What are the accounting statements of small businesses, how to prepare them and where to submit them

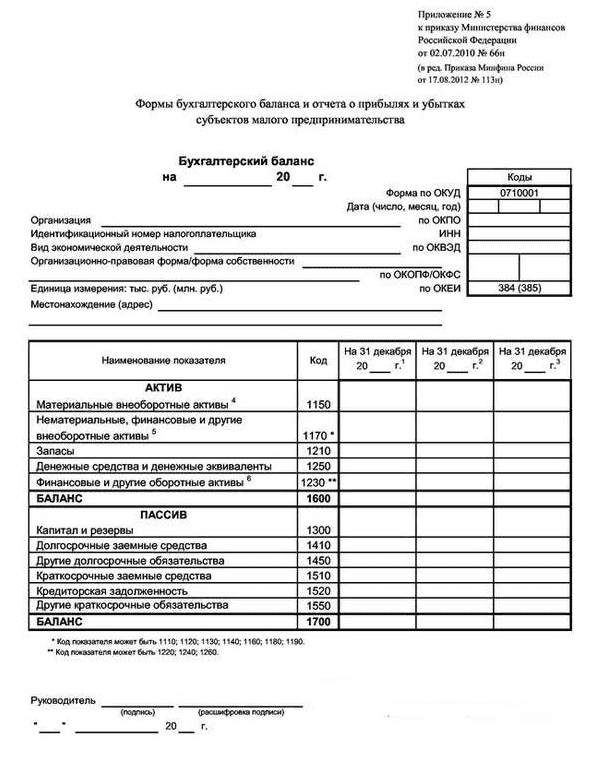

Not all companies need to keep accounting records. However, it is necessary for each enterprise to submit reports, however, a simplified form has been created for small businesses. For example, in the balance sheet there are only 11 lines: 5 for the asset and 6 for the liability. In addition to him, you need to fill out a report on financial results and submit these 2 documents to the tax service and Rosstat before March 31.

Reporting to the state on the results of its activities is the duty of any enterprise (Federal Law of 06.12.2011 N 402-FZ). And this must be done in a timely manner. Failure to submit reports entails fines and increases the likelihood of a tax audit.

Small business reporting

Accounting documents

Small companies can generate reports according to a simplified scheme. But they also have the right to do this on a general basis. At each enterprise, this issue is resolved independently. In addition, you can design the form yourself.

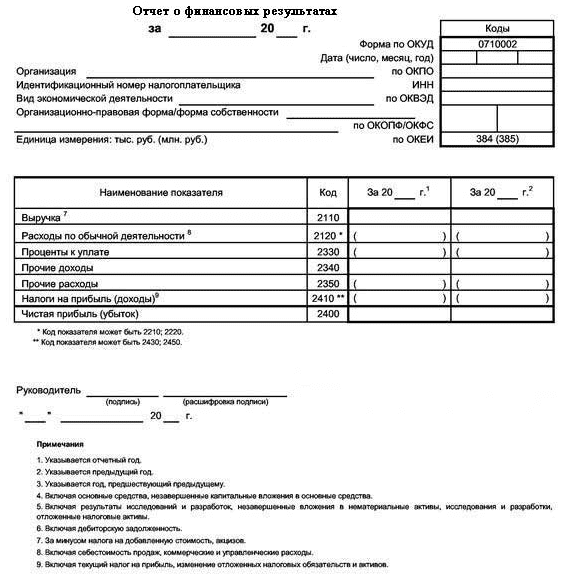

In both cases, 2 documents must be submitted (download the reporting form for 2015):

- balance;

- statement of financial results (previously - profit and loss statement).

The difference between the two is the need for detail. In a simplified version, you do not need to describe everything according to the articles, in general it is necessary to do this. In the first case, it is a simpler form, in the second it is more complicated.

Before filling out the documents, you must make the final entries for the year, close all company accounts.

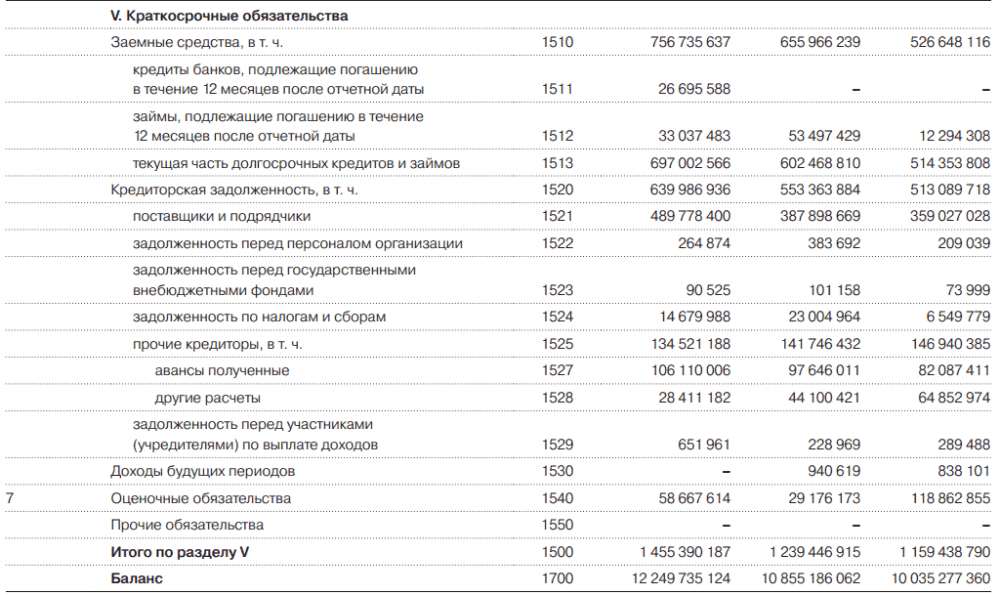

For comparison: the full form of the liability section “V. Short-term liabilities "of OAO Gazprom for 2014.

In a simplified form, as opposed to a complete one, there is only one line.

If you need to specify additional information, without which it is impossible to assess the financial condition of the organization, or you need to disclose accounting policies and other important information, make up an appendix.

How to fill out forms

The basis for filling out the forms is accounting data. Before filling out, you must make all the transactions and close the open accounts (download the completed example).

Changes cannot be made. If in a simplified form it is not possible to register the necessary information, you should use a common form.

Errors can be corrected. How to do this is described in the video:

When aggregating indicators, the line code must be specified for the one from the group, the share of which is greater.

To whom to report

If an enterprise is registered after September 30, then it must report not in the next year, but in a year and for the entire period since the beginning of its activities.

You need to report for the year, you do not need to fill out intermediate forms. But this can be done for self-examination or at the request of the company's management.

It is necessary to submit reports to 2 authorities:

- tax office;

- Rosstat.

This must be done by March 31 of the year.

Note: For small businesses can conduct accounting independently (saving on the accountant) using the Internet service "My Business".

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to do it firstPopular

- The bull and the bear on the stock exchange: the beastly face of the stock market

- Stages of opening a private dental office

- How to open your own store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from simplified to a system with VAT payment

- Car depreciation - what is it?

- Yesterday's business: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)