The procedure for issuing a USN declaration, the taxable base "Income

Tax accounting under the simplified taxation regime, especially if “Income” is chosen as the taxable base, is simple and can be completed by any businessman.

The deadline for submitting reports for LLCs and individual entrepreneurs is inexorably approaching (March 31 for LLC and April 30 for individual entrepreneurs) and in order not to pay money for the preparation and submission of a tax return, we will analyze step by step the entire process of filling out reports on the simplified tax system.

General rules

Before filling out tax returns, you should remember that:

- cost indicators are entered in rubles, kopecks are rounded according to the well-known mathematical rule - over 50 kopecks to 1 ruble, less is discarded;

- only completed pages are numbered, starting from the title page in the special field “Page”, located at the top of the sheet;

- blots and corrections of errors, including correction fluid, are prohibited;

- in the paper version, the declaration is printed on one side of the sheet;

- one cell of the field corresponds to only one letter, number or sign;

- text blocks are entered in capital letters;

- dashes are put in empty cells;

- in the form made on a computer, the absence of edging of cells and dashes is allowed. Printing is carried out in Courier New font No. 16-18;

- the declaration is submitted before March 31 for LLC, until April 30 for individual entrepreneurs.

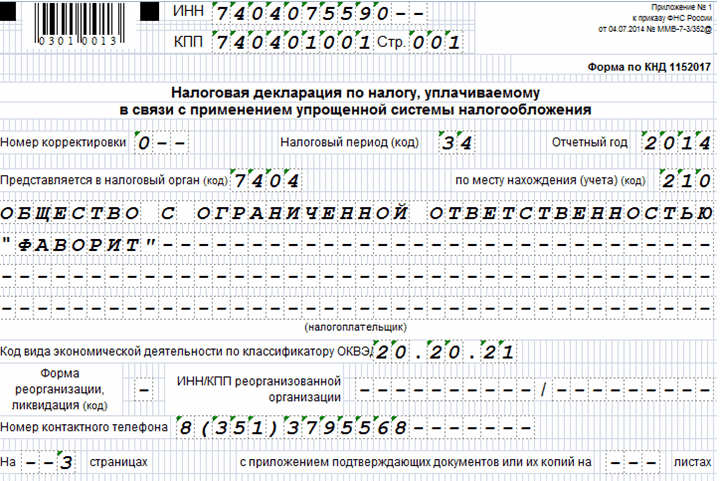

How to independently fill out a simplified tax return, income: 1st page

Let's start with the first half of the title page. Here all information about the enterprise, its form and main distinguishing features are recorded.

| Information |

|

|---|---|

| enter data from the Certificate issued when opening an individual entrepreneur or company |

|

| Correction No. | 0 - indicates the filing of the declaration for the year, 1 - corrected form, 2, 3 etc. - forms with subsequent clarifications |

| Taxable period | 34 - provision of total data for the year, 50 - for an unfinished year, when changing the special regime, liquidation or other changes in the status of the company |

| Reporting year | Time period for which information is provided |

| Tax authority code | The first four digits indicated in the certificate of registration or in the TIN |

| Location of account | 120 - for IP, 210 - for companies, 215 - for a reorganized enterprise |

| Taxpayer | Company name or full name |

| Type of activity code according to OKVED | The main view from the extract of the Unified State Register of Legal Entities (for LLC) or EGRIP (for individual entrepreneurs) |

| Form of reorganization | Individual entrepreneurs do not fill in these fields, only enterprises that are successors of reorganized or liquidated companies. Codes for liquidated companies - 0, transformed - 1, merged - 2, split - 3, merged - 5, split with subsequent affiliation - 6 |

| Contact phone number | Phone number of the company or individual entrepreneur |

| On … pages | Number of form pages |

| With supporting documents | Number of sheets of attached confirmations. In their absence - dashes. |

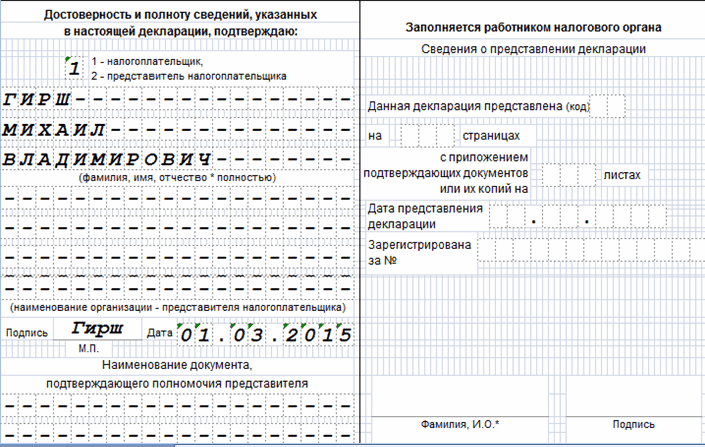

In the lower left part of the title page in the block "Reliability of the information specified in the declaration" code 1 is entered, if all the declared information is confirmed personally by the taxpayer, the number 2 in this field indicates the submission of the form by the representative of the payer. The individual entrepreneur does not fill in anything else in this block, puts a signature and a seal, if any. The head of the LLC fills in the “Full Name” field, dates the document and signs it.

The payer's representative, in addition to the above actions, must confirm his own authority by entering the necessary information in the "Name of the document confirming the authority" field. Usually this is a power of attorney certified by a notary (from an individual entrepreneur) or written out on the letterhead of LLC. In the example, the interests of Favorit LLC are represented by the head, therefore, this field is not filled.

Having finished the design of the first page, proceed to the next steps. For individual entrepreneurs and enterprises that are on a simplified taxation system, "Income" sections 1.1 and 2.1 are provided. Considering that all income information is entered in the second section of the declaration, taxes are calculated and payments that reduce their amount are fixed, and the final tax amounts payable are displayed in the first section, that is, it makes sense to first fill out section 2.1.

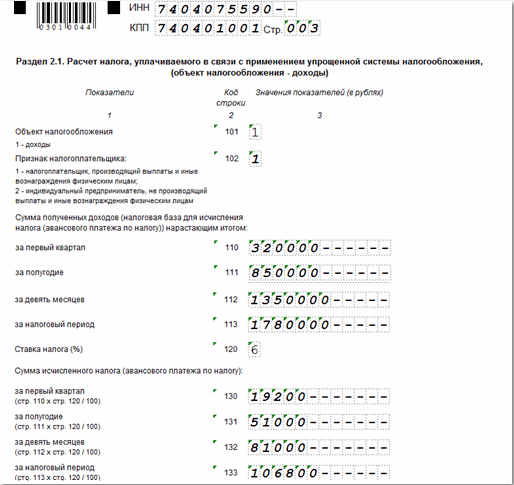

How taxes are calculated: section 2.1

Consider the procedure for the declaration of the simplified tax system, income on the example of Favorit LLC.

| Information |

|

|---|---|

| In the example: |

|

| Tax percentage - 6% |

|

| Tax = Income * 6%. In the example: |

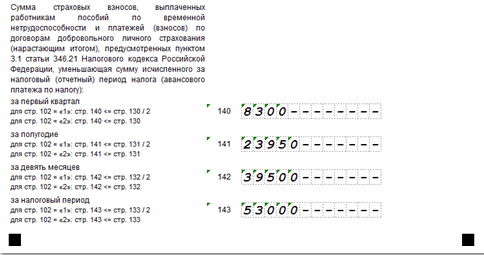

The amount of tax can be reduced for such expenses:

- social contributions paid for hired personnel and for individual entrepreneurs;

- sick leave benefits paid by the employer to employees for the first three days;

- DMS contributions.

These payments are entered in lines 140-143.

| Information |

|

|---|---|

| The field that defines the attribute of the company: with the use of hired labor - 1, without the involvement of personnel - 2 |

|

| The amount of income for each reporting period is indicated. Important: Revenue information is filled in on an accrual basis. In the example:

|

|

| Tax percentage - 6% |

|

| The amount of tax for each reporting period is calculated quarterly according to the formula: Tax = Income * 6%. In the example:

The total tax for the year amounted to 106,800 rubles. |

The final amount of the tax amount is fixed in the first section.

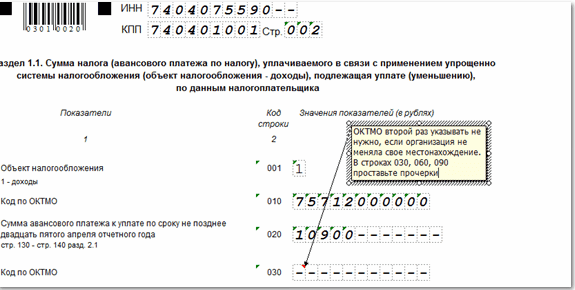

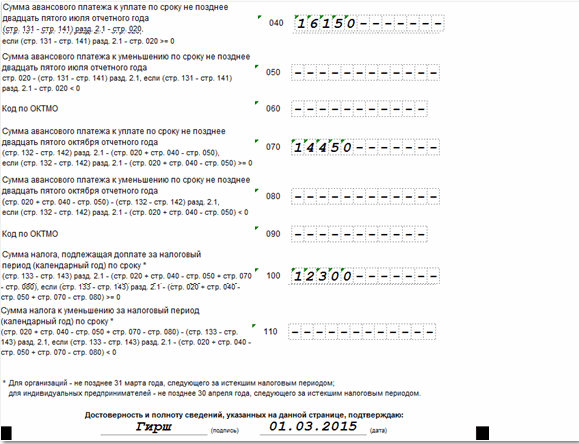

How to complete section 1.1

Let's start with the OKTMO code

This completes the tax calculation. All entries in section 1.1 are confirmed by the signature of the entrepreneur, the head of the company or the person replacing them. The final stage is the dating of the document. It should be remembered that the dates on the title page and the second page must be identical.

The declaration provides for the 3rd section, in which, in the reference mode, receipts from charitable or targeted payments are indicated. In the absence of such financial injections, this section is not filled out and submitted to the IFTS.

Important: The submitted declarations must not be stapled or stapled.

Popular

- Bull and bear on the stock exchange: the "animal" face of the stock market

- Stages of opening a private dental office

- How to open your store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from a simplified system to a system with VAT payment

- The concept of "car depreciation" - what is it?

- Business of yesterday: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint-stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)