Forex daily press action analysis. Price action (Price action) - how to earn? Examples of some trading techniques of the system

Every technical trader (that is, one who makes decisions based on price charts, not fundamentals) trades a little differently. But still, thousands of different strategies can be divided into several main categories. There are traders who trade with price action, there are those who trade with indicators, and there are traders who use price action and indicators at the same time. There are other types of strategies, such as those based on seasonality, order flow or statistical data.

Price action trading is one of the easiest to learn and one of the most effective. If you are just starting out in trading, price action trading can be a great starting point for you.

Price action trading involves making decisions based on the price movement of an asset. Indicators or other methods of analysis are not used, or their weight in decision-making is small.

The price action trader believes that the only correct source of information is the price itself. If the stock goes up, such a trader sees that other market participants are buying it. After that, he, depending on the aggressiveness of these purchases, tries to understand whether the movement will continue. Price action traders usually don't questionWhysomething is happening.

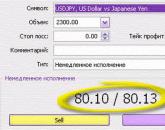

Using historical charts and real-time information (bid, offer, volume, speed and amplitude of movements), such a trader is looking for a favorable entry point into a position. A favorable point can be considered a point that allows you to control the risk and at the same time gives a good profit potential.

Types of price action strategies

A strategy called "breakout" has become widespread. When the movement of an asset's price shows a certain trend, and after that this trend is broken, this tells the trader that new opportunities for trading may appear.

For example, suppose a stock has traded in a range of $10 to $11 over the last 20 days. Finally, the price rises above $11.

This is a trend change that tells the trader that the sideways move may have ended and a move is about to begin that could go to $12 or higher. A breakout can occur after a variety of chart patterns form, including a range (as in the example above), a triangle, a head and shoulders, or a flag.

Breakdown does not mean that the price will continue to move in the intended direction. It often happens that the price comes back. Such a breakdown is called false. It also provides trading opportunities in the opposite direction of the breakout.

Breakouts can be large or small. Breakouts of small consolidations (short periods of time when price is sideways) during a trend move can provide excellent profit potential.

There are also price action strategies based on how the price bars look on a certain type of chart. So, when using candlestick charts, you can apply candlestick strategies, for example, those associated with the engulfing candlestick.

Regardless of the strategy chosen, price action traders pay attention to support and resistance levels, where good trading opportunities can also be found. Support and resistance levels are areas on the chart near which the price usually reversed before. Such levels may remain relevant in the future.

Once you have studied some price action strategy, further analysis will not take much time. You find an asset with certain price conditions that you need, or you wait for these conditions to form. Another advantage is that such a trader can get more favorable entry and exit points compared to indicator-based strategies. The fact is that the indicators are calculated based on the price, but they have a delay in relation to it. By simply focusing on price, you get real-time information, rather than waiting for an indicator that lags to provide it.

Once you have studied some price action strategy, further analysis will not take much time. You find an asset with certain price conditions that you need, or you wait for these conditions to form. Another advantage is that such a trader can get more favorable entry and exit points compared to indicator-based strategies. The fact is that the indicators are calculated based on the price, but they have a delay in relation to it. By simply focusing on price, you get real-time information, rather than waiting for an indicator that lags to provide it.

The disadvantage is that price action strategies are usually difficult to automate. This means that you have to sit and wait for chart patterns to form and then trade them manually. For most people this is not a problem. But if you're hatching the idea of creating a trading robot that would trade for you, then many price action strategies will be ill-suited for this.

Price action trading is not perfect. As with other types of trading, you will have losing trades. Although theoretically the price action idea sounds great, we can only know what the price was doing before we entered the position. If the price was going up and we bought the stock, then the price could very well start going down soon. Such situations cannot be avoided. The main thing is that your profits should be greater than your losses. It takes a lot of time and considerable practice to learn this.

Conclusion

Price Action Trading Is Something All Traders Should Learnmastering system trading. The skill of reading and interpreting price movements on charts is a trading strategy in itself. You can master these skills to perfection by completing . These skills will help you even if you decide to trade using other means of analysis - statistics, indicators or seasonal fluctuations. There are many price action strategies out there, but you only need to learn one to get started. Achieve profitable trading with it, and only then take on the study of other strategies. Price action trading does not guarantee a profit. This is a very good style, but it takes a lot of time and practice to learn it. However, the same applies to other styles of trading.

Stay up to date with all important United Traders events - subscribe to our

Price Action patterns are the basis of the no-indicator trading system. Finding a pattern on the chart will help the trader understand which direction the price will move and why it is doing so.

All Price Action strategies for forex and binary options are based on patterns. Therefore, if you decide to master the Price Action system, then you must know what a pattern is, how it looks and how to identify it on a chart.

A pattern is a specific pattern or pattern of price action. Patterns appeared on the price charts due to the repetition of the behavior of market participants. This suggests that the psychology of humanity has not changed or has not changed significantly over more than 100 years of the existence of the financial market. Market participants are subject to the same emotions, feelings, guided by the same principles in their trading. Therefore, patterns are repeated, and technical analysis is still used by most traders.

Patterns in form can be conditionally divided into:

- candle figures;

- complex models.

Candlestick patterns are simple patterns that consist of one or more candlesticks (bars). They are easy to identify on the chart and remember their shape. The simplest such patterns include pin bars, hammer, inside and outside bars, etc.

We refer to complex models as figures consisting of a certain cycle of candles, certain price-to-time ratios. Very often, to determine them on a live chart, you have to draw lines and various levels. These patterns include triangle, flag, pennant, head and shoulders. Complex models appear on the chart less often, but they are an order of magnitude more reliable than candlestick patterns. Most often they occur during a sideways trend.

According to the forecast for price movement, patterns can be divided into:

According to the forecast for price movement, patterns can be divided into:

Based on the name, it is clear that the patterns of continuation and consolidation of the trend suggest a continuation of the current trend of price movement. If before that there was an uptrend, then a trend continuation pattern formed, then we should expect a further increase in the price of the asset. Trend continuation patterns can be either candlestick (three white soldiers) or complex (triangle, flag, pennant).

Trend reversals are not very common, so trend reversal patterns are somewhat less common than trend continuation patterns. But they can also be both candlestick (pin bar, harami) and complex (double bottom, head and shoulders).

Trend reversals are not very common, so trend reversal patterns are somewhat less common than trend continuation patterns. But they can also be both candlestick (pin bar, harami) and complex (double bottom, head and shoulders).

According to the direction of the trend, patterns are divided into:

According to the direction of the trend, patterns are divided into:

- bullish patterns;

- bearish patterns.

Bullish patterns suggest an increase in the price of an asset, the beginning of an uptrend.

Bearish patterns tell us about the imminent decline in the price of an asset, the beginning of a downtrend.

Price Action Patterns

Each Price Action pattern deserves a separate article, as each has its own peculiarity and requires certain trading strategy rules. For convenience, we will divide the patterns into two lists - candlestick patterns and complex patterns.

Candlestick patterns:

- two flying crows;

- bullish and bearish engulfing patterns;

- bullish and bearish counterattack;

- bullish and bearish belt grab;

- flat top and base pan;

- top tower and base tower;

- gravestone;

- DBLHC and DBHLC;

- TBH and TBL;

- CPR (closing price reversal);

- HR (hook reversal);

- PPR (pivot point reversal).

Complex models:

- umbrella and saucer;

- triple bottom and triple top;

- dead cat jump;

As you can see, there are a lot of patterns and it will be quite problematic to remember everything. However, this guide, which will be constantly updated, will be useful to any Price Action trader.

How to identify a pattern and trade with Price Action

Sometimes it is not easy to identify a pattern on a chart. Sometimes there is not enough experience and knowledge, sometimes patience, due to the lack of which, for some reason, the model does not behave as it should.

The pattern is determined by the following characteristics:

- opening price, closing price, maximum, minimum;

- the shape of the body of the candle(s) and the length of its (their) shadows;

- the position of the candles relative to each other;

- the presence or absence of gaps (gaps) between candles;

- price trend;

- proximity to a support or resistance level;

- trading volume readings.

We will try to reveal the technology of trading on Price Action patterns.

- Clear the live chart from indicators and extra lines. They only prevent you from seeing the pattern. A real Price Action trader trades without indicators.

- Draw support and resistance levels, trend lines and channels on the chart. This will help determine the trend of price movement. See articles on how to build support and resistance levels professionally and examples of building support and resistance levels.

- Determine the trend on the chart. Trading with the trend is the most profitable, and trend reversal patterns are usually quite clear on the chart and, moreover, they do not occur as often.

- Now be patient and wait for the pattern to form. It will be your trade entry point, your trading signal and strategy. It is important that the pattern is fully consistent with its forms, meanings, relationships. If it does not meet at least some conditions, but it “seems” to you that this is a pattern, then it is better to refrain from trading and wait for another suitable case. It's better not to risk it. By the way, this is also part of Price Action trading.

- If you are a novice trader and have difficulty identifying a pattern, then you can use the Price Action indicators. They will help to identify the pattern on the chart.

- Do not rush to enter when the pattern is formed. Wait for confirmation that the price will go in the direction you want. And only after confirmation enter the transaction. No one needs extra risks.

If everything is done correctly, then we take profit from the pattern and enjoy further trading on Price Action.

If everything is done correctly, then we take profit from the pattern and enjoy further trading on Price Action.

Traders are often looking for some complex strategies to make money, but sometimes the best patterns can be found in the price itself. Such patterns are called price action. Working with them is carried out without indicators, trading is comfortable in terms of the fact that you almost certainly know that when trading on H4, the transaction will close in about 4 hours or after 1 day when trading on Daily.

In this article, we suggest that you consider the 4 most popular price action patterns. Let's analyze the patterns one by one with a detailed description.

An important nuance! Study it before further reading of the material. You cannot use price action setups on H4 and D1 if your MT4 terminal server time is not set to GMT+2. Practice shows that setups can occur randomly and do not have much power, so if your broker has a different time zone, it is best to trade on M15-H1.

DBLHC (Bullish/Bearish Setup)

If several bars have the same lows or highs, this is the DBLHC pattern. The closing price of the second bar should be directed away from the local double bottom or double top. That's right, this figure on smaller timeframes will be represented as a double top/bottom.

Trading is carried out in the direction of the price breakout, the stop loss is placed outside the market, below the minimum or maximum, and the take profit can be set at 100 pts, or it can be the bottom of this setup a few bars ago. The pattern works great on time intervals from H1 to D1.

Today, according to this pattern, you can write a price action indicator that will be suitable for MT4 or MT5, if desired. To do this, you need to contact programmers writing in the MQL4 language.

After the formation of the "box" of this model, a rollback often occurs, since this formation most often arises from large candles. For trading, it is best to use sell stop orders to catch the price movement at the very first breakdown of an important level. Make sure that the difference between the two highs (for bearish) and the lows (for bullish) is no more than 5pt in 4-digit quotes.

Best forex brokers

Alpari is the undisputed leader in the forex market and today the best broker for traders from Russia and the CIS countries. The main advantage of the broker is reliability, confirmed by 17 years of work. Alpari gives traders the opportunity to earn and withdraw profits.

Roboforex is an international broker of the highest level with CySEC and IFCS licenses. On the market since 2009. Provides a range of innovative tools and platforms for both traders and investors. It is famous for its excellent bonus program, which includes $30 free for beginners.

Setup "Rails"

This is a commonly used pattern. Sometimes they turn to me for help in writing Price action Expert Advisors on rails. The complexity of writing such a robot lies in the fact that often the effectiveness of its work may depend on the quality of the delivered quotes of the broker, because even individual points of difference can contribute to incorrect recognition of the model. As with the “inside bar” strategy, there can be controversial situations here, especially in a flat.

rails- one of the simplest two-bar formations, consisting of two candles with a reverse price direction. The only caveat is that this formation should only be at a local top or bottom, then the probability of a loss will drop significantly, and the chance to close a deal in plus will greatly increase.

The trading system according to the “rails” pattern may look like this: purchases after the formation of a large candle down and candles up after it, while the stop loss can be set at a local minimum under this formation, and the nearest local maximum or level can act as a take profit. This price action system has stood the test of time. For sales, the situation is reversed. If the market of one candle has grown, for example, by 30 pts, and the next one has fallen by 28 pts, you can sell, with a stop of 35 pts, with a margin and take profit at the nearest local minimum.

Pattern “Outside Bar”

An outside bar or outside bar is a pattern that consists of a complete overlap of the previous bar. If the candle closes below it, then such a pattern should be considered as bearish, if vice versa, then bullish.

Popular patterns such as "Outer Bar", « Inner bar», « Gravestone, can be determined by analyzing the market using the price action indicator. One of these indicators can be downloaded below.

Let's analyze a simple strategy on daily charts, on outside bars. Currency pair - any major or cross pair. Time interval D1. We buy as soon as a candle with “overlapping” appears at local lows. Stop loss is placed under the minimum of this formation, take profit - at the level of the nearest local maximum. Learning price action methods with pictures requires a certain amount of time, because each market situation is unique. Price action is used by many professionals because of the ease of analyzing tools in this way.

At the moment, there are people working on the price action not only in Forex, but also in the stock exchanges. One of these people is Lang Begs, a trader who wrote an excellent course that is relevant in 2015-2016.

Setup "Gravestone"

A gravestone or slab is one of the best patterns that lets you know when a flat or trend can start to reverse. Sets are well suited for both scalpers and medium-term traders. The setup is formed from two candles. The first candle can be very ordinary, without a large body and shadows. The second candle is a signal one, it appears as soon as the body of the candle becomes very small, one of the shadows is most often small, and the other is very large. The trend reversal goes against the big shadow.

Always, regardless of the pattern, it is most easy for novice traders to work with price action, moreover, now there are many forums where traders work with it and share their experience.

Price Action formations help to make money in the market of any complexity. Since the concept of the basis of price movement arises. Additions of advisors and indicators can make it easier to find models that you can earn on. Price action patterns are everywhere, on all currency pairs and metals and on all time intervals. It should be remembered that the higher the timeframe, the more accurate the trading signal for any patterns. The only thing that should not be used is monthly time intervals, since any formations are traded through futures, and they have limited expiration periods, so there will be no money where the pattern begins, and therefore there will be no incentive to continue its development - No.

Sincerely, Alexander Ivanov

Hello, dear visitors of the forex trader's portal! This review will be a continuation of the topic about candlestick formations used by professional traders in their own trading, however, price action is much more than just patterns. This is a separate technique, which is still considered the lot of high-class traders in the financial market. price action methods are successfully applied to any trading instrument, which once again proves a comprehensive analysis of the market in this way. Price action trading today has a lot of interpretations and strategies, but the principle remains the same in any case - price action is an analysis of price behavior. There are many setups of this system, in fact, it itself is based on their search and application in trading. Perhaps, it is not so much the search for price action patterns that is of particular importance, but the direct study of them, coupled with the volumes and levels created by the price. We will talk about all this with you in this large review, which will cover literally all aspects of the technique.

Upon completion of which, you can be sure that you know absolutely everything about price action methods. It is important to practice the acquired knowledge and apply it in your trading daily, if you want to learn professional trading based on one of the most complex and at the same time highly profitable Forex systems. At the end of the article, we've attached some price action book links if you'd like to delve deeper into the tactics presented here.

Simple setups (patterns) price action: Pin bar (pinocchio, tail)

This price action setup is somewhat similar to all the well-known doji, but it is closer to professional trading. After all, this combination has both a confirming bar and a previously known level of placing a stop order. Of course, it is desirable to confirm any price action pattern with volume readings, however, in its pure form, this is not mandatory. Therefore, we will discuss volume reading techniques with you in the following reviews, when we touch on VSA tactics. So, what is this pinocchio.

This price action setup is somewhat similar to all the well-known doji, but it is closer to professional trading. After all, this combination has both a confirming bar and a previously known level of placing a stop order. Of course, it is desirable to confirm any price action pattern with volume readings, however, in its pure form, this is not mandatory. Therefore, we will discuss volume reading techniques with you in the following reviews, when we touch on VSA tactics. So, what is this pinocchio.

As you can see in the picture below, a pin bar is a combination of three bars or candles. Where we can see the so-called: the nose and eyes of the formation. Important to note - right eyes should always be bigger left!!! You should look for it when there is a stable trend in the market. It doesn't matter if the trend is bullish or bearish. It is important that the body of the pin bar (a candle with a long shadow, reverse movement and a small body) is at the bottom of the candle (in a downtrend) and at the top of the candle or bar (in a bullish market direction). A pin bar is used, contrary to a common misconception, as a signal to continue the trend, but not to reverse it. This is very important to understand and remember. Now we will try to analyze the essence of what has been said in more detail.

Price action trading with the use of a pin bar includes the following rules: the entry is made not after the formation of the pattern, but on the breakdown of the nearest price low (for a bearish trend) or high (for a bullish trend). The stop loss level is set according to the middle bar (on the border of its shadow), plus 5-10 points for insurance. Also important is the competent search for a pin bar. As we have already said, this setup is a signal to continue the trend, that is, we are looking for a buy signal only in a bullish trend (a pin bar is always formed on a correction from the main movement). A signal to sell - with an existing bearish trend. Above is a chart showing entry signals in a bearish trend. The same applies to the bullish, we will not dwell on this moment, everything is very clear. Another thing to note is that a buy pin bar setup is ignored in a bearish trend, as well as a sell signal in a bullish trend (which, by the way, is the most common mistake made by beginners).

Simple setups (patterns) price action: CPR (Closing Price Reversal)

One of the strongest price action patterns, signaling a price reversal, is especially common during fast movements in market quotes. Since the signal candle should open with a gap from the closing price of the previous bar (candle) and its closing price should be located below the closing of the previous one. The next moment is also important - the opening of the signal bar is at the peak of the local state of the price. It will be more clear if you turn your attention to the corresponding figure. This pattern does not require confirmation from the market, you can immediately open a trade corresponding to the setup by setting the stop loss level at the maximum of the signal candlestick shadow.

One of the strongest price action patterns, signaling a price reversal, is especially common during fast movements in market quotes. Since the signal candle should open with a gap from the closing price of the previous bar (candle) and its closing price should be located below the closing of the previous one. The next moment is also important - the opening of the signal bar is at the peak of the local state of the price. It will be more clear if you turn your attention to the corresponding figure. This pattern does not require confirmation from the market, you can immediately open a trade corresponding to the setup by setting the stop loss level at the maximum of the signal candlestick shadow.

Simple setups (patterns) price action: Inside Bar (inside bar)

price action strategy including this setup suggests finding IB (inside bar), namely the full range of its movement inside the previous one. In trading, this formation is used to work on the breakdown of the minimum and maximum of the signal bar. However, there are many BUTs and quite weighty ones. The use of an insider bar in its purest form will not bring anything other than loss of money. This setup works well in forex figures: triangle, flag, etc. Perfectly worked out when the price approaches the pivot levels. In general, the essence of applying the pattern comes down to a comprehensive analysis of the behavior of the price itself and formations. For example, in the picture presented to you, you can see the use of the setup in the price channel, where breaking through the high/low of the bar would make sense. Today, there are a lot of trading strategies based on building price levels, on the breakdown of which the trader begins to open deals or on a rebound from the level. This is where price action methods allow you to weed out false price fluctuations and feel what is happening in the market, making informed decisions. Making profitable trades. Perhaps, for many beginners in the market, the search for price action patterns will seem difficult. That's why price action indicator presented by us along with a template and a sound notification about the found setups should help you in practical application on forex. You can download the indicator right now by clicking on this link.

price action strategy including this setup suggests finding IB (inside bar), namely the full range of its movement inside the previous one. In trading, this formation is used to work on the breakdown of the minimum and maximum of the signal bar. However, there are many BUTs and quite weighty ones. The use of an insider bar in its purest form will not bring anything other than loss of money. This setup works well in forex figures: triangle, flag, etc. Perfectly worked out when the price approaches the pivot levels. In general, the essence of applying the pattern comes down to a comprehensive analysis of the behavior of the price itself and formations. For example, in the picture presented to you, you can see the use of the setup in the price channel, where breaking through the high/low of the bar would make sense. Today, there are a lot of trading strategies based on building price levels, on the breakdown of which the trader begins to open deals or on a rebound from the level. This is where price action methods allow you to weed out false price fluctuations and feel what is happening in the market, making informed decisions. Making profitable trades. Perhaps, for many beginners in the market, the search for price action patterns will seem difficult. That's why price action indicator presented by us along with a template and a sound notification about the found setups should help you in practical application on forex. You can download the indicator right now by clicking on this link.

Simple price action setups (patterns): BPC (Breakout Pullback Continuation)

The price action setup means nothing more than - breakdown, return, continuation. This is exactly what was once passed off as an excerpt from the secret strategy of Maitrade (my-trade) on the smart-lab forum. We do not pursue the goal of discussing his activities or discrediting them in any way, this person has a rather ambiguous reputation and only trading statistics will determine his effectiveness as a trader. Our task is to understand all the patterns (price patterns) of price action and their successful application in the financial markets. Once again, we note that the knowledge gained about PA will allow you to trade - in any known financial markets, since everywhere there is a price and its movement. And that's exactly what he's studying. price action and we are with you at the moment. What does the Breakout Pullback Continuation setup indicate to you and me? At a very entertaining moment of the market - the price broke through a certain resistance level and returned ( without breaking it), after which it overcame the previous maximum (formed at the moment of breaking through the level). As a result, the resistance level became the support level. Everything is logical and worth noting - it works quite effectively in trading.

The price action setup means nothing more than - breakdown, return, continuation. This is exactly what was once passed off as an excerpt from the secret strategy of Maitrade (my-trade) on the smart-lab forum. We do not pursue the goal of discussing his activities or discrediting them in any way, this person has a rather ambiguous reputation and only trading statistics will determine his effectiveness as a trader. Our task is to understand all the patterns (price patterns) of price action and their successful application in the financial markets. Once again, we note that the knowledge gained about PA will allow you to trade - in any known financial markets, since everywhere there is a price and its movement. And that's exactly what he's studying. price action and we are with you at the moment. What does the Breakout Pullback Continuation setup indicate to you and me? At a very entertaining moment of the market - the price broke through a certain resistance level and returned ( without breaking it), after which it overcame the previous maximum (formed at the moment of breaking through the level). As a result, the resistance level became the support level. Everything is logical and worth noting - it works quite effectively in trading.

Simple setups (patterns) price action: BUOVB (Bullish Outside Vertical Bar)

A BUOVB price action setup or outer vertical bar is something similar to an inside bar, but in reverse. However, it hardly makes sense to talk about their similarity. In this case, the signal bar completely overlaps the previous one with its range, the closing price of the signal bar for buying should be higher maximum previous. For sale, respectively - below the low of the previous bar. A deal is opened in the direction of the signal bar by placing a pending order (buy stop or sell stop) at its maximum or minimum. Plus the standard 5-10 pips for insurance, it's worth noting that insurance is mostly needed to protect an order from slippage during times of volatility. After all, any price action setups we use in moments of increased market volumes (in moments of powerful market movements, price action is a trend system). Again, the application is especially effective provided that the pattern was formed at any price level or within the formed market pattern.

A BUOVB price action setup or outer vertical bar is something similar to an inside bar, but in reverse. However, it hardly makes sense to talk about their similarity. In this case, the signal bar completely overlaps the previous one with its range, the closing price of the signal bar for buying should be higher maximum previous. For sale, respectively - below the low of the previous bar. A deal is opened in the direction of the signal bar by placing a pending order (buy stop or sell stop) at its maximum or minimum. Plus the standard 5-10 pips for insurance, it's worth noting that insurance is mostly needed to protect an order from slippage during times of volatility. After all, any price action setups we use in moments of increased market volumes (in moments of powerful market movements, price action is a trend system). Again, the application is especially effective provided that the pattern was formed at any price level or within the formed market pattern.

Simple setups (patterns) price action: DBLHC

This setup assumes the same lows or highs of two candles, while the signal candle has a high or low above/below the adjacent bar. In this case, the difference between the minimums or maximums does not exceed 1-3 points. It should be noted that it is acceptable and desirable to have several bars with the same lows or highs, the more candles make up the setup, the stronger it is. The stop order is set according to the basis of the setup, plus 5-10 points. The pattern is quite simple, everything is indicated in the picture and applicable even to a beginner in the forex market. Therefore, we immediately move on to the final simple price action pattern. At the very beginning of the review, we forgot to indicate that price action setups are divided into simple and complex. Simple ones mean formations of 1-3 bars, complex ones, respectively, 4 or more.

This setup assumes the same lows or highs of two candles, while the signal candle has a high or low above/below the adjacent bar. In this case, the difference between the minimums or maximums does not exceed 1-3 points. It should be noted that it is acceptable and desirable to have several bars with the same lows or highs, the more candles make up the setup, the stronger it is. The stop order is set according to the basis of the setup, plus 5-10 points. The pattern is quite simple, everything is indicated in the picture and applicable even to a beginner in the forex market. Therefore, we immediately move on to the final simple price action pattern. At the very beginning of the review, we forgot to indicate that price action setups are divided into simple and complex. Simple ones mean formations of 1-3 bars, complex ones, respectively, 4 or more.

Simple setups (patterns) price action: TBH and TBL

Price action TBH setups are nothing but bars with the same tops; respectively TBL - bars with the same lows. They should not be confused with the previous pattern, since in this case the closing moment of the signal bar does not matter. Again, the more bars that make the same lows, the better the signal, the difference between the lows / highs should be no more than 1-3 points. The stop order is placed in the same way as in the previous setup.

Price action TBH setups are nothing but bars with the same tops; respectively TBL - bars with the same lows. They should not be confused with the previous pattern, since in this case the closing moment of the signal bar does not matter. Again, the more bars that make the same lows, the better the signal, the difference between the lows / highs should be no more than 1-3 points. The stop order is placed in the same way as in the previous setup.

So we have reviewed all the simple price action patterns, plus we have published an indicator that allows you to automatically find the main setups. Remember that the use of these techniques is much more effective, provided that you use them in combination with additional market analysis tools, such as forex patterns (which we will definitely talk about in future forex reviews), trading levels and market volumes. For those who hope to get more information, we suggest you download price action books presented below:

Book: Trading without a headache.

Book: Login Algorithm Price Pivot Zone.

In the next review of market analysis using candlestick formations, we will look at complex price action patterns.

Price Action means trading based on price movement, using non-indicator trading systems and without fundamental analysis. In this article, we present the strongest and most obvious Price Action patterns that appear on the price chart and give us an idea of what to expect from the market in the future.

What are Price Action patterns and what are they

Almost all Price Action is based on patterns. Price Action patterns are specific figures on charts and Japanese candlestick patterns.

It can even be safely attributed to the advanced Price Action patterns.

As you already understood, everything that studies the movement of the price, trend, price channel ... - all this can be attributed to PA trading.

Single Candlestick Patterns Price Action

Now we will dwell in more detail on the models that are most often found on the market and around which you can build effective Price Action strategies.

Doji (Top, Rickshaw, Dragon or Dragonfly)

Not too strong model, which shows the hesitation of investors. It cannot be considered a reversal – it is rather a signal for the emergence of more serious patterns and increased attention to the market situation.

If you see how such a formation has formed on the chart near the support or resistance level, you should increase your attention. It is quite possible that you see the beginning of a new trend that will allow you to make good money.

kangaroo tails

More often than a regular doji, its special variety is triggered with a long shadow on one side and no shadow at all on the other. These Price Action patterns are called Hanged Men, Hammers, Gravestones, Dragonflies, and much more.

You can use the terminology of Alex Nekritin and, following his example, call such patterns “Kangaroo tails”.

The kangaroo tail is a strong pattern, often formed at pivot points. A downward kangaroo tail is a buy signal, while an upward kangaroo tail is a sell signal. If a kangaroo tail breaks through a support or resistance level and a candle closes on the other side of the zone, then this is a highly likely sign of a trend reversal.

You can work on such patterns without a doubt, especially effective signals are obtained if the body of the kangaroo is very small and is located within the range of the previous candle, and the tail is very long and several times larger than the bodies of the nearest candles.

A strong model, indicating that the trend has most likely already changed and large investors unanimously began to move the chart. If the tape appeared after the Kangaroo Tail, this is a sufficient reason to open an order.

You will find the "bearish band" before the beginning of a bearish trend, near the highest level reached by the price. A "bullish band" occurs at the bottom of the chart before the price rushes up.

Star

A rare model, transitional from one-candlestick patterns to more complex patterns. The star is morning and evening. You can work on it only if there is a gap between the “star” itself and the candles surrounding it. The pattern appears at the support and resistance levels, indicating a trend reversal.

Rules for working with one-candlestick patterns Price Action

Price Action patterns consisting of one candle should not be considered an independent signal sufficient to open an order. It is not necessary to pay attention to the emergence of such patterns if they appear far from the support and resistance levels - most likely these are false, random signals. The principle of working on the listed formations of one-candlestick patterns will be as follows:

- Wait until the asset price chart hits a proven support or resistance.

- Wait until a pattern pattern forms in this reversal zone.

- Find confirmation that the model is not false - it can be some kind of technical analysis figure that crosses the MA or some kind of change in the real market (changes in interest rates, the vector of economic development, etc.).

- Open an order in the right direction.

I would like to note that the formed pattern of the Price Action strategy that you noticed will most likely work if there is a visible empty space to the left of the formed model, as in the screenshot below:

Two one-candle patterns next to the resistance line indicate a future bearish trend, there is enough empty space to the left of them, and market volatility allows us to talk about sufficient predictability of price behavior, it is these options that allow you to make a profit by opening orders without excessive risk.

I would like to remind you that the larger the timeframe you work with, the more clearly the strategy will work.

Price Action patterns of two or more candles

Below will be described in detail the patterns, the identification of which on the chart will require the trader's attention and concentration. In return, working with them will make trading more intense and profitable - if these patterns are tracked in time, then you can make a fairly accurate forecast of the behavior of asset charts.

Inner bar

The inside bar is a reversal pattern, but in some cases it can also indicate a continuation of the trend.

Absorption

A strong reversal pattern, a sufficient reason to open an order. Absorption is a pattern pattern that is the opposite of an inside bar. A reversal formation, which can be quite successful if it appears near the support-resistance level.

TBH - two or more Japanese candlesticks with an equal high mean that the resistance level at which such a pattern has formed is under very serious pressure, and the chart can either break through it, which will allow it to go up to the next level, or move back to consolidate. TBH is a medium strength reversal pattern - sometimes it doesn't have enough strength to reverse the price. Appears when a bullish trend changes to a bearish one.

TBL is a reverse pattern to the previous one, when several candles have the same minimum. In order to determine how likely a chart reversal is when such patterns appear near an important zone, the first thing to do is to understand how strong the level that caused their formation is. To do this, you need to go to a higher timeframe and see if the level is saved there. If yes, then the level is quite strong, and a trend reversal is quite likely.

Rails are a strong price action reversal pattern that can be clearly seen on the charts. Serves as a sufficient basis for opening an order. The probability that the pattern will work increases if the size of the candles on the rails is larger than those that preceded them.

The pattern is very good, it is easy to remember, and at the same time it works with a high degree of probability if it appears next to the level. The candlesticks that form this pattern should have bodies that are at least twice as large as those of several previous candlesticks, and reduced shadows.

A medium-strength reversal pattern can be considered a clear signal if a long bearish candle begins to form after it.

A medium-strength reversal pattern, identical to the Dark Cloud Veil, but occurs when bears are replaced by bulls. The veil of dark clouds indicates that the bullish trend on the chart is fading.

The model consists of two candles, the first of which is long bearish, the second is bullish. The reverse related pattern, showing a change from bearish to bullish trend, is called “P rise in the clouds».

Where to look for Price Action patterns?

The formation of patterns in itself, from scratch, does not mean anything. These patterns only work if they are in the right places, namely near reversal levels. If you find an active support or resistance level on the asset chart, you will most likely see the main patterns described by us next to it. Therefore, it is with the search for levels that one should begin the search for patterns on the chart.

About levels

A level is a zone on a chart where the price has reversed many times. The more price reversals were near this mark, the stronger it is considered. The levels are valid for a long time, and the price can exactlyto repeat the fluctuations that happened to her even a few years ago. You should not imagine the level as a clear mark - it always has elasticity and is able to bend under the influence of the price and only then repel it.

To more accurately determine the location of the level, we recommend temporarily changing the chart image from a candlestick to a linear one, drawing support and resistance lines, and switching back to a candlestick to search for patterns - this will significantly increase the accuracy of work.

Best time to search

Pattern patterns can be searched even around the clock, in any trading session, increasing attention at those moments when the asset price chart begins to approach reversal zones. But there are periods of time when it is better not to approach the terminal at all:

- the first half of Monday - at the beginning of the trading week, the market is inappropriately excited;

- the second half of Friday - many investors can close large positions before the weekend, so the market is again unpredictable;

- during news releases marked by strong volatility, unless you specialize in economic analysis.

When, due to these situations, prices do not move as usual, even the main patterns are formed completely haphazardly, confusing inexperienced traders. Our task is to wait until large market participants join the work, who will work according to established patterns and make the market more predictable.

When, due to these situations, prices do not move as usual, even the main patterns are formed completely haphazardly, confusing inexperienced traders. Our task is to wait until large market participants join the work, who will work according to established patterns and make the market more predictable.

Two-candlestick Price Action patterns are a little harder to spot than simple patterns, but they are fairly common and give clearer signals to the trader. Therefore, if you want to use all the opportunities that the no-indicator trading system opens up, try to use them in your work - this will not only increase the number of transactions, but also make them more accurate.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Popular

- Creation of the Procter & Gamble brand

- Business essence, functions and classification

- Price action (Price action) - how to earn?

- Traders millionaires from Russia Top richest traders

- Your own small business ideas

- Ideas for small business with minimal investment

- Small Business - Home Production Ideas

- Small Business - Home Production Ideas

- What can be produced at home for sale

- Sheep breeding business plan