Registration in pfr, foms, fss

There are several options for how you can register with all the necessary organizations. Let's take a closer look at each item.

Registration is carried out at the PFR Office of your area at the place of registration (see the addresses of the branches) and is mandatory. If there are no hired workers, then pay only for yourself to the pension fund, if someone does work for you, then you will have to pay for them.

You will have to pay fixed payments to the Pension Fund, regardless of whether you are in business or not, whether you have income or not. You need to make payments to the pension fund from January 1 to December 31 of the current year. You can pay for the whole year at once, or in installments. Payment can also be made from the entrepreneur's current account, if there is one.

It is possible to pay for the whole year at the end of the year. And the paid receipts must be saved and presented (and their photocopies) to the district office of the Pension Fund of Russia for a report from January 10 to March 1.

If, after registering an individual entrepreneur, you were not given a notice of registration with the Pension Fund, then 2 options are possible.

- Wait until a letter comes to your mail. This usually takes 2 to 4 weeks. Confirmation of registration (for oneself) will be "Notification of registration of an individual in the territorial body of the Pension Fund of the Russian Federation at the place of residence." You don't actually need a letter, you need a registration number and details to pay taxes. Therefore, they can be recognized more quickly by the following option.

- Call by phone to the branch of your PFRF or personally drive up to the branch.

Important! Since May 2, 2014, a regulation has been adopted that cancels the mandatory notification of the tax authority about the opening / closing of bank accounts.

Come on in the FIU as an employer

When an individual entrepreneur or head of a peasant farm hires employees, he must register with the FIU as an insurer. Now his responsibilities include paying insurance premiums for the employee.

If during the state registration of an entrepreneur, his registration in the PF is carried out automatically, then the obligation to register as an employer lies with the entrepreneur himself or the head of the farm. This must be done no later than 30 days from the date of the conclusion of the first employment contract with the employee.

Documents you need to have:

- Application for registration of the policyholder. Download . You can familiarize yourself with the procedure for filling out the application there.

- certificates of state registration of an individual as an individual entrepreneur or a license to carry out certain types of activities;

- documents proving the identity of the policyholder and confirming registration at the place of residence (it is advisable to make a copy of both spreads (for example, a passport) on one sheet);

- certificates of registration with a tax authority on the territory of the Russian Federation (if any);

- documents confirming that an individual has an obligation to pay insurance premiums for compulsory pension insurance (an employment contract, a civil law contract, the subject of which is the performance of work and the provision of services, an author's contract, etc.).

Important! You must provide certified copies of documents.

Registration is carried out within 5 days.

Since September 30, 2014, the registration period and the deadline for deregistration of policyholders with the PFR and the FSS has been reduced from five to three working days.

After registration as an insured, an individual employer is issued a Notice of registration with the territorial body of the Pension Fund of the Russian Federation of the insured making payments to individuals.

Pay attention! If you violate the registration period as an insured, then you will be fined 5,000 rubles (violation up to 90 days). And 10,000 rubles for violation of more than 90 days.

MHIF (Mandatory Health Insurance Fund)

On January 1, 2010, the MHIF does not register any individual entrepreneur or Yur. Persons. All are replaced by the FIU. FIUs must send a notice to the address of the entrepreneur. But they may not be sent, therefore, it is safer and faster to go on your own + you will immediately receive the details for payment. Do not forget to take with you the originals and photocopies of the individual entrepreneur registration certificate, pension certificate and TIN.

Registration and withdrawal of individual entrepreneurs in the FSS. Required documents.

FSS is required only in a couple of cases:

- entering into an employment contract with an employee (when you become an employer),

- conclusion of a civil contract with the obligation to pay contributions to the FSS.

To register with the FSS, an individual entrepreneur is allocated a period of 10 days after signing the first employment contract with an employee. If this deadline is not met, a fine of 5,000 rubles will be imposed.

To register, you must submit an application and the necessary documents (submitted in originals and copies or notarized copies):

- application for registration as a policyholder;

- copy of the passport (employer);

- a copy of the certificate of state registration of an individual as an individual entrepreneur (OGRN certificate);

- a copy of the certificate of registration with the tax authority (TIN certificate);

- copies of work books of hired employees;

- copies of civil law contracts in the presence of conditions in them that the policyholder is obliged to pay insurance premiums for compulsory social insurance against industrial accidents and occupational diseases for the specified persons

If at the time of filing the application a bank account was opened with a credit institution, you must provide a certificate from the credit institution about the specified account.

Registration takes no more than 5 working days and is issued Notification.

If an individual entrepreneur carries out his entrepreneurial activity without using the labor of hired workers (does not conclude labor or civil law contracts with individuals), then such an entrepreneur is not obliged to register with the Fund.

Always check the current list of documents. You can find out in your branch of the FSS (coordinates are presented on the website in the lower right menu "Regional branches").

On a quarterly basis, an individual entrepreneur must submit reports to the Fund's branches at the place of registration in accordance with the 4-FSS RF or 4a-FSS RF (for those paying voluntary insurance contributions to the FSS RF) no later than the 15th day of the month following the expired quarter.

For violation of the deadline, a fine is threatened:

- 5% of the amount of insurance premiums payable (surcharge) on the basis of these reports, for each full or incomplete month from the date set for its submission, but not more than 30 percent of the specified amount and not less than 100 rubles;

- 30% of the amount of insurance premiums payable on the basis of these reports if reports are not submitted for more than 180 calendar days;

- 10% of the amount of insurance premiums payable on the basis of these reports for each full or incomplete month starting from the 181st calendar day, but not less than 1,000 rubles.

Removal from the register occurs upon dismissal of employees, expiration of the term of employment contracts, or the corresponding civil law contracts concluded with employees.

To deregister, insurers must submit the following documents to the territorial body of the FSS of the Russian Federation:

- Withdrawal statement (download);

- certified copies of documents confirming the occurrence of the circumstances that are the reason for the deregistration.

Register with RosStat

(Federal State Statistics Service)

This document is optional. However, some banks and organizations require it. The tax office itself transfers information there and must assign and issue codes to you. But you may never need codes. Unless the individual entrepreneur falls under the sample and he does not have to submit reports. The report is submitted to RosStat before March 2, once a year. And about whether you are included in the sample, you can find out as follows:

1. RosStat will send you a notification by mail or by phone.

2. Contacting the department, you can clarify this issue.

How do you get the codes?

Now it is available via the Internet for Moscow and some other cities. It is worth noting that the data does not appear immediately after the registration of the individual entrepreneur. And after a few days.

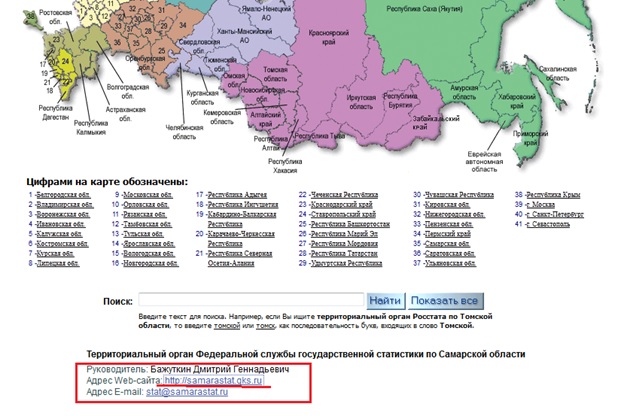

The regions will have to travel personally for now. By this link you can find the territorial bodies of the Federal State Statistics Service. You just need to select an area (by clicking on the map or in the list under the map) and a link to the site in the region will appear at the bottom.

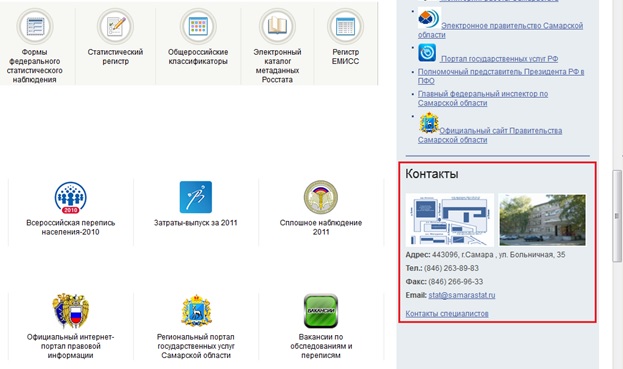

We go to the site, scroll down and see at the end on the right all the contacts: address, phone number, regional office map.

Required documents from you:

Copy of TIN

copy of passport with registration and main page on one sheet

copy of OGRN

copy of EGRIP

Document you will receive:

Notification of the assignment of IP statistics codes with a seal

Registration with Rospotrebnadzor

You should notify this service before starting your business, i.e. before making a profit and at the place of actual provision of services.

There are certain types of activities in which registration of an individual entrepreneur with Rospotrebnadzor is mandatory.

There are 2 ways of notification:

- In the form of an electronic document sent using a single portal of public services. View.

- As usual, come in person to the department.

Required documents:

copy of OGRN;

copy of EGRIP;

copy of TIN;

notification in 2 copies (Template is possible).

Branch addresses can be found as follows:

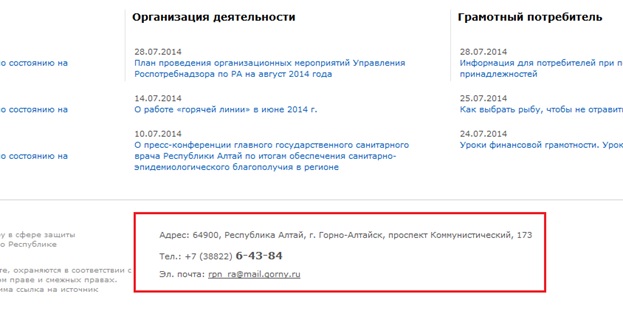

Go to the official website of Rospotrebnadzor. We select the required subject. Click on it and go to the regional site. We go down to the saaaamy bottom and see the addresses and phone numbers:

In addition, Rospotrebnadzor (if you are already registered) must be notified of the changes:

a) change of the location of the legal entity and / or the place of actual implementation of activities;

b) change of the place of residence of an individual entrepreneur;

c) reorganization of a legal entity.

If this information was useful to you, tell your friends about it in social media. networks.

Popular

- The bull and the bear on the stock exchange: the beastly face of the stock market

- Stages of opening a private dental office

- How to open your own store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from simplified to a system with VAT payment

- Car depreciation - what is it?

- Yesterday's business: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)