Calculation of personal income tax - formulas and examples for determining the amount of income tax

The most common tax in all countries of the world is income tax, which is levied on wage earners.

In today's article, we will show the rules for calculating personal income tax, talk about the rates and consequences of evading its payment.

Income tax- one of the main state fees in the Russian Federation.

In our country, such an interpretation is stable. However, this category also includes.

Dedicated to the procedure for calculating, making payments and submitting reports. Unlike many other countries, Russia has adopted not progressive but flat charges. The rate does not depend on the level of income, only on the category of income.

- taxpayers are individuals who received income for the period under review. In addition, personal income tax is paid by individual entrepreneurs.

Non-residents deduct only from what they received in the Russian Federation.

- object serves as income in the form of wages, from entrepreneurial activities or other income (dividends, interest on deposits, lottery winnings, sale of property).

There is an extensive list of exceptions to the list.

- The tax base for individuals - all income received. For individual entrepreneurs - from the amount reduced by the amount of confirmed costs.

The base can be reduced by- a separate article is devoted to them on our website.

- Bid established depending on the status of the payer and the nature of the income.

The main amount of personal income tax is 13%. For non-residents - 15% and 30%.

Who and how is income tax calculated and paid?

The tax agent of the payer is obliged to deal with the accrual and repayment of personal income tax, as well as the submission of reports to the inspection, and only in his absence- the individual itself.

Usually as an agent organization is an employer. The employee is getting paid net of taxes.

For other income, the responsibility for paying personal income tax lies with the individual. This does not apply only to some lotteries and prizes, as well as deposits - most often the bank itself pays contributions to the budget.

The taxpayer is obliged to control whether the organization that paid him the money is an agent or not.

Having opened a notary's office, receiving fees or earning funds from the sale of property, a citizen is obliged to independently determine personal income tax and submit a declaration to the Federal Tax Service on time.

Reporting and payment deadlines for personal income tax for tax agents

- Period- 1 year.

- accrual produced on an accrual basis over 12 months.

- Calculated for every salary, dividends and is retained by the organization.

The tax is calculated monthly on the entire amount of income received, it is not charged from advances.

- Payment- no later than the day following the issuance of wages.

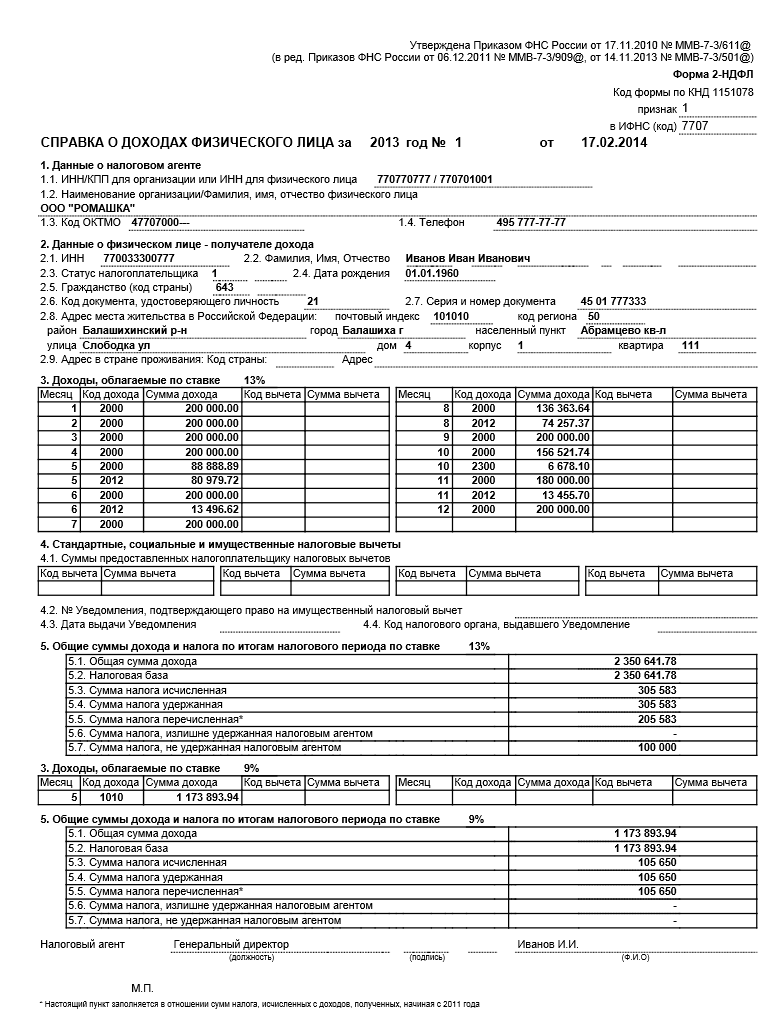

- Reporting - declarations 2-NDFL, which are compiled separately for each employee. Since 2016, a new one has also appeared. This form contains generalized indicators for the period by tax agent.

In the declaration, sign 1 is put down for the amounts from which 13% were withheld. 2 - for income in real form.

- Deadlines. 6-NDFL is filled in on an accrual basis and submitted quarterly until the last day of the month following the reporting one. The final declaration for the year is submitted no later than April 1 of the current year. 2-personal income tax is submitted once every 12 months: with sign 2 - before March 1, 1 - before April 30.

Personal income tax terms and reporting for individuals and entrepreneurs

- Taxable period- 1 year.

- Enumeration occurs 1 time no later than April 1.

The taxpayer, at the request of the inspection, may deduct quarterly advance contributions. This usually applies to individual entrepreneurs and individuals in private practice.

- Reporting Form- declaration 3-NDFL, which indicates all income (with the exception of those on which tax is paid by the employer or other agent).

- for rent Once a year, no later than 30 April.

The procedure and formula for calculating personal income tax

Paying tax on 3-NDFL is not difficult even for a person who is far from economic subtleties. So that the inspection does not have claims against you, fill out a declaration, showing all income for the year and calculate your amount. Pay a contribution to the budget and submit a declaration.

The amount may decrease due to deductions, including professional ones.

The procedure for calculating personal income tax looks like this:

- All received income is divided into categories(at applicable rates).

It is necessary to take into account the usual salary separately from valuable prizes and gifts, where the rate is already 35%.

- Tax deductions are determined.

- Base is shrinking on their size.

- Personal income tax is calculated.

- The final figure is given tax by summing up the individual components.

The easiest way to do all the calculations with the help - this will save you from errors in the calculations.

An inexperienced taxpayer underestimate or overestimate the amounts to be transferred to the budget. This happens if you do not apply deductions or include in the base income that is not taxed (alimony, compensation). Carefully study the list of exceptions and deductions in the Tax Code.

How to calculate personal income tax from salary

The employer is engaged in the calculation, and employees receive the amount “in their hands” minus payments to the budget.

- Tax amount is determined by the formula (income per month) * 13%. Bonuses, vacation pay, advance payments, salary are taken into account.

- If the employee is entitled to benefits(for minor children), then the base decreases monthly.

Note that this happens until the earnings for the year on a cumulative basis exceed 350,000 rubles. From that moment on, tax deductions cease to be valid.

- The calculated amount is subtracted from salary.

Personal income tax, "due" to the share of the advance, is charged at the time of issuance of its main part.

- The taxpayer may receive return of personal income tax for treatment and education. It is necessary to submit supporting documents to the accounting department or inspection of the Federal Tax Service.

The amount of deductions is 2800 rubles (for 2 children). The base is 65000-2800=62200 rubles. The tax for January-May is 62200*13%*5=40430 rubles. In the 06th month, Ivanov's income exceeded 350 thousand rubles - the deductions ceased to operate. For June-August, the amount of tax is 65,000 * 13% * 3 = 25,350 rubles. Total for January-August = 65,780 rubles.

personal income tax on the amount of income of the entrepreneur

The calculation procedure is complicated by professional deductions. An individual entrepreneur can reduce the tax base due to social benefits, and by the amount of expenses incurred.

- Although the tax period is 1 year, in most cases advance quarterly payments.

- Bid for business income - 13%.

- Base- income reduced by the amount of deductions.

For professional deduction costs must be in the list of accepted and have documents. Unacknowledged expenses are not accepted in full, but in the form of a percentage of income established by law (from 20% to 40%).

- You can not pay tax after each transaction.

Example: the income of the entrepreneur Petrov for the 1st quarter of this year amounted to 150,000 rubles, the expenses according to the documents for the same period - 32,000. He rented an apartment for 15,000 rubles a month. We will determine the personal income tax for 3 months to make an advance payment.

The business income base was 150-32=118,000 rubles. The amount of personal income tax is 13% * 118 \u003d 15.34 thousand rubles. From renting an apartment is equal to 15 * 3 = 45,000, personal income tax 13% * 45 = 5.85 thousand rubles. The total tax amount is 15.34 + 5.85 = 21.19 thousand rubles.

How to calculate personal income tax in the presence of other income

If you were given something valuable, you will have to pay personal income tax on the value. Financial assistance in excess of 4000 rubles is also subject to taxation.

We list the most common sources of additional income that are often not taken into account by taxpayers when filling out a declaration:

- Renting out real estate.

- Provision of professional services without registering a legal entity (freelance, part-time work).

- Win.

- Receiving a gift of valuables, shares, money.

- Interest income.

- Profit from trading.

For Russia, tax evasion has become a typical behavior, which until now the state has looked through its fingers. However, the Federal Tax Service became more active in connection with the widespread understatement of income by both the payers themselves and their employers.

personal income tax example

personal income tax example Conclusion

We have considered one of the main sources of replenishment of the budget in the country. All individuals (including individual entrepreneurs) are required to pay it.

The transfer is made either by the employing organization or by the taxpayer. Particular attention should be paid to the calculations correct determination of the tax base- The amount of contributions can be significantly reduced through the use of deductions.

Dear readers! This is a review article on such an important and voluminous concept as personal income tax. If you want to know information not covered in the material, leave your comments.

Popular

- Bull and bear on the stock exchange: the "animal" face of the stock market

- Stages of opening a private dental office

- How to open your store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from a simplified system to a system with VAT payment

- The concept of "car depreciation" - what is it?

- Business of yesterday: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint-stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)