The sources of financing the reproduction of fixed assets include. Sources of fixed assets financing (types)

Financing of fixed assets - the procedure for providing funds, the system of expenses and control over the intended and effective use. Financing methods depend on the specific operating conditions of the business, changes in the direction of its development. They are determined by the characteristics of the reproduction of capital and financing at a certain stage of economic development.

Sources of financing the reproduction of fixed assets are classified into own, borrowed and attracted.

The sources of investment companies to finance the reproduction of fixed assets are:

- 1. Profit remaining at the disposal of the firm;

- 2. depreciation;

- 3. Depreciation of intangible assets.

Sufficient sources of funds for the reproduction of capital is critical to the financial health of the company.

Profit is the foundation net profit enterprises, forms of expression of the value of the surplus product. Its value appears as the difference between the proceeds from the sale of goods (works, services) and its full cost. However, in accordance with the accounting policy chosen by the company, the amount of revenue is determined by the shipped or paid goods. total cost is established on the basis of estimates of production costs and accounting data.

Profit is a general indicator of results commercial activities enterprises.

After paying taxes and other payments from the profits of enterprises to the budget is the net profit. Part of her company the right to direct capital investments of industrial and social, as well as protection environment. This part of the profits can be used for investments within the framework of an accumulation fund or a similar fund established by enterprises.

After profits, the next major source of financing for investment in fixed assets of enterprises is depreciation. In the work of fixed assets, they gradually wear out, i.e. lose their original physical properties, as a result of their decline in the carrying value of the real.

There are physical (material) depreciation and cost depreciation, which includes, in addition to the monetary expression of physical depreciation, a certain amount of moral depreciation. Cost depreciation is compensated by accumulating funds included in the cost of products (works, services) in the form of depreciation charges. The value of the latter depends on the book value of fixed assets and the established rates of their depreciation. Usually, the depreciation rate is determined as a percentage of the book value and differentiated based on the type of fixed assets and their operating conditions. The amount of depreciation should be sufficient for the construction or acquisition of new facilities to replace decommissioned ones.

The depreciation fund is formed by means of monthly depreciation deductions and is used for simple and partially extended reproduction of fixed assets. The direction of depreciation for the expanded reproduction of fixed assets is due to the specifics of its accrual and expenditure: it is accrued over the entire normative term service of fixed assets, and the need for its expenditure occurs only after their actual retirement.

In case of insufficiency own sources financing the reproduction of fixed assets, the enterprise has the right to attract borrowed funds.

Borrowed sources include:

- 1. bank loans;

- 2. borrowed funds from other firms;

- 3. share in construction;

- 4. funding from the budget;

- 5. financing from off-budget funds.

The need for capital investment lending arises from the often occurring shortage of enterprises own funds, which is due to the discrepancy between the available financial resources and the need for them for the expanded reproduction of fixed capital. In this case, there are credit relations between the borrower and the lender (bank), arising in connection with the movement of money on the terms of repayment and compensation expressed in the form of loan interest.

The long-term loan pays for construction and installation works, supplies of equipment, design products and other resources for construction. The repayment of borrowed funds for newly started construction sites and facilities begins after they are put into operation within the terms established by the agreements. For facilities being built at existing enterprises, the repayment of loans begins before the commissioning of these facilities.

Raised funds include funds received from the issue of shares, shares and other contributions from individuals and legal entities to the authorized capital.

Thus, the issue of choosing sources of financing for capital investments should be decided taking into account many factors: the cost of capital raised; efficiency of return from it; the ratio of own and borrowed capital; economic interests of investors and lenders.

Sources of financing the reproduction of fixed assets can be both own and borrowed.

Capital expenditures for the reproduction of fixed assets are, as a rule, long-term in nature and are carried out in the form of long-term investments (capital investments) for new construction, for the expansion and reconstruction of production, for technical re-equipment and for supporting the capacities of existing enterprises.

Through the mechanism of accelerated depreciation, enterprises of all forms of ownership have the opportunity to regulate the amount and timing of financing the reproduction of fixed assets through depreciation. The sufficiency of sources of funds for the reproduction of fixed capital (as well as working capital) is of decisive importance for the financial condition of the enterprise. Therefore, this parameter of the financial condition should be constantly analyzed financial services enterprises.

The source of the enterprise's own funds for financing the reproduction of fixed assets is also the accrued depreciation on intangible assets. The most important source of the enterprise's own funds for financing the reproduction of fixed assets is the profit remaining at the disposal of the enterprise (net profit). Directions for the use of net profit of the enterprise are determined in their financial plans independently.

Borrowed sources of financing the reproduction of fixed assets include: bank loans, borrowed funds from other enterprises and organizations, funds received from equity participation in construction, budget funds and extra-budgetary funds. Many enterprises, regardless of the form of ownership, are created with a very limited capital, which practically does not allow them to fully carry out their statutory activities at their own expense and leads to their involvement in the turnover of significant credit resources. Not only large investment projects are credited, but also the costs of current activities: reconstruction, expansion, reorganization of production, redemption of leased property by the team and other events. Bank loans are provided to the enterprise on the basis of a loan agreement concluded between the enterprise and a credit institution (bank). The loan agreement defines the conditions for granting and repaying the loan. As a rule, a loan is granted on the terms of payment, urgency and repayment. The condition for the repayment of a loan is its provision under the guarantees of other companies known for their financial stability, pledge of real estate or other assets of the enterprise. The source of financing for the reproduction of fixed assets can also be borrowed funds from other enterprises, which are provided to the enterprise on a reimbursable or non-reimbursable basis. Loans to enterprises can also be provided by individual investors (individuals). Other sources of financing the reproduction of fixed assets are budget allocations from the state and local budgets, as well as from sectoral and intersectoral trust funds. Grant financing from these sources actually turns into a source of own funds.

The issue of choosing sources of financing for capital investments is decided taking into account many factors: the cost of capital raised; efficiency of return from it; the ratio of own and borrowed capital, which determines financial condition enterprises; the degree of risk of various sources of financing; economic interests of investors and creditors.

FC classification

depending from the subject performing FC, the main areas of control differ:

· state The FC ensures the interests of the state and society, checks the fulfillment of the obligations of individuals and legal entities to the state and compliance with the law;

· on-farm FC protects the interests of households. the subject and his team from abuse, theft and mismanagement, and also provides an increase in the efficiency of its financial and economic activity;

· legal FC carried out in the interests of the whole society, carried out by law enforcement agencies in the form of audits, forensic accounting examinations and other inspections;

· independent (auditing) control pursues the interests of participants in economic processes (suppliers and buyers, banks and other organizations) through inspections financial stability and creditworthiness of enterprises, reliability of accounting and reporting data;

· public control is carried out public organizations(e.g. trade unions). V modern conditions has no real power.

By time distinguish between preliminary, current and subsequent FC.

Preliminary FC is carried out before performing operations on the formation, distribution and use of financial resources. In this case, the documents subject to approval and execution are checked, which serve as the basis for the implementation of financial activities - draft budgets, financial plans and estimates, credit and cash applications, etc. ( The object of control is compliance with financial legislation - norms, regulations, limits, etc..)

Current FC - is control in the making financial transactions(in the course of fulfilling financial obligations to the state, receiving and using funds for administrative and business expenses, capital construction, etc.)

Subsequent FC- this is the control exercised after the financial transactions (after the execution of budgets, financial plans and estimates, the payment of taxes, etc.). In this case, the state of financial discipline is determined, its violations, ways of prevention and measures to eliminate them are identified.

By FK methods distinguish:

§ observation- involves a general acquaintance with the state of the financial activities of the object of control;

§ examination- Concerns the main issues of fin. activities and is carried out on the spot using balance sheet, reporting and other documents to identify violations of the fin. discipline and elimination of their consequences;

§ survey- is made in relation to individual parties of the fin. activity and relies on a wider range of indicators, which distinguishes it from verification. The survey uses methods such as surveys and questionnaires. The results of the survey are usually used to assess the financial. position of the object of control, the need for reorganization of production, etc.;

§ analysis– is carried out on the basis of the current or annual accounts and is distinguished by a systematic and factor-by-factor approach, as well as the use of such analytical methods as averages and relative values, grouping, index method, etc.;

§ revision- is carried out in order to establish the legality of Fin. discipline on a particular object. Legislation establishes the mandatory and regular nature of the audit. It is carried out on the spot and is based on the verification of primary documents, accounting registers, accounting and statistical reporting, the actual availability of funds.

As a rule, the audit is carried out on the basis of a predetermined work program of auditors, who are endowed with broad rights:

o check on audited objects source documents, boo. reporting, plans, estimates, etc.;

o conduct partial or complete inventories, seal warehouses, cash desks, storerooms;

o attract specialists and experts to conduct audits;

o receive written explanations from officials and materially responsible persons on issues arising during the audit, etc.

Audits are divided into several types

| By content | documentaries - include checking the availability of fin. documents actual– checking the availability of money, the Central Bank, material assets |

| By implementation time | planned - in accordance with the plan unscheduled |

| For the period under review | frontal- All financials are checked. activity of the subject for a certain period selective (partial)- checking financial activity over a short period of time |

| By volume of audited activity | complex- the financial activity of the subject in various fields is checked. Auditors of several bodies take part in them at the same time thematic- are reduced to the examination of any area of fin. activities |

(TC RF, ch. 25, art. 256-259)

1. The concept of fixed assets (PF)

OF- these are means of labor, the value of which is transferred to the manufactured product in parts, as they are worn out over a number of circuits and their natural material form does not change.

In practice, fixed assets include tools with a service life of more than one year and a cost of more than 100 minimum wages.

OF are subdivided into tangible and intangible.

The composition of m material funds includes objects production and non-production destination. The former include OFs for industrial, construction, agricultural purposes, transport, trade, etc. Non-production PFs are designed to serve the needs of housing and communal services, health care, education, culture and sports.

In the structure of the OF, there are passive part (buildings, structures) and active part (machines, equipment, etc.).

TO intangible OF (intangible assets) include computer software, databases, high-tech industrial technologies, technologies integrated circuits, know-how, trade marks, patents and other objects of intellectual property, the ownership of which allows the enterprise to both sell these funds and use them in production for more than one year.

OF are evaluated according to original, replacement and residual value.

Initial cost - the sum of the actual costs of the organization for the acquisition, construction and manufacture of PF facilities, including the costs of delivery and installation, at prices valid at the time of commissioning. A change in the initial cost of an FA is allowed in cases of completion, additional equipment, reconstruction and partial liquidation of the relevant facilities. The increase (decrease) in the initial cost of the FC is attributed to the additional capital of the organization.

The main ways of receiving FC in the KO are:

acquisition of fixed assets through long-term investments;

transfer of PF objects as a contribution to the Criminal Code;

gratuitous receipt of OF objects from government agencies, legal and individuals.

replacement cost represents the cost of reproduction of the OF at a given moment in modern prices and conditions. It allows you to take into account the cost of FCs that differ in terms of the commissioning period at the same prices. The replacement cost is determined by multiplying the book value by the conversion factor. The coefficient is approved by the Government of the Russian Federation upon submission state committee by statistics.

The CA has the right not more than once a year (as of January 1 of the current year) to re-evaluate the objects of the OF in whole or in part.

In current practice, the accounting value of fixed assets, at which they are reflected in the reporting and balance sheet, is usually called book value. If we subtract the depreciation of each object or their combination from the book value, we get the estimated value residual value OF.

2. Sources of financing for the reproduction of the OF

In the process of activity of the CO OF, they perform an economic cycle, which consists of the following stages:

§ depreciation of the OF;

§ depreciation;

§ accumulation of funds for the full restoration of the OF;

§ their replacement by making capital investments.

Distinguish wear physical and moral .

Physical- under the influence of physical forces, technical and economic factors. Physical deterioration is partially restored through repair, reconstruction and modernization.

Moral wear is manifested in the fact that obsolete OF in their design, performance, quality of products do not meet modern requirements.

OF, participating in the production process, transfer their value to the newly created product in parts, as they wear out. This process is called depreciation . Each unit of a commodity contains a part of the value of the means of labor. When the goods are sold, this value as part of the proceeds is returned to the enterprise, separated and accumulated in depreciation fund.

In accordance with Art. 258 of the Tax Code of the Russian Federation, depreciable property, depending on the useful life, is combined into 10 depreciation groups (the classification is determined by the Government of the Russian Federation).

Art. 259 of the Tax Code of the Russian Federation defines two methods for calculating depreciation:

· linear;

· nonlinear.

The amount of depreciation is determined by the company on a monthly basis. Depreciation is calculated separately for each item of depreciable property.

Line method depreciation is applied to buildings, structures, transmission mechanisms included in depreciation groups 8-10 (useful life over 20 years), regardless of the timing of commissioning of these facilities.

For the rest of the OF, the CA has the right to apply both linear and non-linear methods.

(Depreciation is charged in relation to an object of depreciable property in accordance with the depreciation rate determined for this object based on its useful life.

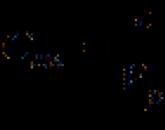

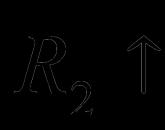

When applying the straight-line method, the depreciation rate for each item of depreciable property is determined by the formula:

K = x 100%

K - depreciation rate as a percentage of the original (replacement) cost of the depreciable property;

n is the useful life of this depreciable property, expressed in months.

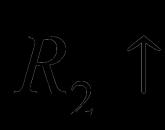

When applied nonlinear method the amount of depreciation accrued for one month in relation to an object of depreciable property is determined as the product of the residual value of an object of depreciable property and the depreciation rate determined for this object.

K = x 100%

K - depreciation rate as a percentage of the residual value applied to this depreciable property;

n is the useful life of this depreciable property, expressed in months - no need to learn!).

Thus, the depreciation fund is one of the main internal sources OF reproduction. Another source can be considered the profit remaining at the disposal of the CO.

In the conditions of expanded production, own sources for the reproduction of OP are usually not enough. Therefore, KOs resort to using external sources :

bank loans;

· cash other legal entities and individuals;

equity participation in construction;

budget credit;

investment tax credit;

By clicking on the "Download archive" button, you will download the file you need for free.

Before downloading this file, remember those good essays, control, term papers, theses, articles and other documents that lie unclaimed on your computer. This is your work, it should participate in the development of society and benefit people. Find these works and send them to the knowledge base.

We and all students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

To download an archive with a document, enter a five-digit number in the field below and click the "Download archive" button

Similar Documents

The essence of fixed assets and their importance in the business of the company. The financial analysis JSC "GSOK Kazan" Composition of fixed assets, sources of their formation. Indicators of liquidity, business activity, return on equity.

term paper, added 08/07/2017

Capital market and interest. Physical and moral depreciation of fixed capital. Depreciation, the mechanism of functioning of the capital market. Factors affecting the percentage. Utility maximization rule. Discounting, coefficient, rate.

test, added 04/04/2012

Evaluation of the overall efficiency of production and economic activities of OAO "Krasny Oktyabr". Financial resources of the enterprise and their sources of formation. The main types of borrowed capital. Usage Analysis working capital and fixed assets of the organization.

term paper, added 01/08/2017

The concept, composition and evaluation of fixed assets - means of labor that are involved in manufacturing process, while maintaining their natural form, transfer their value to the created products. Own sources of formation of fixed capital.

test, added 08/22/2011

Essence, structure and sources of working capital formation. Circulation of working capital, methods of rationing. Methods for determining the planned needs of the enterprise in working capital. Indicators characterizing the effectiveness of its use.

abstract, added 01/25/2012

Sources of financing of fixed capital. Classification of long-term loans. The choice of sources of financing of fixed capital based on a comparison of lending conditions. Calculation of the loan price. Analysis of sources of financing of working capital.

term paper, added 08/23/2013

Principles of organizing the finances of organizations. Types of depreciation charges. Leasing as a form of fundraising. The essence of working capital. Indicators of the effectiveness of the use of working capital. Sources of financing costs in the enterprise.

Popular

- Program for changing the angle of attack and pitch

- Actual output speed Calculation of closed gear train

- What is the procedure for the use of official transport by an employee

- aircraft fuel system

- Agreement for the evacuation of a vehicle Standard agreement for the evacuation of a vehicle

- Bulldozer performance and how to improve it Basic information about bulldozers

- Toyota Production System (TPS) and Lean Manufacturing

- Examination tickets by profession line pipe fitter

- What to do if you don't feel like doing anything

- Globus - shops for the whole family