What an OKVED massage. Step by step massage parlor business plan with opening

How to open a massage parlor from scratch? What form of business to choose for this? Do I need to get a massage license? Which taxation system to choose? You will find answers to these questions in this article.

How to open a massage parlor from scratch?

To open a massage parlor from scratch, you will need to formalize your business activities. The best forms for this would be individual entrepreneurs or LLCs. What is best for you, decide for yourself. To help you special, which compares these two organizational and legal forms. There are pluses and minuses here and there. So, by choosing an LLC, you will not be able to use the patent taxation system. And by registering an IP, you will have to pay a fixed amount without fail.

In their activities, both IP and LLC can be used. For a massage parlor, the USN regime with the object of taxation of income (tax rate of 6%) may be the most suitable. If the share of expenses is high (more than 60%), then you can think about the choice of regime (the rate is from 5 to 15%, depending on the decision of the regional authorities).

Coffee break: sobriety test

Leave your answers in the comments below.

from July 11, 2016, new OKVED codes for entrepreneurial activities are applied. The set of codes depends on the types of activities that the beauty salon will be engaged in.

The list of activities for a beauty salon is diverse, and includes various services provided to the population.

As a rule, beauty salons work providing a full range of services, which includes hairdressing, beauty services, solarium services, massage services.

Which OKVED code to choose an individual entrepreneur for the provision of hairdressing services in 2018

In this case, all activities must be officially registered. In addition, a company or an individual entrepreneur in a beauty salon, as related services, can offer manicure items, accessories, body care cosmetics, including oils, creams, clothing items (for salons), jewelry for sale to customers.

There is also a wholesale sale of cosmetics.

OKVED codes for a beauty salon:

- 96.02 - Provision of services by hairdressers and beauty salons

- 96.02.1- Provision of hairdressing services

- 96.02.2 - Provision of cosmetic services by hairdressers and beauty salons

- 96.09 - Provision of other personal services n.e.c.

- 47.75 - Retail sale of cosmetics and personal care products in specialized stores

- 47.74 - Retail sale of articles used for medical purposes, orthopedic articles in specialized stores

- 47.71 - Retail sale of clothing in specialized stores

- 96.04 - Sports and recreation activities, the grouping includes the use of the services of baths, saunas, solariums

- 46.45 - Wholesale of perfumes and cosmetics

- 46.45.1 - Wholesale of perfumes and cosmetics, except soap

OKVED codes for a beauty salon are given on the example of the new code classifier OK 029-2014 (NACE REV. 2). Some beauty salon activities may require a license.

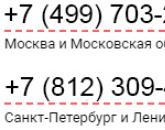

LLC "Accounting company" Aspect-Consulting "provides accounting services for LLCs and individual entrepreneurs in St. Petersburg and the region.

You may be interested in information:

UTII Declaration

Accountant's advice

Extract from the Unified State Register of Legal Entities, EGRIP

Submission of zero reporting in electronic form

Filling out applications

New OKVED codes for a hairdresser (beauty salon) 2018

Hello Victoria!

In order to open a massage parlor, you can register both an individual entrepreneur and an LLC.

Individual entrepreneurs and LLCs are required to pay insurance premiums:

LLC from the moment of conclusion of employment contracts on a monthly basis from the amount of wages of employees (including directors):

Pension Fund of the Russian Federation - 26%;

Social Insurance Fund of the Russian Federation - 2.9%;

Federal Compulsory Medical Insurance Fund - 3.1%;

Territorial Compulsory Medical Insurance Fund - 2%.

From the moment of registration, an individual entrepreneur is obliged to pay insurance premiums for himself to the PFR, FFOMS and TFOMS in the amount of:

FFOMS - 3.1%;

TFOMS - 2%.

Insurance premiums for individual entrepreneurs are paid from the amount of the minimum wage. Minimum wage = 4330 rubles (since 2012, minimum wage = 4611 rubles).

If you provide massage services in a beauty salon, and if a taxation system in the form of UTII is introduced on the territory of the municipality, then massage and sauna services provided to individuals in a beauty salon are subject to UTII. The OKVED code in this case is 93.02 - Provision of services by hairdressers and beauty salons.

The OKUN section with the code 019300 \"Hairdressing services\" along with others includes such services as:

– face and neck massage (code 019326);

— hygienic massage, skin softening, paraffin hand wraps (code 019329);

— softening, toning baths and foot massage (code 019332).

If these services are provided by organizations and individual entrepreneurs that are not related to baths and hairdressing salons, then taxation is carried out in accordance with other taxation regimes (OSN, STS, patent).

The transition of the taxpayer to the simplified tax system is of a notification nature. In order to apply the simplified taxation system, you should, within 5 days from the date of registration of entrepreneurial activity, submit an application for the transition to a simplified taxation system to the tax authority at your location. In the application, the taxpayer must select the object of taxation that he will use to calculate the tax: "income" or "income reduced by the amount of expenses."

When choosing an object of taxation (\"income \" or \"income minus expenses\"), you must independently evaluate the most profitable option. If the activity is associated with significant costs, the object of taxation\"income minus expenses\" is more profitable. In this case, taxable income will be reduced by the expenses incurred.

Individual entrepreneurs engaged in the types of entrepreneurial activities named in paragraph 2 of Art. 346.25.1 of the Tax Code of the Russian Federation, it is allowed to use a simplified taxation system based on a patent. In accordance with paragraphs. 37 p. 2 art. 346.25.1 of the Tax Code of the Russian Federation, individual entrepreneurs providing hairdressing and beauty salon services are entitled to apply the simplified taxation system based on a patent.

In view of the foregoing, an individual entrepreneur has the right to provide services for performing face and neck massage, hygienic massage of the hands, foot massage using softening herbal baths, if he applies the simplified tax system based on a patent for the type of activity \"Providing services of hairdressing and beauty salons\".

If you will do medical massage, then the OKVED code will be as follows: 85.14.1 - activities of paramedical personnel.

For more detailed advice, you can contact the "Center for the Promotion of Small and Medium Enterprises" at st.

Beauty saloon

Nikitina 3B, tel. 276-36-00.

More related articles

OKVED massage services

Helping people is a calling. But massage therapy or physiotherapy can also be a commercial field. For success you need a step-by-step and massage parlor with calculations.

Investments to start

- Equipment - $25,600.

- Legal fees - $1200.

- Stationery and furniture - $4,500.

- Rent and repair $2,800.

- Office computers and equipment - $5,900.

- Advertising and brochures - $1200.

Sales and services of a massage parlor

The sample business plan for a massage parlor includes a large list of services provided:

- Massage therapy - $75 per hour.

- Physical Therapy - $80 an hour. Our commission is $9.

- Mobility Therapy - $40 per hour. Our commission is $7.

- Water therapy - $70 per hour. Our commission is $7.

- Gym - $70 per hour. Our commission is $7.

- Acupuncture - $80 an hour. Our commission is $12.

- Aromatherapy - $40 an hour. Our commission is $7.

- Rijeki therapy - $40 per hour. Our fee is $8.

All of our staff will focus on massage therapy, with other therapies outsourced to third party professionals who meet certification requirements. For effective work, different ones will be used.

The salon for massage will be located in an apartment building on the ground floor.

The area of the leasing premises is 82 sq. m, the price per month of rent - 492 dollars.

Nearby are elite high-rise buildings, public transport stops, convenient access roads and parking. A wheelchair ramp will also be installed in the side door, allowing easy access for all our customers.

According to generally accepted standards of sanitary supervision, at least 8 sq.m. should be allocated to one massage place, good brightness of lighting, absence of drafts, supply and exhaust ventilation and central heating. All these requirements will be fulfilled by us strictly.

Equipment

The main reception area will have nurses' stands, eight to twelve chairs, clothes hangers, a coffee table, a bookshelf containing various handouts and customer information.

There will be a total of eight treatment rooms with an adjustable bed, a chair, wall charts of the human body, and a small drawer to store supplies.

The main equipment, materials and tools listed in the business plan for:

- Medical cabinet.

- Emergency Medical Kit.

- Tonometer.

- Disposable sheets.

- Medical shield.

All staff members will be trained in their area of expertise; we will not hire anyone who is not certified in the medical fields.

The region has a college that has many graduates every year. We will fill our open positions from these qualified students.

For professional contract positions and we will conclude contracts.

In addition to massage therapists will work:

- Administrator.

- Technical staff.

- Accountant (outsourcing services).

The payroll asset for employees will be $460.

The opening hours of the massage parlor will be from 9:00 to 18:00 Monday to Friday and half a day on Saturday. Contract therapists may book appointments outside of these hours as needed.

Marketing plan

Separately, in the business plan of a massage parlor, it is included for the promotion of the project and ways to promote it.

It will not be difficult to get the first customers, since now quite a lot of people pay attention to their health. But the main emphasis will be placed on making the institution popular and the salon visited by the maximum number of not only amateurs, but also people in need of massage.

- Soedanie.

- Distribution of electronic messages.

- Advertising on radio and mass media.

- Word of mouth radio.

- Distribution of booklets.

- Holding shares.

- Distribution of free certificates.

- Bright banner ad.

Financial plan

Massage parlor operating expenses:

- Office rent - $1,400 per month.

- Phone - $200 per month.

- Office supplies - $250 per month.

- Gym - $400 per month.

- Parking fee - $240 per month.

- Utilities - $450 per month.

- Advertising - $700 per month.

- Media Ads - $400 per month

Total - $4,040 in monthly operating expenses.

- Revenue from own staff will be $234,000 per year. This was determined by two therapists working six hours a day for five days a week. At an hourly rate of $75 per hour, that's $4,500 for each of the 52 weeks of the year.

- The revenue from other professionals we have attracted will be $96,096 per year. This was determined by the fact that seven therapists worked four hours a day for six days a week. With an average hourly rate of $11 per hour, that's $1,848 per week for each of the 52 weeks of the year.

- Income from flat fees charged per professional will be $22,500 per year. Each professional will be charged $125 per month, resulting in a monthly income of $1,875 (15 therapists each paying $125 per month).

How much can you earn from a massage

Based on the above figures, the total projected revenue from the massage business is $352,566 for the first year. Our total projected expenses for the first 12 months are $229,680. Earnings from starting a massage parlor from scratch are: $352,566 - $229,680 = $122,886. We conclude that it is.

In the property of the coordination form of activity, registration will be passed and .

Required OKVED code for a massage parlor:

- 93.02 - "providing services to hairdressers and beauty salons";

- 93.04 - "physical culture and health work."

Taxation system

The best option for a massage parlor system is USN (6% of monthly income).

Documents for registration

The set of documents required to open a massage parlor from scratch:

- Final acts from the fire inspection and Rospotrebnadzor.

- Help from Sanepid supervision.

- Signed agreement with Dezsluzhby.

- Signed employment contracts with employees.

- Documents confirming the medical qualifications of specialists.

Do I need licenses for a massage parlor

Since the massage parlor business plan with financial calculations will provide therapeutic massage services and other therapeutic procedures, it is necessary to obtain a massage license and license the massage parlor.

Popular

- Step by step massage parlor business plan with opening

- Trade in vegetables, fruits and berries as a profitable business

- How to open a travel agency from scratch

- How to open a travel agency from scratch without experience and money IP in tourism pros and cons

- Sale and production of souvenirs of the system of taxation and OKVED

- What is the OKVED code for hairdressing services for SP OKVED for a beauty salon

- Capital investment efficiency ratio

- Small business in Russia: facts and figures

- How to start trading on the stock exchange - detailed instructions

- Exchange spread - what is it?