Correct calculation. How to calculate the unit cost of production: types, calculation methods

The popularity of catering points will never go out, because human laziness and love for food are eternal. Indeed, not everyone, having desired the Stolichny salad, Kiev cutlet and Prague cake for dessert, can afford to break into the store in order to purchase everything you need and lock yourself in the kitchen, cooking for several hours. The harsh reality with work, traffic jams and fatigue dictates its own rules, but you want to eat deliciously. For many years, enterprising people have been successfully earning on these human weaknesses, who have managed to build a serious business in a successful kitchen. How to make a calculation for a dish in the dining room so as not to work in the negative, or, conversely, not to scare away potential customers with exorbitant prices? At the same time, golden hands are not enough for success, because the market and competition dictate their own rules. It would seem - a dining room and a dining room, what can you earn there? However, people's attachment to the classics, when they cooked according to the "Book of Tasty and Healthy Food", is worth a lot.

On fingers

To tell the truth, at the moment the output of the cost is overestimated, since it is more logical to form the final price of a menu item based on people's tastes, demand and average market requests, however, for internal cost tracking and cost equalization, dish costing is still recommended.

For example, let's take one of the now popular French confectioneries: the company uses high-quality raw materials with an appropriate price tag, uses special equipment for the preparation of its products, which is very expensive (for example, the same fully automated chocolate tempering machine - you can’t save on it). succeed, as this is fraught with failures and damage to expensive resources), rents the premises of the required area, and so on and so forth. The calculation of dishes is at a glance, but they cannot reduce costs, as the quality, name and, as a result, demand will suffer, so you have to keep the bar. They also cannot put a uniformly high mark-up on those positions that are expensive in their own right, and those 300% of the cost price that is on the lips of the population are simply swept aside. So what to do? Consider the menu that the confectionery offers:

- yeast baking;

- cakes and pastries;

- marshmallow candy.

The first and third positions in terms of cost, if not a penny, then close to it, while even half of the cakes cannot be “cheated” because of expensive resources. Therefore, the second position is sold significantly cheaper, and the difference is made up by buns and sweets. Moral: The calculation of the cost of a dish is not always based on the purchase prices of its components.

Of course, a pastry shop is different from a canteen, but the principle of working with final products nutrition is similar.

Where to begin?

Those who are especially lazy can use ready-made online templates that can be found everywhere on the net, but they are too general and quite rough in the calculation. It would be more correct to once independently deduce prices and stick to them in the future, adjusting based on demand. In order to display the correct calculation of a dish in the dining room, you must have on hand:

- a completed menu, which will indicate the list of dishes provided by the catering point;

- technological cards for each menu item;

- purchase prices of all products that are involved in the preparation of menu items.

Menu

A word of advice: when choosing dishes in the dining room, do not overdo it. The very definition of this catering point implies simple, artless food that can evoke nostalgia for the times of the Union. In other words, no sushi. Yes, and the preparation of a calculation of dishes from the abundance of complex positions will become, if not more problematic, then certainly more boring. It is difficult to maintain a list as thick as an encyclopedia, both on a professional and material level, since it is difficult to find universal chefs in the dining room, and it is expensive to maintain the desired composition of products on an ongoing basis.

Technological cards

This term is understood as a document that contains information about all the features of the dish. It includes the following data (not necessarily all, part is selective):

- The term and specifics of the storage of the dish. Conventionally: ice cream at a temperature of -18 ... -24 ° C is stored for 3 months, while bread, at a temperature of +20 ... +25 ° C, is stored for 72 hours;

- the nutritional value ready meal: number of calories, in some cases - the ratio of proteins / fats / carbohydrates;

- requirements for the implementation and serving of the finished dish;

- directly the recipe itself, which includes the composition and cooking algorithm;

- recipe source;

- description appearance, the principle of decorating dishes;

- the weight of the finished portion.

It is impossible to neglect the technological map, since the principles of work "maybe" and "by eye" will please only until the first fine from the supervisory authorities.

There are two ways to acquire this document - purchase a ready-made one, which will be made to order for you, or withdraw it yourself. The first is frankly expensive, and the second is not difficult, which we will prove below.

Example

Menu item name: Kiev cutlet.

Technological map number 47.

Dishes: roast.

Expected yield of the finished dish (serving size): 310 grams.

Layout of products per 100 grams of the finished dish:

- chicken fillet purified - 29.82 grams;

- butter - 14 grams;

- chicken egg - 3.27 grams;

- bread from premium flour - 8.88 grams. The expected weight of the semi-finished product at the exit is 50.35 grams;

- for roasting - 5.21 grams;

- bean garnish ( routing No. 741) or potato (technological map No. 42) - 52.08 grams.

dishes, its chemical composition and calorie content, recipe

The beaten chicken fillet is stuffed with butter, dipped in eggs, breaded twice in ground white bread, deep-fried for about 6-7 minutes until a rich golden crust is formed. Spread on a baking sheet and bring to readiness at a temperature of 200-220 ° C in the oven. Products are optionally served on heated toast. The default garnish is bean or vegetable.

Purchase prices for products

An item without which it is impossible to display the calculation of a dish in the dining room. Ideally, you should add to them fare if the raw materials are brought not by the supplier, but by you, through the mediation transport companies or on their own. Also consider the funds spent on loading / unloading, if these services are paid separately.

Counting principle

With the above information in hand, the matter remains small.

It is necessary to indicate the name of the dish, on the basis of the technological map, put down the products that are required, in the right quantity, indicate the derived purchase prices and sum up. That's all, you got the cost price of the dish.

Let's move on to practice

Calculation of the dish (example - the same Kiev cutlet, we take the average prices for the capital):

- peeled chicken fillet - 29.82 grams, where 1000 grams costs 180 rubles;

- manufactured in accordance with GOST) - 14 grams, where 1000 grams costs 240 rubles;

- chicken egg - 3.27 grams, where 1000 grams costs 120 rubles;

- bread made from premium flour - 8.88 grams, where 1000 grams costs 60 rubles;

- for roasting - 5.21 grams, where 1000 grams costs 80 rubles;

- bean garnish (technological card No. 741) or potato (technological card No. 42) - 52.08 grams, where 1000 grams costs about 50 rubles.

As a result, we get:

- chicken fillet, peeled from skin and bones - 5.37 rubles;

- butter (real, made according to GOST) - 3.36 rubles;

- chicken egg - 0.4 rubles;

- bread made from premium flour - 0.54 rubles;

- cooking fat for frying - 0.42 rubles;

- bean garnish (technological card No. 741) or potato (technological card No. 42) - 3.12 rubles.

Thus, we get a calculation of a dish in the dining room "Cutlet in Kiev": the cost of 100 grams of a serving is 13 rubles 20 kopecks.

By the same principle, a calculation is made of all items prescribed in the menu, including side dishes, desserts and drinks.

Of course, prices are unstable, and rewriting the cost manually from time to time is at least irrational, so you can create dish templates in any program that allows you to keep count, the same Microsoft Excel at least. Just drive in the components, write down the calculation formula and adjust the purchase price when it changes.

If it is planned to implement automated accounting, then everything is elementary here - almost everything trading programs, "sharpened" for public catering systems, have the option "calculation of dishes". Moreover, it is revealed not only in the possibility of posting the actual purchase price of the ingredients in the relevant lines - they also carry out, in real time, movement and write-off. Thanks to this, you can always track step by step where, figuratively speaking, "2 kilograms of oil have disappeared."

Practical use

As mentioned earlier, the calculation of the costing at the moment only indirectly affects its selling price, since the latter is formed under the influence of a number of characteristics, including the average for the market, the resources spent on other menu items, as well as such banal needs , as ensuring the full functioning of the dining room. The latter indicates the level of prices that must be maintained for the profitability of the enterprise in general.

By and large, it is the dining room that is a fairly profitable enterprise, since the standard list of dishes, which is usually honored by such establishments, is distinguished by a frankly low purchase price without losing its useful qualities. Relatively speaking, the preparation of the same vinaigrette or pickle takes a minimum of funds, and the people's love for them is close to the concept of "eternity". The calculation of dishes is able to show the organization's accounting department how profitable certain items of the assortment are, whether it is necessary to introduce something new or, on the contrary, remove dishes that do not pay for themselves.

The formation of the price for certain services depends on the cost of the cost of its provision, which includes the costs of materials, wages, depreciation and other costs expressed in monetary terms. In this regard, accountants of business entities providing services to the population are wondering what the calculation of the cost of services looks like (sample).

What is meant by the cost of services

Rendering a certain kind, type and nature of the service to the population, business entities determine its cost, the amount of which is individual for each of the services. To do this, a set of amounts for the implementation of costs in the provision of a particular service is calculated. All costs included in the cost of services are grouped:

- according to costing items;

- by cost elements.

The cost of production of works, services is the cost of resources spent in the process of production of products, provision of services or performance of work. The cost of the spent resources is calculated both for the production of products (provision of services, performance of work), and for the sale of services, works, products.

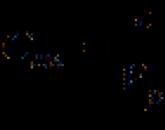

Table 1. Calculation of the cost of the service "Regular manicure without coating"

Analysis of the cost of products works services

Consider an example of an analysis of the cost of services provided by an enterprise by cost elements in table 2.

Table 2. Analysis of the cost of services by cost elements of Avtoservis LLC for 2014 - 2016

| Name of cost elements | changes, | changes, |

||||||||

| 2015 | 2016 | 2015 | 2016 |

|||||||

| Material costs | ||||||||||

| Labor costs | ||||||||||

| Deductions for social needs | ||||||||||

| Depreciation | ||||||||||

| Total cost | ||||||||||

From Table 2 we can conclude that in 2014 material costs accounted for 29.58% (2375 thousand rubles), in 2015 - 28.68% (2604 thousand rubles), in 2016 - 27.83% (3033 thousand rubles). The share of material costs in the total cost in 2015 compared to 2014 decreased by 0.9%, and in 2016 compared to 2015, the share of these costs decreased by 0.85%.

The share of labor costs in the total cost in 2015 increased by 1% compared to 2014, and by 0.11% in 2016 compared to 2015. The share of expenses for social contributions in 2014 was 1.29%, in 2015 - 1.38%, in 2016 - 1.26%. The share of contributions for social needs in 2015 compared to 2014 increased by 0.09%, in 2016 compared to 2015 decreased by 0.12%.

Depreciation in the total cost of the enterprise in 2014 is 6.55%, in 2015 - 7.38%, in 2016 - 6.24%.

Other expenses in the total amount of expenses amounted to 56.85% in 2014, 55.81% in 2015, and 57.82% in 2016. The share of other costs in the total cost in 2015 compared to 2014 decreased by 1.04%, and in 2016 compared to 2015 increased by 2.01%.

Service costing (sample)

Entrepreneurs and organizations working in the provision of any services often require an example of calculating the cost of services. Correct calculation allows you to choose the optimal price for the service, and therefore increase profits. We tell you what should be taken into account when calculating the cost of services and what formulas should be used.

Cost - what characteristics you need to know

The cost price in economics and accounting is the total cost of all resources spent on the production of products or the provision of services.

If, in the case of the production of material things, there are actually no questions regarding cost calculations, it is enough to add up the cost of all raw materials, labor resources and fixed assets - then the cost estimate for the provision of services is not so obvious.

To understand how to calculate the cost of a service, first of all, it is necessary to create an exhaustive list of all the resources spent on its provision. This is often difficult to do, because modern market presented great amount services of various kinds: from those involving the use of any material means of production or raw materials to those based solely on the work of a specialist.

Estimating the cost of providing services is not so obvious.

What is included in the cost - how not to miss anything

Conventionally, all resources used in the provision of services can be divided into the following types:

- Associated with the remuneration of a specialist - the so-called "direct". These are the amounts that the employee receives for his labor activity. A hairdresser - for a haircut, a driver - for transportation, a system administrator - for servicing the local network.

- Associated with the purchase of materials or raw materials used within the service. For example, for a hairdresser - hair care products, for a driver - gasoline, for a system administrator - payment for the Internet and licensed software.

- Payment for fixed assets of production - depreciation deductions for depreciation of equipment, maintenance and repair Vehicle, rental property and payment utilities.

- Remuneration of labor of administrative and managerial personnel - the cost of the work of those specialists who do not provide services directly, but manage the process of their provision or perform another managerial function.

- Tax and other mandatory contributions to the budget and insurance funds. Any officially registered organization is required to pay taxes, as well as transfer funds to medical and social insurance funds. From the point of view of economy, it is more reasonable to include these costs in the cost price.

- Other expenses. For instance, advertising campaign, payment for communication and travel for employees, etc.

For example, an entrepreneur provides comprehensive services for birthdays and anniversaries. For each event, he attracts a presenter, musicians and a photographer - their wages, as well as tax deductions (if employees work officially) will be treated as direct expenses.

This also includes the cost of renting the premises where the events take place, and paying for utilities. But in addition to direct and fixed costs, there will be indirect non-permanent ones, namely: salary of the organizer himself, decoration of the hall with flowers and balloons.

Separate nuances of accounting for certain categories of expenses

If the cost of the resources required to provide the service is quite high, or it is impossible (more precisely, undesirable) to purchase them without the consent of the client, it would be more correct not to include these costs in the cost price, but to present them to the client separately for payment.

For example, when renovating an apartment, the choice building materials impossible without a customer. For this reason, it is worth presenting two estimates to the client: one with the cost of materials, the other with the direct cost of providing the service.

The calculation of the cost of services is based on the addition of the cost of all resources spent on their provision.

An example of cost calculation for different categories of services

Now you know the basic principles for calculating the cost of providing services, namely what needs to be taken into account when calculating. For clarity, consider a few examples of how to calculate the cost different categories services - from the simplest to the more complex.

Calculation of the cost of services - tutor, hairdresser, massage therapist

Consider a sample calculation of the cost of services for a tutor, hairdresser and massage therapist. Despite the fact that these professionals work in a very different areas, they are united by a similar list of resources expended. Such work is based largely on their own knowledge and skills.

For example, the tutor actually needs only their own knowledge to work. In most cases, notebooks, pens and reference books are purchased by students. However, even if the tutor purchases teaching aids at his own expense, this amount is not so significant in relation to the period of its use (at least for several years) and pays off in the first month of work.

Therefore, as a rule, tutors set the price per hour of work without any consideration of the cost of the materials used, but solely depending on their own qualifications. WITH Specialists who go home to students sometimes include travel compensation in their payment and in rare cases compensation for travel time.

With the services of hairdressers, the situation is somewhat more complicated, since in their work they use some equipment - scissors, hair dryers - as well as consumables - hair care products, paint, varnishes. There are several calculation options.

Let's say the master accepts clients at home, that is, he does not need to pay rent and include in the price the salary of the administrative staff of the salon. For the dyeing procedure, he uses paint worth 1,500 rubles, consumables (hats, towels) for 200 rubles, equipment (scissors, hair dryer, brushes) of which includes 50 rubles in the price. Then the cost of staining will be: 1500 + 200 + 50 = 1750 rubles.

Of course, for the client, the procedure will cost more. The final price will depend entirely on the value at which the master evaluates his work. It will be equal to: 1750 (cost) + salary of a hairdresser. Similar services in the salon will cost much more, since in addition to the first two items of expenditure - materials and labor of the master - they will include the cost of utility bills and rent, as well as indirect payments to the administration of the institution.

As for the work of massage therapists, the calculation is carried out in a similar way: consumables in the amount of a specialist's remuneration, appointed in accordance with his qualifications and personal assessment. When providing services in medical institution, additional accruals to the cost price will be made by analogy with a beauty salon.

How to calculate the cost of transport services

Cost calculation transport services will be much more difficult. It is based on the value of one machine hour - that is, the cost of 1 hour of machine operation, as well as on the values of consumables, depreciation and employee wages.

How to calculate machine hour? This is a rather complicated operation, which requires the simultaneous accounting of a very significant number of indicators. For this reason, it is better to involve a professional estimator in the calculation. In general, it can be summarized that this indicator is calculated by dividing the sum of all expenses for the acquisition, maintenance of equipment and wages of employees by the number of hours worked. The cost of an hour of transport service will actually be equal to the cost of a machine hour.

The calculation of the cost of transport services will be much more difficult.

The cost of creating a turnkey website

Services are provided not only in the real, but also in the virtual world. If it is generally clear with what to include in the cost of the former, then how is the cost of providing services in the virtual space summed up, for example, when creating websites?

Creating a website includes the following categories of expenses:

- purchase of a domain name ("address" of the site);

- hosting;

- purchase of software;

- remuneration to the creator of the site (if it is a hired specialist).

However, most entrepreneurs prefer to order not only the site itself, but also its primary content. In this case, you will have to pay for the services of a web designer, layout designer, content specialist (who will write information for the main sections of the site).

Online stores may need to bring in a photographer- for professional shooting of goods. In addition, the cost of a website or an online store will include the cost of equipment (computers, office equipment) and its depreciation.

Why calculate the cost of services

The calculation of the cost of services is useful to entrepreneurs and organizations for several reasons at once. Firstly, it allows you to correctly plan the budget, take into account the cost of materials or equipment, and also understand what costs will have to be incurred to provide a certain number of services. Secondly, knowledge of this indicator will help to correctly form pricing policy, including creating a trade margin. Thirdly, accurate knowledge of the cost makes it possible to optimize the work process.

Conclusion

The calculation of the cost is important, as it allows you to correctly set the price for the provision of services, optimize the process of their provision. To calculate the cost, it is necessary to take into account all the resources that were spent. This list will include both the cost of equipment and consumables, and the remuneration of hired personnel.

Production costs (cost)- this is the current costs of the company for the production and sale of products, expressed in monetary terms, which are the estimated price base

Calculation unit- this is a unit of a specific product (service) according to costing items (according to costing)

The basis for calculating prices is costing (distribution costs).

It is compiled for the unit of measurement of the quantity of manufactured products adopted taking into account the specifics of production (1 meter, 1 piece, 100 pieces, if produced at the same time). The calculation unit can also be the unit of the leading consumer parameter of the product.

Lists of costing items reflect the features of production.

For modern domestic practice, the following list of costing items can be considered the most characteristic:

- raw materials and supplies;

- fuel and energy for technological purposes;

- wage production workers;

- payroll of production workers;

- overhead costs;

- general running costs;

- other production expenses;

- business expenses.

Items 1-7 are called production costs, as they are directly related to maintenance production process. The amount of production costs is production cost. Article 8 (sales expenses) expenses associated with the sale of products: the cost of packaging, advertising, storage, partly transportation costs. The sum of production and selling expenses is total cost of production. There are direct and indirect costs. Direct costs relate directly

on the cost of a particular product. According to the above list, direct costs are represented by items 1-3, which is typical for most industries. indirect costs are usually associated with the production of all products or several of its types and are indirectly related to the cost of specific products - using coefficients or percentages. Depending on the specifics of production, both direct and indirect costs can vary greatly. For example, in mono-production, direct costs are almost all costs, since the result of production is the release of one product (ship building, aircraft building, etc.). On the contrary, in hardware processes ( chemical industry), where a gamut of other substances is obtained simultaneously from one substance, almost all costs are indirect.

There are also conditionally fixed and conditionally variable costs. conditionally permanent called costs, the volume of which does not change or changes slightly with a change in the volume of output. For the vast majority of industries, general production and general business expenses can be considered as such. conditional variables consider the costs, the volume of which is directly proportional to the change in the volume of output. Usually these are material, fuel and energy costs for technological purposes, labor costs with accruals. The specific list of costs, as we have already said, depends on the specifics of production.

Manufacturer's profit in price - the amount of profit, minus indirect taxes, received by the manufacturer from the sale of a unit of goods.

If the prices for the goods are free, then the amount of this profit depends directly on the pricing strategy of the manufacturer-seller (Chapter 4).

If prices are regulated, then the amount of profit is determined by the rate of return established by the authorities, and with the help of other levers of direct price regulation (Chapter 2).

In modern Russian conditions, the objects of direct price regulation at the federal level are natural gas prices for monopoly associations, electricity tariffs regulated by the Federal Energy Commission Russian Federation, tariffs for modes of transport with the largest cargo turnover (primarily tariffs for freight railway transport), the price of vital drugs and services that are most significant from the economic and social standpoints.

The object of direct price regulation by the subjects of the Russian Federation and local authorities is a much wider list of goods and services. This list depends to a decisive extent on two factors: the degree of social tension and the possibilities of regional and local budgets. The higher the social tension and the larger the amount of budgetary funds, the greater, other things being equal, the scale of direct price regulation.

V Russian practice at state regulation prices and in the vast majority of cases, with a system of free prices, the full cost of a unit of goods is taken into account as the basis for using the percentage of profitability when calculating profits.

Example. The cost structure for costing items per 1000 products is as follows:

- Raw materials and basic materials - 3000 rubles.

- Fuel and electricity for technological purposes - 1500 rubles.

- Remuneration of the main production workers - 2000 rubles.

- Accruals for wages - 40% of the wages of the main production workers

- General production expenses - 10% of the wages of the main production workers.

- General business expenses - 20% of the wages of the main production workers.

- The cost of transportation and packaging - 5% of the production cost.

It is necessary to determine the level of the manufacturer's price for one product and the amount of profit from the sale of one product, if the profitability acceptable to the manufacturer is 15%.

Payment

1. We calculate in absolute terms indirect costs, given as a percentage of the wages of the main production workers, per 1000 products:

- accruals for wages = 2000 rubles. *40% : 100% = 800 rubles;

- overhead costs \u003d 2000 rubles. *10% : 100% = 200 rubles;

- general expenses = 2000 rubles. *20% : 100% = 400 RUB

2. We define the production cost as the sum of the costs of articles 1-6.

- Production cost of 1000 items = 3000 + 1500 + 2000 + 800 + 200 + 400 = 7900 (rubles).

3. Costs for transportation and packaging = 7900 rubles. 5%: 100% = 395 rubles.

4. Full cost of 1000 products = 7900 rubles. + 395 rub. = 8295 rubles; total cost of one product = 8.3 rubles.

5. Manufacturer's price for one product = 8.3 rubles. + 8.3 rubles. 15%: 100% = 9.5 rubles.

6. Including profit from the sale of one product = 8.3 rubles. 15%: 100% = 1.2 rubles.

Manufacturer price- the price, including the cost and profit of the manufacturer.

Actual sale of goods (services) according to manufacturer's prices(manufacturer's price, factory price) is possible mainly when there are no indirect taxes in the price structure. In modern economic practice, the list of such goods (services) is limited. As a rule, indirect taxes are present in the price structure as direct pricing elements. In absolute prices

most goods (services) included value added tax(VAT).

The structure of prices for a number of goods contains excise. This indirect tax is included in the price of goods that are characterized by inelastic demand, i.e., an increase in the price level as a result of the inclusion of an excise tax in it does not lead to a decrease in the volume of purchases of this product. Thus, the fiscal tax function is implemented - ensuring budget revenues. At the same time, excisable goods should not be essential goods: the introduction of an excise tax in this case would be contrary to the requirements social policy. In this regard, both in domestic and international practice, excisable goods are primarily alcoholic products and tobacco products. Commodities such as sugar and matches, characterized by the most a high degree demand inelasticity, are not excisable, since they are included in the list of essential goods.

Along with the main federal taxes (value added tax and excise), prices may include other indirect taxes. For example, before 1997 in Russia, a special tax was included in the price structure. In 1999 sales tax was introduced in almost all regions of the Russian Federation. Later, these indirect taxes were removed.

Let us dwell on the methodology for calculating the value of value added tax in the price as the most common tax.

The price without VAT is the basis for calculating value added tax. VAT rates are set as a percentage of this base.

Example. Manufacturer price level -

9.5 rub. for one product. The value added tax rate is 20%. Then the level of the selling price, i.e., the price exceeding the manufacturer's price by the amount of VAT, will be:

- Tsotp \u003d Cizg + VAT \u003d 9.5 rubles. + 9.5 rubles. 20%: 100% = 11.4 rubles.

Elements of the price are also intermediary wholesale markup and trade allowance, if the product is sold through .

Selling price- the price at which the manufacturer sells products outside the enterprise.

The selling price exceeds the manufacturer's price by the amount of indirect taxes.

Rules for accounting and regulation of intermediary services

Intermediary (trade) allowance (discount)- the form of price compensation of the wholesale (trading) intermediary.

Distribution costs- the intermediary's own costs, excluding the costs of the purchased goods.

Both the wholesale intermediary and trade markups, by economic nature, as noted in Chapter 2, are the prices of services of the intermediary and trade organizations, respectively.

Like any price, an intermediary price reward contains three elements:

- intermediary costs or distribution costs;

- profit;

- indirect taxes.

Rice. 9. General price structure in modern Russian conditions. Ip - production costs (cost); П - profit; Hk - indirect taxes included in the price structure; Nposr - wholesale intermediary allowance.

As competition develops, the chain of intermediaries decreases. At present, in domestic practice, a wide range of consumer goods sold only through a reseller and directly from the manufacturing plant.

In business practice brokerage fee can be calculated in the form allowances and discounts.

In absolute terms, the intermediary discount and surcharge are the same, since they are calculated as the difference between the price at which the intermediary purchases the goods - purchase price, and the price at which it sells - selling price . The difference between the concepts of "discount" and "surcharge" appears if they are given in percentage terms: the 100% markup base is the price at which the intermediary purchases the goods, and the 100% discount base is the price at which the intermediary sells this product.

Example.

- The intermediary purchases goods at a price of 11.4 rubles. and sells it at a price of 13 rubles.

- In absolute terms, discount = surcharge = 13 rubles. - 11.4 rubles. = 1.6 rubles.

- The percentage of the allowance is 1.6 rubles. · 100%: 11.4 rubles. = 14%, and the discount percentage is 1.6 rubles. · 100% : 13 rub. = 12.3%.

Under conditions of free prices, intermediary allowances are used when the seller does not experience hard price pressure, i.e., takes the position of a monopolist (leader) in the market. In such a situation, the seller has the opportunity to directly add remuneration for intermediary services.

However, more often intermediary allowances are used as a lever of price regulation by the authorities, when market conditions allow selling goods at a price higher than allowed by the interests of national economic and social policy. So, in Russia for a long time supply and marketing allowances for the most important types of fuel were applied. These allowances were regulated federal authorities authorities. At present, in almost all regions of Russia there are trade allowances for products of increased social importance. These allowances are regulated by local authorities. The scale of their use increased significantly after the 1998 crisis.

Under conditions of free prices, intermediary discounts are used when the seller is forced to calculate his indicators in strict dependence on the prices prevailing in the market. In this case, the calculation of the intermediary's remuneration is based on the principle of "discarding" this remuneration from the level of the market price.

Intermediary discounts are usually provided by manufacturers to sales intermediaries and their permanent representatives.

Along with intermediary discounts and surcharges associated with the price level, a wide

such a form of remuneration for an intermediary as establishing for him percent of the cost of goods sold.

The profit of the intermediary is determined using the percentage of profitability to distribution costs. Distribution costs- the intermediary's own costs (for example, rent for premises, labor costs, packaging and storage of goods).

The costs associated with the purchase of goods are not included in the distribution costs.

Example. Taking into account the conditions of the previous example, we determine the maximum allowable distribution costs for an intermediary if the minimum acceptable profitability for him is 15%, and the VAT rate for intermediary services is 20%.

We can represent the absolute value of the intermediary remuneration by an equation, taking for x the maximum allowable distribution costs:

- x + x * 0.15 + (x + 0.15x) * 0.2 = 1.6;

- x = 1.16 (rubles).

If the sale of goods is accompanied by the services of not one, but several intermediaries, then the percentage of the markup of each subsequent intermediary is calculated on the price of its purchase.

Example. The intermediary sells the goods trade organization. Subject to the above conditions, this sale will be carried out at a price of 13 rubles. (11.4 + 1.6).

Then the retail price at the maximum allowable markup of 20% will be 15.6 rubles. (13 + 0.2 * 13).

Intermediary discounts and surcharges must be distinguished from price discounts and allowances.

The former, as mentioned above, constitute remuneration for intermediary services, therefore their presence is always associated not with one, but with several price stages (their number is directly proportional to the number of intermediaries).

Price discounts and markups are sales promotion tools (Chapter 4). They are used in relation to one price level and are associated with one price stage.

The general structure of the price in modern Russian conditions, taking into account all of the above elements, is shown in fig. 9.

The cost of production is one of the main quality indicators economic activity enterprises. The value of the cost directly depends on the volume and quality of products, as well as on the level rational use raw materials, equipment, materials and working hours of employees. The cost indicator is the base for determining the price of the manufactured goods. In the article we will talk about the specifics of calculating the cost indicator, as well as using examples, we will consider the methodology for determining the cost of production.

Under the cost understand the current costs incurred by the organization for the production and sale of products. At enterprises, it is customary to calculate two cost indicators - planned and actual. The value of the planned cost is determined on the basis of the estimated average cost of the manufactured goods (works, services) for a certain period of time. To calculate the planned cost, indicators of the consumption rates of materials, raw materials, labor costs, and equipment used in the production process are used. The basis for calculating the actual cost is the actual production indicators that determine the cost of producing a unit of output (group of goods).

The monetary indicator of the cost price is determined by calculating the cost estimate - identifying the costs of producing a unit of output (a group of goods, separate species production). To calculate the cost, costing items are used, which determine the type of costs that affect the cost. The types of costing items depend on the characteristics of the type of goods produced, the specifics of the production process and the economic sector in which the enterprise operates.

Types of production costs

V industrial practice use the concepts of production and full cost. To determine the production cost, such costing items are used as materials, raw materials, technological costs (fuel, energy, etc.), wages of production workers (including salary accruals), general production and general business expenses, as well as other production costs. To calculate the total cost of manufactured products, it is necessary to take into account not only production costs, but also commercial expenses. This type includes the cost of selling products, namely advertising, storage, packaging, wages of sellers, etc.

Costs that affect the cost of production may vary depending on the volume of goods produced. Based on this criterion, there are conditionally fixed and conditionally variable costs. As a rule, semi-fixed costs include general production and general business expenses, the level of which is not affected by the quantity of products produced. Labor costs, technological costs (fuel, energy) are considered conditionally variable, since the indicators of these types of costs can be increased (decreased) depending on the volume of production.

Calculation of the cost of production on examples

The cost of commercial products (services, works) in accounting can be determined from the information in reports and balance sheets. The cost indicator is determined by excluding from the amount of costs for the production and sale of products the costs of non-production accounts, as well as the sum of balances, changes in balances and semi-finished products that are not included in the cost of production.

Production cost calculation

Let's say Teplostroy LLC is engaged in the production of electrical appliances. The reports of Teplostroy LLC for November 2015 reflected the following:

- production costs - 115 rubles;

- charged to the accounts of non-production expenses - 318 rubles;

- charged to the account of deferred expenses (account 97) - 215 rubles;

- charged to the reserve account for future expenses and payments (account 96) - 320 rubles;

- balances on accounts of work in progress, semi-finished products - 815 rubles.

The unit cost of production will be:

Cost calculation by allocating costs

Let's say Elektrobyt LLC is engaged in the production of electrical equipment.

Data for calculation:

- for the period January 2016, the workshop produced 815 units;

- expenses for materials, components, spare parts - 1,018,000 rubles;

- selling price for electrical equipment amounted to 3938 rubles. (3150 rubles + 25%);

- wages of production workers (including contributions to social funds) - 215,000 rubles;

- overhead costs (electricity, equipment depreciation, etc.) - 418,000 rubles;

- general business expenses (maintenance of management personnel) - 1800 rubles.

At Elektrobyt LLC, direct costs include material costs; spare parts and semi-finished products; wages of production workers (incl. insurance premiums). The rest of the costs are indirect.

Calculation of direct production costs per unit of output:

(1,018,000 rubles + 215,000 rubles + 418,000 rubles) / 815 units = 2026 rub.

Calculation of indirect general business expenses per unit of production:

1800 rub. / 815 units = 2 rub.

Let's present the calculation of the cost price of a unit of electrical equipment produced in the form of a statement.

Popular

- Program for changing the angle of attack and pitch

- Actual output speed Calculation of closed gear train

- What is the procedure for the use of official transport by an employee

- aircraft fuel system

- Agreement for the evacuation of a vehicle Standard agreement for the evacuation of a vehicle

- Bulldozer performance and how to improve it Basic information about bulldozers

- Toyota Production System (TPS) and Lean Manufacturing

- Examination tickets by profession line pipe fitter

- What to do if you don't feel like doing anything

- Globus - shops for the whole family