Short in trading: features of trading in a falling market. What are shorts and longs on the stock exchange and how to work with them? What are long and short in Forex

Long or buy deal (purchase, buy, long deal, long)– this is the name of a purchase transaction that a market participant opens in the hope of making a profit from an increase in the price of an asset. The very name of the transaction to buy long or long trade is slang and appeared on the stock exchange, since the rise in stock prices is considered a longer process than their fall.

Market participants opening buy transactions, that is , those who play to increase the price of an asset are called. It is believed that bulls use their horns to push the price up.

The opposite of a long trade is, accordingly, market participants who play to reduce the price of an asset are called bears. It is believed that bears use their paws to push the price down.

What is a long trade in Forex?

A buy trade in Forex is also called a long trade or long. A buy transaction on the foreign exchange market involves the purchase of the base currency for the quote currency.

For example, in the EUR/USD currency pair, the base currency is EUR and the quote currency is USD. Accordingly, when opening a long position in the EUR/USD pair, a trader buys a certain amount of euros for dollars, counting on an increase in the value of the European currency.

When to open a buy position?

As a rule, a long trade is opened on the assumption that the base currency in the currency pair will continue to rise.

In fundamental analysis, this could be the publication of positive macroeconomic statistics, an increase in the interest rate of the Central Bank, etc.

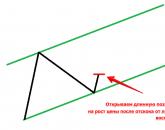

From the point of view of technical analysis, longs are opened when the price rebounds from (the lower boundary of the uptrend). As a rule, buy positions are used only when trading in an uptrend and during a rebound from the lower border of a flat. Opening long trades against the trend carries high trading risks.

Opening a buy position in an uptrend

Opening a long position in a flat

A buy position in the MetaTrader 4 terminal is opened with a Buy order, but a long position can also be opened using pending orders and BuyStop.

What is shorting on the stock exchange is a question that is often of interest to novice traders who plan to make money on the difference in the value of cryptocurrency or other assets. In short, shorting is selling an instrument that is not available. The trader borrows it from a broker or exchange participant, after which he waits for the price to drop and sells it. The difference between the purchase and sale prices ends up in the trader’s wallet, and the trading instrument is returned to the broker (site participant). What are the subtleties of such earnings? What risks of short transactions should you be aware of? What is the essence of short selling in the case of cryptocurrency? Let's talk about this in the article.

What does it mean to short on the stock exchange - general provisions

When trading on the stock exchange, a market participant buys assets in the hope of their price rising in the future or sells in the hope that their value will fall. Taking into account this feature, there are two types of transactions - long (long) and short (short).

In the first case, the trader purchases the instrument of interest when its price decreases, and then sells when the maximum level is reached. In the second situation, market participants act in the opposite way. He borrows a suitable asset, sells it, and buys it back after the value decreases.

We are talking about opening short transactions by obtaining a loan with different leverage - from 1:2 to 1:100 or more. The instrument can be stocks, bonds, regular currency and virtual money. The choice of the trader is huge, which makes it easy to choose the appropriate subject of the transaction.

In other words, to short is to play short or open short positions (to sell). The word short is of English origin (“short”), which means “short”.

The general algorithm of actions is as follows:

- A market participant selects an instrument, analyzes the market and waits for a situation when signs of a future price decline appear (the reason may be negative news, the situation around the subject of the transaction, and so on).

- A trader turns to a broker (exchange) with a request to borrow a certain subject of a transaction - shares or other stock market instruments. This service can be compared to a loan, because the broker receives remuneration in the form of a commission.

- The investor sells the received asset, monitors the market and controls the price of the selected object.

- When the value drops to a minimum level (in the trader’s opinion), he buys assets and returns them to the broker with a commission. The difference between the cost of selling and buying is the trader’s earnings.

How to short on the stock exchange?

Investors know that cryptocurrency prices have high volatility. After prolonged growth, periods of sharp depreciation occur against the backdrop of negative news or other events. Such moments are an opportunity to earn money. To do this, it is enough to know how to short on the stock exchange, what it is and what rules must be followed.

Conditions

Opening short positions with leverage has a high level of complexity. This is especially true when working with altcoins, which have minimal liquidity and volatility. They are characterized by a narrowing of the market (squeeze), so experienced traders act to compress the instrument of interest, and participants with little experience risk being left without money. This is why shorting on the stock exchange is a dangerous activity without experience.

Terms of sale transactions:

- Presence of a trend or flat.

- High liquidity of the cryptocurrency used.

- Analysis of exchange rate price changes for a specific time period.

- Having a clear strategy with mandatory adjustments taking into account market trends.

- Understanding the risk and likelihood of losing a deposit.

Peculiarities

To open short positions, you must be able to analyze the market situation and know the nuances of technical and fundamental analysis. In practice, not every market participant who knows how to play long is able to make money when the value of cryptocurrency falls.

Experienced investors know the peculiarities of the market and the psychology of beginners. They accurately predict when traders will go short, so they wait for the position and begin the squeeze process. It's about making a profit by creating pressure on existing orders. To protect your deposit, it is not recommended to trade during short positions and sell at the peak points of the rally. Also, you should not start trading and open short positions at the beginning and end of the trading session. When choosing the appropriate time, you should focus on the activity of exchange users or the time zone of the site office.

It is known that for the value of coins to increase, a sufficient trading volume and buyer activity are required. In other cases, the price of coins most often falls. A market decline is often stopped by the presence of sales that begin at any time and without special preconditions. This feature is dangerous for participants who choose to trade short. If traders believe in a positive trend (an increase in the value of an asset), the price may behave unpredictably - pass through support or, conversely, continue to move upward.

The best solution to trade on momentum is at moments when the selected cryptocurrency has increased or decreased in value. Additional tools and strategies are used to achieve this. When looking for instruments that are declining in price, it is important to look at the parameters of the cryptocurrency and control the compression process. It occurs at a time when participants have prepared for a future decrease in the value of the virtual coin.

Technique

Knowing how to properly short on a cryptocurrency exchange, a trader reduces his own risks and gets the opportunity to make money. Before starting trading, it is important to remember the number of traders. Their number in a falling market is much lower, so orders for long bets “suppress” adherents of a short position. When “playing short”, it is important to understand that when the price is reduced by half, it is easy to make money taking into account trading leverage. If the cost has increased, the size of the losses can reach 100%. This is why the participant’s risks are higher when shorting.

The technique of trading in a falling market involves the use of the following opportunities for short trading (application depends on the current market situation):

- Selection of cryptocurrencies, the cost of which goes to the resistance level.

- Working with relative strength assets.

Here you need to consider the following points:

- A signal to stop trading is the appearance of a triangle or double top (technical analysis patterns). The essence of the latter is the periodic rise in the value of cryptocurrency over a short period of time.

- With declining performance in the cryptocurrency market, it is important to look at the short-term parameters of the value of coins. If the market is in a bearish trend that does not correspond to the parameters of a declining market, it is worth studying short-term price parameters.

- Playing short brings maximum profit when the rate decreases significantly, so it is recommended to accurately calculate the entry and exit points of the position.

Principles

A market participant who decides to short an exchange must consider the following:

- The price of assets rises “on a ladder” and falls using an “elevator”. This indicates a slow price increase, but in the case of a bearish trend the situation develops quickly. Experienced investors know the situation when, when playing long, you can watch a growing market for a long time, trade successfully, and then lose everything in one moment. For example, a price increase may last 2–3 months, but a fall will take only 2–3 days.

- Shorting, unlike trading long positions, allows you to earn more. But long-term investors who focus on the future growth of the value of cryptocurrency are better off abandoning this method.

- When searching for weak assets that have preconditions for a price decline, it is necessary to analyze the market and determine current trends. For example, are there any prerequisites for a fall in the value of cryptocurrency. A trader should be wary of the sale of virtual coins, especially if this trend is repeated several times in a row.

Precautions when trading short

When playing short, it is important to protect assets from loss and use the principles of diversification. To do this, you can use several cryptocurrencies, including Ethereum and Bitcoin. You can choose other virtual coins (there are more than 1000 of them), but the total amount must be less than the total amount of ETH and BTC.

When forming a portfolio, it is important to adhere to the following ratio (as an option):

- 20% Ethereum.

- 40% Bitcoin.

- 20% of other (promising) cryptocurrencies.

- 20% of free funds for playing short.

After purchasing Bitcoin and Ethereum, virtual coins are immediately transferred from the exchange platform to “cold” wallets. Before purchasing altcoins, it is advisable to split 20% of the allocated funds into twenty parts and purchase different coins (for the future).

The free 20% can be used to work on the fall of the cryptocurrency without worrying about the safety of capital. When the price drops sharply, the investor uses the money he has and makes money by shorting the position. With the profit you make, you can buy new altcoins.

General rules for safe trading when shorting:

- We take the necessary measures to ensure the safety of funds in the account.

- We do not risk more than 10% of the funds available in the account in one transaction.

- We take into account possible drawdowns on the deposit and diversify losses.

- We take into account the dangers of playing short and keep the risks under control.

When playing short, a trader needs to remember the existing risks of trading:

- The value of the asset may increase. The cryptocurrency market is in constant dynamics. The value of virtual coins can be influenced by many factors, so predicting price movements is a difficult task. If an investor expected a decline, but the price went up, he could lose his entire deposit.

- Not every asset can be shorted. For example, this option may work with cryptocurrency, but it is better to avoid short trading using new securities.

How to short on the stock exchange - examples

Websites of popular exchanges for short trading

Before opening short positions on cryptocurrency, you need to decide on a suitable trading platform. Let's highlight a number of exchanges:

- Bitfinex.com- a large platform with high functionality and one of the TOP 5 exchange platforms (in terms of trading volume). Features include a large number of participants, the possibility of trading with leverage of 3.3 times, as well as the availability of many cryptocurrencies (Ethereum, Bitcoin, Monero, Dash and others). Pros: ease of registration, Russian-language interface and high level of security.

- Bitmex.com- an equally popular platform that has proven itself to be the best and allows you to trade virtual coins. The service offers the purchase and sale of altcoin contracts and allows work with high leverage (up to 1 to 100). The exchange operates automatic deleveraging. This means that profitable positions may decline if a remote order cannot be executed. Before you start, you need to understand what it means to short on a cryptocurrency exchange and read the questions and answers section on the official website. There are no commissions for depositing or withdrawing funds, but you will have to pay for each transaction (detailed information here - bitmex.com/app/fees).

- Ledgerx.com- a modern platform for trading and clearing, under the control of US regulators. The service offers clients good conditions, which makes the site attractive to investors. The disadvantage is the lack of a Russian-language interface and training information. In addition, to register for this service, individuals must submit a number of documents - an IRS form (W8 or W9) and copies of documents.

- We study commissions, conditions for depositing and withdrawing, the size of leverage and operating rules.

- We make a wallet for cryptocurrencies (for coins that will be traded on the exchange). For convenience, it is better to give preference to online wallets. In the future, after accumulating a large amount, it is better to transfer funds to desktop or paper crypto wallets.

- We register on the exchange platform and replenish the deposit. Only after this the trader gets access to margin trading and shorting.

- Log in with your details and select the margin trading section.

- We borrow the required amount of cryptocurrency. The system provides the asset independently, but you can choose one of the proposed options (conditions vary). The main thing is to have sufficient funds to open a position. On ordinary exchanges, exchange instruments are dealt with by brokers, but here other participants in the system act as lenders. Loan rates are low.

- We sell an asset, for which we select the order type, set the price and click on the appropriate button.

- We expect the price to change in the right direction and buy cryptocurrency.

- We return the debt and receive the difference into the account.

After receiving income, the money is withdrawn to a cryptocurrency wallet, bank card or other available method. The first withdrawal may take several weeks.

Opening short positions with cryptocurrency seems to be a simple activity that promises large income for the trader. This idea is wrong. On the contrary, playing short is recommended only for experienced participants. You need to know what it means to short on the stock exchange, be able to analyze the market, know the rules of safe trading and have technical analysis skills. Working on the news and the current situation in the cryptocurrency market can lead to negative consequences and a quick loss of the deposit. That is why it is better to practice on a demo account, study the theory, and only then start trading with real money.

Video on how to short cryptocurrency:

How to trade short and long on Bitfinex:

How to short cryptocurrency on OKEX.COM:

In order to correctly understand the meaning of these words and understand the mechanics of trading on the market, you need to dig a little deeper into the essence of these concepts.

What is a short and long position on the stock exchange?

Analyzing visual technical charts, we can come to the conclusion that for the most part, the growth of quotes occurs slowly and progressively. Accordingly, the concepts " purchase" And " long term position"have become synonymous. This is how the concept “ long» ( from English long – long).

In turn, all stock market crashes and major falls occurred very abruptly and unexpectedly. And in order to profit from a fall, you should open a position for a short period of time, take profit, and close it immediately. In contrast to the bullish longu", fall work began to be called " shorts", from " short» ( English - short).

In turn, all stock market crashes and major falls occurred very abruptly and unexpectedly. And in order to profit from a fall, you should open a position for a short period of time, take profit, and close it immediately. In contrast to the bullish longu", fall work began to be called " shorts", from " short» ( English - short).

Short and long in simple words

To begin with, all stock markets rise over the long term. If we consider the dynamics of any stock index with a history of more than 50 years, we can easily verify this.

On the Wall Steet in New York there is a 3-ton bronze statue of a bull - a classic holder of a long position.

What is this connected with? First of all, with inflation. Today, no one is surprised that every year the prices for certain products and services increase. Cars, food, clothing, medical care, etc. – the price either increases or remains the same. If there is a situation in the economy where prices, on the contrary, are falling, this, oddly enough, is an alarming sign.

One way or another, a constant rise in prices is a normal and beneficial phenomenon for the economy. It spurs consumer demand, which ultimately leads to job growth and scientific and technological progress.

How does this help you understand what is long and short? Let's return to the securities market. Stocks, like any other commodity or product, also rise in price under the pressure of inflation. After all, behind the securities there are very real production capacities: machine tools, drilling rigs, real estate, copyrights and innovative technologies. Thus, the gradual increase in prices for stock indices is nothing more than a reflection of inflation on the property that stands behind specific shares. From this simple rule, investors have formed certain behavior patterns that explain why short and long position That's what they're called.

Features of calculations of long and short positions

Outside the Frankfurt Stock Exchange, Bear, the traditional short-seller, is not shown alone; he is accompanied by an imposing bull.

Answering the question, “ what is long and short on the stock exchange“It is also worth noting that traders always opened a long position “on their own”.

That is, they bought some asset as their property and could keep it in their portfolio, no matter how it changed in price. However, if a trader opens a short position, then he must borrow the asset from his broker, sell it, wait for the price quote to go down, and then buy it back at a low price, and then return the borrowed asset back to the broker, keeping the difference in the form of profit.

This is a rather complicated operation for an inexperienced investor, but this is how long and short positions.

Example:

Let's say the current stock price is $61. Are you sure that tomorrow its price will drop to $51 . At the same time, you have a friend who can lend 100 of these shares. You take shares from him and sell them today at a price $61 , and help out $6100 . Let's say the forecast turns out to be correct and tomorrow the shares are already worth $51 . You buy 100 shares again by spending $5100 , and return the securities to your friend. $1000 remains with you as profit.

Exactly the same mechanics work on the stock exchange. long and short operations.

But the broker is not your friend, and will not lend you an asset just like that.

For each day of using borrowed shares, you will need to pay interest, which depends on the key rate in the country. The higher the bet, the more expensive it is to be in a short position.

Thus, the trader should expect income that will exceed the fee for using the financial instrument. That is why it is not profitable to hold sold assets in a portfolio for a long time. Therefore, a position aimed at earning money from price reductions is called short.

What does long and short mean? on practice?

Buying an asset to make a profit is usually called a long position, and selling, accordingly, a short position. In English, a short position and a long position are referred to as “long” and “short”.

Curious readers may be interested in the situation when a trader opens long and short at the same time. In practice, this situation is impossible, because these are inverse operations and they cancel each other.

Eg, if you bought 100 shares Tesla, then you will not be able to open a short position on this instrument, because selling 100 shares will simply bring the trader to zero. In order to open a short position from this position, you must place an order to sell 200 shares at once. Of these, 100 will be sold those that were purchased earlier, and another 100 will be borrowed from the broker and sold “at minus».

However, the very idea of opening a position in “both directions” is not without meaning, and in practice, opening long and short at the same time Maybe. To do this, you need to use the derivatives market.

Eg, you can buy 100 shares Nvidia on the stock market and at the same time short a futures contract for 100 shares of Nvidia. As a result, the trader will find himself in “ null» position, because the income from the growth of shares will be absorbed by the loss on the futures account, and vice versa - the profit from a short position in the futures market will be offset by the loss from the decline of shares in the stock section.

If you open and close a short position within one trading day, you will not pay interest to the broker for it.

Opening such positions can be interesting for arbitrageurs, as well as for investors who engage in hedging. But it is difficult to make a profit in such a situation from exchange rate changes.

On the technical side, long and short operations also have a number of subtle points. In particular, the broker forcibly closes the client's short position in shares before closing the shareholder register. This is done so that the broker can receive dividends on securities that actually belong to him.

Poll: Which position do you prefer?

Trading in the foreign exchange market is carried out by buying or selling currencies, stocks, raw materials and metals. The trader's earnings are the exchange rate difference. Buy cheaper, sell more expensive - these are the main postulates of trading on the Forex market. In order to determine the moment of maximum decline in the price of an asset and buy it, trading strategies and advisors are created. What terms are typical for the Forex market to define positions for buying and selling financial instruments? What do Short and Long positions mean?

What is Short and Long on the stock exchange?

When trading on the Forex market, you can only do one of two actions - sell a currency pair or buy it. Selling a financial asset among traders is called a short position. Buying a currency pair is called a long position. The names of the positions Short and Long have nothing to do with the time the trade is held open. Sell and buy orders can be open from a few minutes to several weeks.

A long position involves purchasing the first financial asset in a pair. For example, when you click the Buy button in the trading terminal on the line with the euro-dollar instrument, the trader buys a certain volume of euro currency for dollars. If your account currency is different from US, then in order to buy the euro-dollar pair you will have to borrow dollars from the broker.

The scheme seems complicated only theoretically. In practice, the trader does not feel any inconvenience. He enters a long position (Long) if he expects further growth of the pair. If his prediction comes true and the price actually rises, he closes the order with a sell. The MetaTrader 4 trading terminal has only 3 buttons - “Buy”, “Sell” and “Close”.

A short position involves selling a currency pair, commodities, shares or other financial instruments. The sale of an asset is usually carried out through a loan scheme from a brokerage company. For example, a trader assumes that the price of Coca-Cola shares will fall and wants to make money on this. To sell shares, you need to own them. A trader has only a trading account opened in dollars, euros or rubles.

To enter a short position in Coca-Cola shares, the trader borrows from the stock broker for the balance currency. If their price actually drops, he returns the loan to the broker and keeps the difference for himself as profit. If their price rises, the trader loses money on the difference between the sale price and the current price established in the market at the time the order was closed.

Examples of short and long positions in the Forex market

Let's look at examples of Short and Long positions on Forex using the trading platform of a brokerage company as an example Alpari.

On the H4 timeframe of the chart of the pound-dollar currency pair, a situation has arisen, the resolution of which implies a fall in the currency pair. The price has been moving flat for a long time (brown rectangle in the figure below). Sooner or later, it must leave the horizontal corridor, which is limited by two yellow lines on the chart.

The trader assumes that the price will break through the lower limit of the range and continue to decline, so he opens a short position (Short) in the place marked with a red rectangle. He sells pounds and at the same time buys dollars. When closing a transaction, the trader performs the reverse operation.

The opposite situation developed for the dollar-yen pair. The price was in a flat for a long time at the very bottom of the trend. The trader expects the corridor to break upward and enters a long position (Long) after the price breaks through the resistance line. The pair is growing, the purchase makes a profit.

Also, an analogue of the opposite transaction when closing a position in Forex is stop loss and take profit. When a buy order is closed at a stop or profit, the reverse operation occurs - selling the currency pair. The sale of a financial asset is closed using a stop or take profit by returning the loan to the broker and fixing the result of the transaction - the same as when closing orders manually.

Those traders who buy financial assets are called "bulls" in trading slang. Those who sell financial instruments are called “bears.” The same trader can be both a buyer and a seller, a bull and a bear, even within the same day. The stock market is usually dominated by bulls, since it is more profitable to invest in the growth of promising enterprises than to calculate and analyze the possible failures of any giants whose shares are traded on the stock exchange.

Basically the terms Short and Long are found in the stock exchange. In the Forex market, a more traditional designation for purchase and sale transactions is accepted - Buy and Sell, respectively. Long positions with the prefix Long and short positions with the prefix Short can mainly be found on some specialized platforms where traders communicate.

We remember that the profitability of trading very much depends on

Short (from the English “short selling”) is the sale of shares in which you initially do not have shares, but take them on credit from a broker.

We bring to your attention interviews on the use of shorts with traders who have been working in the stock market for a long time. These are interviews with traders who have their own trading style. One is more focused on intraday trading, the other prefers to roll over positions over several days. This, of course, determines why and how they open a short position, and how long the “short” lasts.

Our interlocutors are professional private traders: Andrey (15 years of experience in the market) and Sergey (12 years of experience in the market).

Are you more focused on intraday trades or do you move your shorts over multiple days?

Andrey: It is quite rare to speculate within a day; I prefer to take a position for one or several days

Sergey: I am an intraday speculator and close all margin positions overnight 99% of the time.

Why do this?

Andrey: When there is an upward trend in the market, everything is clear: you buy securities and wait for the right moment to take profits. You can, of course, tactically unsuccessfully enter the market and buy at a local maximum, but if the trend is strong, then sooner or later you will gain profit.

But what to do when the market falls and you are sitting on money? Try to play for a “rebound”: buy shares, hoping for a local minimum, and then quickly get rid of them, remembering that the trend is generally downward? A very dangerous occupation! How many times have I done this and sometimes even quite successfully. However, in general, this led to the fact that you buy securities, and the market goes further down, leaving you with two options: either become an investor, sit in the securities for a long time and wait for the trend to change, or close the position at a loss. Sometimes such a purchase of securities can take months, and you have to sit outside the market, although you understand that, in general, you guessed the direction.

To avoid getting into such troubles, it is better to play not against the trend, but with the trend, placing stops at exits from it. That's what shorts are for.

Shorting is a bearish play when you see that the trend is downward and you have money. In order not to play by buying, you sell borrowed securities and wait until the trend changes. Of course, you can make a mistake when entering the market and sell not at the maximum, but if you guessed right in the general trend, you will still come out with a profit.

Sergey: I consider playing only “from long” to be a fundamentally wrong approach. This deprives the speculator of interest in the market at a time when the market is falling, although one can and should make money on a falling market. In addition, trading only “from a long position” leads to natural losses in a falling market, when a person who is accustomed to playing only from a long position tries to “play against the market.” I believe that a trader must take advantage of all the opportunities that the market provides and play both up and down.

How to choose the right moment to open a short?

Andrey: Overall, this is, of course, a downward trend. And the moment of sale itself depends on the strategy or trading system. For example, you can open shorts when the uptrend breaks down.

Sergey: When going short, I use the same approach as when going long, as I trade intraday. I monitor several markets at once: futures for S&P, oil, ADR, dollar exchange rate on the MICEX. It's important for me to track when multiple signals arrive at the same time. For example, futures on S&P and ADR on Gazprom shares moved down or up simultaneously, but shares on the MICEX did not have time to react to this movement, and the spread between ADR and shares on the MICEX deviated in one direction or another more than it is on average per day . In this case, I open a position using short stops.

Most often, how long does your “short” last?

Andrey: While the trend lasts.

Sergey: I hold shorts until the indicators on the basis of which I opened the position all move in the opposite direction.

What securities do professionals usually short?

Andrey: Professional speculators (not those who keep their savings in stocks, but those who actively trade every day to make money on short-term and medium-term price changes) try to trade only the most liquid securities in order to close at any time on a signal from their trading system position. In general, these are “blue chips” - the most liquid shares on the Russian market. This rule also applies to short positions.

Sergey: I am an intraday speculator and therefore work only with the most liquid shares for which there is a corresponding fairly liquid hedge market (ADR LSE, Forts). It is the presence of a hedge market, in my opinion, that increases short-term volatility, which is exactly what “intradealers” need.

What about the fact that short trading is riskier and you can lose all your money?

Andrey: This is wrong. The risk increases when using leverage rather than short. And the greater the leverage, the greater the risk. If we talk about trading with “first leverage” using shorts, then, from a risk point of view, this is practically the same as buying shares with your own money. Just in one case, you play for a rise and buy a certain number of shares with your money. And in another case, you count on a decline in the market and, having leverage of 1 to 1, borrow and sell the same number of shares as in the first case. After all, the market can be in three states: an uptrend, a sideways trend, and a downtrend. You can buy shares during an upward and sideways trend, but playing for growth in a downward trend will inevitably lead to losses. This means that if you only play long, then at least 33% of the market will pass you by. “Short” allows you to participate in the market 100%.

Sergey: In my opinion, the risk when trading short or long is absolutely comparable.

So, the traders we surveyed are unanimous in the following:

1. Without “shorts” it is impossible to fully trade stocks, otherwise you deprive yourself of significant opportunities that “shorts” provide to the trader.

2. Shorting with 1 to 1 leverage is analogous to simply buying shares, and the risks are comparable.

3. You should short only the most liquid securities - this way you can reduce possible risks

4. It is necessary to use stops and not let losses grow.

Popular

- Business and Entrepreneurship

- Compare broker spreads

- Price Action Strategy: Definition of Patterns and Recommendations for Their Application

- Algorithms and stock trading: Hiding large trades and predicting stock prices Risks associated with algorithmic trading

- Labor market under conditions of perfect and imperfect competition

- Real biography of Dmitry Potapenko Who is Dmitry Potapenko really?

- What assets to invest in

- Pricing strategy of an educational institution

- We measure the Net Promoter Index (NPS)

- Forecasting demand, structure and sales volume