity, which is aimed at systematic obtaining arrived.

I. Commercial legal entities

This profit can be received, for example, from the sale of goods, the provision of services, the performance of work, the rental of property, and so on. In addition, the concept of a business entity implies that it must be registered in this capacity in the manner prescribed by law. The category "business entities" includes both individual entrepreneurs and legal entities - various commercial organizations. In the first case, the subjects of entrepreneurial activity are citizens of a given country, foreign citizens and stateless persons registered accordingly. In the second case, foreign legal entities are also considered business entities.

Citizens as business entities must necessarily have the following characteristics:

- legal capacity (the general ability of a person to have rights and bear obligations);

- legal capacity (ability to have and exercise civil rights, perform civil duties);

- residence.

These signs just provide what is called legal status business entities. In addition, citizens, as business entities, are required to be responsible for their debts incurred in the course of work, both to creditors and to the budget. Otherwise, business entities are declared bankrupt by a court decision, after which they lose the status of an entrepreneur.

An enterprise, as a business entity, must also have a number of features. First, it is the presence of separate property. Secondly, it is an opportunity to independently acquire, as well as exercise various property and non-property personal rights and bear obligations. Thirdly, it must meet its obligations. And, finally, fourthly, it is the right to be a plaintiff and a defendant in court on his own behalf.

Signs of business entities

Business entities are those business units that meet the following criteria:

- have separate property;

- lead economic activity;

- have the relevant competence;

- registered in the manner prescribed by law.

Responsibility for the property of business entities rests with them.

Creation of business entities

SPDs are created by performing legally significant actions, adopting and signing relevant acts.

Ways to create business entities are divided into four main types:

- constituent and administrative;

- constituent;

- contractual constituent;

- permissively constituent.

The choice of any type depends on the current market situation, the degree of monopolization of the industry, the number of founders of the company. The procedure for registering business entities depends on the legislation of the country, but in general includes entering information about the entity into single register data. This is necessary so that in the future, in accordance with the tax code and other legal documents, taxation of business entities is carried out.

Similar articles

Introduction

1. The concept of business entities, their signs

1.2.2 The fact of registration in the prescribed manner or legitimation in another way

1.2.3 Business management

1.2.4 Availability of economic competence

1.3.5 Independent property liability

2. Individual entrepreneur as a business entity

2.1 The concept of an individual form of entrepreneurship

2.2 Legal capacity of an individual entrepreneur

2.3 Licensing of an individual form of entrepreneurship

Conclusion

List of used literature

Introduction

Each branch of the legal system is characterized by the presence of subjects of law that are participants public relations who, in accordance with the law, are capable of being bearers of the respective rights and obligations.

Business law has its own specific subject composition, which differs from the composition of other branches, primarily civil law.

Subjects of business law are referred to as economic entities, that is, participants in entrepreneurial activity, within the limits of their competence, are carriers of certain economic rights and obligations.

What type of business is a commercial organization?

They manifest themselves through certain features, depending on which their classification is built.

The composition of economic entities, indicating their characteristic features, is defined in civil law.

Legal scholars use the phrases "subject of entrepreneurial activity" and "economic entity" as identical.

The concept of "economic entity" is defined as "Russian and foreign commercial organizations and their associations (unions and associations), non-profit organizations, with the exception of those not engaged in entrepreneurial activities, including agricultural consumer cooperatives, as well as individual entrepreneurs."

The concept of business entities, their characteristics

1.1 The concept of business entities

Entrepreneurship is an initiative independent activity of citizens aimed at obtaining profit or personal income, carried out on their own behalf, under their own property responsibility or on behalf of and under the legal responsibility of a legal entity. An entrepreneur can carry out any type of economic activity not prohibited by law, including commercial mediation, trade, procurement, consulting and other activities, as well as operations with securities.

In accordance with the civil legislation of the Russian Federation, capable individuals, legal entities - commercial organizations, foreign citizens, stateless persons, foreign organizations can be business entities. Non-profit organizations, fulfilling their statutory provisions, may engage in entrepreneurial activities.

Important for the participation of citizens in the implementation of entrepreneurial activities is established by Art. 18 of the Civil Code of the Russian Federation the content of their legal capacity. So, “citizens can have property on the right of ownership; inherit and bequeath property; engage in entrepreneurial and any other activities not prohibited by law; create legal entities independently or jointly with other citizens and legal entities; make any transactions that do not contradict the law and participate in obligations; choose a place of residence; have the rights of authors of works of science, literature and art, inventions and other results of intellectual property protected by law; have other property and personal non-property rights”.

Thus, an individual who has reached the age of 18 has the right to engage in entrepreneurial activities in accordance with the procedure established by law individually or to create legal entities.

To engage in entrepreneurial activity without forming a legal entity, a citizen, in accordance with the established procedure, must obtain a certificate of an individual entrepreneur, and to carry out trade, acquire a patent.

As for legal entities, in accordance with Art. 48 of the Civil Code of the Russian Federation, a legal entity is an organization that owns, manages or operates separate property and is liable for its obligations with this property, can acquire and exercise property and personal non-property rights on its own behalf, bear obligations, be a plaintiff . Legal entities must have an independent balance sheet or estimate. A legal entity is considered to be created from the moment of its state registration in the prescribed manner, it has its own name, containing an indication of its organizational and legal form. Depending on the organizational and legal form, legal entities act on the basis of a charter, or a constituent agreement and a charter, or only a constituent agreement.

In accordance with Art. 50 of the Civil Code of the Russian Federation, legal entities are divided into two types: commercial and non-commercial organizations. A commercial organization is an organization that sets profit making as the main goal of its activities. In accordance with the established law and constituent documents, in accordance with the procedure, a commercial organization distributes net profit between the founders (participants). Consequently, in accordance with civil law, all commercial organizations (except for a state-owned enterprise) can be considered entrepreneurial. Commercial organizations can be created in the form of business partnerships and companies, production cooperatives, state and municipal unitary enterprises.

Non-commercial organizations are those that do not have the purpose of their activities to make a profit and cannot distribute the profits received among the participants (founders). However, non-profit organizations can carry out entrepreneurial activities only in so far as this serves to achieve the goals for which they were created, and in accordance with these goals.

Business entities are persons who can engage in this activity. Entrepreneurial activity can be carried out by any citizen who is not limited in rights; any foreign citizen and stateless person within the powers, established by law of the Russian Federation, as well as associations of citizens - collective entrepreneurs (partners).

The status of an entrepreneur is acquired through the state registration of an entrepreneur in the manner prescribed by the legislative acts of the Russian Federation.

Entrepreneurial activity without registration is prohibited.

Entrepreneurial activity carried out without the involvement of hired labor is registered as an individual entrepreneurial activity. Entrepreneurial activity involving hired labor is registered as an enterprise.

Subjects of business law can be classified according to various criteria:

1. Depending on the form of ownership, state, municipal, private, collective enterprises are distinguished.

2. Depending on the nature of the economic competence of subjects, one can single out the state, regions, enterprises, their divisions.

3. Also, enterprises are distinguished by their organizational and legal form.

Thus, it is possible to single out the subjects whose competence is dominated by doing business:

Entrepreneurs - individuals;

Enterprises - legal entities;

· Divisions of enterprises.

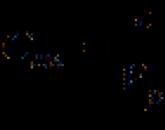

The main types of business entities according to Civil Code RFs are shown in the diagram (Fig. 1).

Figure 1. Business entities

1.2 Signs of business entities

A business entity can be recognized as a person who uses his property not to satisfy his personal needs, but for the purpose of making a profit.

It must be taken into account that the subject of entrepreneurship and its legal essence are characterized by specific features that together distinguish the entrepreneur from other participants in civil circulation, and this indicates the need for its special normative allocation.

One of the main features that define an entrepreneur as a subject of civil law is that it is always an economic entity that carries out activities for profit.

The subject of entrepreneurial law is recognized as the bearers of economic rights and obligations, possessing the following features:

availability of separate property;

the fact of registration in the prescribed manner or legitimation in another way;

management of business activities;

the presence of economic competence;

· self-responsibility

1.2.1 Presence of separate property

This sign of an economic entity is the main one. Legal form Separation of property is, first of all, the right of ownership, which provides the owner with maximum opportunities to directly engage in entrepreneurial activities, as well as manage enterprises created by the owners, determine the direction of their activities and the conditions for its existence.

There are also forms of separation of property dependent on the owner of the rights: the right of economic management, operational management, intra-economic management, lease.

Commercial and non-profit organizations

Commercial organizations- enterprises and organizations whose main purpose is to make a profit.

Non-profit organizations:

- public and religious voluntary associations citizens on the basis of their common interests to meet spiritual and other non-material needs. These organizations have the right to carry out entrepreneurial activities only to achieve the goals for which they were created;

- foundations - non-profit organizations that do not have membership, created on the basis of voluntary and property contributions from legal entities or citizens.

They pursue socially useful goals. Foundations are allowed to create business companies or participate in them;

- non-profit partnerships are organizations based on the membership of citizens and legal entities. The goal is to meet the material and other needs of the partnership participants. When leaving this partnership, its members receive a part of the property or its value, which they transferred upon entry. Membership fees are non-refundable;

- institutions - non-profit organizations created by the owner (state or municipal structures) to carry out managerial, socio-cultural and other functions. The institution is responsible for its obligations.

Commercial legal entities

Institutions are wholly or partly funded by the owner. The property of the institution is assigned to it on the basis of the right of operational management;

- Autonomous non-profit organizations - organizations created by citizens or legal entities on the basis of voluntary contributions. The goal is to provide services in the field of health, science, education, sports, etc. Autonomous non-profit organizations do not have membership. The property transferred to these organizations by the founders is their property;

- associations of legal entities - associations and unions that are created for:

a) coordination of activities of commercial organizations;

b) protection of common property interests of commercial organizations;

c) coordination of protection of interests.Members of associations and unions retain their independence and the right of a legal entity.

Main differences non-profit organizations from commercial:

- profit is not the purpose of the activity;

- non-profit organizations should not pay dividends and enrich their founders;

- non-profit organizations are much more open to public scrutiny.

Commercial such legal entities are called, the purpose of which is to make a profit by carrying out any activity not prohibited by law. Commercial organizations include the following:

1. Business partnerships– contractual associations of several persons for joint management business activities under a common name. Decisions are made by majority vote, the number of which each participant has in proportion to the share. Nominal value of a share - its value at the time of investment.

1.1. General partnership- a business partnership, the participants of which jointly and severally bear subsidiary liability for its obligations with all their property. Profits and losses are proportional to contributions. More than two members. The partnership may disintegrate when one member withdraws from it; for the admission or withdrawal of members, an agreement on the establishment of the partnership is again concluded.

1.1.1. Faith partnership- a business partnership consisting of two categories of participants: general partners (complementary partners), jointly and severally bearing subsidiary liability for its obligations with their property, and fellow contributors (limited partners) who are not liable for the obligations of the enterprise.

2. Business companies- these are organizations created by one or more persons by combining (separating) their property for doing business.

2.1. Limited Liability Company – a commercial organization, the authorized capital of which is divided into shares of a certain size, formed by one or more persons who are not liable for its obligations. Everyone is responsible within their contribution. Profit is distributed in proportion to the contribution. The main feature is the ban on the sale of their shares on the open market.

2.2. Additional Liability Company- a commercial organization, the authorized capital of which is divided into shares of predetermined sizes, formed by one or more persons jointly and severally bearing subsidiary liability for its obligations in an amount that is a multiple of the value of their contributions to the authorized capital.

2.3. Joint-stock company - a commercial organization formed by one or more persons who are not liable for its obligations, with an authorized capital divided into shares, the rights to which are certified by securities - shares. Liability is limited to the amount paid for the shares. Shares can be privileged guaranteeing the receipt of dividends not lower than fixed percentage from the nominal value, regardless of the performance of the joint-stock company, as well as - giving the pre-emptive right to participate in the distribution of property remaining after the liquidation of the company (do not give the right to vote). Shares can be nominal and bearer. Share price- its price, which in a free market is not a constant value. During a crisis, the exchange rate falls, during a rise it rises. A share is sold for such an amount that, when placed in a bank, will give income not lower than the dividend. nominal cost- the amount indicated in the share. The difference from partnership is that capital is formed in the form of money and divided into equal shares, presented in the form valuable papers- shares. Authorized capital JSC is made up of the nominal value of the acquired shares and represents minimum size JSC property.

2.3.1. Closed JSC- distributes issues of new shares between specific persons known in advance. The number of members is not more than 50, shareholders have the right of first refusal to purchase shares alienated by other shareholders.

2.3.2. Open JSC- has the right to offer shares for purchase to an unlimited number of persons.

3. Production cooperative (artel)- this is an association of persons for the joint conduct of entrepreneurial activities on the basis of their personal labor and other participation, the initial property of which consists of share contributions of members of the association. The profit of the cooperative is distributed among its members in accordance with their labor participation.

4. State (municipal) enterprise- a legal entity established by the state or a local government for entrepreneurial purposes or for the purpose of issuing particularly significant goods (work or services), whose property is in state (municipal) ownership.

5. Concerns is a form of contractual large super-associations, usually of a monopoly type. The most important feature is the unity of ownership of their member firms, enterprises, banks.

5.1. Cartel - contractual association of enterprises, based on an agreement on the regulation of production volumes, selling prices, terms of sale, delineation of sales markets. Each company is legally independent.

5.2. Trusts - a form of association of enterprises in which they completely lose their commercial, legal and industrial independence and are subject to a single management.

5.3. Syndicate - a form of contractual association of enterprises, involving the centralization of the supply of syndicate members and the sale of their product. That. competition between its participants in the field of marketing and procurement of raw materials is eliminated. The commercial independence of the members of the syndicate is completely lost, and the production independence is partially lost. Syndicate participants can be not only enterprises, but also associations, concerns, trusts.

IP- based on the personal property of citizens. One person owns the p/n and receives all the income.

II . Non-commercial legal entities.

Non-profit organizations are those that do not pursue profit as the main goal and do not distribute the profits received among the participants (Article 50 of the Civil Code):

1. Consumer cooperatives- an association of persons on the basis of membership in order to meet their own needs for goods and services, the initial property, which consists of share contributions.

2. Homeowners associations - non-profit association persons - owners of premises for joint management and operation of a single complex of real estate (condominium).

3. Public associations - a non-profit association of persons based on the commonality of their interests for the implementation of common goals.

4. religious organization - an association of citizens whose main goal is the joint confession and dissemination of faith and has signs corresponding to these goals (ceremonies, teaching religion, religious education).

5. Fund- a non-profit organization that does not have membership, founded to achieve socially useful goals through the use of property transferred to its ownership by the founders.

6. institution- an organization created by the owner to perform functions of a non-commercial nature and financed by him in whole or in part (have the right to operational management of property, the owner bears subsidiary responsibility).

Any non-profit enterprise must use all profits to carry out its activities.

Popular

- Program for changing the angle of attack and pitch

- Actual output speed Calculation of closed gear train

- What is the procedure for the use of official transport by an employee

- aircraft fuel system

- Agreement for the evacuation of a vehicle Standard agreement for the evacuation of a vehicle

- Bulldozer performance and how to improve it Basic information about bulldozers

- Toyota Production System (TPS) and Lean Manufacturing

- Examination tickets by profession line pipe fitter

- What to do if you don't feel like doing anything

- Globus - shops for the whole family