Beauty salon ENVD or usn. How to open a hairdressing salon from scratch step by step (legal issues)? Why you can't do hairdressing at home

Hello!

I worked as a hairdresser in salons for many years, but now I decided to go into this business myself. I do not want to open a hairdressing salon and hire masters. I plan to cut and color clients' hair in a rented residential apartment, the owner of which does not mind, and sometimes at clients' homes.

I want to ask you:

- Is it a business activity? Need to register an IP? Or is it enough to pay 13% personal income tax once a year?

- Is it possible to provide hairdressing services in apartments?

- If I suddenly decide to buy a patent, is it needed for every district of the city in which I work?

- Can I accept payment with the issuance of strict reporting forms instead of online checks? Clients are ready to transfer money from card to card: will the tax authorities be against it?

Sincerely

Greetings Anton. Your activity is entrepreneurial, you need to register an individual entrepreneur. The law prohibits the provision of hairdressing services at home, but the fines for this are small. The patent for your activity is usually valid throughout the region.

Anton Dybov

tax expert

For face-to-face payments in cash or by card until July 1, 2019 Transfers from card to card are allowed if the money is credited to the current account of the individual entrepreneur. Until July 1, 2019, strict reporting forms are not needed for them, as well as an online cash desk.

Why the activity of a private hairdresser is entrepreneurial

According to the Civil Code of the Russian Federation, entrepreneurial activity is considered to be an independent activity that a person engages in at his own risk in order to systematically make a profit, in particular, from the provision of services.

In your case, even the vague wording of the Civil Code is enough to say: you are planning to go into business. And this involves registration of IP.

- Manufacture or acquisition of property for subsequent profit from its use. You bought scissors and other attributes, they are needed for a haircut for a fee - the condition is met.

- The interconnection of all transactions made by a person in a certain time. You will purchase consumables and advertise for the profit from the services - the condition is met.

- Stable relationships with sellers, buyers, other contractors. As soon as you develop a base of regular customers and suppliers, the condition will be met.

Why you can't do hairdressing at home

The Housing Code of the Russian Federation allows private entrepreneurship in an apartment, if it does not interfere with other residents. And it does not matter if it is your own, rented or is in free use.

But alas, there are special sanitary norms and rules for hairdressing salons - SanPiN. It is possible to cut and dye hair on them in residential buildings only in rooms with a separate entrance and ventilation, which are located:

- on the ground floor and in the basement;

- on the first floor;

- on two floors: first and second;

- in an outbuilding.

And a private hairdresser must comply with the Rules of consumer services. They oblige individual entrepreneurs to place a sign, arrange a consumer corner, and have a review book. In your case, especially on the road, all this is hardly possible.

Penalty for violation - 500-1000 R or 3000-4000 R- depending on which article of the Code of Administrative Offenses the inspector of Rospotrebnadzor prefers. True, for this he must become your client. It is problematic to track that you provide hairdressing services at home in a different way.

The territory of the patent for hairdressing services

According to the patent laws of Moscow, St. Petersburg, Moscow and Leningrad regions, one "hairdressing" patent is valid in all municipalities. You do not need to buy a patent for each area of work.

Find your region's patent law and see what it says. And also check in the law whether your type of activity has the right for a newly registered individual entrepreneur.

Acceptance of payment for hairdressing services

Detailed topic with online cash registers T-F recently parsed Therefore, here briefly.

- Issue strict reporting forms for face-to-face payments in cash or by card. But it needs to be done

- Accept non-cash payments, including transfers from card to card, without issuing any document and without an online cash desk. True, the Ministry of Finance spoke directly in this spirit only on settlements by payment orders. But the logic of officials is applicable to other non-cash transactions.

However, it is impossible to receive transfers from clients to a card that you entered before registering an individual entrepreneur - this is contrary to banking rules. You will have to issue a new one with a link to the IP current account.

If you have a question about personal finances, expensive purchases or a family budget, write to: ask@tinkoff.ru. We will answer the most interesting questions in the magazine.

Many of those who want to do business, for example, open their own beauty salon, do not know what legal form to register for it - an LLC or an individual entrepreneur, especially if the company is medium or small. And what is better to open, IP or LLC, for a beauty salon, not everyone knows. Each type of business has its advantages and disadvantages not only for the period of registration, but also for the period of work.

Pros and cons of starting a sole proprietorship

The benefits of opening a sole proprietorship include the following:

. Ease of registration (during registration, you can do without the help of a lawyer).

. Keeping a cash register is simplified.

. There is no need to pay tax on the property that is used in the organization.

. There is no need to include an accountant in the staff - the entire accounting procedure comes down to filling out a book.

. There are fewer inspections by the Tax Inspectorate.

. Simplified company liquidation procedure.

. Possibility to choose a patent system for calculating taxes.

. It is possible to independently make all decisions related to the activities of the company.

. Lower tax rates.

The disadvantages of sole proprietorship include:

. There is no way to attract additional investors in the form of founders.

. Even after the liquidation of the enterprise, there is a risk of losing all property.

. Low level of attractiveness for investors.

. There is no possibility to re-register or sell the company (you can close and open a new one).

. There is a need for a fixed contribution to the Pension Fund even when there is no profit.

. There is a need to pay personal income tax.

. An individual entrepreneur must himself manage the work of his organization.

. There is no way to promote a brand without registering it.

Pros and cons of opening an LLC

The advantages of opening an LLC include the following:

. High level of protection of all property rights (all founders are liable for their debts only in the amount of shares in the authorized capital).

. There is an opportunity to expand the company by attracting investors in the form of new founders.

. It is possible to create such a business management body that will meet all the features of a particular company.

. It is possible to control the degree of influence on production processes by reducing or increasing shares.

. It is possible to attract investors who do not have Russian citizenship.

. There are no restrictions on the size of the authorized capital.

. It is possible to invest both money and intangible assets in the statutory fund.

. It is possible to withdraw from the founders of the enterprise at any time and receive a share within 4 months.

. To manage the enterprise, you can appoint a director who will not be the founder.

. It is possible to cover past losses with current profit.

. Higher level of attractiveness for investors due to the possibility for them to become a founder.

. There is an opportunity to sell or re-register the company.

. There is no need to pay taxes when dealing with losses.

Disadvantages of opening an LLC:

. There should be no more than 50 founders.

. At the slightest change in the composition of the founders, it is necessary to make all changes in the documents.

. Registration is more complicated than when opening an IP.

. It is important to observe cash discipline.

. Dividends are paid no more than once every three months.

. It is necessary to maintain internal and tax accounting in any system of taxation.

. Under the general taxation system, it is important to pay tax on property used in the work of the company.

. There is a possibility of difficulties with finances during the exit of one of the participants.

. It is necessary to keep a record while making business decisions.

. It is more difficult to close an LLC than a sole proprietorship.

A greater number of individual entrepreneurs in Russia work in the service sector, which is related to vehicle maintenance and food, in retail trade. This means that there is no need to register an LLC if the company works with individuals, and the business is conducted independently. The opening of an LLC is chosen by those who plan to attract investors to expand their business.

Beauty salon - IP or LLC?

Beauty salon is a fairly broad concept. So many companies can be called - from a simple hairdresser to a large company that provides a wide range of services (they include fitness, solarium and massage). Beauty salon - is it better to open an individual entrepreneur or LLC? The IP form may only be suitable for a barbershop with several masters, and this barbershop is visited by residents from nearby houses to dye or style their hair or get a haircut. If the list of services of a hairdressing salon is supplemented with the services of a solarium, a beauty parlor or the sale of all related products, then the situation will change. Physiotherapy, solarium and other services are classified as wellness procedures and do not fit the UTII system. The sale of all related products requires the purchase of a license. This means that you need to draw up an LLC system even when the beauty salon has one owner. In any case, it will be the right decision!

Analytical material on the choice of an effective form of taxation, in which the tax burden will be minimal.

The purpose of our article is to provide practical assistance in choosing the form of taxation. We propose to pay attention to the following two tax systems:

- UTII (Chapter 26.3 of the Tax Code of the Russian Federation).

- Patent (Chapter 26.5 of the Tax Code of the Russian Federation).

Now let's proceed directly to the calculation of the tax burden for beauty salons, for each of the above forms of taxation.

Beauty salon on UTII

Until April 2011, entrepreneurs had certain difficulties in applying UTII, since far from the entire range of beauty salon services could be attributed to UTII taxation. OKUN prevented this, since code 019300 “Hairdressing services” did not imply the provision of cosmetic services, or, for example, OKUN 019200 “Sunbed services”, was applicable for UTII only in baths and showers.

The changes that were made to the classifier by order of Rosstandart No. 1072-st, approved on December 23, 2010, put everything in its place. The changes began to take effect on April 1, 2011, and since that time the code 019300 has been changed to "Hairdressing and beauty services provided by public utility organizations." By the way, all these explanations for the convenience of entrepreneurs were also given in the letter of the Ministry of Finance No. 03-11-11 / 31, dated 01/25/2013.

We figured out the controversial issues for UTII, you can proceed to the calculations of the tax burden. To do this, we need knowledge of the following components of the formula:

- Physical indicator for beauty salons;

- Deflator coefficient (K1) for 2013;

- Adjusting coefficient of basic profitability (K2) for your region in which the beauty salon is located.

We can find the value of the physical indicator in article 346.29 (paragraph 3) of the Tax Code of the Russian Federation. Based on one employee of a beauty salon - 7500 rubles per month. Please note that if the organizational form of your business is an individual entrepreneur, then, as one employee, you must also take into account yourself when calculating tax.

The deflator coefficient (K1) for 2013 was adopted by the Order of the Ministry of Economic Development No. 707, approved on October 31, 2012, and its size is 1.569.

As we indicated earlier, the specific value of the K2 coefficient must be calculated for the region in which your salon is located. Suppose that you opened it in Tula and hired 5 employees, i.e. including the IP itself, when calculating the tax, 6 people will appear. The value of the K2 coefficient is determined on the basis of Decision N 51/1126, adopted by the Tula City Duma on October 24, 2012. It will be equal to 0.7.

All data are known we will calculate UTII.

UTII amount(per year) \u003d 7500 * 6 * 1.569 * 0.7 * 15% * 12 \u003d 88962.3 rubles

It is possible to reduce the amount of UTII payable by 50% of the insurance premiums that were paid for your employees. This provision contains article 346.32 of the Tax Code of the Russian Federation (paragraph 2).

The frequency and timing of tax payment are provided for in Article 346.32 of the Tax Code of the Russian Federation (paragraph 1). This should be done quarterly and no later than the 25th day of the month immediately following the reporting period (quarter).

Patent for beauty salon

Each of the subjects of the Russian Federation has the right to introduce a patent form of taxation on its territory in accordance with the provisions of Article 346.43 (paragraph 1) of the Tax Code of the Russian Federation. Subparagraph 3 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation provides for the possibility of applying taxation on the Patent when providing hairdressing and cosmetic services. We remind you that this form of taxation is applicable only if the organizational form of your business is an individual entrepreneur.

As well as with UTII, the cost of a Patent is different in each region. For commensurability, we will make calculations using the example of the city of Tula.

In this region, the application of the patent form of taxation was introduced by law No. 1833-ZTO, approved in the Tula region on November 14, 2012. And the potential annual income for the Patent was adopted by law No. 1834-ZTO, approved in the Tula region on November 14, 2012.

The size of the annual potential income in the provision of hairdressing and cosmetic services is presented in the table.

The rate for calculating the cost of a Patent is 6% (Article 346.5 of the Russian Tax Code). For commensurability of calculations for two forms of taxation, we substitute the marginal income in the formula for a number of 4 to 6 people.

Patent cost(per year) = 633000 * 6% = 37980 rubles

For the payment of taxes on the Patent, the following principle and terms are established:

- In the event that you acquire a Patent for a period of less than 6 months, then you must fully pay its cost no later than 25 days from the start of its validity.

- If you purchase a Patent for more than 6 months, then payment can be made in installments: 1/3 of its cost no later than 25 days from the start of its validity, and the remaining 2/3 of the cost no later than 30 days before its expiration.

To finally make sure which form of taxation is more profitable, a comparative characteristic should be carried out in the context of the number of employees. The tax burden for UTII and Patent with different numbers is presented in the table.

| Number of hired employees, people | The amount of tax on UTII, rub. | The cost of the Patent, rub. |

|---|---|---|

Note: When calculating UTII, we always add one more (the IP itself) to the number of employees if your business has such an organizational form. In our calculation, everything was done exactly according to this principle.

We remind you once again that you have the opportunity to reduce the amount of UTII due to paid insurance premiums for employees in the amount of 50% of their amount.

And finally, I would like to clarify one very important point regarding the sale of various cosmetics or jewelry in beauty salons. If your salon has a similar service, then you should take care of its separate taxation. The fact is that such activity relates to retail trade, and accordingly you need to acquire a Patent for this type of activity, as well as pay UTII for retail trade (depending on the form of taxation you have chosen).

Russian legislation creates all the conditions for entrepreneurs to develop their business comfortably. Even the taxation of individual entrepreneurs does not provide for any specific rate or a single tax for all businessmen. Everyone has the right to decide on which system to be taxed, and there is plenty to choose from. There are 5 tax regimes in 2019, radically different from one another.

- Services sector. To work with individuals, you can choose an imputation, since it is not necessary to use cash registers on it. And for cooperation with legal entities, it is better to give preference to simplification. And with those, and with other persons - it is possible to combine two taxation.

- Wholesale and retail trade with a large area of the room / hall. Beneficial use of USNO with deduction of costs.

- Distribution and retail trade with a small area. The use of an imputed tax or a patent is more relevant.

- For large production it is good to use the BASIC, and for small - a simplified tax.

Online journal for an accountant

Each taxation system has its own calculation rules. For example, if an entrepreneur conducts only one type of activity and wants to apply the SIT, then you can calculate the tax using the calculator on the website of the Federal Tax Service https://patent.nalog.ru/info/. The peculiarity is that in 2019 the patent applies only to certain types of activities and only if the local authorities have decided to introduce this tax. With regard to the patent, there is another feature that is unique to this system of taxation - insurance premiums do not reduce the tax. Therefore, in relation to a patent, the cost can be immediately accurately calculated.

First, let's find out how much to pay for an individual entrepreneur under any taxation system, regardless of income. Insurance premiums must be paid. In 2019, an entrepreneur is obliged to pay contributions at least “for himself” from the moment of registration as an entrepreneur until the termination of activities. Fixed contributions are set on a yearly basis, so when asked how much to pay an individual entrepreneur in 2019, we can say that the minimum amount is 32,385 rubles for the entire year:

If the number of employees has become more than 15, or the annual revenue amounted to more than 60 million rubles, then the tax authorities will deprive you of the right to apply PSN. Also, individual entrepreneurs are deprived of the right to use PSN in case of violations of patent payment.

The transition to PSN is regulated in accordance with Art. 346.43. of the Tax Code of the Russian Federation, the rules are established by the subject where the IP is registered, depending on the subject, the amount of income to which the tax calculation (patent value) is applied is different. You can switch to the PSN by submitting an application to the tax authority at the place of registration, the application must be submitted 10 days before the start of using the PSN, the tax authority will issue a patent within 5 working days from the date of receipt of the application, or notify the decision to refuse to issue it.

Patent taxation system for individual entrepreneurs in 2019

- Only individuals can obtain a patent. Companies are not issued certificates.

- As accessible activities for which a patent is issued, only retail trade in small stores, as well as the provision of services, can be distinguished.

- The number of employees of the IP should not exceed 15 people.

- The premises of the IP should not be more than 50 square meters.

- Keeping records of profits for each issued certificate. The procedure is performed to control the annual profit of an individual entrepreneur, which should not exceed 60 million rubles.

- There is an advance tax payment system.

- The insurance premiums paid do not affect the reduction in the cost of the patent.

- If an entrepreneur provides services in the field of public utilities, then he must take care of purchasing a cash register or special forms of strict reporting.

- When using hired labor, accounting is required.

- When the certificate is canceled, the individual entrepreneur switches to the general taxation system.

- Value Added Tax.

A patent only grants the right to an entrepreneur to carry out a certain type of activity. A patent is issued to a citizen in the tax office. The certificate can be purchased for a period of 30 days to 12 months. To date, the patent system of taxation is rarely used.

IP on the simplified taxation system (STS) in 2019

As for VAT, here the restriction is associated only with the importation of goods from abroad (VAT is paid upon importation at customs), as well as when concluding simple partnership agreements or trust management of property. All in all, replacing the three biggest and most nasty taxes with one is a boon for small businesses.

In the late 1990s, the question of the development of small and medium-sized businesses became acute. Representatives of the business world persistently demanded that the government give small businesses more tax freedom, set lower rates and rid private entrepreneurs of paperwork as much as possible. When is a businessman to work if he is overlaid with the requirements of reports, notifications, tax returns, bookkeeping and other formalities?

How is the taxation of a barbershop

How is the taxation of a barbershop IP carried out? What system of taxation is better to choose? These questions worry many entrepreneurs. The provision of hairdressing services is a popular service for the population in large cities and small villages. If in the countryside this activity can be done at home and not particularly concerned about the timely fulfillment of the obligation to pay taxes on time, not to bother with the problem of how to decide on the taxation system, then in the city for a hairdresser entrepreneur this issue is acute.

When applying the patent system, reporting to the inter-district inspection is not provided, there is no obligation to have a cash machine, but the entrepreneur must record the income from the activity permitted by the patent in the income book. The form of this document can be printed from the website of the Federal Tax Service, neatly stitched, laced, numbered and recorded daily income received as it is received at the cash desk or credited to the account. This fixation of revenue is called the cash method.

In order not to lose the right to use PSN prematurely, the hairdresser, together with the owner, must make a payment before the expiration of the patent with a duration of up to 6 months, and for a period of 6 to 12 months, it is possible to split the payment into 2 parts: transfer a third before the expiration of 90 days from the date of obtaining the right to the PSN, the rest - no later than the expiration of the patent.

How is the taxation of a barbershop IP carried out? What system of taxation is better to choose? These questions worry many entrepreneurs. The provision of hairdressing services is a popular service for the population in large cities and small villages. If in the countryside this activity can be done at home and not particularly concerned about the timely fulfillment of the obligation to pay taxes on time, not to bother with the problem of how to decide on the taxation system, then in the city for a hairdresser entrepreneur this issue is acute.

The question of what the taxation of a hairdresser's IP will be, opens up wide horizons of choice: he can apply UTII, STS or switch to PSN in his activities.

Due to the fact that hairdressing services have recently changed their name in the classifier and acquired the status of public services, anyone can engage in such activities. This means that the issue of taxation is of interest to a large circle.

Simplified taxation system (STS)

To switch to the simplified tax system, an individual entrepreneur must decide on the object of taxation. This may be the total income, in which case the percentage payable will be six. If this is profit before taxes (income minus expenses), then the percentage will increase to 15. Let's estimate what share of expenses arises at the salon for ennobling heads. These are rent payments (if there is no own hall), salary, utilities, purchase of consumables (cosmetic supplies, hygiene items, etc.).

After summing up the expenses, we determine their share relative to income. If expenses take 60 percent or more of revenue, then it is more profitable for a hairdressing salon to take profit as an object for calculating taxes. If the situation allows us to talk about a smaller share of expenses, then there is no alternative to 6% of income with simplification. A hairdressing salon, like any service company, prefers not to dump, working from turnover, so the costs here are minimal. It is logical to conclude that simplified taxation for a hairdresser is more profitable to calculate from income and set equal to 6%.

After summing up the expenses, we determine their share relative to income. If expenses take 60 percent or more of revenue, then it is more profitable for a hairdressing salon to take profit as an object for calculating taxes. If the situation allows us to talk about a smaller share of expenses, then there is no alternative to 6% of income with simplification. A hairdressing salon, like any service company, prefers not to dump, working from turnover, so the costs here are minimal. It is logical to conclude that simplified taxation for a hairdresser is more profitable to calculate from income and set equal to 6%.

When applying the simplified tax system, it is necessary to make a payment on a quarterly basis, and you can schedule one visit to the tax office with a report - at the end of the year. And in the barbershop you need to install a cash register.

Back to index

Single tax on imputed income (UTII)

UTII among haircut and hair styling salons has become widespread. Perhaps this is the best option if the entrepreneur himself and a maximum of two colleagues work on a small area. In case of business growth, this option should be checked additionally. The legislator has established a formula for calculating the taxation of a hairdressing salon. It is the product of a physical indicator (number of employees in a hairdressing salon), basic profitability (set for this business in the amount of 7,500 rubles), a deflator coefficient (set annually by the Ministry of Finance), a coefficient that adjusts the basic yield (set by local authorities), and the tax rate.

Taxes for individual entrepreneurs on UTII do not end, in this case (UTII) the hairdresser pays more deductions to extra-budgetary funds and at the same time enjoys the established benefit. Taxation provides for relief in the form of reimbursement of payments to funds, but provides for a limit in size - no more than 50% of the calculated tax.

Taxes for individual entrepreneurs on UTII do not end, in this case (UTII) the hairdresser pays more deductions to extra-budgetary funds and at the same time enjoys the established benefit. Taxation provides for relief in the form of reimbursement of payments to funds, but provides for a limit in size - no more than 50% of the calculated tax.

Taking into account that payments to the PFR, FSS, MHIF are always much more than the single tax paid by the entrepreneur, the benefit looks like an awkward nod to business. The total payments to the funds amount to 30% of the wage fund, their hairdresser is obliged to pay before the 15th day of the billing month.

The need to report tax payment comes after each quarter. You can work in the salon without a cash register, opening a bank account is also optional.

Back to index

Patent taxation system (PSN)

If a hairdressing salon receives a patent, then it declares its intention:

- do not earn more than 1 million rubles a year (if a hairdresser is in a million-plus city, then revenue can be increased from 3 to 10 times);

- do not hire more than 15 hairdressers to work under one roof;

- not join the work under special agreements (simple partnership agreements, joint property management agreements).

Taxes for individual entrepreneurs in this case are limited to paying for a patent, which is 6% of the projected income. This is a good option for those who do not digest the design work, and when they visit the tax office, they experience sacred awe. It is now possible to avoid these shocks for a whole year, and if you wish, you can extend it for the next year, if you notify the IFTS by registered letter of your desire to extend the pleasure before December 20 of the current one.

Taxes for individual entrepreneurs in this case are limited to paying for a patent, which is 6% of the projected income. This is a good option for those who do not digest the design work, and when they visit the tax office, they experience sacred awe. It is now possible to avoid these shocks for a whole year, and if you wish, you can extend it for the next year, if you notify the IFTS by registered letter of your desire to extend the pleasure before December 20 of the current one.

When applying the patent system, reporting to the inter-district inspection is not provided, there is no obligation to have a cash machine, but the entrepreneur must record the income from the activity permitted by the patent in the income book. The form of this document can be printed from the website of the Federal Tax Service, neatly stitched, laced, numbered and recorded daily income received as it is received at the cash desk or credited to the account. This fixation of revenue is called the cash method.

In order not to lose the right to use PSN prematurely, the hairdresser, together with the owner, must make a payment before the expiration of the patent with a duration of up to 6 months, and for a period of 6 to 12 months, it is possible to split the payment into 2 parts: transfer a third before the expiration of 90 days from the date of obtaining the right to the PSN, the rest - no later than the expiration of the patent.

Popular

- How to start an accounting firm

- Sale and production of souvenirs of the system of taxation and OKVED

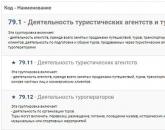

- Okvad: hairdressing services Okvad for a hairdresser

- OKVED "hairdressing services" - OKVED interpretation for cosmetic services eyelash extensions

- Shopping center Kashirskaya Plaza

- Roadside complex with a gas station on the federal highway Logistics complex roadside building 3 on the map

- home money ideas how to make money sitting at home

- How much can you earn on YouTube for views: real numbers Examples of earnings on YouTube

- Mini ice cream making equipment price

- Will there be a benefit from 10 cows