The sole founder and director in one person. Sole founder and director in one person Two firms with one director

The only founder and director in one person is a typical picture for a small business. Moreover, turning a startup into profit often requires the manager to invest a year or even more in its development of labor and money, without receiving anything in return.

In such a situation, paying the director's salary is a luxury that not everyone can afford. The luxury of paying insurance premiums from a salary, maintaining personnel records and submitting a huge amount of “salary” reporting.

Meanwhile, in the already established business, they want something fundamentally different - social guarantees (sick leave, vacations), the formation of pension savings, and a monthly salary. These are the benefits of an employment contract.

Is it necessary to conclude an employment contract and pay a salary if your company has the sole founder and director in one person? Unfortunately, there is no single official answer to this question. And if you came here for the exact "yes or no", then I will immediately disappoint you.

Meanwhile, there are advantages - to use the situation in a way that is beneficial to you. And in both cases, guided by the norms of the law.

Employment contract with a single founder

All official sources who are called upon to clarify controversial issues - Rostrud, the Ministry of Finance, extra-budgetary funds, courts - like capricious young ladies, put forward opposite points of view. And with references to the legislation. That does not prevent them from changing their position to the opposite after a while.

By the way, the letters of Rostrud and the Ministry of Finance are not legal acts, they contain only explanations and opinions and cannot have legal force.

Above, we have already briefly outlined the reasons why an employment contract with a single founder can be beneficial, we repeat:

- – the ability to receive monthly income from the business, regardless of the presence of profit;

- — social guarantees (payment for vacations and various benefits);

- - formation of pension insurance experience for calculating pensions.

Examples of opinions of officials against the conclusion of an employment contract: letters of Rostrud dated 06.03.2013 No. 177-6-1, dated 12.28.2006 No. 2262-6-1, letter of the Ministry of Finance dated 02.19.2015 No. 03-11-06/2/7790, letter of the Ministry of Health and Social Development dated August 18, 2009 No. 22-2-3199. Here are their arguments:

- If the sole founder and director are in one person, then the employment contract will contain two identical signatures, it is with itself, which is impossible.

In paragraph 3 of Art. 182 of the Civil Code of the Russian Federation states that an agreement signed by the same person on both sides has no legal force. But the provisions of this article do not apply to labor relations, this is civil law.

- Article 273 of the Labor Code from chapter 43 (labor relations with the head) states that the provisions of this chapter do not apply to managers who are the only participants (founders) of their organizations.

As you can see, the statements are very controversial.

The employment contract of the director with himself or with the company?

What arguments can be made in your favor if you are the only founder and director in one person and want to conclude an employment contract?

- The parties to the employment contract are different– the director as an individual and the organization as a legal entity. It is known that a legal entity has its own legal capacity and acts in legal relations on its own behalf, and not on behalf of its founders. Therefore, the director's employment contract "with himself" is possible.

- Chapter 43 of the Labor Code, to which officials refer, describes relations with a leader who is not a founder. In the Labor Code itself, there is no prohibition to conclude an employment contract with a single founder. And even in Article 11, among the persons to whom labor legislation does not apply, the founding director is not named.

Indirectly confirms the possibility of concluding an employment contract with a single founder insurance law. So, for example, in paragraph 1 of Article 7 of Law No. 167-FZ of December 15, 2001 “On Compulsory Pension Insurance in the Russian Federation”, we find that the insured persons are “those working under an employment contract, including heads of organizations who are the only participants (founders).

There are similar provisions in laws No. 326-FZ of November 29, 2010 (medical insurance) and No. 255-FZ of December 29, 2006 (social insurance).

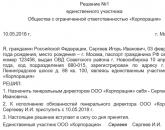

Order for the director - the sole founder

Labor relations with the General Director are formalized in accordance with all the rules of labor legislation, with the conclusion of an employment contract. If the founder is the only one, then the contract can be concluded for an indefinite period.

The text of the agreement states that this employee “is entrusted with the duties of the general director on the basis of the decision of the founder (participant) No. ... .. dated ......”.

Those. First you need to sign the decision of the only member of the company. The decision will say: "I assign the duties of the general director to myself."

Based on the decision, an order is issued for the director - the sole founder, which says something like the following: I, full name, begin to fulfill my duties as the general director of LLC “...” from (date). Grounds: decision of the sole participant of the company No. ... dated ...

The requirement to issue an employment order is contained in Art. 68 of the Labor Code of the Russian Federation. A job entry is made in accordance with the general rules established by the Rules for maintaining and storing work books (approved by Decree of the Government of the Russian Federation of April 16, 2003 N 225), as well as the Instructions for filling out work books, approved. Decree of the Ministry of Labor of the Russian Federation of October 10, 2003 No. 69.

The signed order on the performance of duties will be an order for employment. Based on the concluded employment contract and order, an entry is made in the work book.

The entry in the work book is done as follows:

- - in column 3: Appointed to the position of General Director

- - in column 4: details of the order

If you plan to conclude an employment contract not only with the director, but also hire other employees, then.

Salary of the director - the sole founder

The employment contract will provide for the payment of wages to the director. Its size must be economically justified (Article 273 of the Tax Code - expenses are economically justified and documented).

Please note that the salary of the director - the sole founder can be paid only upon signing an employment contract. If it is not, then the tax authorities will not recognize it as an expense.

The explanation is simple - among the expenses that cannot be taken into account when calculating the tax base for income, the Tax Code indicates any remuneration to managers, except for an employment contract (clause 21, article 270 of the Tax Code of the Russian Federation).

The salary of the director is paid according to the same rules as the rest of the employees, there are no differences. Personal income tax is also withheld and insurance premiums are charged.

Sole founder and director in one person without an employment contract

There is also a reverse situation when the founder does not want to conclude an employment contract, but performs managerial functions. Since we refuted the arguments of the Ministry of Finance and Rostrud, we will not refer to their conclusions and justifications. Let's go from the other side - from the position of civil law.

Article 53 of the Civil Code, Art. 32, 33, 40 of the Law "On LLC" indicate that the director is the sole executive body of the company and carries out the day-to-day management of the activities of the LLC.

There is no link to the presence or absence of an employment contract and payment of wages. From the moment the sole founder, by his decision, assumes the functions of the sole executive body, he receives managerial powers.

Thus, the only founder who wants to manage his organization himself has the right to either conclude an employment contract or do without it.

SZV-M for founding director

All employers are required to submit a report to the FIU in the SZV-M form. This must be done no later than the 15th day of the month following the reporting month. Until March 2018, according to the official position of the Pension Fund, SZV-M did not need to be filed against a founding director with whom an employment contract was not concluded and who did not receive a salary. This was explained by the fact that such persons were not recognized as employees, and therefore insured persons.

However, the FIU has changed its position since March 2018. Now SZV-M is submitted to the founding director in any case, regardless:

- - the presence or absence of an employment contract concluded with him;

- - the presence or absence of salary payments to him;

- - conducting business activities by the organization or stopping it.

Also, the SZV-STAZH report is submitted to the founder.

Officials explain their demand by the fact that Article 16 of the Labor Code states that even without a concluded employment contract, in this case, labor relations arise with the employee due to his actual admission to employment.

On this topic, you can read: PFR letters No. LCH-08-24/5721 dated 03/29/18, 17-4/10/B-1846 dated 03/16/18.

Moreover, regional offices for reinsurance require to include in the SZV-M not only the founder in the singular, but also all the founders, if there are several of them.

Is the Founding Director included in the PCA?

The form of Calculation of insurance premiums (RSV) in section 3 includes personalized information about the amount of wages accrued to each employee.

Therefore, if an employment contract is concluded with the founding director and a salary is paid to him, then such an individual and payments to him must be clearly reflected in section 3.

However, according to the latest position of officials (letter of the Ministry of Finance dated 06/18/18 No. 03-15-05/41578, letter of the Federal Tax Service No. GD-4-11/6190@ dated 04/02/2018) section 3 of the RSV should also include data on the director - the sole founder, even if an employment contract has not been concluded with him, and he does not receive a salary. In this case, in subsection 3.2 there will be zero indicators.

Officials explain this by the fact that despite the lack of payments, such a person does not cease to be insured. And it is insured because labor relations still exist, even without an employment contract.

In this article, we deliberately considered not only the problem of concluding or not concluding an employment contract, but also the reporting to be submitted. Because in the same situation, the same organs say completely different things. Fantastic! There cannot be an employment contract in principle, but at the same time it is. As well as the obligation to file reports.

No matter what you do, you will still be wrong! Therefore, there is only one conclusion - do what suits you best - by concluding or not concluding an employment contract. But in the reports, the only founder and director in one person must be mandatory.

If you have no time to waste time on accounting routine, if you have more important business tasks, then write on the page or in the online chat, we will be happy to help you. In the comments, you can ask questions about the content of the article, if you have any.

Management in LLC

The Civil Code of the Russian Federation directly provides for both the possibility of establishing an LLC by one founder, and the admissibility of the operation of an LLC, initially established by several persons, later with one participant.

This can happen either as a result of the retirement of the remaining founders from the LLC over time, or in the event of the acquisition by one person of 100% of the shares of the LLC (part 2 of article 88 of the Civil Code of the Russian Federation). If in business practice the term “founder of an LLC” is usually used, then the legislator prefers to use the term “participant of an LLC”. From a legal point of view, these terms are almost identical: the founder is the participant who was involved in the creation of the LLC. In what follows, we will ignore this minor difference.

Management in an LLC can be:

- Three levels including:

- general meeting of participants (GMS);

- board of directors (BoD);

- one or more executive bodies.

- Two-level, without SD formation. For an LLC with 1 participant, the presence of a SD in the management system does not make practical sense; in this case, a two-level management system is used.

Executive power in an LLC can be organized in 3 ways:

- sole executive body. In practice, this body/position is most often referred to as the "general director", although there are other names.

- The sole executive body together with the collegial executive body (usually there are the names "board" or "management").

- The management company is another legal entity that performs the functions of an executive body.

When matched founder and director of LLC in one person usually the 1st variant of the organization of the executive body is used.

The main governing body of the LLC is the OSU, it makes decisions on the most important issues of the functioning of the LLC. The competence of the OSU is determined by art. 33 of the Law "On Limited Liability Companies" dated February 8, 1998 No. 14-FZ (hereinafter - Law No. 14-FZ). A number of issues relate to the exclusive competence of the GMS, i.e. their resolution cannot be transferred to another body of the LLC by the charter of the company. If there is only one participant in the LLC, then he makes decisions on behalf of the GMS alone. Such decisions must be made in writing. In this case, a number of provisions defined by Law No. 14-FZ in relation to the OSU do not apply (Article 39 of Law No. 14-FZ).

Can a founder be a director of an LLC?

A direct and positive answer to this question is contained in Part 2 of Art. 88 of the Civil Code. Note that when the director and founder are in one person, the management system in an LLC does not become one-level. Although all decisions at any level of management in such an LLC are made by the same person, from a legal point of view, this is a two-level management system. The issue of differentiation of competence is solved as follows:

- the powers of the participant are determined by the charter of the LLC;

- all other issues are resolved by the general director on a residual basis (in the absence of a board of directors in the management system).

For an LLC with one participant (who is also a director), the rules of Law No. 14-FZ on interested-party transactions and major transactions do not apply (part 1, clause 5, article 45 and part 1, clause 9, article 46 of the said law).

In an LLC with a single member, there is no conflict of interest, it is simple in administration and resembles an individual entrepreneur from a managerial point of view. However, legally there are significant differences between an individual entrepreneur and such an LLC.

Founder and CEO in one person: employment contract

One of the main issues that arise in practical life is the issue of an employment contract (TD) with the director. The features of drawing up a TD in this case are discussed in the article "Employment contract with the general director of an LLC (sample)". Chapter 43 of the Labor Code of the Russian Federation (LC) is devoted to the issues of an employment contract with the director (as well as members of the board). However, in the event of a coincidence of a participant in an LLC and its director, its regulation does not apply (part 2 of article 273 of the Labor Code). At the same time, the director of an LLC is not included in the list of persons to whom the regulation of the Labor Code does not apply and with whom an employment contract is not concluded (part 8 of article 11 of the Labor Code). There is some legal uncertainty.

An additional complication lies in the following: if an LLC concludes a TD with a director, then who signs it on behalf of the employer?

It turns out a kind of legal paradox: TD on behalf of the employee and on behalf of the employer must be signed by the same individual. Note that in this case, an individual is in a different status: in one case, he acts on his own behalf (employee), and in the other, he is a representative of a legal entity. Note that the ban on the conclusion of transactions for a representative in relation to himself as an individual is contained in paragraph 3 of Art. 182 of the Civil Code. But the regulation of the Civil Code does not apply to labor relations, and there are no such prohibitions in the Labor Code.

Law enforcement practice: TD with a director in an LLC with one participant (aka director)

As a result, different law enforcers expressed different views on this subject and formed different law enforcement practices in their activities. Let's consider the expressed points of view.

- Rostrud, in a letter dated 03/06/2013 No. 177-6-1, stated that an employment contract with the director was not concluded in this case.

- On March 10, 2015, on the site onlineinspektsiya.rf (information portal of Rostrud), an answer was given that the TD (and no other contract) is concluded in such a situation, the director’s salary is not accrued, deductions to the Pension Fund and the Social Insurance Fund are not made. But on March 17, 2016, the opposite answer was given to the same question: the TD is concluded, the salary is accrued.

- The Ministry of Health and Social Development believes that in this case, labor relations arise regardless of whether a TD is concluded or not (Order No. 428n of June 8, 2010). In this case, the director is subject to compulsory social insurance. Note that this department does not currently exist, and its successor, the Ministry of Labor, did not give an official explanation (there are only the above-mentioned consultations of Rostrud, a service subordinate to the Ministry of Labor and Social Protection).

- The Ministry of Finance believes that in this situation a TD is not concluded (letters No. 03-11-06/2/7790 dated February 19, 2015, No. 03-11-11/52558 dated October 17, 2014). At the same time, the accrued salary cannot be included in the composition of costs that reduce the taxable base. The first of the above letters is applicable to organizations that are on the simplified taxation system (simplified taxation system), the second is for enterprises paying UST (agricultural tax).

- The judicial authorities are of the opinion that in such a situation, labor relations arise (decree of the FAS ZSO dated November 9, 2010 in case No. A45-6721 / 2010 and a number of other precedents). In an important definition of the Armed Forces of the Russian Federation dated February 28, 2014 No. 41-KG13-37, it was concluded that such labor relations are regulated by the general provisions of the Labor Code (recall that Chapter 43 of the Labor Code does not regulate them). This point of view is confirmed in paragraph 1 of the decision of the Supreme Arbitration Court of June 2, 2015 No. 21). In a number of court decisions, it was concluded that labor decisions arise on the basis of the decision of a single participant, while registration of a TD is not required (determination of the Supreme Arbitration Court dated 5.06.2009 No. VAS-6362/09).

Founder and director are one person: risks

How to be an entrepreneur in such a situation? There is no single answer. But we believe that the risk of adverse consequences is much higher in the absence of TD with the director. Rostrud, which is the control body in the field of labor and is authorized to conduct inspections and impose administrative penalties, as mentioned above, often changes its point of view on this issue.

Sole founder - CEO in 2 companies

The legislation does not contain prohibitions for the sole participant of an LLC to hold the position of director in 2 or more such LLCs. But only one AP in this case is the main one. In the rest of the LLC, the director must draw up a TD on part-time work. All part-time contracts are subject to the rules of Ch. 44 of the Labor Code, including the norm on the length of the working day not exceeding 4 hours (Article 284 of the Labor Code) and the norm on the calculation of wages in proportion to the established working hours (Article 285 of the Labor Code).

IMPORTANT! The rule on the need for a permit to work part-time by a higher management body of an LLC, contained in Art. 276 of the Labor Code, does not apply to the founding director, since it is located in Ch. 43 of the Labor Code, and this chapter does not apply to this situation.

Note that a large number of simultaneously occupied directorial positions is a reason for verification by the tax inspectorate. Thus, one of the criteria for the possible unreliability of the information included in the Unified State Register of Legal Entities is the combination of more than 5 such positions by an individual holding a director's position in different organizations (letter of the Federal Tax Service dated 3.08.2016 No. GD-4-14/14126@).

LLC with one participant (aka director) is a very common and convenient practical tool for entrepreneurship in business life. In order to avoid problems with state regulatory authorities, we recommend (at the moment) to conclude an employment contract with a director in such an LLC. Before creating a trading house with a director, it is necessary to draw up a written decision of the sole participant of the LLC on his appointment.

- How to appeal against the actions (inaction) of the tax inspectorate?

- How to challenge the decision of the tax authority to hold accountable for committing a tax offense?

- Is it necessary to give explanations to the tax authorities, in connection with the non-classification of operations for the sale of goods and materials to the objects of VAT taxation with reference to paragraphs. 7 p. 2 art. 146 of the Tax Code of the Russian Federation?

- What should the employer do if the employee did not take the 2-NDFL certificate upon dismissal?

- Interrogation (giving explanations) of the taxpayer

Question

The founder and director of the LLC is the same person. The LLC has been in existence since 2001. Registration of a legal entity was carried out at the place of residence of the founder. To date, the founder bought an apartment as an individual. face for office use. Currently, the LLC is located at a new address, accordingly, it is necessary to make changes to the constituent documents and register with the tax authority. Is such registration possible if the object has not passed the procedure of transfer to non-residential premises?

Answer

: For information on how to make changes to the charter of an LLC and register such a change with the registering tax authority, read the recommendations below. Most likely, the registering tax authority will register these changes. However, the use of residential premises as an office is possible only after the transfer of such premises to non-residential premises (paragraph 3 of Article 288 of the Civil Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated February 14, 2008 No. 03-03-06 / 1/93). Otherwise, the owner of the premises may be held administratively liable under Article 7.22 of the Code of Administrative Offenses of the Russian Federation.

When developing a set of documents on changing the address of the location of a legal entity, you can use the following samples: Changes to the charter, Minutes of the general meeting of participants, Decision of the sole participant.

When filling out an application in the form P13001 for amendments to the constituent documents of a legal entity, refer to Sample.

The requirements for filling out the application are contained in Sections and Appendix No. 20 to the Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/25@.

The rationale for this position is given below in the materials of the Lawyer System.

“Periodically, in every society there are changes that require amendments to the constituent documents.

The most common grounds for changing the bylaws are:

- change of legal address*;

- change in the size of the authorized capital;

- creation of a branch (representative office);

- name change;

- changes in the structure or competence of the governing bodies.

Making changes is connected with the state registration procedure. A lawyer needs to know how to prepare documents for registration and ensure that it passes the first time.

The procedure for amending the constituent documents

The only constituent document of an LLC is the charter (clause 1, article 12 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”, hereinafter referred to as the LLC Law).

Changing the charter of an LLC is within the competence of the general meeting of participants and is carried out exclusively by its decision *. The law prohibits the inclusion in the charter of a provision that changes in the charter fall within the competence of other management bodies (clause 2, article 33 of the LLC Law).

The founding agreement and the decision (minutes) on the creation of an LLC are not required to be amended when changing the charter.

However, to change a specific circumstance that entails the need to change the relevant information in the articles of association, a unanimous decision may be required.

Council (166,978)

Since the legislation does not establish requirements for the execution of minutes of the general meeting of participants, as a guideline it makes sense to apply by analogy the requirements established for the execution of the minutes of the general meeting of shareholders in paragraph 2 of Article 63 of the Federal Law of December 26, 1995 No. 208-FZ "On Joint Stock Companies » and clause 4.29 of the Regulation on additional requirements for the procedure for preparing, convening and holding a general meeting of shareholders, approved by order of the Federal Financial Markets Service of Russia dated February 2, 2012 No. 12-6/pz-n*.

Amendments to the charter are drawn up either in the form of a new version of the charter, which contains new information instead of old information, or in the form of changes as a separate document, which indicates that appropriate changes are being made to a specific paragraph of the charter. At the same time, neither the text of the amendments nor the new version of the charter is required to be signed.

Council (166,979)

It is better to formalize the changes in the form of a new version of the charter, and not in the form of changes as a separate document.

Subsequently, it will be much more convenient to use a single current version of the charter than a partially valid version of the charter with several (or many) annexes to it on separate sheets, which will need to be agreed upon when reading. In addition, individual sheets may be lost.

State registration of changes

The changes made are subject to state registration and become effective for third parties only from the moment of registration*.

If information about branches and representative offices changes, then there is no need to wait for registration itself - such changes become effective from the moment when the LLC notified the tax authority about them (paragraph 3, paragraph 4, article 12, paragraph 5, article 5 of the Law on OOO).

The general period in which it is necessary to submit documents for registration after the decision to make changes is not established by law. However, the LLC Law establishes the deadlines for submitting documents for registration in cases of increase and decrease in the authorized capital.

To register the changes, you need to submit the following documents to the tax office that carries out state registration (clause 1, article 17 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, hereinafter referred to as the Law on state registration)*:

- application for state registration;

- decision (minutes) on making appropriate changes;

- changes made to the constituent documents of a legal entity (the charter in a new edition (or changes as a separate document) must be submitted for registration in two original copies);

- document confirming the payment of the state fee.

Who has the right to submit documents for state registration of changes to the constituent documents of LLC (131.5942)

The General Director or another person who has the right to act on behalf of the LLC without a power of attorney (an entry about this person must be in the Unified State Register of Legal Entities)

When amending the constituent documents, the applicant is the head of the permanent executive body (i.e. director) or another person who has the right to act on behalf of this legal entity without a power of attorney*.

- decision (minutes) on amendments to the constituent documents;

- changes to the constituent documents of a legal entity.

The charter in the new edition (or changes as a separate document) is submitted in two original copies.

There is no need to pay state duty.

The registering authority within five days makes an appropriate entry in the Unified State Register of Legal Entities (clause 2, article 19 of the Law on State Registration). The company receives in hand (or by mail):

- record sheet of the Unified State Register of Legal Entities;

- extract from the Unified State Register of Legal Entities;

- charter (changes as a separate document) with a mark of the tax authority.".

Professional help system for lawyers, where you will find the answer to any, even the most complex question.

Question from Clerk.Ru reader Evgenia (Vladivostok)

Tell me, if the IP (UTII) and LLC (USNO) have the same founder, in the LLC he is also the director, can the LLC sell goods to the IP? In this case, can the tax authorities attribute them to related parties and recognize the transactions as invalid?

First of all, I note that only a court can recognize a transaction as invalid. The tax authorities do not have such powers.

By virtue of the provisions of Art. 168 of the Civil Code of the Russian Federation, a transaction that does not comply with the requirements of the law or other legal acts is void, unless the law establishes that such a transaction is voidable, or does not provide for other consequences of the violation.

According to paragraph 3 of Art. 182 of the Civil Code of the Russian Federation, a representative cannot make transactions on behalf of the person represented in relation to himself personally. Unequivocally answer the question of whether the norm of paragraph 3 of Art. 182 of the Civil Code of the Russian Federation, unfortunately, is not possible. The reason is that arbitration practice in this respect is very contradictory.

Thus, the Federal Antimonopoly Service of the East Siberian District, in Resolution No. A78-5281 / 06-F02-3598 / 08, A78-5281 / 06-F02-3779 / 08 of August 13, 2008, recognized the lease agreement as void on the grounds that on behalf of the lessor and on behalf of the lessee, the contract was signed by the same person who was the director of the lessor organization and the individual entrepreneur - the lessee. According to the court, such a situation violates the provisions of paragraph 3 of Art. 182 of the Civil Code of the Russian Federation, which prohibits a representative from making transactions on behalf of the represented in relation to himself personally.

However, there is another position. The Federal Antimonopoly Service of the Moscow District, in Decree N KA-A40 / 7291-09 of 08.06.2009, rejected the tax authority's argument that the supply agreement was null and void due to the fact that the agreement was signed on behalf of both parties by the same individual, with reference to paragraph 1 of Art. 53 of the Civil Code of the Russian Federation, by virtue of which the bodies of a legal entity cannot be considered as independent subjects of civil legal relations and, therefore, act as representatives of a legal entity in civil legal relations.

Similar conclusions are also contained in the Resolutions of the Federal Antimonopoly Service of the Volga District dated July 4, 2006 in case N A55-31646 / 05-34, the Ninth Arbitration Court of Appeal dated February 22, 2008 N 09AP-1139 / 2008-GK, the Federal Antimonopoly Service of the North-Western District dated March 26, 2007 in case N A13-5001 / 2006-24.

Thus, the majority of courts still agree that a person performing the functions of the sole executive body in an organization cannot be considered as a representative of this legal entity, and, accordingly, paragraph 3 of Art. 182 of the Civil Code of the Russian Federation is not applicable to disputed transactions. At the same time, you should keep in mind the possibility of disputes with the tax office, which can only be resolved in court.

In addition, you need to take into account the possibility of a dispute with the tax authorities regarding the compliance of the contract price with the level of market prices. The fact is that the tax authorities can check the correctness of the application of prices for transactions between related parties (clause 1, clause 2, article 40 of the Tax Code of the Russian Federation). In the event that the prices of goods applied by the parties to the transaction deviate upwards or downwards by more than 20 percent from the market price of identical (homogeneous) goods, the tax authority has the right to make a reasoned decision to charge additional tax and penalties calculated in such a way as if the results of this transaction were evaluated based on the application of market prices for the relevant goods, works or services (clause 3, article 40 of the Tax Code of the Russian Federation).

For the purposes of taxation, interdependent persons are recognized as individuals and (or) organizations, relations between which may affect the conditions or economic results of their activities or the activities of the persons they represent (paragraph 1, clause 1, article 20 of the Tax Code of the Russian Federation).

Paragraph 1 of Art. 20 of the Tax Code of the Russian Federation provides for a list of grounds for recognizing organizations and (or) individuals as interdependent by virtue of law.

In addition, persons may be recognized as interdependent by a court decision on other grounds, if the relationship between these persons may affect the results of transactions for the sale of goods, works, services (clause 2, article 20 of the Code).

Establishing the fact of interdependence of persons due to circumstances other than those listed in paragraph 1 of Art. 20 of the Code (as in this situation), is carried out by the court with the participation of the tax authority and the taxpayer in the course of consideration of the case concerning the validity of the decision on the additional assessment of tax and penalties (clause 1 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 N 71) .

Getting a personal consultation from Svetlana Skobeleva online is very simple - you need to fill out . Several of the most interesting questions will be selected daily, the answers to which you can read on our website.

Send to mailTax consultant 1C-WiseAdvice

As part of tax planning projects, we often have to resort to such a legal optimization tool as splitting a business into several legal entities. In addition to safe tax cuts, this allows you to solve many other tasks that are equally important for business: from diversifying the risks associated with unscrupulous suppliers to protecting company assets from tax authorities and creditors in the event of an unforeseen bankruptcy.

Today we will talk about how to safely introduce several legal entities into the business structure using the “simplification” in order to reduce the tax burden of the company.

How exactly should you not do it?

If the company is already on the "simplification", but the amount of revenue is about to exceed allowable limits- there is a great temptation to open another legal entity with the same type of activity, the same founders and at the same legal address in order to continue doing business on preferential tax terms.

Or the owner of a company with a common taxation system may come up with a sensible idea to divide his business into two identical legal entities with the simplified tax system, laying the proceeds for each of them in legal limits and thereby reduce the tax burden.

So. In both cases, such a "frontal" path will be illegal, since the goal is obvious - a deliberate reduction in taxes. Recently, tax inspectors have been successfully proving the illegality of this approach in court.

When splitting a business to reduce taxes, there are important safety rules to follow.

What is the benefit of "simplification"?

Let's look at a specific example of how much taxes can be reduced by replacing one legal entity with VAT by two separate firms operating without VAT (that is, using a "simplification").

Let's say the company's revenue is 100 million rubles. / year. And its expenses for the same period amounted to 65 million rubles. (VAT included).

In this case, for the year the company must pay the following amounts to the state treasury:

- RUB 5.34 million in the form of value added tax;

- RUB 5.93 million in the form of income tax.

- RUB 5.25 million or 5.25% of revenue (if applicable USN-15 mode);

- 6 million rubles or 6% of the proceeds (if the regime USN-6).

- 2.5 times - when the business is split into 2 firms with USN-15;

- 2.2 times - when the business is split into 2 firms with USN-6.

Safety Rule #1: No Spontaneous Startups of New Companies

Tax optimization is a project. And, like any project, it requires competent preliminary preparation. Therefore, the first thing that is important to understand is the number of participants in the new business structure.

It is better to proceed from the forecasted amount of revenue for the coming year. This will allow you to correctly calculate how many new legal entities on the "simplified" system will be required and will help to avoid the unsystematic opening of new LLCs, as soon as the indicators of one of them approach to limits.

Security Rule #2: No Affiliation of Legal Entities

The inevitable suspicion of illegal tax cuts and the commission of a tax crime by the IFTS arises if several legal entities on the "simplified" system have the same general director or founder. To see this, it is enough for inspectors to obtain information from open sources (for example, from an extract from the Unified State Register of Legal Entities).

Of course, the interdependence of participants is not in itself evidence of an unjustified tax benefit and tax avoidance. But in most cases, this situation is a reason for a thorough tax audit. And already as part of the audit, inspectors will begin to dig deep and will be able to prove the relationship between legal entities for the purpose of tax optimization, if:

Organizations closely interact with each other on non-market conditions. For example, to replenish working capital, one company provides interest-free loans to another or sells goods to it at a price lower than that of external counterparties.

For security reasons, it is necessary to avoid intersections in activities, such as issuing loans to each other, reselling goods, works or services. That is, purely outwardly, the activities of companies should have an independent character.

Either the relationship of companies must be convincingly justified by business objectives (see below - "Safety Rule No. 3")

The companies have the same employees. As a rule, firms created for the distribution of revenue do not hire new employees. Financial documents are signed by the same managers as in related organizations. Most often they are issued part-time, which clearly proves the relationship of companies.

For security reasons, each company must have its own (albeit small) staff of employees who will not be issued part-time in other organizations of the group.

The companies are served by the same full-time accounting department. Often, despite the presence of several seemingly independent legal entities, financial accounting for them is maintained by the same accounting service, which is part of the infrastructure of the main company. At the same time, it is obvious that the main activity of this company is the sale of goods or the provision of services, and not accounting. This gives the inspectors a reason to believe that this particular company is the decision-making center and in fact only one operates, and the rest exist to save taxes.

To protect your business from tax claims, it is enough to outsource the accounting of related legal entities to a specialized accounting company.

Safety Rule #3. Business separation must be justified by business objectives

If affiliation is indispensable, then when introducing a new legal entity into the business infrastructure, it is necessary to have a clear idea of what business goal it will pursue. The official reason for the division of the business must be convincing in the eyes of the tax inspectors.

For example, companies within the Group may sell different types of goods. Or you can distinguish between their activities on a territorial basis. There are many options.

But only in this case it will be possible to justify the expediency of having several companies on the "simplified" system as part of one group of companies.

Safety Rule No. 4. Independence of conducting activities of each participant

Lack of self-sufficiency is the main nitpick of the tax authorities, along with interdependence. In the eyes of the tax authorities, each company should be completely independent. What is it expressed in? The tax authorities must see that each participant is an independent business unit, that is, there are fixed assets on the balance sheet, he bears expenses and has a current account and specialized specialists in the state. In our opinion, the independence of each legal entity in terms of doing business enhances protection in real court cases within the framework of fragmentation and makes it difficult to implement subsidiary liability.

So, adhering to the above principles, business splitting can be a profitable and convenient tool for legally reducing taxes. And in the case of claims from the IFTS, it will always be possible to justify the reasons for the division of business processes into different firms with non-tax purposes.

Since the activity of each company has its own specifics, we develop individual solutions for a specific client.

If you need to properly divide your business, or you want to clean up several open LLCs without waiting for a tax audit and additional charges, our tax consultants are always ready to help.

We hope to be of service to you!

Contact an expert

Popular

- What is the organizational legal form

- Basic production assets Calculate the main production assets

- The formula for the average annual cost of fixed assets How to calculate the average annual opf

- Write a complaint about the magnet store

- What are fixed and variable costs

- Validity period of certification of workplaces Organizations certification of workplaces for working conditions

- Competitions for the New Year: for adults, for children, for a fun company

- Denta-el - a network of dental clinics

- All about swift birds: what they look like, where they live and what they eat

- IP has a checkpoint - is there one, how to find out and see your checkpoint, what do the numbers mean and when a checkpoint may be required