How to trade options? Trade Secrets. Where to begin? Options Trading Philosophy Proportional Reverse Call Spread

From the outside, trading derivatives such as options may seem like a rather confusing business, however, having understood essence of options As a derivative financial instrument, you will surely be able to understand how you can use this unique instrument to protect your own positions and generate additional profit.

The closest in essence to options from the widely known concepts is insurance policy. For example, you pay the insurer a premium of $100, and within a year, the insurer agrees to pay you compensation of a certain amount if something happens to your car.

Let's repeat some important points. An option is a standard exchange contact, which gives the right (but not binding, like, for example, a futures contract) to buy or sell a certain amount of the underlying asset (oil, gold, currency, wheat, stocks, etc.) at a certain price at the end of a certain period.

A certain price in exchange practice is called "strike", or option strike price. Specific expiration date - the exact expiration date of the option.

For example, on February 15, 2011, we buy one call option on the EURUSD currency pair with an exercise price of 1.4000 with an expiration date of April 1, 2011. Under this contract, we will have the right (without obligation) to buy euros for 1.4 US dollars in a month and a half. If the price falls below this mark, it makes no sense to exercise the option, since you can buy euros cheaper on the cash market. However, if the price goes above 1.4, we will get a long EURUSD position with already existing profit on it.

The main participants in options trading are hedgers - players who seek to protect existing positions in the futures or cash market from rising or falling prices. When calculating the option premium, forecasts for a particular market behavior are ignored, and an increase or decrease in prices for a particular asset is considered equally probable.

Option Options

Any option has standard parameters, which determine the conditions for future mutual settlements between buyers and sellers of contracts.

So, options have the following parameters:

- option type. The most traded options are American and European options. American-style contracts can be exercised at any time during the life of the option, while the result of a European-style option transaction can only be fixed on the exercise date.

- transaction direction. Bought options may give the right to buy (call options, call-options) or sell goods (put-options, put-options) at the end of the contract life.

- option lifetime. The term of the contract is clearly limited by the date of its expiration (expiration date). In the practice of options trading, options expiration dates are determined by the exchange.

- underlying asset. An option contract can be concluded on a variety of assets. Options on raw materials, currencies and bonds are most actively traded.

- option strike. The strike price of an option sets a threshold price, going above/below which will mean accumulation of profit for the holder of the call/put option.

- option premium(option value). This is the amount of payout made by the buyer of the option. The seller of the option receives a premium for the risk he takes. The value of an option is a key concept in trading these derivatives for both the holder and the seller of the options. The option premium is divided into two parts: time value and intrinsic value.

Intrinsic value of option contracts

According to the intrinsic value, all options are divided into two types:

- options in the money (itm, in-the-money). The current price is below the exercise price for calls, and above for puts. Thus, the option already has a certain market value;

- options out of the money (otm, out-of-money). The current price is above the strike price for calls, and below for puts. Out-of-the-money options have no market value and are riskier purchases;

- options at the money (atm, at-the-money). The current price is at the exercise level of a call or put option.

For example, a call option on the EURUSD currency pair with a strike of 1.3000 at a market price of 1.3500 is an in-the-money option (its intrinsic value is 500 pips). A EURUSD option with a strike of 1.3000 at a market price of 1.2500 is out of the money (its intrinsic value is 0).

Time value of options contracts

The time value of options is, in fact, the variable on the basis of which the risk of buying or selling an option is determined. Growing intrinsic value over time beneficial to buyers and dangerous to option sellers.

Estimating the time value of options is very difficult, and it is simply impossible to get accurate data. Dozens of parameters are taken into account when calculating the time value, some of which were listed above in the subsection "The role of the buyer and seller of options". Regardless of the method used to calculate the time value of an option, the difference between preliminary data and real data is usually quite significant.

An important feature of the time value of options is its gradual decrease by the time of execution option. This translates into different premiums for near and far options: of two options with the same strike, the option with the more distant expiration will cost more.

Here manifests itself similarity of options to an insurance policy A: If you purchase fire insurance, the longer the insurance period, the greater the likelihood of a fire, and therefore the higher the insurance premium. From this feature of options, one important conclusion can be drawn - over time, the option loses its original value. On the expiration date, the time value of the option is zero.

Brief conclusions

The information presented in the article may seem difficult for you to understand, but the essence of the above can be contained in the following conclusions:

- an option is a kind of insurance policy that can insure against unwanted changes in the price of a particular asset traded on the stock exchange;

- Buying a put option or selling a call option provides an opportunity to profit from lower prices;

- time always plays on the side of the option seller: over time, purchased options lose their time value and the likelihood that the option will not be exercised, and the premium will remain for the option seller, increases.

buying call options or selling put options provides an opportunity to profit from rising prices;

buying options is justified in cases where you expect a significant increase or decrease in prices. In conditions when, in accordance with your forecast, prices will increase / decrease slightly, or remain in place, it is better to sell call or put options;

WITH practical aspects options trading you can find in the section "".

If you carefully study the aspects of options trading, then this derivative financial instrument can become a stable source of profit and reliable protection of your investments from any adverse market fluctuations.

Options trading held in the futures section of the Moscow Exchange, called FORTS - RTS futures and options. Trade turnover in this segment is approximately 10%-15% of the total amount of all transactions carried out in this segment (the rest is trade). Options trading carried out within the framework of a standard exchange session.

On stock exchanges, options are quoted by value. The exchange offers a list of options for quotation with a certain set of strikes, which change with a set step.

The strike closest to the current spot price of the underlying asset is called the center strike. For example, the current share price is 10.5 rubles, the option lot is 1000 shares. In this case, options are offered for trading with the following strikes: 9000, 9500, 10000, 10500 (central strike), 11000, 11500, 12000.

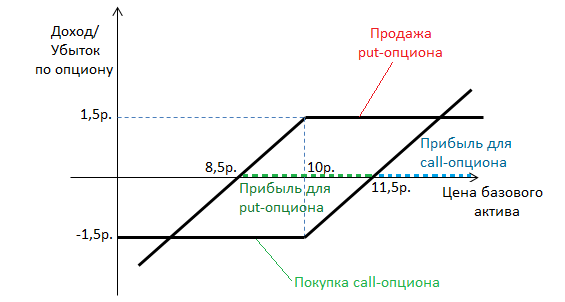

The income functions of buyers and sellers are as follows

Looking at the figure, we can conclude that options trading involves the asymmetry of the position of counterparties in the transaction. Thus, option buyers have the opportunity to receive unlimited profits, and their loss is limited to the size of the premium paid. The seller's maximum possible profit is equal to the premium, and the potential loss is infinite. In view of the foregoing, one may get the impression that it is not profitable to sell options, but this is not so.

Example. Let the investor predict a small increase in the stock price. Today the share price is Rs. The investor has the opportunity to buy with a strike of 10 rubles. and a premium of 1.5 rubles. and sell at the same strike and premium. What strategy should an investor choose?

Based on the constructed chart, we can draw the following conclusion: if a slight price change is expected, then it is more profitable to sell options (ie, in sideways trends). If significant price fluctuations are expected, then options are worth buying.

Options trading involves three states of this instrument, depending on the ratio of the strike and the spot rate of the underlying asset.

For the buyer of a call option, the following is true:

- If the strike > the current market rate for the underlying asset, then the option is called the option " without money" (or " for money”), i.e. with loss;

- When the strike< текущего спотового курса, то опцион называется «in money" (or " with money”), i.e. with a win;

- If the strike is equal to the current market price of the asset, the option is called " near the money».

For buyers of put options, the following will be true

- Out of money (without money, at a loss) if the strike price is less than the stop price;

- At the money (near the money, at breakeven) when strike = market price;

- In the money (in the money, in the profit zone) if the strike is higher than the spot market price.

Options trading - how an option contract is executed on the Russian derivatives market

Suppose, on the expiration date, the investor sees that the option he purchased earlier is “in the money” and decides to exercise it. To do this, he needs to have funds on the futures account (which must be opened before purchasing the option agreement) equal to the initial margin on the futures on the RTS index multiplied by the number of futures, and the counterparty on the transaction must have the same account with the same amount.

When a call option is exercised, the buyer opens a long position on the futures contract, and the seller of the option opens a short position on the same futures. The buyer of the call option is credited with positive , and it is deducted from the seller, at the same time the option trading ends, and the exercised options disappear.

When a put option is exercised, the buyer is short the futures and the seller is long. As a result of the transaction, a positive variation margin is credited to the put option buyer's account, which is deducted from the seller's account. From the moment the money is transferred, option positions disappear, and options trading is considered completed.

Options trading carried out according to the following main strategies: (direct, proportional, inversely proportional, calendar), .

This article will talk about how to trade without using any particularly complex terms, in order to first of all achieve understanding among those people who encounter such instruments for the first time.

- Particular attention will be paid to how this or that option behaves in different phases of the market.

Generally, option trading will be of interest to those traders who have trading experience and who are not satisfied with working with stops. There can be many reasons, ranging from those that allow the price to fly through your stops and ending with psychological discomfort.

It is no secret that human psychology is an extremely complex matter and it is very difficult for people to put up with mistakes in their own actions. This explains why more than 70% of private investors do not use at all, which leads to another not very pleasant statistic. More than 80% of the practice of independent options trading on the Moscow Exchange is unprofitable, including due to the failure to adopt strategies to limit losses.

Options trading gives you the opportunity to flexibly change your position and pre-mortgage your risk in a particular instrument. From a psychological point of view, this is a more pleasant alternative, which partly explains why "" is so popular with forex brokers.

How to trade options on the stock exchange

The cornerstone of options trading is strike price. This is the price at which the underlying asset will be delivered (if the option is on, then they will be delivered). The price can be central (market) and distant.

- For example, today Sberbank costs 100 rubles, and the strike price is also 100 rubles. This price is central. The price of 120 rubles at a market price of 100 rubles is already a far price.

An important truth for any option trader is that you, in essence, ( movement) of the market. Let's take a vivid example. Sberbank shares are starting to fall by 3-4% per day. You can easily make money on this by buying a put option with a strike of -40% of the current price (shares cost 100 rubles, and our strike is 60 rubles). In a situation where the same shares start exactly the same explosive growth of 3-4% per day, we buy a call option with a strike of + 40% of the current price (shares cost 100 rubles, and our strike is 140 rubles) and earn on growth .

In any case, if Sberbank shares move, we will make money.

Nothing prevents us from buying with one strike value (this strategy is called "straddle"), depending on the developed movement. We will win if there is a movement, no matter where, it is important that it will be. But if Sberbank starts a long and stubborn consolidation, staying in one place week after week, we will get a loss. Our purchased options will become cheaper the more the faster the date of their delivery approaches.

The logic is very simple - there is a movement - there is a profit from the purchase of options, there is no movement - we have a loss.

Thus, when buying options, we have the so-called "bought volatility" in our portfolio.

An inquisitive reader will ask himself the question “if there are two positions for ordinary instruments - long and short, then there should be a reverse position from the purchase for options?”

and will be right. The reverse position is the sale of options. In such a situation, we will earn only if Sberbank remains in its corridor and does not actively grow or fall. There will be a situation of "sold volatility". We will receive a reward for selling the option and a theoretically unlimited loss if the price develops a movement, so the sale of such options is usually a prerogative.

Video on how to trade options on the stock exchange

How to correctly calculate the purchase volume of an option so that you are not closed by a margin call broker

An option, like a futures contract, has its own GO (warranty support). Usually, if you use a responsible broker, you can freely open a position in GO equal to your portfolio. You cannot lose more than the option itself is worth.

An option has an intrinsic value and a time value.

The second depends on the distance of the price from the strike. For example, if we bought a call option with a strike of 80,000 and the price of the underlying asset is 85,000, then the intrinsic value will be 5,000 points. And no matter how the volatility falls, the price will not fall below these 5 thousand points in any way. And the time value can vary, depending on the very volatility. At the moment, with the growth of volatility, the time value increases.

When buying and selling options, only limit orders are used.

Using a market order can result in a loss because the volatility within the order book can vary greatly. The exchange broadcasts the so-called "theoretical price", which should be guided by. To buy an option, it is enough to set + -0.01% of the current price.

An already mentioned aspect to consider when trading options is option analysis. As mentioned above, high volatility increases the price of an option at the moment, and it is far from always adequate. On some news or information stuffing, volatility may jump, which will increase the price of the option. It is necessary to analyze its chart in order to understand which volatility is normal for this instrument, and which is too low or too high.

An already mentioned aspect to consider when trading options is option analysis. As mentioned above, high volatility increases the price of an option at the moment, and it is far from always adequate. On some news or information stuffing, volatility may jump, which will increase the price of the option. It is necessary to analyze its chart in order to understand which volatility is normal for this instrument, and which is too low or too high.

- This can be done with a simple comparison.

If the option volatility for 2 weeks was 80-100, and before the Fed's speech it soared to 200, it is worth waiting until the unrest calms down and the volumes return to their normal corridor.

Once again, the higher the volatility, the more expensive the option.

Another problem may be that some brokers do not keep a history of volatility, saving on customer service. This information is broadcast only for today and the investor does not have the opportunity to analyze it for a longer period through his terminal. This point must be clarified in advance before opening a trading account. You can analyze it using a regular candlestick chart on a 5- or 15-minute interval.

Do not start your journey by selling options.

This carries and can cause serious psychological discomfort for a trader, given that comfortable trading for a novice player is a very important indicator.

In this part, we will learn how to trade options on the stock exchange on our own, set up an option desk and determine the optimal time to open a position.

First of all, we will build optional desk to navigate the tools of interest to us. An example will be given on the updated program version 7 and older.

- Having loaded the default settings, we need to click on the button " Create window", Further " Customize Menu". A large two-part table will open. The available options will be displayed on the left, and the ones already selected on the right.

- In the left part of the window we find the heading " Futures and Options”, then under it select “ Options board". We accept the changes and now when you click on the button " Create window» we will have the line « Options board". By selecting this item, we will open the settings window for our future desk.

Each desk is built for each option separately. We will build this one on the basis of the option on RTS index. Given the huge number of tradable contracts, we need to choose the closest option to us, which is expiration in a month ( monthly). If we consider options on RTS, we can notice that the first option and the last one have the best liquidity. Let's give an example:

A futures on the RTS 6.16 index is circulating on the stock exchange. Options with expiration 4.16 and 6.16 will have the highest liquidity. When 4.16 ceases to exist, 5.16 will also become the most liquid.

At the moment, the nearest option is April (4.16) and we will choose it. It will have the code RI95000BD6, but be called RTS-6.16M210416CA 95000.

If you look at these numbers, you can easily find all the information itself: R.I.-RTS, 95000 - strike, BD6 month and year (as well as marking codes for futures). Letters SA at the end of the name means that this is a call option, the put option ends in PA or PU.

Let's return to the opened table. There we add the ones we are interested in option ranges on RTS. Nothing prevents us from adding all their diversity.

The following window will appear. At the request of the trader, you can add one more column: volatility to pay attention to it too. This indicator is the same for both put and call options.

Now let's take a closer look at the indicator theoretical price. It is broadcast by the exchange and it indirectly affects the actual value of the option. It was created for information so that the trader can always roughly compare this price with the current market. As a rule, this price differs from the real supply and demand.

What is real option price? In fact, this is the amount that buyers and sellers offer for a contract. Looking at our RTS option, we see that at the theoretical price 660 , the price at the moment is lower, between 620 and 630. This spread is still relatively low. On illiquid options, it can be much higher. This moment will immediately catch your eye if you have previously traded futures or stocks.

Below you can compare the chart of a call option with a strike. 95 000 and its underlying asset, futures on the RTS index. Unlike the futures and the underlying asset (for example, the futures on Sberbank shares), the option does not have to repeat the fluctuations of its parent at all. The explosive growth of the option with a strike of 95,000 was due to the fact that the RTS began to rise very confidently in recent days, moving towards this line.

And now let's talk in more detail. about the option price. It represents the amount that a trader pays to get an option and must be put into the breakeven point. For example:

Our call option on RTS with a strike 95 000 and option price 620 will have a break even point 95 620 . At the same time, it does not matter to us how the price will move towards its strike. Anything above 95 620 is our profit. Mirror situation with the put option. Now we will need subtract the option price from the strike- at a lower price 94 380 we will earn. If we have in the portfolio two types of options, then we will start earning, or when the price drops below 94 380 or when it grows taller 95 620 .

Two types of using options in trading

The classic use of options is insurance(hedging).

How it works? Let's return to the RTS index. The futures price is currently 95 000 and we believe that it is already too expensive and will soon begin to fall. We open short, for example, for 1 contract. And at the same moment buy an option call for one RTS contract with a strike 95 000 . We pay our 620 rubles and get insurance actual insurance. If our calculation turned out to be correct and RTS rolled back, say, to 75 000 , earn 20 000 points, minus 620 rubles that were spent on our option, which was not exercised. And if we didn’t guess right, and our index grew, say, to 115 000 , then the loss on the futures is obtained, which we freely fix, after which we exercise our option. By this time, he managed to rise in price for these very 20 000 and we will remain on our own, minus the cost of the option in 620 rubles. This is an ideal trading strategy for people who do not want to use stops in their work.

Now consider trading with "pure" options.

If we simply buy a put or call option, then we will start earning when the price of the underlying asset (RTS index) exceeds 95 000 (or fall below 95 000 when buying a "put"). In such a situation, our option will add "intrinsic value" and will grow as much as the underlying asset grows (+/- time decay and a number of other factors). Roughly speaking, while RTS stands still 94 000 points, call option with strike 95 000 will only cost the "time value", which is equal to ~ 620 rubles. But as soon as RTS grows up to 96 000 , then this thousand points will be added to the value of our option and will grow along with the RTS until the option expires, or until we close the position.

From here are formed slang concepts.

- Option " in money is called a contract that has reached and exceeded its strike (for example, for a call of 96,000 at a strike of 95,000 and for a put of 94,000 at a strike of 95,000).

- Option " on money” is called a contract that is clearly at the strike price, and has not yet moved in any direction.

- Option " out of money is called a contract that has not reached the strike price.

As for the collateral for options, it is usually approximately equal to the value of the underlying instrument's GA. Following the rules, you should start options trading by buying call or put options, not by selling them, since short positions in options are fraught with huge losses for an inexperienced trader.

The best brokers for trading and investment

- Investments

- Trading

| Broker | Type | Min. deposit | Regulators | More |

|---|---|---|---|---|

| Options (from 70% profit) | $250 | CROFR | ||

| $500 | ASIC, FCA, CySEC | |||

| $250 | VFSC, CROFR | |||

| Forex, CFDs on Stocks, Indices, ETFs, Commodities, Cryptocurrencies | $200 | Cysec, MiFID | ||

| Forex, Investments | $100 | IFSA, FSA |

| Broker | Type | Min. deposit | Regulators | View |

|---|---|---|---|---|

| Funds, stocks, ETFs | $500 | ASIC, FCA, CySEC | ||

| PAMM accounts | $100 | IFSA, FSA | ||

| Stock | $200 | CySec |

| Broker | Type | Min. deposit | Regulators | View | ||||

|---|---|---|---|---|---|---|---|---|

| Forex, CFDs on Stocks, Indices, Commodities, Cryptocurrencies | $250 | VFSC, CROFR | ||||||

| Stocks, Forex, Investments, cryptocurrencies | $500 | ASIC, FCA, CySEC | Forex, Investments | $100 | IFSA, FSA |

Charts how to trade options on MICEX or other exchanges

To dot all the “i”, we will use charts that will reflect the profitability when in certain positions.

This is how the price chart of a regular oil futures, which could be in our portfolio, looks like. It is clearly seen that as the price of oil rises, our profits grow.

And this is how the graph of the profitability of the call option on oil with a strike of $50 and expiration on May 4 will look like. The red line shows the refraction of price with time value, which in turn depends on volatility. Roughly speaking, this is what our portfolio looks like if we bet on the growth of oil.

And this is how the graph of the profitability of the call option on oil with a strike of $50 and expiration on May 4 will look like. The red line shows the refraction of price with time value, which in turn depends on volatility. Roughly speaking, this is what our portfolio looks like if we bet on the growth of oil.

Now compare this chart with the next one, where a put option has already been bought, with the same strike and expiration date. On the profitability segment, the expiration period is clearly visible, when we stop incurring losses.

And the fourth graph illustrates the simultaneous acquisition of 2 types of options and "put" and "call". The breaking point represents the closing of a losing option.

The actual value of options uses many more parameters to calculate. In addition to time and intrinsic value, gamma, vega, theta and delta are also used. In fact, the delta is exactly the blue line on our charts (that is, profitability). The remaining parameters should be studied after mastering the basic skills of options trading, since their analysis requires a certain level of savvy in mathematics.

Instead of output

The material in this article will help a novice trader to correctly open positions from options in his portfolio, it can also be used as a reminder so as not to get lost in concepts and understand the direction of work of a particular instrument. We deliberately did not touch on mathematical formulas and did not analyze the concepts of "Greeks": delta, gamma, theta, vega and rho, so as not to overload the reader. The impact of these indicators on options can be analyzed later, after mastering this material.

The material in this article will help a novice trader to correctly open positions from options in his portfolio, it can also be used as a reminder so as not to get lost in concepts and understand the direction of work of a particular instrument. We deliberately did not touch on mathematical formulas and did not analyze the concepts of "Greeks": delta, gamma, theta, vega and rho, so as not to overload the reader. The impact of these indicators on options can be analyzed later, after mastering this material.

Having examined it in detail, you can understand that options, although they differ from ordinary trading instruments, are no less interesting and profitable for this. To work with options, you should have extensive experience in trading underlying assets and futures. Linear trading strategies are very difficult to endure psychologically, fixing losses over and over again. Options allow you to determine the loss in advance and not exceed it in the course of trading. However, when using them, it is important to remember that the price changes extremely quickly and this is influenced by many more factors than conventional instruments.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

The article is intended to guide novice futures traders in a complex option market, in an abundance of various contracts, in a variety of trading strategies.

So, you have just entered the derivatives market. For what? Most people answer this in order to make money on any trend, in order to enrich their trading arsenal, which previously included only stocks, with new tools. Many people are captivated by the truly limitless possibilities of options: and off-scale yields with a successful set of circumstances, and a variety of strategies, and earnings in a falling market, and the possibility of shorts, and the provision of free leverage. Yes, this is all true, options have certain advantages for making money on the securities market and it is foolish not to try to use them. But do not forget that with the help of the same options, if they are used incorrectly and inaccurately, you can quickly lose all the initial capital.

Well, your choice is clear - you decided to build your trading not without the help of options. Suppose you have already studied certain reference materials on derivatives, selected a trading platform, decided on a broker and trading program, opened an account with a broker and credited it with some funds for trading. You follow the market of the underlying asset, monitor the news background, etc. You think you already know how to predict price movements and you can't wait to get started. But where exactly to start and how to build your trading philosophy? However, don't be in such a hurry. Let's deal with option traders first.

For a better understanding of the processes taking place on the options exchange, you first need to understand with whom you will actually trade, who is present on this market. It would be nice to know who benefits from certain operations, who is usually a seller and who is a buyer, at what moments certain players enter the market, and much more. Knowing this will help you look at some market trends in a different way and will allow you to predict changes in premiums and option volatilities.

In general, there are three classes of bidders in the options section. These are hedgers, directional position traders and, in fact, volatility traders. Let's start with a little more detail on each category.

Hedgers. These may be investors who own a portfolio of stocks, or individuals who hedge their production or foreign exchange risks. Why do they come to the option contracts market? Portfolio managers have an interest in protecting their portfolio from falling in order to have insurance in case of a collapse in quotes. Persons with foreign exchange positions in their business or production process come to the market in order to protect themselves from foreign exchange risks. Let's talk about portfolio investors below. These are competent investors who understand that without insurance, nowhere. How else? We all know what happened to the shareholders of the people's IPO - VTB or Rosneft. Quotes have fallen significantly below the placement levels and it will take a long time to wait for their recovery, and you may not even wait at all. However, if investors in the "people's" companies had purchased put options on their shares, then such deplorable losses could have been avoided.

So, hedgers are knocking on option desks to buy put options on stocks. This is usually. They can also write call options on their portfolio. And finally, they can buy a put and sell a call at the same time, forming nothing more than a "fence", which was described in one of my previous articles. Hedgers are willing to pay for puts and are willing to sell calls. From this, it immediately becomes clear that the volatility on puts on stocks and stock indices, as a rule, is higher than the volatility on calls. The extra demand for puts and the extra supply of call options creates an asymmetric volatility profile, in other words, high strike volatility is generally lower than low strike volatility.

Hedgers are always present on the market, even in the most “sunny” periods, times of bull rallies, when it seems obvious to everyone that the market is set for a long and powerful growth. However, insurance against unforeseen situations is always needed and the market can start a correction at any moment.

The second class of participants in option trading includes traders with directional positions. These are traders who use options to play on the growth or fall of the underlying asset, on the market being flat, on the market reaching or not reaching certain levels, and so on. Such traders can both sell and buy options. More precisely, they can perform four basic operations: buying a call (expecting an increase), selling a call (predicting overbought), buying a put (expecting a fall), selling a put (expecting an increase or stabilization of the market). As a rule, these persons are well versed and predict the dynamics of the movement of the underlying asset. They started out trading stocks, but they came to the options market to get additional opportunities for trading directional strategies. After all, if a long and protracted flat trend is predicted, then it is quite difficult to make money only on stocks. They know that options allow the construction of different strategies for the behavior of stocks and obtain a variety of risk and reward profiles. At the same time, it is not at all necessary to even know about such a concept as volatility. Indeed, volatility is just a matter of the price of the strategy. The higher it is, the higher the option premium. Traders of directional positions, as a rule, value the option in terms of "expensive-cheap". What transactions and in what cases do such traders make? Well, for example, if a trader made a conclusion that a certain stock is overbought, then a call option for this stock is sold, and it is not at all necessary that they have this stock in their portfolio. How is a strike chosen? Depending on the break-even level and profitability of the strategy. Usually, a small analysis of possible levels is carried out, a break-even point is calculated for each strike, in the end, the profitability of all possible options is compared, then a choice is made in favor of a certain strike. The same can be said about the analysis of the expiration dates of the selected options. Positions are usually held until expiration.

Another example of transactions for this category of participants is the purchase of puts or calls if the market is predicted to fall or rise. In this case, volatility is also practically not analyzed, because with a strong fall, puts become more expensive, as with a strong growth, calls become more expensive, these players argue. Positions may not be brought to expiration, because you can fix the profit by selling a previously purchased option.

Finally, the third group of players are professionals, volatility traders. They generally do not take on directional stock movement risks and use delta-neutral trading strategies. What does this mean? The choice in favor of buying or selling an option is made based on the analysis and forecast of volatility. If it is predicted to grow, then options are bought; if a decline in volatility is expected, options are sold. Immediately after the option trade, the trader brings the portfolio to delta neutral. This can be done either with another option or with the underlying asset. Moreover, traders adhere to delta neutrality almost constantly in order to eliminate even the slightest risk of directional movement. Delta neutrality is maintained by daily portfolio balancing with the underlying asset or other options.

For volatility traders, it often doesn't matter which option (put or call) to buy/sell, the main focus is on the implied volatility of that option. When do these players make a profit? Of course, when their forecast on volatility comes true, while the direction of movement of the underlying asset is not at all important, the main thing is the intensity of such movement.

The most common question I get asked is if volatility traders suddenly realize at one moment that this or that stock is going to shoot, can they then take naked calls, because they will surely bring profit. They can, of course, no one can stop them from doing so. However, they do such operations very rarely, because there is simply no 100% guarantee of growth (fall). Therefore, these traders create delta-neutral positions and do not depend on the direction of movement of the quotes of the underlying asset. Their profit depends only on changes in volatility.

So, once you understand who is in the options market, it's easier to move on. If you have opened a combat account and have not yet classified yourself in any of the three categories listed above, then below I will state a couple of thoughts on this matter.

Any trader, in order to make money, tries to predict some kind of movement. This could be a change in the underlying asset and/or a change in volatility. If you have a forecast for the stock price in the future, you will try to make money on the movement of the stock. If you have a forecast for the behavior of volatility in the future, you will earn on volatility. And if you have a forecast for both points, then you will strive to earn on both movements. That's actually the whole philosophy. I'll explain in more detail.

Suppose there is a certain stock and options on it, traded with some market volatility. At the stock price, you can predict the growth, fall or no change in quotes. For volatility, you can similarly predict growth, fall or stability. It turns out nine different cases in relation to a single stock and options on it.

Let's consider the first possible option. You think that the volatility of a certain stock will fall, while the stock itself will rise. In other words, you are positioning yourself as a delta bull and a volatility bear at the same time. This forecast makes sense if normalization is expected on the stock market, perhaps a smooth growth of quotations. How do you make money, what strategies to choose? Very simple. In fact, these are strategies with positive delta and negative vega. The simplest of these is selling a bare put. Indeed, if the stock goes up, the put will go down in price. If volatility falls, the put will also become cheaper. And if the forecast is justified both for the stock and for volatility, then the profit will be more significant, the put will fall in price more strongly. There are more complex strategies that allow you to make money on this movement. This is, for example, a bullish vertical spread - simultaneously buying an ITM call and selling an ATM call.

The second likely scenario is bearish volatility and bearish delta. This strategy is used if a slow and smooth downward slide of the market is expected. What strategy to choose? The simplest is the sale of naked calls, a little more complicated is the bearish vertical spread, which implies the simultaneous purchase of an ITM put and the sale of an ATM put. We remind you that these constructions allow you to earn on the fall of the stock and on the fall of volatility.

The next possible option is when the trader is neutral in his opinion on the movement of the underlying asset, and, for example, expects an increase in volatility. By the way, such a trader is a typical volatility trader, a player from the third category described above. What should he do with such expectations? Buying strangles or straddles is recommended, or just buying options with a delta hedge as an option. Straddles and strangles allow you to make money on any movement in stocks, whether it is a fall or rise. Even if the market does not go anywhere, but adds to the nervousness, your straddle will rise in price and it can be sold at a profit.

If you do not have a definite forecast for volatility, but there is a forecast for the growth or fall of the underlying asset, then it is recommended at first to simply buy or sell the underlying asset itself. In fact, there have been many cases in history when, for example, when a stock was expected to rise, a call was bought, but no profit was received due to a decrease in volatility. In the fall of volatility, more was lost than was earned from the growth of the stock. This often happens, because. volatility tends to fall on smooth growth. That is why it is more expedient to simply acquire the underlying asset.

And finally, the last distinctive case is when the trader agrees with the market volatility and does not have a forecast for the stock. Then it is better for him to rest a little aside and not take active steps, wait for the situation to change.

It is clear that any current situation on the market can be classified according to the appropriate criteria and attributed to one of the nine segments, and then you can choose the appropriate strategy, options will only help with this.

The considered groups of participants in the options market and the concept of nine possible situations, I hope, will help beginners navigate the complex options market and help them earn their first money on it.

Good luck in trading!

If you want to leave your opinion you need or.

Binary options trading is a way of earning, which has become available to everyone with the development of information technology, in particular the Internet.

Among other types of earnings on the global Internet, financial trading stands out - trading on the stock exchange. This type of financial trading, such as binary options trading, compares favorably. This approach to exchange trading has become the most popular due to the high profitability of the process, accessibility and simplicity.

So what is binary options trading and how to make money on it?

First of all, it is necessary to clarify that a binary option is one of the varieties of an exchange contract, which is used to make a profit on movements in the price of assets (currencies, stocks, goods) in the global financial markets.

Income on binary options depends not so much on the price of a financial asset, but on the correct forecast that a market participant makes. In order for the contract to make a profit, you need to determine the direction of movement of the price of the selected asset before the completion of the transaction. That is, you choose a period of time after which the price of the selected asset will be higher or lower than the current one. If you make a correct forecast, then you earn about 85% (the rate depends on the broker) from the investment, otherwise you lose all investment in this option. Thus, this tool is very convenient for hedging risks when using other types of trading in financial markets, such as the Forex market.

Assets are currency pairs, indices, commodities, stocks or other securities that can be used to enter into contracts to buy or sell (PUT or CALL).

PUT option– A deal to buy an option to reduce the value of the selected asset is executed if a price decrease is expected.

CALL option– A deal to purchase an option to increase the value of the selected asset is executed if the price is expected to rise.

One Touch or One Touch– A deal to buy an option for the price to reach a certain level (One Touch) or not to reach it (No Touch) before expiration.

Expiration– The time when the option expires, i.e. the result of the concluded contract is fixed.

In/Out Options– A deal to buy an option, in which a corridor is predicted in which the price will move until expiration (In-option) or the price goes beyond the corridor (Out-option).

Timeframe is the time interval on the price chart.

Binary options trading as an affordable way to make money online

Many experts say that today it is binary options that are the most profitable way to earn money. They explain this extremely simply, because in order to get a sufficiently large, moreover, predetermined profit, it is necessary to correctly determine the expected direction of movement of the asset's value before the start of trading.

The uniqueness of this type of earnings lies in the fact that the receipt of income can occur quite quickly. There is no need for a long wait, as when waiting for the calculation of interest on a bank deposit. You can independently choose the time after which the forecast for the movement of the asset price will be checked.

First of all, you need to understand that binary options are not something magical that allows you to earn millions in a short time without risk. That is, to earn rather big sums, and quite quickly, of course, it is possible, but it is quite difficult and has certain risks. To earn money, and not lose the invested amounts, you need to learn how to predict market movements, correctly calculate the direction of change in the value of an asset. Believe me, it's not as easy as it might seem to many.

Choosing a reliable broker

For a successful start in working on binary options, it is very important to choose a reliable broker. A broker who will not manipulate quotes and will pay out your profits. We recommend that you start with small amounts, make a trial deposit, go through verification, make a trial withdrawal, and only after that start serious work. Below are the top 3 brokers we recommend starting trading with.

| Broker | Bonus | Min. deposit | Pay | Review | Open an account |

|---|---|---|---|---|---|

| 2 types of bonuses | Up to 90% | |||

| 100% for the first deposit | Up to 90% | |||

| Bonus up to 100% | Up to 85% |

What is the difference between binary options trading and Forex trading

There is a difference between binary options trading and Forex trading, and a very significant one! And it mainly consists in the fact that in order to make money on the Forex market, you must ensure that the quotes go in the direction of your forecast by a significant number of points, after which you must close the deal! But with binary options trading, everything is different - the above-mentioned number of points will not matter to you. One point passed by the price in the direction of the forecast will be enough to receive a full-size income! At the same time, the option completion time (expiration) is known in advance, while in the forex market you yourself fix the time, thus there is a risk of receiving an unplanned significant loss, which is impossible in binary options: you cannot lose more than the bet made.

Why do you need a broker?

To start trading, you need to open your trading account, for this you need a binary options broker.

A broker is primarily a legal entity - a company that provides you with services for accessing the financial market, in which the trader, that is, you, independently carries out operations. It would be more correct to call a binary options broker a company that provides brokerage services. This is a fairly significant difference. The fact is that brokers can be divided into two categories - brokers that carry out operations on behalf of the client and at the expense of the client, and the second - brokers that carry out operations on their own behalf, but at the expense of clients. The second category is often large financial corporations in which clients are investors and receive a percentage of the company's total profits. But the first option is just those companies whose services we use when trading binary options.

Binary options trading platform

The platform is a trading terminal with which you can trade binary options anywhere and anytime.

The convenience that you will receive when trading depends on the choice of a trading platform. A good platform has the following characteristics:

- Asset quotes are presented in a large window, where it is quite easy to analyze quotes;

- Quote charts can be chosen between linear and candlestick;

- It is desirable that technical indicators be integrated into the platform, through which you can create your own;

- The profitability of options must be at least 85%;

- Price charts can be moved back in history for testing strategies and analysis, reduced, zoomed in, etc.

Binary options trading on Android and Apple

Traders have the opportunity to engage in option trading without being tied to a computer. There have been mobile versions of trading terminals on the market for a long time, where you can trade binary options anywhere with the Internet. The main difference between mobile trading and trading on classic trading platforms is that the trading platform will always be there in your pocket!

In general, the mobile platform is just a mini-copy of the standard broker platform.

Binary options trading software

For a large number of traders around the world, the possibility of affordable and comfortable earnings is precisely binary options trading. It is no coincidence that the reviews of professionals say that an easy and comfortable way to engage in trading is with the help of automatic robots. Such programs were created specifically to simplify the work process. Any trader will be able to set up the program, then she herself, with the help of additional tools and, will determine market trends and place orders. While you are busy with other things, spending time with your family or at the office, binary options trading is on your account. Video tutorials, author's techniques and will help you adjust your trading and achieve the best results.

Automatic trading in binary options is a real way out for those market players who do not have the opportunity to constantly be at the computer, as well as for those for whom this type of income is not the main one. Such programs for trading on binary options will also be useful for those speculators who are just starting their journey in this area of earning, but would already like to have income on deposit.

Money management when trading binary options

Money management implies an optimal and strategically verified financial management, ensuring the highest possible profit. In essence, it is a science that teaches effective deposit management for profitable trading in the long term.

Successful trades are ensured by the implementation of one main recommendation, which is that you should not enter into transactions that exceed five percent of your deposit.

How to trade binary options correctly?

Getting started trading binary options, you need to analyze and study the theory.

For reasonable trading, at a minimum, it is necessary not to deviate from the simplest set of rules:

1) Find out the complete information about binary options. Do not imagine that this income is for the lazy. Learn the theory, try everything in demo practice.

2) Do not throw all the money into trading at once. This is silly. Start with "penny" and practice on a demo account. Don't take risks and don't rush.

3) Choose a broker carefully, be sure to study the reviews, find out all its trading conditions, check how they serve in the chosen company.

4) Never give your money to brokers to trade them on their own, without you. Brokers are forbidden even to advise anything on contracts to traders, to personally open transactions from clients' accounts. As soon as such an offer arrives, grab the deposits and run without looking back.

5) Having accumulated some money in the account, try to withdraw. This will both reassure you and give you the opportunity to check the honesty of the company, the performance of the withdrawal mechanism.

6) Always remember: the deposit can be lost. Get used to this idea. If you can't get used to it, it's better to take the money to a bank account. They will be more wholesome.

These binary options trading rules will allow you to build a clear system of actions already at the first stages of your acquaintance with trading, make it effective, and help you avoid unnecessary losses. There are many advantages to this type of income: a great option for remote work with the ability to receive unlimited income, a way of self-improvement, learning something new, a real opportunity to change your life for the better - all this is offered today by binary options. Online trading is convenient, affordable and simple.

In addition, starting to get acquainted with trading, you should determine for yourself the tools of work, strategies that will help you work more efficiently in the market and achieve high results. Each trader must decide for himself how it is more convenient for him to work in the market: it can be trading by volume on binary options, express options, long-term transactions, etc. The style of trading largely depends on the personality of the speculator, on how much he is willing to take risks and whether he has enough time to trade.

This is also influenced by the choice of the trader's tools: both oscillators and systems that are able to optimize the work with binary options. Trade flat or trend, during news releases or when the market is completely calm, no matter what you choose as your profitable strategy, use the binary options trading rules listed here, improve your trading and achieve more.

Binary options trading scam or true?

Like any job, activity in the financial markets will not allow you to get fabulously rich instantly. It will take long and hard work to earn money.

Based on the fact that binary options on the exchange market are used on an equal footing with other types of trading, they fall under the legal control of regulators in different countries. Among them is the world 's most famous supervising state body . In addition, there are bodies such as FCA, NFA, FSA, ESMA, CFTC, ASIC, SIBA. The reliability of binary options is also confirmed by the recognition by the largest and most important state financial bodies of countries with the most developed level of economy.

As far as we know, the binary options market in the CIS is not regulated in any way. The government of Russia and other post-Soviet countries has not yet legally defined the bodies and mechanism for regulating binary options. That is why a non-governmental body that performs regulatory functions is currently working on the CIS option market - (The Center for Regulation of Financial Markets).

How to start trading binary options?

1) You should study the varieties of options

3) Find out the methods for determining the price of the contract

4) Find out the advantage of operations with binary options in comparison with traditional ones. About the benefits

5) Make an accurate calculation of your operating costs.

Is it possible to make money from scratch?

Yes, you can! To do this, you need to “keep your finger on the pulse” and follow the news and promotions held by various brokers. Very often, traders are provided with special promotions that allow them to try their hand at binary options trading on a real account and for real money. Study the topic and follow the news, you may have a chance to try your hand without investment.

How much can you earn with binary options?

The amount of possible earnings on binary options is, of course, a rhetorical question, and although there is no absolutely exact answer to it, we will try to give some recommendations that can help you earn quite a lot!

To be honest, the question itself is not entirely correct. You can earn as much as you want! Rather, you need to ask the question - what needs to be done to earn a lot?

Popular

- How to make money on the stock exchange: examples Is it possible to get rich on the stock exchange

- Event marketing: types, tools and examples

- How to start earning in the game Farm Neighbors?

- Rewriting for a beginner: a memo to a beginner How to learn rewriting

- How to make money on Facebook: Facebook page monetization schemes without investments

- How does Facebook and VKontakte make money

- Step-by-step registration instructions

- Earnings on VKontakte likes

- Vktarget - earnings in social

- Golden tie with money withdrawal