What is the OKVED code for hairdressing services for SP. OKVED "hairdressing services" - OKVED interpretation for cosmetic services eyelash extensions

The sphere of beauty was relevant in society hundreds of years ago. Barbers and hairdressers, barbers and makeup artists of those times were valued in the high classes, and the best craftsmen were even invited to the royal court to serve the elite. Today, the activity of beauty salons is more mass and does not constitute a special cult. But this prevalence has become beneficial for the state. After all, each new beauty salon brings money to the state treasury in the form of taxes and deductions to various funds. Therefore, in OKVED 2016, hairdressing services for individual entrepreneurs and legal entities have a very specific structure and their own subclass.

To find codes for organizing a hairdressing business in the All-Russian Classifier of Economic Activities, you do not need to make much effort. Unlike many other profiles and directions, this is simplified to the limit. Target information by type is located in section “S” in subclass 96.02, which is the code for filling out an application when passing the state registration procedure for a new business entity. Using this grouping, you will deprive yourself of the need to enter clarifying data on the relevant pages of the application. However, if we are talking about a highly specialized business, and not about a general-purpose salon, additional information may also come in handy.

What is included in this activity

In OKVED 2016, hairdressing services are represented by a rather extensive list of specialized operations that can be found in any beauty salon. So, these include:

- Hair trimming.

- Women's and men's haircuts.

- Curling and straightening.

- Chemical operations to change the appearance of hair.

- Shaving beards, eyebrows, sideburns.

- Shaving and contouring.

- Laying and styling.

That is, when organizing your own business, you can indicate in the certificate of registration only specialized areas for a hairdresser. But today it is difficult to find organizations that deal exclusively with haircuts and hairstyles. Firstly, it is unprofitable against the backdrop of serious competition, and secondly, because of this approach, precious customers are lost, who need not only trim their bangs.

However, if with such a limited set of codes you decide to also provide make-up, manicure and pedicure, massage, SPA procedures, then the very first tax audit that reveals income from these types of activities will impose serious penalties on you. And if there is also specialized equipment, you can lose it.

Additional destinations

If you carefully study OKVED, hairdressing services are not so unambiguous and limited. This includes other areas of activity. For example, it can be working with wigs, combing them, adjusting, styling, fixing hairpieces. The only exception is the production of wigs. In addition, the following areas can be distinguished in separate areas:

- Manicure and skin care.

- Pedicure and foot care.

- SPA procedures aimed at healing and improving the visual qualities of the skin.

- Massage of the face, neck and other parts of the body.

- Peeling, scrubbing, mechanical effect on the epidermis.

- Make-up services, including the creation of images through professional make-up, etc.

In addition, we forgot to mention all kinds of dyeing, highlighting, coloring, bleaching and other procedures associated with color and structural changes in hair.

Practical Observations

If your task is to open a narrow-profile salon that will provide a limited set of services in only one direction, you can indicate all the subclasses that interest you on the relevant pages of the application during state registration with the Federal Tax Service. But it's much easier to use the whole grouping. It will not oblige you to perform the range of work in which you do not specialize, but will become insurance in case of an unplanned expansion of areas of activity within the walls of the organization.

And now let's say a few words about the organizational part. The procedure for opening a new business entity in the form of a legal or natural person is almost the same. But it is worth remembering some significant differences that may further affect the course of events. Form No. P21001 is adopted as the main application form for an individual entrepreneur, while future organizations use form No. P11001. These forms differ in form and content. An individual indicates codes from the All-Russian classifier of types of economic activity on sheet "A", and legal entities are required to enter these data in the corresponding fields of sheet "I".

In addition, if you are a legal entity, then for legal work on the territory of the Russian Federation, all codes for the types of professional activity must be included in the company's charter, which contains the main provisions on the form of management and organization of activities. So be careful when drawing up and filling out documents in order to register the first time and start working in the field of hairdressing services without hindrance.

1) What OKVED should be applied when rendering cosmetology services and what type of taxation does it fall under? 2) We want to open a beauty salon (hairdresser, solarium, cosmetic services, manicure) What type of taxation should I choose? Better Sole Proprietorship or LLC?

You are advised

tax consultant

accounting and legal consultant

Good afternoon 1) In accordance with the All-Russian Classifier of Economic Activities, cosmetology services are classified under code 85.14 \"Other health protection activities\" without dividing cosmetology into therapeutic and surgical, as well as without dividing cosmetology services into medical and cosmetic. (Letter of the Ministry of Economic Development of the Russian Federation of July 12, 2007 N 10169-AB / D18). 2) IP, at the STS 15%, or UTII (depending on your location), if related products are sold in the salon, but only if the area of \u200b\u200bthe trading floor does not exceed 150 sq. m. If the area of the beauty salon is more than 150 square meters. m, then you can put a showcase next to the salon administrator, on the floor plan indicate the part of the room where the sale is carried out. In this case, an order is issued - to carry out the accompanying sale of goods here, in the marked zone. In the lease agreement, we recommend that you write that trade is carried out from the sales counter (the area of which is less than five square meters), and hairdressing services are provided on the rest of the rented area. In this case, you will be able to avoid claims from the tax authorities regarding the application of the UTII regime. Sincerely, Barinova Elena 2 opinion: The type of your activity can also be attributed to Section O. Provision of other communal, social and personal services. OKVED 93.02 Provision of services by hairdressers and beauty salons. If in the territory where services will be provided, UTII for household services has been introduced, then the use of UTII will be most beneficial for you (cosmetology services are household - OKUN code 081501). If you do not want to apply UTII, then you can choose USN or OSNO if you wish. What to choose: IP or LLC - depends on many factors. We note right away that conditionally all the existing differences between individual entrepreneurs and LLCs can be conditionally divided into several groups: Organizational. Economic. Legal consequences. Organizational differences - include all issues related to the registration and organization of a business in one form or another: Registration of an individual entrepreneur (IP) requires a minimum of documents, and does not require payment of authorized capital, obtaining a legal address. The amount of the state duty for registering an individual entrepreneur is 800 rubles, and for registering an LLC - 4000 rubles. Individual entrepreneurs do not need to open a current account and have a seal; for legal entities, the presence of a current account and a seal is mandatory. An individual entrepreneur can apply such types of taxation, such as a patent, that are not available to legal entities. The transition from LLC to sole proprietorship is much easier and faster. The reverse situation is much longer and more costly. The economic advantages of an LLC over an individual entrepreneur are more significant. Despite the fact that at first glance, an individual entrepreneur has lower initial costs, in the future it often turns out that the costs of maintaining a legal entity may turn out to be lower than that of an entrepreneur without forming a legal entity. For example, if an individual entrepreneur does not conduct business, then he still has the obligation to pay a fixed contribution to the Pension Fund, but for a limited liability company in such a situation, payments are not provided, it is enough just to provide "zero" reports and an information letter that payments were not made to individuals. Certain difficulties exist in the field of lending, where banks are traditionally more loyal to legal entities. For credit institutions, the main difference between IP and LLC is that the latter have a clear amount of authorized capital, which, if necessary, can be levied. And even if in most cases the authorized capital of an LLC is at least ten thousand, then the probability of obtaining a loan from an organization will be higher than that of an individual entrepreneur. At the same time, the legislation is more loyal to individual entrepreneurs, for example, the amount of penalties for administrative offenses for them is less than for legal entities. Sincerely, Larisa Alexandrovna

Entrepreneurial activity based on the provision of personal services is simply bound to be successful, since it is for this type of service that the consumer has the greatest demand. Moreover, personal services are especially successful, since it is very important for each person to feel comfortable in this world. Such a business is influenced by territorial location, but it is usually quite profitable. It is for personal services that OKVED 96.02 is used, and for which ones, we will consider in this article.

What is included in this type of service

Personal services, despite their diversity, have one thing in common: they are performed specifically for the consumer and are able to satisfy his personal needs. Everyone strives to be beautiful: both women and men, and age does not really matter.

That is why many entrepreneurs want to occupy such a market niche, since the demand for these services usually does not decrease, but only increases, and the correct location of the business point in the territorial plan can provide the entrepreneur with stable profits for a long time.

It is worth noting that the code we are considering includes hairdressing services, as well as beauty salons, they are based on hair washing, all types of hairdressing activities, including the creation of hairstyles, as well as aesthetic beard correction. In addition, under this code, you can consider some types of cosmetic services, including cosmetic massage.

Decryption based on the classifier

This code can be deciphered step by step using the new edition of the classifier. This is OKVED-2, recognized as valid in 2017. It is worth noting that this type of activity according to the old classifier had a different code, but we are interested in decoding OKVED 96.02 at the moment:

- The code under discussion refers to the section of the classifier S, which combined other types of services provided to the population.

- 0 - code applied to other personal type services.

- 02 - a code that indicates the provision of various personal services by hairdressers, as well as beauty salons.

The code in the form in which it is indicated in the last paragraph is written in the registration documents, as well as when it is confirmed. In addition, OKVED can be used to designate the activities of an entrepreneurial object in its charter. In this case, when changing the code, it is necessary to make changes to it.

So, the code discussed in this article is used in the work of hairdressers and beauty salons, when they provide personal services, which cannot include the manufacture of wigs, even if they are made to order in a salon. Cosmetic services may also be included in the list of services provided by this business facility.

from July 11, 2016, new OKVED codes for entrepreneurial activities are applied. The set of codes depends on the types of activities that the beauty salon will be engaged in.

The list of activities for a beauty salon is diverse, and includes various services provided to the population.

As a rule, beauty salons work providing a full range of services, which includes hairdressing, beauty services, solarium services, massage services.

Which OKVED code to choose an individual entrepreneur for the provision of hairdressing services in 2018

In this case, all activities must be officially registered. In addition, a company or an individual entrepreneur in a beauty salon, as ancillary services, can offer manicure items, accessories, body care cosmetics, including oils, creams, clothing items (for salons), jewelry for sale to customers.

There is also a wholesale sale of cosmetics.

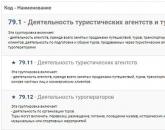

OKVED codes for a beauty salon:

- 96.02 - Provision of services by hairdressers and beauty salons

- 96.02.1- Provision of hairdressing services

- 96.02.2 - Provision of cosmetic services by hairdressers and beauty salons

- 96.09 - Provision of other personal services n.e.c.

- 47.75 - Retail sale of cosmetics and personal care products in specialized stores

- 47.74 - Retail sale of articles used for medical purposes, orthopedic articles in specialized stores

- 47.71 - Retail sale of clothing in specialized stores

- 96.04 - Sports and recreation activities, the grouping includes the use of the services of baths, saunas, solariums

- 46.45 - Wholesale of perfumes and cosmetics

- 46.45.1 - Wholesale of perfumes and cosmetics, except soap

OKVED codes for a beauty salon are given on the example of the new code classifier OK 029-2014 (NACE REV. 2). Some beauty salon activities may require a license.

LLC "Accounting company" Aspect-Consulting "provides accounting services for LLCs and individual entrepreneurs in St. Petersburg and the region.

You may be interested in information:

UTII Declaration

Accountant's advice

Extract from the Unified State Register of Legal Entities, EGRIP

Submission of zero reporting in electronic form

Filling out applications

New OKVED codes for a hairdresser (beauty salon) 2018

Hello Victoria!

In order to open a massage parlor, you can register both an individual entrepreneur and an LLC.

Individual entrepreneurs and LLCs are required to pay insurance premiums:

LLC from the moment of conclusion of employment contracts on a monthly basis from the amount of wages of employees (including directors):

Pension Fund of the Russian Federation - 26%;

Social Insurance Fund of the Russian Federation - 2.9%;

Federal Compulsory Medical Insurance Fund - 3.1%;

Territorial Compulsory Medical Insurance Fund - 2%.

From the moment of registration, an individual entrepreneur is obliged to pay insurance premiums for himself to the PFR, FFOMS and TFOMS in the amount of:

FFOMS - 3.1%;

TFOMS - 2%.

Insurance premiums for individual entrepreneurs are paid from the amount of the minimum wage. Minimum wage = 4330 rubles (since 2012, minimum wage = 4611 rubles).

If you provide massage services in a beauty salon, and if a taxation system in the form of UTII is introduced on the territory of the municipality, then massage and sauna services provided to individuals in a beauty salon are subject to UTII. The OKVED code in this case is 93.02 - Provision of services by hairdressers and beauty salons.

The OKUN section with the code 019300 \"Hairdressing services\" along with others includes such services as:

– face and neck massage (code 019326);

— hygienic massage, skin softening, paraffin hand wraps (code 019329);

— softening, toning baths and foot massage (code 019332).

If these services are provided by organizations and individual entrepreneurs that are not related to baths and hairdressing salons, then taxation is carried out in accordance with other taxation regimes (OSN, STS, patent).

The transition of the taxpayer to the simplified tax system is of a notification nature. In order to apply the simplified taxation system, you should, within 5 days from the date of registration of entrepreneurial activity, submit an application for the transition to a simplified taxation system to the tax authority at your location. In the application, the taxpayer must select the object of taxation that he will use to calculate the tax: "income" or "income reduced by the amount of expenses."

When choosing an object of taxation (\"income \" or \"income minus expenses\"), you must independently evaluate the most profitable option. If the activity is associated with significant costs, the object of taxation\"income minus expenses\" is more profitable. In this case, taxable income will be reduced by the expenses incurred.

Individual entrepreneurs engaged in the types of entrepreneurial activities named in paragraph 2 of Art. 346.25.1 of the Tax Code of the Russian Federation, it is allowed to use a simplified taxation system based on a patent. In accordance with paragraphs. 37 p. 2 art. 346.25.1 of the Tax Code of the Russian Federation, individual entrepreneurs providing hairdressing and beauty salon services are entitled to apply the simplified taxation system based on a patent.

In view of the foregoing, an individual entrepreneur has the right to provide services for performing face and neck massage, hygienic massage of the hands, foot massage using softening herbal baths, if he applies the simplified tax system based on a patent for the type of activity \"Providing services of hairdressing and beauty salons\".

If you will do medical massage, then the OKVED code will be as follows: 85.14.1 - activities of paramedical personnel.

For more detailed advice, you can contact the "Center for the Promotion of Small and Medium Enterprises" at st.

Beauty saloon

Nikitina 3B, tel. 276-36-00.

More related articles

OKVED massage services

Popular

- How to start an accounting firm

- Sale and production of souvenirs of the system of taxation and OKVED

- Okvad: hairdressing services Okvad for a hairdresser

- OKVED "hairdressing services" - OKVED interpretation for cosmetic services eyelash extensions

- Shopping center Kashirskaya Plaza

- Roadside complex with a gas station on the federal highway Logistics complex roadside building 3 on the map

- home money ideas how to make money sitting at home

- How much can you earn on YouTube for views: real numbers Examples of earnings on YouTube

- Mini ice cream making equipment price

- Will there be a benefit from 10 cows