Taxes

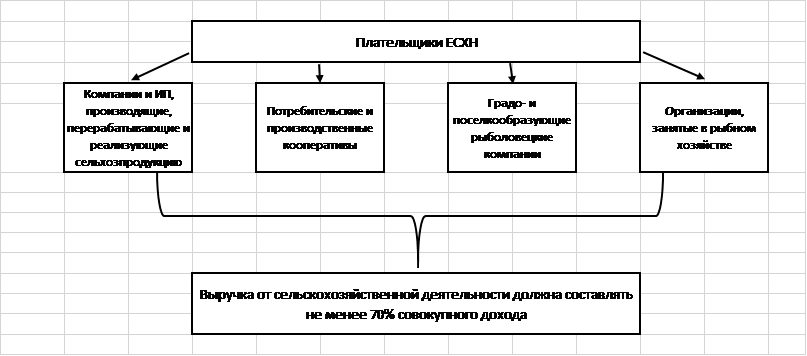

Organizations and individual entrepreneurs working in the agricultural industry enjoy government benefits and preferences. A special fiscal regime has been developed for them - a single agricultural tax. The Unified Agricultural Tax rate is set at 6%,...

Instructions Determine how appropriate it is for your company to switch from a simplified taxation system to a system with payment of value added tax. With such a transition, the enterprise loses...

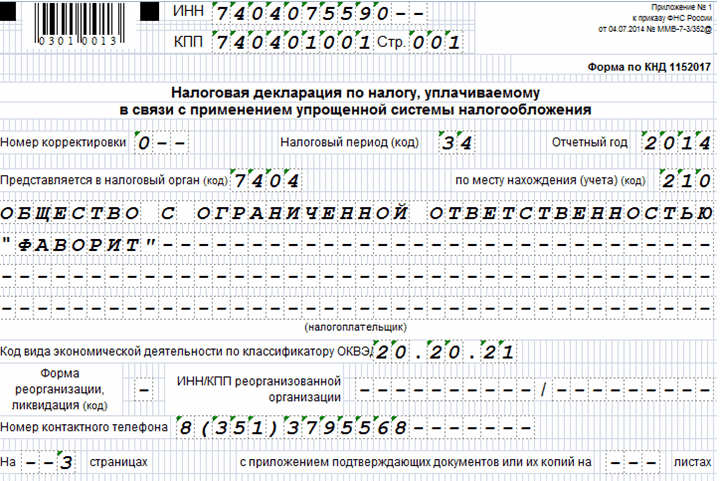

Every individual entrepreneur has an obligation to submit reports and pay taxes. Difficulties often arise with filling out a tax return and calculating payments. A declaration is a document in which...

Maintaining home accounting is a guarantee of maintaining wealth in families. Users can control their finances both the old fashioned way, that is, in notebooks, and in modern ways, by installing them on computers...

You need to fill out a zero declaration without corrections or errors in the text, and when filling out a document on a computer, there are certain rules that you must adhere to very strictly. Any blots make...

Keeping tax records under the simplified taxation regime, especially if “Income” is selected as the taxable base, is simple and can be completed by any businessman independently. Term...

The most common tax in all countries of the world is income tax, which is levied on persons receiving wages. In today's article we will show the rules for calculating personal income tax, talk about rates and the consequences of evasion...

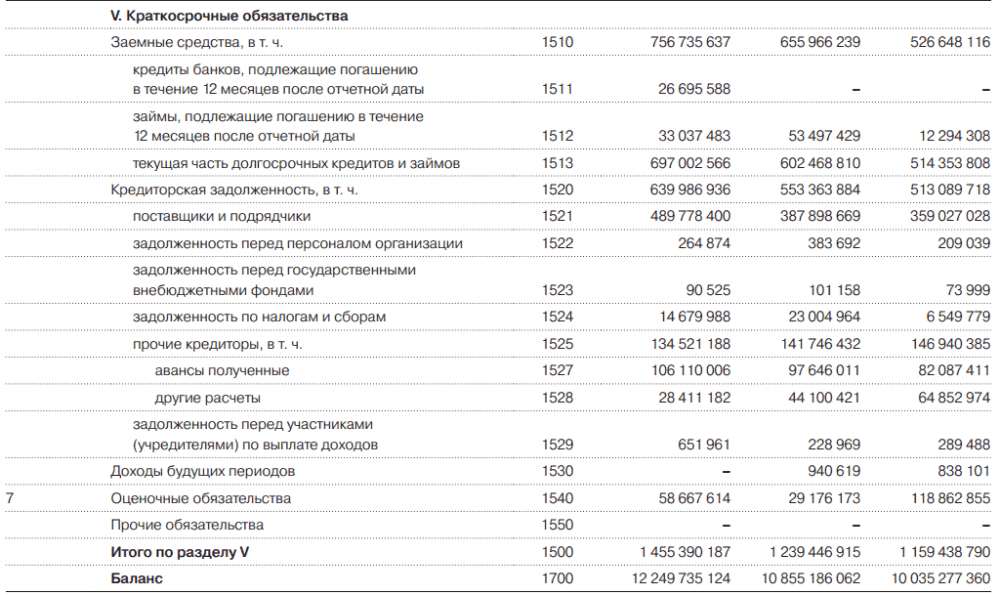

What are the financial statements of small enterprises, how to prepare them and where to submit them

What are the financial statements of small enterprises, how to prepare them and where to submit them

Not all companies need to keep accounting records. However, every enterprise must submit reports, although small businesses have their own simplified form. For example, there are only 11 left on the balance sheet...

At the moment of opening their business, entrepreneurs register with the tax authorities and begin to transfer taxes and contributions to the state, determined by the taxation scheme they have chosen. Many entrepreneurs...

Advance payments by individual entrepreneurs to the simplified tax system in 2019 are made three times a year, regardless of the chosen object of taxation. Entrepreneurs pay in advance not only part of the single tax, but also contributions to insurance funds “for themselves”....

Popular

- Timing of desk inspection

- Paying income tax on wages

- Extract from the Unified State Register online through the official website of the tax service

- A story in an envelope: letters home from a soldier who did not return from the war

- What is PPR in production definition

- Can children's toys be returned to the store?

- Anatoly Rudy: “there are no big and small enemies, there are just enemies

- Regional growth point competition

- Regional growth point competition

- How to assign additional responsibilities to an employee