What does stock spread mean? Exchange spread - what is it? Spread fixed with expansion

Hello dear readers! Today we will analyze the spread on the stock exchange - what is it? Traders who trade are familiar with this concept.

Quite often in the MT4 terminal, we can see a loss. Beginners are confused and do not understand why they entered at the same price, and then ended up in the red. But before you get acquainted and understand the opening prices of orders, you need to study and understand the basic concepts of online trading.

In this article, you will learn about the concept of spread, its types and factors that affect the size.

The spread is the difference between the bid (buy price) and ask (sell price). It is rare that their prices match. After all, the buyer wants to buy goods at a lower price, and the seller's interest is to sell at a higher price.

In the market, goods are sold at a price that both parties agree on. If the buyer agrees to the seller's offer, then a transaction occurs.

To make it easier for you to understand, let me give you an example: there are trades in the stock market. Sergey wants to buy shares of a huge well-known company and offers 145 rubles for one piece. Then he places an order and indicates the number of shares (let's say - 750). If no one has offered more than the amount, then the price indicated by Sergey becomes the bid price.

By the way, now it is possible to buy shares without leaving home through a broker, as well as open an individual investment account (IIA) remotely.

To buy a small block of shares for trial, you can use the button below:

Buy shares online

At this moment, there is no seller who would agree to give the shares at the bid price, but there is a person who would sell the goods at their set price, for example, 144 rubles. He submits his order, and the price indicated in it becomes the ask price, since it is the lowest of all offered.Now you can determine the difference between these two prices, it is called the spread, which in this case is equal to 1 ruble. If there is a person who buys shares for 144 rubles and sells them to Sergey for 145 rubles, then there will be a loss of 1 ruble per share.

Spread types

There are 2 types of them in the foreign exchange market:

- floating;

- fixed.

Floating characterizes the difference between the selling and buying prices of the exchange rate, where broker keeps the spread as low as possible until there is an increase in volatility (volatility).

fixed they call the difference between buying and selling, which the broker specifically sets at a particular value, and this does not depend on the current volatility of the currency pair.

Also, with a fixed spread, you see the number of pips that make up the cost of each trade.

But not everything is as smooth as it seems. There is also a drawback: the cost of trading operations is constantly high.

This option is perfect for traders who sell through automatic systems.

What is a floating spread? It is chosen mainly by scalpers and ECN brokers. They receive insignificant income with a fairly high degree of probability.

Factors that influence the size

One of the most important factors on which the size of the spread depends is currency liquidity. More well-known currency pairs are sold with low spreads. As for the rare ones, they rise to tens of points.

It is very important to remember that the difference between prices on the exchange is closely related to the monetary units that are used.

Another, no less significant factor is the amount of the transaction. The high cost is accompanied by the usual tight spreads.

How to secure profitable trades

Every trader should focus on spread changes. The highest performance will be if the maximum number of market conditions is fully taken into account.

The success of a trading strategy is based on an effective assessment of the market odds and certain financial conditions of the transaction. You must analyze all possible risks and evaluate the cost of the transaction.

So that you do not lose, be sure to do a comprehensive analysis, and in addition, you must clearly understand what a spread is.

Since its value can change, the strategy must be flexible enough. In this case, it will be possible to adapt to the market movement.

On this story came to an end. To keep abreast of all events, be sure to subscribe to blog updates, share information with friends on social networks. See you soon!

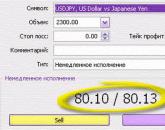

Prices are quoted in the form of currency pairs or exchange rate quotes, where the relative value of one unit of currency is expressed in units of another. The exchange rate that is applied to a client wishing to purchase the face value of a quote is called the BID. This value represents the highest price at which a currency pair will be bought. In turn, the cost of the sold unit is called ASK and denotes the lowest price at which the currency pair will be put up for sale. BID in all cases has a lower value than ASK.

The difference between ASK and BID is the spread. It can be presented as the cost of maintaining brokerage systems and replaces transaction fees. The spread is traditionally indicated in points - a percentage value at a point, that is, in the form of the fourth decimal place in the quote currency.

What is a spread on the stock exchange: types

Fixed spread is the only price difference between ASK and BID, which is maintained at a constant level and does not depend on market conditions. These values are set by dealer companies for auto-traded accounts.

Fixed spread with expansion differs in that it is divided into two parts. A certain fixed part of it is predetermined, while the other part can be adjusted by the dealer in accordance with market conditions.

The variable spread fluctuates in correlation with market conditions. Typically, its value remains low during times of market downtime (approximately 1-2 pips), but in a volatile market it can actually expand to as much as 40-50 pips. This type of spread is closer to the real market, but it brings a high degree of uncertainty to trading and makes it more difficult to create an effective strategy.

This is the basic information about what a spread is in financial terminology. What else do you need to know for successful trading?

How to take into account the spread?

By observing the variable spread on the chart, a trader can determine the moments when its value reaches extremes - maximum or minimum. With a minimum spread (from 0 to 1 pips), it is possible to open two positions at the same time (buy and sell), and then close both at the time of the maximum value. As a result, the profit will be equal to the highest value of the spread. This trading strategy with variable spread conditions has the advantage of low risk.

This is explained simply: in this case, the profit does not depend on the actual quote of the currency pair, it is based only on the value of the spread. In addition, if a trading position is opened during the minimum spread, it guarantees a break even result and makes profit very likely. What is the exchange spread in this case? In simple terms, this is the ratio of actual prices on which you can make a profit.

What has a big impact?

There are several factors that affect the size of the spread. The most important of these is currency liquidity. Popular currency pairs are traded with the lowest spreads, on the contrary, rare pairs raise tens of pips. Speaking about what a spread on the stock exchange is, you need to remember that it is inextricably linked with the monetary units used.

The next factor is the amount of the transaction. The average trade price is followed by standard tight spreads on the exchange, the extreme trades (too small and too large) are quoted with wider values due to risks.

How to calculate the spread on Forex? In a volatile market, rates and offers are more widely scattered than in a calm economy. The status of the trader also affects the value of the spread - large-scale market participants or premium clients enjoy personal discounts. The Forex market is currently highly competitive, and as brokers try to stay close to clients, the spread tends to be fixed as low as possible.

How to secure profitable trades?

Each trader should pay sufficient attention to changes in this value. Maximum performance can only be achieved when the maximum number of market conditions are fully taken into account. A successful trading strategy must be based on an effective assessment of market performance and specific financial conditions of the transaction. The best tools here are complex analysis, forecasting, risk analysis, transaction cost estimates. And, of course, a clear understanding of the question of what is a spread on the exchange. Since this value is subject to change, the strategy must also be flexible enough to adjust to market movements.

Let's start with a riddle:

Ask and Bid were sitting on the pipe. Ask fell, Bid disappeared, what was left on the pipe?

The answer to this joke question is at the end of this article on the concepts of ask, bid and spread. And, you see, it is not at all funny when traders do not understand such basic terms. And by the way, analyzing bids and asks can be very helpful in identifying price reversals, as you will see below.

Before getting acquainted with the bid, ask and spread, let's remember such fundamental concepts as supply and demand. Offer is the amount of goods that the seller wants to sell.Demand is the quantity of the product that the buyer wants to purchase.

According to the law of supply and demand,“ceteris paribus, the lower the price of a product, the greater the effective demand for it (willingness to buy) and the smaller the supply (willingness to sell)”

Let's look at an example of how supply and demand interact.

Suppose, somewhere in Africa, a prospector has found one of the largest diamonds. An interested buyer found out about this and will offer to buy this diamond for $1 million. The prospector took a couple of days to think. But the very next day, information about the find was leaked to the newspapers, and other interested persons appeared. The prospector received an offer to sell the diamond for $1.1 million, thus rejecting the price of the previous offer of $1 million. A little later, two more buyers appeared, offering 1.2 and 1.3 million, respectively. It turns out that demand has increased. The bid price is the bid price, or the price at which buyers are willing to buy a product. “Bid” in translation from English literally means - the offered price, offer

The next day, in the mines in Asia, prospectors found 10 of the same diamonds as a few days earlier in Africa. Immediately after the news of this came out, the price and demand for the African diamond fell due to the abundance of the same type of diamonds.

What is a bid

Bid price is the bid price or the maximum price at which the buyer is willing to buy the good. The buyer does not want to buy expensive. This is the logic of the law of supply and demand.

What is ask

Ask price is the bid price or the lowest price at which the seller is willing to sell the product. The seller does not want to sell cheap.

When there are factors that increase the market value of the goods, the seller raises the ask price. The buyer accordingly understands that he has little chance of purchasing the desired product at the previous price, and is also forced to increase the bid. When the market price falls, the opposite happens. The transaction occurs only when there is a buyer who is ready to pay immediately the entire amount that the seller wants. Or the seller agrees to take as much money as the buyer is willing to pay.

What does it look like when trading on the stock exchange?

The figure above shows a 5-minute trading chart for oil futures on the Moscow Exchange. At the bottom of the chart, the Bid/Ask indicator is shown as a histogram. Pay attention to the behavior of the indicator on the upward price reversal from under the level of 80. Evaluate the indicator data at 17:20. The predominance of the green color indicates that more purchases were made on the market at the ask price (namely, 20918 lots were bought). For comparison, the sales at the bid price were significantly lower (the red bar is significantly smaller, to be exact - 6184 lots sold). As a consequence of this behavior, an intraday rally to the 80.80 level began.

The accumulation of purchases made at the bid price is one of the signs of the presence of enterprising large players. Download and install ATAS, observe the beginning of uptrends using the Ask/Bid indicator and you will see similar behavior on almost every day. The price levels at which such a pattern is formed often act as support levels in the future.

Another way to visually identify the imbalance of market buying and selling is to use Bid/Ask Imbalance when setting up a cluster (for more information about the Bid/Ask Imbalance cluster type, see

- Market (market order) - applications (orders) at the current price. These are orders of those who are in a hurry to buy / sell immediately at the best price that is on the market, that is, at the bid or ask price.Such orders will be fulfilled quickly.

- Limit (limit order) - applications (orders) at a predetermined price. If you are not in a hurry to buy and are ready to wait for a better opportunity to buy, your choice is buy-limit. For example, the plan is to buy at yesterday's low and sell-limit at yesterday's high. If both orders are executed, you will be in profit. But they may not be fulfilled if the requested price does not find those willing. Then the result from trading will be zero. But it is better than the loss from the price fall after the buy-limit is executed.

Hi all!

Today we will talk about what a spread is in trading and whether it should be taken into account in trading. So, let's begin.

Spread on the stock exchange - what is it?

The spread is the difference between the best bid and ask prices. It is on every instrument and is set by the exchange. In the course of trading, the spread can change, expand or narrow. The smaller the spread, the higher the instrument's liquidity. The wider the spread, the lower the liquidity on the instrument. If we want to buy an instrument with a large market spread, then we will buy it at a worse price than we would like. Therefore, the value of the spread should always be taken into account in your trading. Especially if we trade low-liquid securities with a large spread.

Do I need to take into account the spread?

I always include the spread size in the risk per trade. On liquid futures, it can be ignored, since it is minimal. But with shares of 2-3 tiers, the picture is completely different. Many are afraid to trade such securities, including because of the large spreads. But if you approach the matter correctly, then you can also earn money on illiquid assets. By the way, the value of the spread on each instrument may change during trading. Let's take illiquid assets as an example. When the market opens, especially after a gap, the spread can be much larger. Therefore, at such moments it is especially dangerous to open a position, since it will be possible to open a position on the market at an extremely unfavorable price for us. And yes, close it too. Although there is an option to simply place an order for closing at the best price and wait for it to be executed.

The main thing when trading on low-liquid stocks is to choose the right instruments and not trade complete slag. Personally, I trade instruments with a turnover of more than 4-5 million. Although if there is an interesting situation for me on a less liquid paper, I can consider an entry point on it as well. At the same time, I always put the spread into risk and always try to look at the density in the order book from below, which I can cover the position in case of emergency. Since there are situations when the spread seems to be small, but the glass below is empty and there is simply no one to cover the entire volume.

Here is another small example on EnelRos paper, which I bought by the way. After a quick buy-back at the close of the market, the spread widened greatly. And it was possible to close this paper before closing only at an extremely disadvantageous price. Therefore, I had to wait for the opening the next day and try to throw it off at a better price, which I successfully succeeded 🙂

I will end here, if you have any questions, leave them in the comments.

Don't miss new articles — subscribe to blog news.

Sincerely, Stanislav Stanishevsky.

The difference in the price of various assets, whether it be currency, stocks or precious metals, is the one and only source of income on the exchanges. It is on price fluctuations that traders earn serious money, using various statistical tools and information channels for accurate investment forecasting. At the same time, you can earn both by increasing and by decreasing the value of the object of trade. In any case, such an important concept as a spread will participate in such operations - the difference between the best buying and selling price of an asset at the moment.

Beginners and experienced traders are offered optimal conditions for making deals!

The minimum spread and low commission are the key advantages of the AvaTrade brokerage platform!

What is spread in simple words

In order to understand what a spread is on the stock exchange, it is enough to imagine any trading operation - for example, buying clothes with further resale. The difference between the price originally paid and the money received in the course of speculation in everyday life is called profit or income. The spread is an analogue of this difference, and in this case, brokers receive income.

In the foreign exchange market, transactions are not made on all positions. Therefore, to evaluate specific trades, the concept of spread is used, which, in fact, reflects the liquidity of this market. The greater the difference between the price of buying (ask) and selling (bid) a currency, the lower is the liquidity of the market. In the sense that it will be very difficult to sell this position quickly for a profit. By analogy with the above example, if you “pull up” the price of a resold coat too high, then it will be quite difficult to sell this product.

What is spread in trading

What factors affect the spread

- Liquidity (popularity) of a currency pair. In the most popular tandems, the spread usually does not exceed 3-5 points, and when trading rare currencies, for example, the Canadian dollar or the Swedish krona, this figure can reach 50 points or more.

- The current market situation, which in turn depends on economic and political factors in different countries and in the global community as a whole. Any "hot" news that can affect the rates of leading currencies significantly affects the size of the spread.

- The presence of affiliate programs, the participants of which receive remuneration precisely at the expense of the spread. By the way, the rapid growth of affiliate programs in this segment contributes to an increase in the size of this fee, which is an inevitable “headache” for any trader.

Conclusion

Considering and keeping track of the size of the spread in trading, you can more accurately calculate the profitability of each transaction. This parameter is also actively used to evaluate

Popular

- Creation of the Procter & Gamble brand

- Business essence, functions and classification

- Price action (Price action) - how to earn?

- Traders millionaires from Russia Top richest traders

- Your own small business ideas

- Ideas for small business with minimal investment

- Small Business - Home Production Ideas

- Small Business - Home Production Ideas

- What can be produced at home for sale

- Sheep breeding business plan