Tax rate eeshn

Organizations and individual entrepreneurs working in the agricultural sector enjoy state benefits and preferences. A special fiscal regime has been developed for them - a single agricultural tax. The unified agricultural tax rate is set at 6%, the tax base is calculated as the difference between the revenue and expenditure side. This reduces budget payments to a minimum, which creates favorable conditions for the development of crop production, animal husbandry and forestry.

In 2017, the unified agricultural tax rate is set at 6%. This value is valid throughout the country, with the exception of two areas:

- Crimea;

- Sevastopol.

In these regions for 2017-2018, a preferential rate of 4% is established, prescribed by regional legislation. In 2016, it was even lower - 0.5%.

Important! The privilege applies only to those companies and individual entrepreneurs that carry out activities directly on the territory of these subjects of the Russian Federation.

Who can become a single agricultural tax payer?

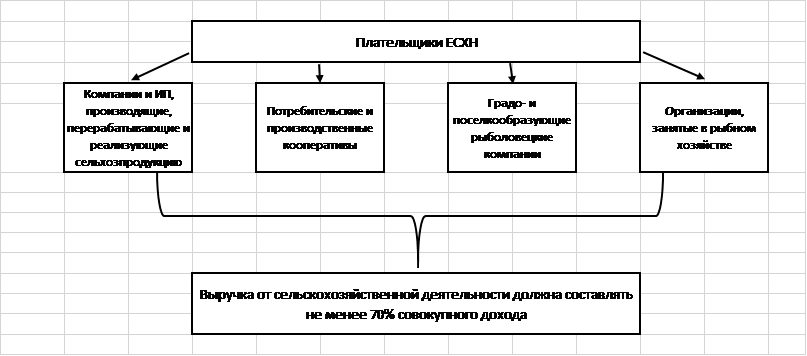

A special unified taxation tax rate is available for a limited number of companies that meet legal requirements. These include:

- Firms and individual entrepreneurs producing, processing and selling agricultural products.

- Agricultural consumer and production cooperatives recognized as such in accordance with applicable law.

- Town- and village-forming fishing companies (if they employ at least half of the inhabitants of the settlement, including workers and their families).

- Fisheries companies and individual entrepreneurs employing no more than 300 employees, owning ships or using them under charter contracts.

For all of the listed categories of taxpayers, there is a general rule on the structure of revenue: at least 70% of receipts must come from agriculture.

Important! In 2017, agricultural activities include auxiliary activities: grazing, culling poultry, spraying chemicals against insect pests, etc.

What taxes are replaced by the Unified Agricultural Tax?

A feature of the unified agricultural tax is the exemption of its payers from transferring other budget payments typical for OSNO. This means a reduction in the fiscal burden and a simplified accounting procedure.

Agricultural companies do not pay to the treasury:

- property tax;

- VAT (except for cases when the agent's obligations are fulfilled and products are transported across the state border of the Russian Federation);

- income tax;

- Personal income tax (with regards to the budgetary obligations of individual entrepreneurs without employees).

Of particular importance is the exemption from VAT - the most complex tax in terms of accounting and calculations. Organizations and entrepreneurs do not need to issue invoices, keep journals of received and issued invoices, book of purchases and sales. This saves time and money on wages for accounting employees.

What taxes do agricultural producers pay?

Organizations and individual entrepreneurs that attract employees are required to perform the functions of a tax agent and transfer 13% of staff income to the state treasury. Payment of tax is made no later than the next day after the transfer of wages, for vacation pay and certificates of incapacity for work - no later than the last day of the reporting month.

The use of hired labor implies the obligation of the company or individual entrepreneur to pay insurance premiums. In 2017, the rates for them are set at the following level:

| Extrabudgetary fund | Bid |

| FIU | 22 |

| FSS | 2,9 |

| FFOMS | 5,1 |

Important! A sole proprietor agricultural worker without employees is obliged to make fixed insurance payments for himself.

According to paragraph 3 of Art. 346.1 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs that have switched to the Unified agricultural tax do not lose the obligation to pay transport tax on cars, buses, water and air transport they own.

Vehicles named in clause 2 of Art. 358 of the Tax Code of the Russian Federation. These are combines, tractors and special machines (livestock trucks, milk trucks, etc.). It is important that two conditions are met simultaneously:

- the equipment is used for agricultural activities;

- machines are registered with agricultural producers.

Unified agricultural tax does not exempt a company or individual entrepreneur from paying customs duties required to transport goods across the border of the Russian Federation. They are obliged to fulfill agency VAT obligations arising from transactions with authorities and foreign partners.

How to calculate the taxable base for the unified agricultural tax?

The formula for calculating the unified agricultural tax is set as:

Tax = (Income - Expenses) * 0.06.

The income includes proceeds from the sale of manufactured products and non-sale activities (provision of premises and agricultural machinery for rent, issuance of rights to use intellectual property, sale of property, participation in other organizations, etc.).

Important! To calculate income, the cash method is used, i.e. the calculation takes into account the proceeds actually received at the cashier's office or on the current account. It includes advances received from buyers.

In the composition of the expenditure part, which reduces the taxable base, you can include expenses from the list given in paragraph 2 of Art. 346.5 of the Tax Code of the Russian Federation. It is strictly limited and cannot be interpreted in the direction of expansion.

Among others, the Tax Code of the Russian Federation mentions the following expenses:

- for the purchase of new fixed assets and repairs, modernization of existing ones;

- for the purchase of intangible assets;

- for the remuneration of personnel;

- to pay taxes and fees (in addition to the single tax), insurance premiums for hired employees;

- for the purchase of raw materials, materials necessary for the implementation of agricultural activities;

- to advertise goods;

- for the purchase of stationery, payment for the services of a hired accountant, auditor, notary;

- to ensure safety at work, equipment and maintenance of the first-aid post.

So that the costs mentioned in Art. 346.5 of the Tax Code of the Russian Federation, could reduce the taxable base, they must meet the requirements:

- be fully paid (cash method is used for cost accounting);

- be confirmed by primary documents;

- be actually incurred.

Advances paid to suppliers of goods and services are not included in the expense portion of the tax formula. They have been paid for, but not actually incurred: the purchased products have not yet been shipped, the work has not been done.

Features of calculating the unified agricultural tax

Companies using the UAT are not required to keep separate accounting records. They determine the size of the single tax based on accounting data.

A contradiction arises: in the accounting program, the accountant reflects transactions upon the completion of the transaction, and not the actual payment. This means that for the correct calculation of the budget obligation, only paid transactions must be selected from the set of transactions.

The selection method is fixed in the accounting policy of the company. Most often, balance sheets for 60 and 62 accounts are used for these purposes.

The legislation establishes the obligation of companies and individual entrepreneurs to transfer a single tax twice a year:

- advance payment based on the results of six months - until 25.07;

- the total based on the results of 12 months - until March 31 of the next year.

When calculating the advance payment of the unified agricultural tax, the tax rate is multiplied by the difference between semi-annual income and expenses.

The final calculation is determined by the formula:

Tax = (Income for the year - Expenses for the year) * 6% - The amount of the advance paid.

If the formula is successful, the taxpayer transfers the calculated amount to the budget. If a negative number is obtained, he can issue a refund from the state treasury in accordance with Art. 78 of the Tax Code of the Russian Federation or offset the overpayment in honor of other federal budgetary obligations.

Comparison of unified agricultural tax and other tax regimes

In the process of choosing a taxation system for a small company or individual entrepreneur, it is necessary to carry out calculations and compare the conditions within the framework of the existing regimes. Let's present their essential characteristics in the form of a table:

It is obvious from the above data that the conditions for the unified agricultural tax are the most loyal for taxpayers. The regime assumes a minimum rate of 6%. A similar value is set for the STS "Income", but the taxable base within this system is much larger than for the Unified Agricultural Tax.

The unified agricultural tax is comparable to the STS “Income minus expenses” for those regions where the rate is set at a minimum level of 6%. The general tax regime cannot compete with the unified agricultural tax, since assumes a high rate (the difference is more than three times), a more complex accounting procedure and the need to calculate and pay VAT.

The unified agricultural tax rate is only 6%, which creates favorable conditions for the development of the agricultural sector. There is no minimum tax, and therefore companies that do not make a profit do not pay anything to the budget. This makes the Unified Agricultural Tax a smart choice for farms, companies and individual entrepreneurs.

If you find an error, please select a piece of text and press Ctrl + Enter.

Popular

- The bull and the bear on the stock exchange: the beastly face of the stock market

- Stages of opening a private dental office

- How to open your own store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from simplified to a system with VAT payment

- Car depreciation - what is it?

- Yesterday's business: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)