How to learn to sell banking products at Sberbank. Effective script and technique for selling banking products

Page

5

3. The method of forming the client’s needs and requests is the most complex and requires special skill and knowledge. First, with the help of skillfully formulated, targeted questions and active listening to the answers, the manager identifies the true interests and needs of the client's business. This is achieved through the use of open-ended and clarifying question technology, techniques for giving a positive signal, or reflexive listening techniques. Then, using the summarization technique, the problem is formulated and a solution is proposed.

For example, during meetings with the chief accountant of the enterprise, a problem was identified related to an increase in overhead costs and the need to reduce them. To solve this problem, the manager offers one solution - participation in a salary project, which will reduce the costs of receiving cash from the bank, delivering funds to the enterprise, and issuing them to employees. There is a choice of two options - transferring employee salaries to a demand deposit or a deposit using a plastic card.

The general rule used in any of these methods is that by talking about the features of the services, the manager focuses the client’s attention on the benefits and values that the latter will receive if he uses them.

In order to successfully use the OPT scheme, it is proposed to be guided by the following two formulas:

1. Features of the banking service and (or) its advantages + Linking phrase + Value of the service for the client (O + F + C)

2. The value of the service for the client + Linking phrase + Features and (or) its advantages (C + F + O)

Rules for the effective sale of banking products

Rule 1. Selling banking products is the skill of a personal manager.

Selling is a skill. If the personal manager is experienced and a master of his craft, then this seems natural and given by nature. However, sales skills and proficiency are acquired. It should be noted that it is fashionable to learn professionalism in the field of sales and become a master of this business. You just need to learn and apply knowledge and skills. There are a number of sales techniques, but technique alone, without the appropriate skills, will not help you move far forward. Therefore, a manager needs to improve his skills.

Rule 2: Selling begins with knowledge.

Knowledge is the basis on which the professionalism of a personal manager is built, it is the foundation of his success.

As a professional manager, the following knowledge is necessary:

1. About the bank's clients and the needs of their business. When a manager prepares for a meeting, he must collect and study information about the client and all key managers. The secret of consultative selling is that the manager acts not only as a provider of banking services, but also as an advisor and consultant who can be trusted. He not only sells a banking product, but also brings each client ideas for solving a problem and developing a business. A manager should not focus his attention only on the leader making the decision. Of course, this is the person with whom you need to have a relationship, since he has the final say, but it is important to be able to obtain information from other employees. To do this, you need to communicate with people, visit enterprises, and make acquaintances.

2. About the banking product or service that the manager offers to clients. Namely: to know the characteristics of the product, its features, value for the client, how suitable it is for the client, what are the advantages of the banking product over similar products of competing banks.

3. About competing banks: their products and services, their prices, advantages and disadvantages of competitors.

4. About the strengths and weaknesses of your bank.

Based on this knowledge, you need to build a conversation with the client.

Rule 3. The manager must be able to “listen” to the client.

Many personal managers believe that their gift of eloquence will help them when selling banking services. However, the main difficulty for the manager is to encourage the client to speak. A manager should not talk more than 45% of the time, but should listen more. It is necessary to ask questions and determine the needs, “hot spots” of the client, because if the manager manages to get the client to talk, this will help to find out what needs the client has, what he needs. After which you can continue the method of solving his question, showing how banking products will help satisfy his desires and needs.

Rule 4. Customers do not buy banking products, they buy benefits.

When offering banking products, the manager must understand that customers are not buying banking products or services, they are buying the satisfaction and benefit that they can receive from these products. Therefore, during the presentation you should not talk exclusively about the properties of the product. The properties or features in the OPC scheme are focused on the product itself. It is necessary to talk about benefits. Benefit or value in OPC is what those same properties mean to the client. The benefit is “focused” on the client. When presenting a banking product, it is important for the manager to show what real benefits these product properties will bring to the client.

In order to find out what benefit and value to present to the client, the manager needs to: firstly, give the client the opportunity to talk about what is especially important to him, and, secondly, during negotiations, listen carefully to him, determine what is especially important worries the client. Then show what benefits the client will receive by using these properties of the banking product.

Rule5. The manager must be able to mentally put himself in the client's shoes.

Before selling a banking product or service, the manager needs to imagine himself in the place of the client-buyer in order to determine what is important and significant for the client. For example, what will be most important for the director of a trading company for business development, what benefit is important to him and can influence him to make a positive decision to use the service offered; In what case will a manager devote time to a personal manager? It is logical to assume that for the head of a trading company, the safety of money, a convenient time for collection of proceeds, timely delivery to the current account, reasonable prices, and an employee to whom one can address questions will be important.

Once the manager takes the customer's position, he will be able to understand the customer and his needs. It is important to remember that clients use banking services based on their own needs. It is important to make the client feel that he is important to the bank. It should be the manager's focus. To do this, it is necessary to talk about his needs, problems, and what the manager can do for him. At the same time, find mutual benefits. For the client, the benefit is the value of the service; for the manager, for example, it is the knowledge that he helped the client solve an important problem and at the same time increased the volume of sales of banking products. When a manager puts himself in the client's shoes, he will understand the clients' problems and how banking products and services can help solve these problems.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Similar documents

The difference is in the sale of products and services. Meetings with potential clients: familiarization with services and support of the first step. General anatomy of sales. The stages that the customer goes through. Tips on how to make more effective advertising.

presentation, added 08/19/2013

Concept of services and quality. Basic nomenclature of quality indicators. The main differences between services and goods. Practical advantages and disadvantages of various methods for measuring service quality. Comparison of the effectiveness of the quality of services of various companies.

course work, added 11/11/2014

Sberbank of Russia is a universal bank that satisfies the needs of various groups of clients in a wide range of banking services. Mission of the enterprise, economic and accounting block. Information system, innovative aspects and elements of creativity.

practice report, added 05/30/2012

Methods of control and stimulation of employees of the office of Sberbank OJSC in Dalnerechensk. Analysis of the manager's leadership style and method, organization of the personnel service. Corporate structure of the enterprise. Assessment of the quality and competitiveness of banking services.

practice report, added 04/18/2015

Analysis of the quality of the company's services. Action plan for updating the material and technical base. Costs for staff development. Technical and economic indicators of the effectiveness of measures aimed at improving the quality of services provided.

thesis, added 05/12/2011

Research into the goals and subject of information management. Characteristics of trends in the development of information technologies. Analysis of the structure of the market for information products and services, its legal regulation. Objects of professional activity of a manager.

abstract, added 06/12/2013

Concept and classification of banking services and marketing approach to their management. Organizational and economic characteristics of the Lugansk city branch of Oschadbank. Activities aimed at improving the efficiency of bank service management.

thesis, added 03/29/2009

In most financial institutions, at least half of all costs are spent on organizing sales. To improve the efficiency of the branch or agent network and to be able to devote more time to sales, many banks and insurance companies have centralized administrative functions and introduced new IT tools. However, these efforts largely fell short of initial expectations. Some measures were essentially ineffective: sales volumes remained virtually unchanged, and in some cases even decreased, as institutions failed to direct the freed-up time to areas of activity that generate income, and the costs of managing the network continued to rise.

What is the reason for this situation? Experience shows that when implementing such programs, the factors that cause the colossal difference in the performance results of departments within a single sales network remain unattended. A huge dispersion is observed when comparing the performance of different companies. For example, a study of insurance agencies in Germany found that the most successful players in the industry were three times more efficient than the weakest companies.

However, an even more serious concern is the performance gap between different branches or organizational units of the same financial institution. In both insurance companies and banks, the difference between the top and bottom quartile divisions in terms of sales performance is on average 75%.

Addressing performance differences

Differences in performance are not always a bad thing. For example, branches of banks and insurance agencies operating in promising markets can be expected to earn higher profits and insurance premiums. However, differences in operating metrics such as conversion rates are a sure sign that not all development opportunities are being exploited.

For example, let's take one of the main performance indicators: the number of meetings with clients. At one bank in Northern Europe, differences in branch performance of more than 60% were explained by the fact that the number of customer meetings per sales person was not the same. Closing this gap allowed branch sales to increase by 15-20%.

This situation is largely typical of the insurance industry: highly effective insurance agents often have 15-20 meetings with clients per week, while their less fortunate colleagues struggle to reach ten. In addition, high-performing employees have higher meeting performance because they spend most of their time working with potentially more profitable clients and concluding many more contracts. The most successful insurance agents complete seven out of ten contracts, while the laggards show just over half of this figure: they have less than four out of ten proposals resulting in the signing of a contract.

While people's skill levels will always vary, significant efficiency gains can be achieved by applying lean management techniques to streamline work processes, implement and share best practices, and eliminate activities that do not add value to customers. In our experience, these methods are just as effective in a front office environment as they are in a back office environment. After implementing lean management principles in its sales department, a Latin American bank was able to increase the number of customer meetings by 50% and overall sales by 20%; At the same time, it was possible to reduce the staff of non-sales employees by more than 20%. And an insurance company from Europe has achieved a sustainable increase in the productivity of insurance agents by 15-50%.

Increased efficiency and reduced costs are not the only benefits that can be achieved by introducing lean management principles into sales. Organizing a sales process based on lean principles increases employee engagement and improves the quality of customer service, as well as ensuring a sustainable long-term effect of the transformations. Later in this article, we'll look at how lean sales processes can be implemented in financial institutions and examine some of the key success factors for implementing change.

Changing working methods in the sales department

Financial institutions looking to maximize the cost-effectiveness of their branch or agent network will find that lean management allows them to spend more time on the sales process, standardize the sales approach, and provide greater control over the performance of their front-line employees.

Spend more time on the sales process

In the work of front office employees, value is created through direct interaction with customers. However, retail bank sales professionals on average spend less than half of their working time offering products and services to customers or participating in sales management activities (mentoring, planning, or skill development). The rest of the time is spent, as a rule, on maintenance and administrative functions. Lean management methods are the best way to reduce administrative burden and increase sales efficiency by 20-30%.

To free up time for sales, organizations operating according to lean management principles eliminate unnecessary work activities, such as entering identical information into several different systems (back office, customer relationship management, accounting and sales control). Such establishments automate routine operations and encourage customers to use the Internet to make simple inquiries, or assign sales to employees who typically perform other functions, such as tellers, when they are not busy serving customers.

To optimize other sales activities, you can standardize the methodology for preparing meetings with clients, automate the process of providing information on loan applications, develop simple procedures for selling products and services, and centralize functions for working with potential clients. By combining these methods, some financial institutions, where the administrative workload of sales staff was particularly high, have been able to double, and in some cases even triple, their sales volume.

Lean management techniques can equally well be applied to insurance agencies and wealth management offices. One large sales organization with over 10,000 customer-facing consultants was able to reduce branch operating costs by 10-15% by using lean methods to manage key processes and activities. For example, by optimizing and automating account opening, it was possible to reduce the total time spent on this operation from 19,000 to 13,000 hours per year and at the same time reduce the duration of customer service by 33%. The additional time freed up for sales was equivalent to one and a half full-time positions in each branch.

In most cases, lean methods allow financial institutions to free up at least half the time spent on non-sales activities. However, extra time is only one side of the coin. The next task is to use this time profitably: reduce costs, improve the quality of service and increase sales. However, these activities need to be carefully thought through and planned in advance, as improvements will not happen on their own. In one European bank, where administrative functions were centralized to free up additional time for sales, the result was exactly the opposite: sales time decreased from 32 to 29% of the total working time of the branch. Unless structures and systems are put in place to help shape new behaviors and the appropriate motivation to work in new ways is not created, people soon revert to familiar ways of working.

Increasing staff productivity and competitiveness of bank products: an example of introducing lean manufacturing principles in the field of underwriting

Pavel Bolshakov, Semyon Yakovlev

The lean manufacturing system (Lean) can be successfully applied in solving almost any bank problem related to increasing the efficiency of processes, be it selling products, servicing, retaining customers or reducing operating costs. This article provides a case study where the implementation of lean principles in a bank's retail lending underwriting division helped reduce operating costs and improve the competitiveness of the bank's product offerings.

When one of the large Russian banks was faced with a high CIR (cost-to-income ratio), to improve productivity and quality of service, it was decided to implement a Lean system in all operational and support divisions of the bank. The department that reviews applications for loans from individuals was chosen as one of the first departments to implement lean manufacturing principles.

Initial diagnostics of the process revealed several significant shortcomings: long processing times for applications, significant differences in labor productivity between employees (up to 100%) and in the share of approved applications (up to 75%), a high level of errors at the data entry stage (up to 50%), and There is also a large volume of manual operations. Managing the division was complicated by large and unpredictable queues between different stages of processing loan applications, systematic overtime, and irregular employee work schedules, which further reflected the need for process changes that would increase customer and employee loyalty. Many of the listed shortcomings were the result of dividing the organization of the loan application process into several groups (stages) responsible for different parts of the process: entering and checking the correctness of data; checking the borrower and making a decision; informing the borrower about the decision and organizing the issuance of the loan. This work structure did not allow bank employees to see the entire process and understand how the quality of their work affects its final result. In addition, activities in the field of underwriting have a pronounced seasonality, which was not taken into account when planning the division’s workload. In this regard, during off-peak periods there was a structural surplus of employees, and during periods of peak load, the level of service decreased significantly due to an increase in the processing time for loan applications.

Analysis of organizational factors and the results of process diagnostics made it possible, within the first month, to formulate an effective and quick-to-implement solution related to changing the organizational structure of the unit. This solution was to create end-to-end process workcells. In these cells, specialists for each of the individual stages of the process are combined in such a way that the size of queues between stages is minimal. An example of the approach is shown in Diagram 1.

The effect of introducing end-to-end process cells consists of several elements:

- Increased productivity and reduced overall time required to process loan applications by reducing queues and downtime between different stages of the process;

- Reducing the share of rework and errors due to constant feedback between stages within one department;

- Increase skill levels and reduce attrition by taking advantage of learning opportunities for new roles and switching between different roles.

To test hypotheses about the increase in process efficiency through the use of a new organizational approach, a pilot project was developed and successfully implemented within three months for the underwriting division and related functional services. As part of the pilot project, it was decided to organize a test cell, which made it possible to “close” all the key stages of the process - data entry, assessment and decision-making on the application, as well as the issuance of a loan - within one unit. At the same time, maximum functional interchangeability of employees was ensured, that is, the ability to switch employees from one role to another in the event of queues or insufficient flow of applications. Diagram 2 provides an illustration of the process organization within an end-to-end process cell.

The pilot project was organized in two stages. First, planning and design of the test cell were carried out within one month, then over the next two months the work of the cell was organized, its support was carried out and the result was measured. The rapid deployment of the test cell and support of its operation were organized thanks to the following specially developed tools:

- A set of necessary organizational and technical requirements to ensure the readiness of IT systems to manage the flow of applications, the readiness of employees to work within the test cell, the readiness of the premises and the necessary working conditions;

- Models for managing flow and assessing the required labor costs at various stages of the end-to-end process, allowing you to understand the required cell size - the number of personnel within each functional area, depending on the intensity of the flow and the level of approval for the selected product;

- Matrices of employee interchangeability, compiled, in turn, on the basis of a matrix of personnel qualifications and experience;

- Rules for managing the flow of applications and rules for redistributing employees. This tool was specially designed for the cell manager and made it possible to make a decision within 3-5 minutes about the need to switch a certain number of employees from one role to another;

- A set of management tools - vision boards, regular morning meetings, reporting systems.

The implementation of the pilot project allowed the bank to achieve a significant improvement in performance in almost all problem areas identified at the diagnostic stage. Improving the quality of data entry and reducing queues between stages was due to leveling the load on employees due to the redistribution of roles in the case of a large incoming flow of loan applications. Standardization of the process and the use of tools such as vision boards have reduced the variability in individual performance indicators. The result was a reduction in application review time and a higher average approval rate. The main results of the pilot project are shown in Diagram 3.

The results of this project indicate that Lean tools can be successfully used in Russian conditions. At the same time, as the above example showed, a positive result is achieved through the use of both innovative and basic Lean tools (vision boards, reporting system, regular operational meetings, motivation system, etc.). Moreover, this approach is applicable to a wide range of processes in banks, insurance, telecommunications and other service companies; it allows you to significantly increase labor productivity and the level of competitiveness of products on the market in the shortest possible time and without significant investments.

Pavel Bolshakov

Semyon Yakovlev- McKinsey partner, Moscow

Standardize sales methods

Traditional sales incentives often influence only those employees who are already performing well and, when given incentives, begin to perform even better, when it would be more important to use them to equip less-performing employees with the skills they need to improve their performance. If management is committed to ensuring that all sales professionals achieve consistently high results, they should not simply send people “free sailing” and force them to find clients, allocate resources and develop their own methods of work. Instead, it is necessary to implement standard sales procedures that are designed based on best practices and aimed at smoothing out performance differences. Many organizations believe that they already have standard sales procedures in place, but if you take a closer look at what sales professionals actually do, you will often find that these procedures are not actually implemented in practice.

To develop the most effective work procedures and convince sales people to follow them, you first need to take a step-by-step look at the current process and analyze how front office employees establish relationships with clients, make appointments, negotiate, consult, negotiate contracts and carry out further work. with clients. At the same time, during the analysis it is necessary to note the most effective methods for further use. Managers then step-by-step design the approach to the sales process they want employees to use, identifying the skills, tools and systems needed, and establishing the optimal level of standardization.

Let's give an example. Some institutions have strictly regulated procedures for scheduling appointments with clients. This function is often performed by non-sales employees, call center agents, or an outside contractor. At the same time, during negotiations with clients, a much more flexible approach is used, taking into account the specific circumstances and needs of each client.

Other institutions standardize the negotiation process itself, developing standard agendas for common meeting topics—for example, a full product review or a short meeting to sell specific products and services. Tools are also being introduced to help consultants negotiate more effectively, such as product guides with a list of compelling arguments in favor of purchasing the products offered, as well as questionnaires that help identify client needs. One North American life insurance company developed a set of scripts for insurance agents to use when negotiating with clients. For each scenario, the agent had a ready-made set of phrases or a meeting plan to build a dialogue with the client. These tools have increased the productivity of long-time agents by more than 15% while increasing customer satisfaction.

At one Asian bank, sales performance on outbound telephone calls varied widely within and between branches. This situation required serious and large-scale changes. For example, in one branch, among employees with comparable tenure and a similar client base, the productivity of the most effective employee was five times higher than the results of the least effective colleagues. To improve the performance of less productive staff, the bank introduced a standard customer service procedure that specified who to call and what to say when. This measure made it possible to reduce the personal portfolio of clients of the division manager, thanks to which he was able to devote more time to his subordinates, observe their actions and train them daily in the process of work.

A financial institution analyzed its existing work and client scheduling patterns to develop a standard weekly schedule with a set schedule of calls, meetings, administrative duties, and performance discussions with employees. At first, all sales agents had to strictly adhere to the established schedule, but after a while the more effective ones were allowed to adjust it based on their own needs (see diagram 1).

Sales professionals who are used to working independently may have a hard time adjusting to a set schedule. One European insurance company overcame initial staff resistance by asking its most successful insurance agents to work collaboratively with colleagues on their own weekly schedule. After trying this schedule and achieving better results, other agents accepted the innovation more readily.

Through systematic analysis and evaluation of the sales process, financial institutions build an evidence base for further development. When organizing the sales process under the new rules, management should consider the final sales plans to set mandatory goals for achieving key indicators, such as the number of discussions with customers per week, the frequency of customer meetings and the pace of product acquisition.

Strengthen control over work results

When a financial institution is able to free up more time for sales and standardize the process with best practices, sales leaders can use newly developed criteria and targets to evaluate the performance of their reports and help them learn new ways of working. In terms of performance monitoring, there are two main aspects to consider: assessing not only results, but also specific actions, and ensuring transparency of information about performance. It is necessary to evaluate the specific actions of employees, because if in the sales management process and when discussing performance issues, attention is focused only on results, managers are not able to see weak links in the sales organization process itself. By the time the results come in, it may be too late to correct the situation. However, when managers monitor current work flow—for example, the number of client meetings completed this week and the number of meetings scheduled for the next—they can quickly take action.

Providing transparency has become much easier with the advent of visual performance management tools, such as vision boards, which allow you to monitor the progress of work in the department on a daily basis. Another powerful tool is performance tables - an interactive management tool that gives a clear picture of the performance of both individual employees and the entire department as a whole, and also allows you to compare the performance of employees or departments of the same level: sales specialists with comparable education and work experience or branches with similar market opportunities and starting operating conditions (see Diagram 2).

By using a scorecard to measure branch performance, managers can first gain an overview of financial performance and then drill down into the specific operating areas behind those numbers. Line managers use performance tables to identify what training and support is needed for the sales professionals under them, and senior managers use them to analyze the overall human resources situation that affects the organization as a whole.

Lean organizations focus on mentoring and training, provide line managers with clear objectives, and provide simple tools and procedures to help them. Managers spend most of their time with subordinates in the work process, observing their actions and providing feedback. Ideally, they should identify specific skill gaps for each team member and create individual development plans. Information about employees' length of service and skills helps determine the nature and frequency of training (see Figure 3). At one retail bank, line managers are required to coach their subordinates in two areas: skill development (based on observations of the employee's interactions with customers over the phone and in person) and performance (based on the employee's performance on key indicators). Each month there is at least one meeting with each employee to discuss skills and another to discuss performance issues. At the end of each meeting, the manager and sales specialist draw up a short development plan, the implementation of which is checked at the beginning of the next meeting. After introducing this approach at the bank, sales increased by more than 20%.

However, it’s not just line managers who need to change their approach to mentoring. Senior managers also need to reconsider how they manage and develop subordinates. For example, when assigning a task to employees, most senior managers default to the assumption that they have the necessary qualifications to complete it. Typically, they do not analyze how effectively subordinates will be able to complete a given task, and do not take the time to help them improve their skills.

Let's look at an illustrative example. The head of sales at a European insurance company was tasked with improving his performance meeting skills. At that time, the entire discussion boiled down to the fact that the manager was expressing dissatisfaction with the work of his subordinates - four directors of regional divisions - and they were looking for excuses in response. As part of the lean transformation program, the sales executive spent 30 minutes a week working with a visiting expert to help him identify skill gaps in regional directors and find ways to close those gaps. The training provided the manager with the necessary knowledge, and through discussions with subordinates, he really began to solve problems, addressing the root causes of poor performance of customer service employees. In addition, he took part in discussions that regional directors had with sales managers. Getting used to new ways of working was not easy. Two regional directors had to be replaced, but the results were truly impressive: a year after the lean transformation began, premium income grew by more than 20%, and by another 10% the following year.

The disparity in sales performance across most financial institutions is so great that implementing lean management techniques to develop the skills of underperforming employees can yield enormous benefits. The lean management system also provides a solid foundation for further improvements, as it allows for strict regulation of key work processes and increased transparency of information about work results. Those institutions that have already implemented lean management in the back office have a golden opportunity to use the skills and transformation experience they've learned to improve sales performance. On the other hand, for those companies that are just beginning to become familiar with the concept of lean, sales can be a good starting point on the transformation journey. One way or another, in order to get the maximum benefit from the lean management system, it is necessary to perceive it not as a one-time measure to stimulate sales, but as a fundamentally new approach to managing the process as a whole.

Pavel Bolshakov- McKinsey consultant, Moscow

Stefan Roggenhofer- Partner at McKinsey, Munich

Semyon Yakovlev- McKinsey partner, Moscow

There are five key stages in any transaction whose purpose is to sell a product to a consumer. The transaction will be successful if you follow simple rules at each stage. There are only a few of them for each stage. These are simple but effective techniques, proven by the experience of many successful sales professionals. Their application in practice will help even a novice sales employee to successfully negotiate and sell credit cards. Just tell a newbie about them during an interview. These rules can be applied not only to the sale of credit cards, but also in any area of commerce. These rules apply well even to cold calling.

The first meeting with a buyer should not immediately begin with an offer to purchase a credit card. First, you need to establish a comfortable and trusting relationship between you and your interlocutor. This will be the best ground for further sales.. Even a business conversation should begin with a smile. During the interview, try to compliment the client - people love to be praised. Talk to him about business, work, business, family. Communication with the client is an important part of the transaction. Firstly, it will give the potential buyer the feeling that they are truly interested in them. Secondly, you will receive information that will identify his needs and will allow you to further offer the client useful services from your bank. A person in a good mood is more willing to make deals and is predisposed to agree to the proposals of his interlocutor.

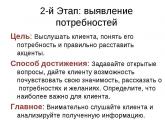

Stage two: identifying client needs

The main goal of this stage is to identify the need of the person who is in front of you, and also to push him to independently make the decision you need. This is why you need to ask the client about what he does and how he spends his finances. For example, if a person has a small salary but high expenses, offering him a credit card will be quite simple. If he is predisposed to savings, you can offer a credit card in a package with a debit card. Be sure to show interest in what the client is telling you. You can show active interest by nodding during your interlocutor’s story, assenting to him. The psychological technique of paraphrasing also works well. That is, the interlocutor’s phrase is taken and a question is formulated from it. It may begin with the wording: “If I understand correctly...?”

Third stage: service offer

So, the desire and need formulated at the second stage must be realized. And this is where you can offer products to the client. In our case, this is a credit card. It is necessary to tell that all his problems voiced to you can be easily solved by purchasing a credit card from your bank. Provide the customer with detailed information about how credit cards work. Especially if you see that he doesn’t understand this. At this stage, it is very important to use only words and expressions that your interlocutor can understand. Do not overuse terms and specialized expressions. The client should feel that your offer does not come from the desire to “sell” him a credit card, but from his own needs.

For a successful presentation of the product offered, it is important to use the following simple rules of sales technique:

- Make the most of your customer knowledge. Apply all the information received from him during the first and second stages. You must be as informed as possible in order to present the credit card in the most profitable way. Work through all possible ways to find this information.

- Use numbers and statistics. Statistical data, savings percentages, ratings, favorable comparisons with competitors' figures - all this will make the presentation convincing and add weight to you in the eyes of a potential buyer. Give examples from personal experience. You can even make them up, but the main thing is convincing. A manager who uses numbers always looks more convincing than one who doesn’t use them at all. But don't overdo it, your speech should remain understandable.

- You yourself must believe in the quality of what you offer. If you are not sure that you are offering the client a truly advantageous card that will be useful to him and will really help solve a number of his problems, nothing will work out. He will feel that you do not believe in your words and will doubt the benefits of such an acquisition.

Stage four: dealing with client objections

A client who does not object or argue is not an interested client. Under no circumstances should comments and objections be ignored. You need to boldly take on them and confidently convince your interlocutor. Take the bull by the horns, so to speak. At this stage it is also important to maintain an atmosphere of goodwill. He should feel that you wish him only the best, want to help him solve a problem, and not impose a credit card to fulfill a sales plan.

Fifth stage: closing the deal

The banking industry is highly competitive and the main task of this stage is to obtain consent from the client to complete the transaction. After all, a situation may arise in which the previous four stages went perfectly, but the deal did not take place and the potential buyer left with the words: “Well, I’ll find out what and how.” No, your task is to convince the client at the fourth stage - you shouldn’t look for a better offer. How to do this correctly was described above.

Once consent has been received, you can submit your application. Completing an application is the final stage, signaling that the successful sale of the card has been carried out. The client provides the bank with passport and contact information and becomes part of the client base by simply purchasing a credit card.

Be sure to take recommendations from satisfied customers. They are useful for working with other clients in the future. It is useful to post such recommendations on the banking company’s website and on its social networks. You should ask the buyer if he has friends who would also benefit from the information you provide about the service. This will help expand your base and attract new customers. It is very good if your bank has a special loyalty program for such cases, in which an active participant in the system, having brought his friends to the bank to receive the service, receives useful bonuses for himself in return.

Hello, dear friends and readers of the blog about finance and cash flow. Sales stages- these are steps to successfully promoting your services or products. To successfully sell anything, you must first master sequential sales stages. Today I will talk about the work of a bank employee in terms of consulting a client who came for a loan. I think this information will be useful not only to a banker, but also to any specialist working in the service sector.

It will be interesting not only for the sales consultants themselves, but also for any person as a participant in the sales process, since the promotion of goods and services is based on psychology, knowledge of the human soul. And everyone here likes to read and talk about psychology. I will divide the information into several blocks in accordance with the steps of promotion, where I will also share my experience and observations.

Main stages of sales in a bank

These steps consist of seven stages, each of which complements each other, being a logical continuation of the previous level.

If you carry out this technique on a regular basis, you can develop the skill of successfully promoting services, which will be useful for both a novice consultant and an experienced seller. Below is a list of these stages.

- Establishing contact.

At this stage, it is important to prepare for the client’s visit. How you meet the borrower determines how the dialogue will proceed. Agree that it is not pleasant when you come as a client and are met with indifference or ignorance. Many consultants make mistakes at this level, sending negative signals to the client. This is especially true nowadays, when competition for buyers is especially high.

The same applies to the case when the seller himself visits the client, the customer. Not only non-verbal language plays a role here, but also appearance. But if the suit can be prepared, then with psychology everything is more complicated. I confess, I myself sometimes have to make an effort to mentally prepare for a client, to create the necessary emotion in order to be convincing to the borrower.

But when it becomes a habit, people start coming to you. Agree, it's nice. Of course, if we talk about issuing loans, this may not be the best sign, since it can be understood that people can easily take out a loan through you. But politeness and goodwill are always needed. This stage lasts about a minute.

- Identifying needs.

Here you need to ask the right questions to choose the right tariff plan or identify a potential VIP client. At this stage, you need to find out about the client’s place of work, his credit history, income level, and his goals in obtaining a loan. A bank employee must have negotiation skills in order to ask in such a way that the client does not get stressed by your questions. This step lasts 3-4 minutes on average. The beginning of this step could be something like this: “To find the right tariff plan for you, I need to ask you a few questions. Do you mind?

- Product presentation.

A bank's front-line employee must be competent in his field: know the tariff plans, regulatory documentation and bank regulations in order to successfully talk about his bank's products and offer several options to the loan buyer. You need to show the advantages of your services in a favorable light, talk about the requirements for the borrower, and emphasize the importance of each client: “We have an individual approach to each client.” The step lasts up to 3-4 minutes.

- Work with objections.

This is perhaps the most difficult stage of sales. Here you need to remain cool and calm and remember that every client is important to the organization. I’m not saying this for the sake of rhetoric. It is the client who brings profit to the company. This step requires you to demonstrate flexibility and knowledge of your competitors' products. One day I went to other banks to get my credit card information. Later, this knowledge came in handy when I sold cards to clients. I did this easily, because I knew the advantages of both my bank and the advantages of this product in other banks. Now the interest rate does not always play a decisive role in obtaining a loan. This stage continues from 1 minute to 3 minutes.

- Closing the deal.

After dealing with objections, it’s time to harvest the fruits. Even if a person just came for a consultation, you need to leave such an impression so that he comes back again. At this stage, you need to summarize everything previously said, repeat the advantages of your product, and once again talk about the requirements for the borrower. This sales level lasts about a minute during your entire consultation.

- Additional sale.

In banking, this stage is also called cross-selling, that is, the parallel sale of an additional product or service. I remember reading somewhere that at McDonald's every seller must offer something additional to what has already been purchased. Thus, the company’s income increases, and it’s not just about caring for the client. 😉 In a bank, this could be a service for paying for loans from third-party banks, transfers, deposits, which can be offered by any bank employee.

- Ending the contact.

And at the very end of the consultation, you should ask: is everything clear to the client, does he have any questions, thank him for his attention and invite him again to your company. And it would also be great to give a potential buyer some kind of booklet with information about your products.

These were the main stages of sales of services in the bank. You can apply this information through the lens of your business, where there is a client and a buyer. I’m interested in how you yourself promote your services and apply some of your own ideas and schemes? Write it in your comments.

Popular

- How to organize a business renting apartments?

- Washing machine repair business Without advertising is like without air

- Why sales growth can kill profits and the entire business

- Partnership to create an Internet business

- Where is the easiest place for an individual entrepreneur to open an account?

- Overview of the necessary equipment for making pallets

- Detailed review of the TextSale article exchange

- Earn money by viewing advertising Earn money by viewing commercial advertising

- All about the game Golden Mines

- Grouse breeding Grouse breeding at home as a business