Change OKVED through your personal account. How to correctly fill out an application in the form p14001 when adding an OKVED? What documents are needed to make changes

When filling out an application on form P21001, an individual entrepreneur must indicate which lines of business he will be engaged in. To do this, in sheet A of the application for registration of an individual entrepreneur, enter codes for the types of activities of an individual entrepreneur.

Codes are digital designations of types of activity, they are selected from the OKVED classifier. For example, if an individual entrepreneur opens a beauty salon, then his OKVED codes will be:

- 96.02 Provision of services by hairdressers and beauty salons;

- 96.04 Sports and recreation activities;

- 96.09 Provision of other personal services not included in other groups.

If in the course of activity the entrepreneur decided to engage in business areas that were not immediately indicated in the application for registration of an individual entrepreneur, then it is necessary to add OKVED codes. Suppose that a small shop selling professional cosmetics will be organized in a beauty salon, in this case it is necessary to inform tax office on adding OKVED codes for individual entrepreneurs.

We have developed a step-by-step instruction for you on how to add OKVED codes for individual entrepreneurs in 2020. With its help, you can independently add new types of IP activities or exclude those that you no longer plan to engage in. Let's take a closer look at the steps for an individual entrepreneur to add new OKVED codes in 2019.

Step 1. Choose new OKVED codes

Please note that it is necessary to add OKVED codes for individual entrepreneurs in 2020 in accordance with the classifier OKVED-2 or OK 029-2014 (NACE Rev. 2). Other editions of OKVED ceased to be valid from January 1, 2017.

On our website you can pick up the current ones.

New OKVED codes must consist of at least 4 characters, and it is not necessary to indicate codes of 5 or 6 characters. For example, you open a clothing store, then you only need to enter the code 47.71. This group will also include codes such as 47.71.1, 47.71.2, 47.71.3, 47.71.4, etc. At the same time, specifying such codes separately will also not be a mistake.

If you encounter difficulties in selecting new OKVED codes for individual entrepreneurs, you can seek a free consultation from professional registrars.

Step 2. Decide which OKVED code will be your main one

The main OKVED code is the one by which you receive or plan to receive the maximum income. The tariffs for insurance of employees against occupational diseases and accidents at work depend on which OKVED code for individual entrepreneurs is the main one. Entrepreneurs-employers, when changing the main OKVED code, must submit to the FSS a certificate confirming the main type of activity. This must be done no later than April 15 following the results of the previous year. Individual entrepreneurs without employees do not submit such a certificate, even if their main type of activity has changed.

If your main activity has not changed, then only additional OKVED codes need to be entered in the application R24001.

Step 3. Fill out an application form P24001

Application P24001 is intended to change the information contained in the unified state register individual entrepreneurs. A change in the types of activities of an entrepreneur is reflected in the USRIP, therefore, it is necessary to report a change in OKVED IP codes in the form P24001. The application has 9 pages, but not all of them need to be filled out.

The title page indicates the usual data of the entrepreneur: OGRNIP, TIN and full name. To enter new OKVED codes, page 1 of sheet “E” is intended, moreover, you can add both the main code and additional ones. In our example, only the option with the addition of additional OKVED codes is indicated, the main code does not change, therefore clause 1.1 is not filled out.

If you introduce a new main activity, then you must exclude the old main code. To do this, in addition to page 1 of sheet “E”, page 2 of sheet “E” must also be filled out. Here you also indicate additional OKVED codes that you want to exclude from the USRIP.

The last page is sheet G, where you need to indicate your phone number and email address. You do not need to sign the application in advance! If the entrepreneur himself submits the P24001 form, then he signs the application in the presence of the tax inspector. When notarized (if the application is submitted by mail or by proxy), the signature of the individual entrepreneur is certified by a notary.

Form P24001 can be filled out by hand in black ink or by computer in 18 point Courier New font, capital letters only. You do not need to staple the application, but you can fasten it with a paper clip.

Are you running your own business? We advise you to open a current account for non-cash payment of bills and receiving Money for the work done. Moreover, now many banks offer profitable terms opening and maintaining a current account.

Step 4. Submit documents to the registration authority

What documents are needed to add OKVED IP? If the entrepreneur personally reports changes to the registration documents, then you must have a passport and the completed application P24001 with you. A person submitting an application on behalf of an individual entrepreneur must, in addition, have a power of attorney to make changes to the USRIP. The state duty is not charged when changing OKVED codes for an individual entrepreneur, therefore, no payment document is needed in this case.

Documents must be submitted to the tax office that registered the IP. In large cities, these may be special registering IFTS, such as the 46th tax inspectorate in Moscow. You can also contact, which provides services for making changes to the EGRIP.

Please note: the deadline for submitting documents for changing the OKVED IP codes is only three business days from the moment you start working on new codes. The fine for late submission of an application is 5,000 rubles (Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

Step 5. Get a USRIP record sheet with new codes

Instead of an extract from the USRIP since 2014, the tax office issues a USRIP record sheet with new types of entrepreneurial activities. The date on which you or your authorized representative must come to the IFTS will be reported by the tax inspector; according to the law, five working days are allotted for registering a change in information about an entrepreneur.

If you chose “send by mail” as the method of receiving the document, then add a few more days to these days for the delivery of the letter to your address.

We hope that our instructions on how to add a type of activity for an individual entrepreneur will help you independently process the change in OKVED codes. To reduce the risk of change registration being denied, we recommend that you prepare Application P24001 at .

You can learn how to work with the document designer in the service from.

Form No. P24001 2020 "Application for amendments to the information about the individual entrepreneur contained in the USRIP" download (KND 1112502) in excel for free

17.03.2020

New form No. P24001 "Application for amendments to the information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs"(form code according to KND 11125 02, submitted to the registration authority upon state registration individual enterprises entrepreneurs) and the requirements for its execution were approved by the Order of the Federal Tax Service No. ММВ-7-6/25@ dated January 25, 2012 "On approval of the forms and requirements for the execution of documents submitted to the registration authority during state registration legal entities, individual entrepreneurs and peasant (farm) households"as amended by the Order of the Federal Tax ServiceNo. ММВ-7-14/333@ dated May 25, 2016 "On amendments to the annexes to the Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/25@".

Order No. ММВ-7-14/333@ registered with the Ministry of Justice of Russia on June 16, 2016 No. 42555. The document begins to be valid: June 28, 2016.Download form:

Form No. P24001 "Application for amendments to the information about the individual entrepreneur contained in the USRIP" ( tif, source: GNIVC)

New from 06/28/2016:

The only changes in the form and requirements for registration according to the orderNo. ММВ-7-14/333@ dated May 25, 2016associated with the transition to OKVED 2. Excerpt from the order:in paragraphs 1.6, 2.16, 5.16, 15.10 of Appendix No. 20 the words "according to the All-Russian classifier of species economic activity OK 029-2001 (NACE Rev. 1)" shall be replaced by the words "according to the All-Russian Classification of Economic Activities OK 029-2014 (NACE Rev. 2)".

Requirements for filling out the form (Instruction for filling out from Appendix No. 20 to Order No. ММВ-7-6 / 25@).Excerpt from Appendix No. 20. Source here and below: FTS. These requirements and General requirements to the execution of the submitted documents can be downloaded from the link above.

XV. Requirements for filling out an Application for amendments to the information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs (Form No. Р24001)

15.1. An application for making changes to the information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs is issued in the event of a change (correction) of information about an individual entrepreneur previously entered in the Unified State Register of Individual Entrepreneurs.

In the event of a change in passport data (change in the data of a citizen's passport Russian Federation(including in connection with the change of surname, name, patronymic individual), or the issuance of a passport of a citizen of the Russian Federation in connection with the acquisition by a stateless person or a foreign citizen of the citizenship of the Russian Federation) and information about the place of residence of an individual entrepreneur, an application for making changes to the information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs is not issued .

15.2. Section 1 "Information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs" is filled in in accordance with the information from the Unified State Register of Individual Entrepreneurs.

15.3. In section 2 "The application is submitted" in the field consisting of one familiarity, the corresponding digital value is entered.

If the value 2 is entered in the above field, the field consisting of fifteen characters shall indicate the state registration number of the entry (OGRNIP or GRNIP), which was entered into the Unified State Register of Individual Entrepreneurs on the basis of an application containing errors. At the same time, an error is understood to be a typo, typo, or other similar error made by the applicant when filling out an application submitted earlier during the state registration of an individual entrepreneur and which led to a discrepancy between the information included in the records of the Unified State Register of Individual Entrepreneurs on electronic media, the information contained in the documents submitted at the same time as this statement.

15.4. The section “For official marks of the registration authority” is filled out taking into account the provisions of clause 2.4 of these Requirements.

15.5. Sheet A "Information on the data of an individual entrepreneur" is filled in in case of a change (correction) of the surname, first name, patronymic, birth information of an individual entrepreneur - a foreign citizen or a stateless person.

15.5.1. Section 1 "Last name, first name, patronymic" is filled out taking into account the provisions of subparagraph 14.2 of these Requirements.

15.5.2. In section 2 "Gender" in the field, consisting of one familiarity, the corresponding digital value is entered.

15.5.3. Section 3 "Information about birth" indicates the date and place of birth of an individual.

15.6. Sheet B "Information on Citizenship" is filled in when a citizen of the Russian Federation or a foreign citizen changes citizenship, or a stateless person acquires citizenship.

15.6.1. In section 1 "Citizenship" in a field consisting of one familiarity, the corresponding digital value is entered.

If the value 2 is set, section 2 is filled in, which indicates the country's numeric code according to the All-Russian classifier of countries of the world OK-025-2001.

15.7. Sheet B "Information on the place of stay in the Russian Federation" is filled out taking into account the provisions of subparagraph 2.9.6 of these Requirements in relation to an individual who does not have a place of residence in the territory of the Russian Federation.

15.8. Sheet D "Information about the identity document" is filled out taking into account the provisions of subparagraph 2.9.5 of these Requirements by a foreign citizen or stateless person.

15.9. Sheet D "Information on the document confirming the right of a foreign citizen or stateless person to temporarily or permanently reside on the territory of the Russian Federation" is filled out taking into account the provisions of subparagraph 2.9.5 of these Requirements, in case of changes in the data of a residence permit or temporary residence permit.

15.10. Sheet E "Information on codes according to the All-Russian classifier of types of economic activity" indicates the codes according to the All-Russian Classifier of Economic Activities OK 029-2014 (NACE Rev. 2).

15.10.1. Section 1 "Information on codes according to the All-Russian classifier of types of economic activity to be entered in the Unified State Register of Legal Entities" indicates at least four digital characters.

15.10.2. Section 2 "Information on codes according to the All-Russian classifier of types of economic activity to be excluded from the Unified State Register of Individual Entrepreneurs" is filled in in accordance with the information contained in the Unified State Register of Individual Entrepreneurs.

15.11. In sheet G, section 1 is filled out taking into account the provisions of subparagraph 14.12.1 of these Requirements.

15.11.2. Section 2 “The application is submitted to the registration authority directly by the applicant and signed by him in the presence of an official of the registration authority. Identification document submitted by the applicant” is filled out official registration authority that accepted the application.

15.11.3. Section 3 "Information about the person who certified the authenticity of the applicant's signature in a notarial procedure" is filled out taking into account the provisions of subparagraph 2.20.6 of these Requirements.

Form P24001 (application in form P24001) is intended for making changes to the USRIP (in types of activity, passport data, change of residence) by an individual entrepreneur. The form is filled out when information about the IP is changed or in case of errors made in the application earlier. We also submit P24001, if necessary, or delete the old OKVED codes, according to which the IP no longer conducts activities ...

Completing Form P24001

For all changes in the EGRIP, the corresponding application is filled out:

- Page 001 must be filled out without fail. Further, only sheets that correspond to the changes being made are filled out. When changing the full name and place of residence of an individual entrepreneur, now it is not necessary to make changes to the Register.

- Sheet A is filled out either by a stateless person in case of a change in full name and birth information.

- Sheet B is filled out only when changing citizenship.

- Sheet B is submitted by individuals in the absence of a place of residence in the Russian Federation. Sheet D and D are also filled out by foreigners and stateless persons.

- Sheet E consists of two parts. In section 1 indicate the added OKVED, and in section 2 - excluded codes. The code must contain at least 4 characters. Be sure to fill out sheet G.

The procedure for filling out the forms is given in the Federal Tax Service of Russia No. ММВ-7-6/25@ dated 01/25/2012.

If the entrepreneur did not report within three working days to the tax authority about the changes, he faces a fine in 5000 rub.

You can submit documents in person and in five days receive documents on the change in the USRIP. You can delegate your rights to change activities to another person by a notarized power of attorney or send them by mail.

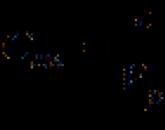

Sample filling when adding OKVED 2020

Most often, form P24001 is filled out when adding or deleting activities. Here's what the sample form looks like in this case:

Sample filling R24001 when adding OKVED - Title page

Sample filling R24001 when adding OKVED - Sheet E

Sample filling R24001 when adding OKVED - Sheet G

This example considers the case when OKVED codes need to be added and when the main activity remains unchanged (therefore, paragraph 1.1. is not filled in here).

▼ Try our bank rate calculator: ▼

Move the "sliders", expand and select " Additional terms”, so that the Calculator selects the best offer for opening a current account for you. Leave a request and the bank manager will call you back: he will advise on the tariff and reserve a current account.

If you need to change the main OKVED, indicate new code in paragraph 1.1 and fill out the second page of sheet E (available in the form, download link above). To exclude additional codes, page 2 of sheet E is also filled out.

Download the sample filling to your computer in Excel format: you will only have to replace the data indicated as an example with your own.

Submitting documents on your own

Only 3 steps:

- New forms do not need to be notarized. Print all required sheets form P24001, sheet G is signed at the registration authority when submitting documents.

- Take copies of your passport, TIN, registration certificate and document on the change of surname (if it has changed). Now you can go to the registration authority with your passport.

- Having accepted the documents, the inspector will issue you a receipt, according to which in five days you will be able to receive documents on making changes to the EGRIP.

We send by mail or through a trusted person

The list of documents is the same: sheets of the P24001 form, a copy of the passport, a copy of the TIN, a copy of the change of full name (if necessary).

If the notary sews only sheets 1 and 2 in the application, then carefully sew the rest of the sheets to them a little lower. All firmware must be visible and readable.

It is not necessary to stitch the P24001 application in 2020. It is enough to use a paper clip. But it is better to clarify this issue in your Federal Tax Service: in some regions, the tax authorities may urgently ask for this.

Now you can make an inventory of the attachment and send the application Form Р24001 and supporting documents in a valuable letter.

Form P24001 | Application form and sample for IP updated: December 30, 2019 by: All for IP

Consumer demand for market novelties is always higher than for familiar goods and services. You must always be on the alert and change in accordance with the needs of the audience. Do not forget that if you decide to take steps in another area, you will have to formalize a change in the type of activity of the IP. How to legally change the scope of business and not make a mistake anywhere?

How to change the type of activity

If you decide to run new project, then first you need to find a suitable one for him. This cipher must be selected from the OKVED list ( All-Russian classifier types of economic activity). An individual entrepreneur who registered in 2017 should be guided by new edition OKVED.

OKVED code found. Information about a new type of activity must be reported to tax service to make changes to legal documents(EGRIP). There is nothing difficult in this. Individual entrepreneurs must fill out an application in the form P24001. The form contains the OKVED codes of the new and old business.

An individual entrepreneur who registered in 2018 needs to be guided by the new edition of OKVED.

Making changes to the EGRIP

The step-by-step instructions for making changes to the (Unified State Register of Individual Entrepreneurs) are quite simple. The main attention here should be paid to filling out an application for changes:

- We go to the website of the Federal Tax Service in the section "Registration of individual entrepreneurs".

- Download form P24001.

- If there are doubts about the correctness of filling out the form, you can find a sample of filling out the form Р24001to avoid mistakes.

- We fill convenient way: by hand or on a computer.

- We print out an application for changing the type of activity of the IP.

- We complete the package of documents.

- We go to the tax office, in which we passed.

We fill out an application

Step-by-step instructions for filling out the P24001 form:

1. On the first page, information about the entrepreneur is entered, where it is indicated, full name. and . We write only in capital letters and black ink.

2. The following pages are labeled E:

I. On page E1, information about the new activities of the IP, which is entered into the USRIP, should be indicated. This is a code that corresponds to the current classifier of economic activity of an individual entrepreneur and contains 4 digits. These are the figures for the main group of economic activity. Subgroups are optional. This page indicates the change of the main activity. Remember, there can only be one.

II. On page E2, code marks are made on the types of activities that should be excluded from the general register. The codes of the main and additional view activities.

You only need to fill in the codes that are added or excluded. Active species do not need to be included in the application.

III. If the main type of entrepreneurship remains, then only the codes of new additional areas need to be added to the list. Their number can be any, but not more than 50 items that are allowed by law.

IV. The number of pages with codes is printed only in the completed form. Blank pages do not need to be printed and submitted to the tax office.

V. Application P24001 contains another sheet, which is designated "Sheet G". We print it out and fill it out only by hand with black ink.

VI. This completes the preparation of an application for changing the type of activity of an individual entrepreneur in the USRIP.

Documents for the tax office

The following documents are required to submit information about a change in the activity of an individual entrepreneur:

- completed application Р24001;

- the passport;

If an entrepreneur applies to the Federal Tax Service through a representative, the following must be added to the package of documents:

- a power of attorney certified by a notary;

- representative passport.

Data transfer methods

This saves a lot of time for the entrepreneur. Documents are filled out online. The main nuance electronic application is the presence electronic signature. It must be valid on the day the data is filled in and sent electronically.

2. Documents can be submitted by mail.

We fill out the application form and complete the documents according to step by step instructions described above. We put it in an envelope with a description of the contents. The letter must be registered as registered, with declared value and acknowledgment of receipt.

3. Personal appeal.

When an individual entrepreneur applies personally or through a representative to the tax department, the inspector issues a receipt on receipt of documents. From this moment, the procedure for entering information about the change in the activities of the IP is launched. It takes 5 business days.

The procedure for changing information about the activities of the IP takes 5 working days.

After completing the procedure or refusing to satisfy the request, the inspector issues an appropriate document. You can get it in person, by mail or through a representative.

Submission deadlines

It is clear that for any changes in the activities of the IP there are strict time frames that should not be violated. Information on the choice of a new direction in business must be provided to the Federal Tax Service within 3 days from the moment the decision was approved or the activity began (according to paragraph 5 of article 5 of the Federal Law No. 129). In case of violation deadlines a fine in the amount of 5,000 to 10,000 rubles may be imposed on an individual entrepreneur (according to paragraph 3 of article 14.25 of the Code of Administrative Offenses).

To change the type of activity of an individual entrepreneur, you do not need to pay a state duty. Change the field of activity as much as you like, but do not forget to report it to the tax office in time.

You can change your occupation at any time. Everything is quite simple if you follow our instructions. Knowing the rules for paperwork and the deadlines for applying to the tax office, you can search for your niche as much as you like. Moreover, it is not prohibited by state regulations.

In the course of doing business, there is a need to adjust the main activity. The legislator allows the introduction of such changes in the registration data of individual entrepreneurs. In this case, the businessman undergoes a special procedure regulated by the norms of the current legislation.

Choice of activity

In the process of registering an individual entrepreneur, he chooses the types of his future activities. The legislator does not limit the number. Experts recommend choosing a maximum of 30 OKVED points. In this case, one of the species is defined as the leading one. This occupation brings the entrepreneur potentially the largest income.

Here are some tips for choosing the type of work area:

- Keep in mind that not every activity option is authorized for an individual entrepreneur;

- Some options can be implemented only after obtaining additional state permission (licensing, SRO certificate, etc.). If the IP does not really want to work in this area, then it is better not to include the code in the application.

Leading IP activity

The choice of the type of activity as the main one is made to achieve two goals:

- According to it, state statistical bodies refer an entrepreneur to a specific sector of the economy and maintain a system of control and reporting;

- He has influence over the tax system. So, UTII and PSN may be preferred by those businessmen who have chosen the types of activities approved by the legislator. Based on this, tax will be calculated.

Changing the main activity code

The entrepreneur at will transforms the main type of activity. He does not need any objective reasons or evidence of the need for this procedure.

To change the prevailing code, do the following:

- Obtain an extract from the USRIP, which contains information about the registration of an individual entrepreneur;

- Fill out an application in a strict form;

- To certify the application with a notary by providing him with an extract from the USRIP, passport, TIN, registration certificate;

- Submit an application to the tax office at the place of registration.

After 5-7 days, the applicant will receive a new extract, which has already been amended.

Making an application

The procedure for converting the main activity option is simple. The main thing that a businessman needs to do is fill out the application correctly. Let's consider the procedure in detail.

An application in the form R 24001 is filled out when the registration data of the entrepreneur is corrected. This can be a surname, place of residence, citizenship, etc. An application for this form is filled out if errors are found in the USRIP. It is also issued when the main variation of the case is changed.

Form P 24001 includes several sheets. The entrepreneur does not need to complete each. In a particular case, he selects only those that he needs. For example, sheet A - information about IP; sheet B - information on citizenship, sheet C - data on the address of the entrepreneur, etc.

When changing the prevailing variant of activity, the businessman fills in the title page and sheet E. The rest are not drawn up.

The title page consists of two sections:

- It is filled in taking into account the data contained in the USRIP (registration number, full name, TIN)

- The figure is indicated in accordance with the note (1 - change in information about the businessman, 2 - correction of a previously made mistake).

Then we proceed to the design of sheet E "Information on OKVED codes." By filling in the section, you can not only change the main activity option, but also add / exclude several auxiliary types. Codes are issued in accordance with OKVED. It is permissible to enter only those that include at least three characters.

It is enough to indicate the type of activity for OKVED code, which contains three digits (XX.X subclass), this will mean that the individual entrepreneur can also engage in other activities indicated in the group of this subclass (XX.XX group). For example, if an individual entrepreneur indicated OKVED 47.2, then he can freely engage in entrepreneurial activity in the sphere of other groups of this subclass: 47.21, 47.22, 47.23, etc.

When adjusting the main variant of the activity, items 1.1 and 2.1 must be completed. Moreover, first of all, it is indicated the new kind, and in the second - the one that is subject to exclusion. The restriction on specifying a four-digit code applies only to new types, and three-digit numbers are also subject to an exception. If the entrepreneur wants to keep the previous type of business, but as an additional one, then it must be included in clause 1.2 of the application.

When specifying the codes, a check is made according to Government Decree No. 285, since in this case government agency will send a request to the Ministry of Internal Affairs about the presence or absence of a criminal record at the entrepreneur. A positive response will be the basis for refusal to conduct the registration procedure.

The difference between the procedure for individual entrepreneurs and LLC

The procedure for changing the leading case variation for an individual entrepreneur does not have any difficulties, unlike the same actions for an LLC. The organization is additionally making adjustments to founding documents. At the same time, the decision of the meeting of founders with approved changes is attached to the data package transmitted to the tax office.

The second difference is that individual entrepreneurs do not pay a state fee for changing the main code, for an LLC they set a fee for adjustment. The legislator gives the entrepreneur the right to freely choose the scope of work. He can always make adjustments to the business and registration documents. To do this, the individual entrepreneur submits a completed application to the state body and waits 5 days. The result of the procedure is the issuance of an adjusted extract from the USRIP.

Popular

- Program for changing the angle of attack and pitch

- Actual output speed Calculation of closed gear train

- What is the procedure for the use of official transport by an employee

- aircraft fuel system

- Agreement for the evacuation of a vehicle Standard agreement for the evacuation of a vehicle

- Bulldozer performance and how to improve it Basic information about bulldozers

- Toyota Production System (TPS) and Lean Manufacturing

- Examination tickets by profession line pipe fitter

- What to do if you don't feel like doing anything

- Globus - shops for the whole family