Open IP on your own

Briefly: The registration procedure includes several stages: preparation of documents, payment of state duty, submission of documents for registration to the Federal Tax Service. The cost of the issue is 800 rubles. (state duty for registration of IP). Read more in our article.

in detail

Consider step by step how to open an IP in 2015 on your own.

Preparation of documents

To register an individual entrepreneur with the Tax Office, you will need to prepare the following list:

- Copy and original of the passport;

- Receipt (or copy) of payment of the state duty in the amount of 800 rubles. (clause 6 of article 333.33 of the Tax Code of the Russian Federation);

- Copy of TIN. If there is no identification certificate, it will still have to be obtained by submitting an application. In this case, registration will take 10 days: 5 will be spent on issuing a TIN, and the same amount on registering an entrepreneur. In some divisions of the Federal Tax Service, a copy of the identification certificate may not be needed, however, its number must be indicated in the application for opening an IP without fail;

- Power of attorney. It is needed only if the opening of an IP for an individual is handled by his representative. The power of attorney must be certified by a notary.

Application for registration of physical individuals as IP.

The application can be filled out in black ink and block letters, or you can use the document generation program on the website of the Federal Tax Service, and then send it through the proposed form (if there is an electronic signature). The finished form can also be taken from the state tax inspector immediately before submitting documents. On the penultimate page of the application, you must enter up to 20 OKVED codes corresponding to the type of business activity;

Citizens of foreign countries (non-residents) planning to do business in Russia, in addition to the above documents, provide a residence permit or temporary residence permit, as well as a copy of a certificate confirming registration in the territory of the municipality.

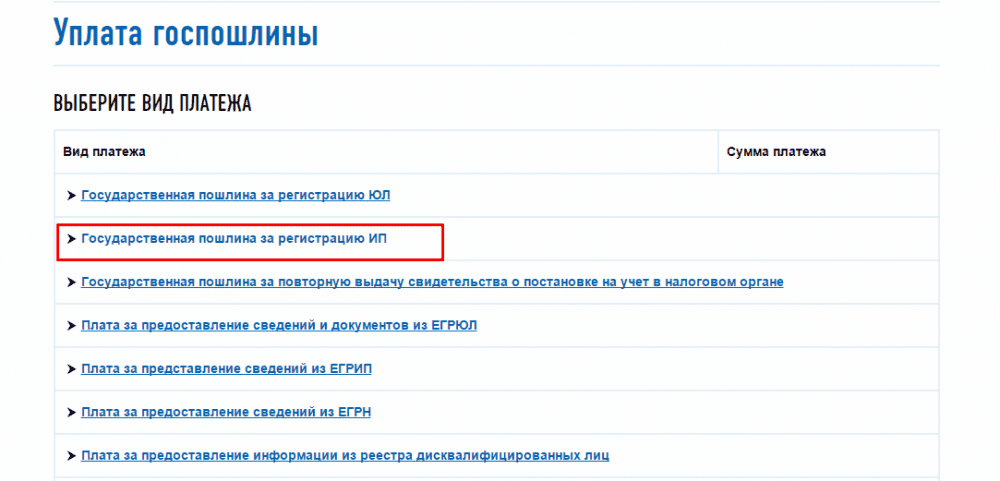

Payment of state duty

The amount of the state duty for registering an individual entrepreneur is 800 rubles. It can be paid at any of the commercial banks (but usually everyone pays through Sberbank RF).

Submission of documents for registration to the Federal Tax Service

After paying the state duty, you must visit the territorial office of the Tax Service in order to submit the prepared documents for registration.

In addition to a personal visit, there is another way to submit documents for opening an IP - through the website of the Federal Tax Service. To do this, you need to send through a special form scanned copies of all pages of the passport, certified by an electronic signature, as well as the application itself.

Olga, seamstress:“It seemed to me very convenient to send all documents through an electronic form: there is no need to go somewhere and waste your time. 3 days after I sent the scans to the Federal Tax Service, they called me and set the date for the issuance of the Certificate.

The decision to open one's IP in all cases is made within 5 working days from the date of application, after which the applicant or authorized representative is assigned a date for receiving the following documents:

- Certificate of state registration of an individual as an individual entrepreneur (OGRNIP);

- Certificate of registration with the Federal Tax Service;

- Extract from the USRIP;

- Certificate of registration with the Pension Fund (PF RF);

- Notification from Rosstat that statistical codes have been assigned to individual entrepreneurs.

Sometimes entrepreneurs are not issued a registration document with the Pension Fund of the Russian Federation for a long time for a variety of reasons: the late response of the Pension Fund to the notification of the Federal Tax Service about the establishment of another individual entrepreneur, forgetfulness or negligence of employees of one of these organizations, etc. In such cases, the entrepreneur must take care of himself by contacting the pension fund at the place of registration and providing the IP Registration Certificate, passport, TIN and SNILS.

Responsibility for violation of the terms of registration with the FIU is provided for by the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”, and for an entrepreneur it may threaten with a fine of 5,000 rubles. up to 10,000 rubles

In what cases can the Federal Tax Service refuse to register an individual entrepreneur:

- Incorrectly specified data in the application;

- Providing an incomplete package of documents;

- Contacting the Federal Tax Service not at the place of registration;

- Lack of liquidation of a previously opened IP. An entrepreneur has the right to receive only one State Registration Certificate;

- The current term of the ban on doing business by a court decision;

- Forced closure of an individual entrepreneur less than 1 year ago, or recognition of an entrepreneur as bankrupt.

Within 30 days from the date of opening of the IP, it is also necessary to submit an application for the transition to the selected taxation system.

Currently, there are 5 tax payment systems in Russia:

- General. It implies value added tax payments, personal income tax, property of individuals, insurance and pension payments. It applies if the entrepreneur did not submit an application for transfer to another system during registration, or when his business is not suitable for transfer to other systems;

- Simplified taxation system (USN). It is considered the most common and profitable, here the entrepreneur has a choice: to pay 15% of the difference between the total profit and calculated expenses, or 6% of the total income;

- Single tax on imputed income (UTII). This method of paying taxes is less common, because a limited number of persons can use it;

- It is appropriate to choose the single agricultural tax (ESKhN) if it is planned to engage in agricultural activities;

- Patent system of taxation. In this case, you will have to acquire a patent that exempts you from paying income taxes for a certain period. It will be beneficial for entrepreneurs who plan to receive large excess profits from their business.

Andrew, web designer:“I have a business that involves only making a profit without any investment, so I issued a simplified tax system (6% of income). This is very convenient, because you do not have to perform additional mathematical operations, although the inspector of the Federal Tax Service is involved in the preparation of all reports.

Mini-video course: Step-by-step instructions for opening an IP

What is the punishment for entrepreneurial activity without registration

Entrepreneurial activity means an activity, the income from which has been received by a person more than once.

Doing business without registering with the Federal Tax Service entails the imposition of an administrative fine from 500 to 2,000 rubles. (Clause 1, Article 14.1 of the Code of Administrative Offenses of the Russian Federation), and obstruction (illegal refusal to register an IP) is punishable by large fines or deprivation of the right to hold certain positions in acc. from Art. 169 of the Criminal Code of the Russian Federation.

Alexander, household appliances repairman:“The first time I registered as an individual entrepreneur in 2007, and in 2008 I wrote an application for liquidation. I decided to try my hand at business again in February 2015, and faced a number of nuances: the tax authorities delayed the registration deadlines, and instead of the prescribed 5 days, it all lasted almost a month. The same thing happened to my friend. Legislation is constantly improving, but in fact there are no positive changes!”

Do I need a current account and a seal for IP

The legislation does not provide for a direct obligation to obtain a seal and open a current account by an individual entrepreneur, however, this will be appropriate if:

- It is planned to conclude contracts with large organizations. A number of LLCs or OJSCs prefer to work with individual entrepreneurs who have their own seal;

- It is necessary to control income from the Federal Tax Service or cashless payment through terminals - in this case, you need to open a current account.

The cost of making a seal varies from 250 to 3000 rubles, and the price of creating a current account depends on the bank chosen by the entrepreneur.

Advice from Moneymaker Factory: The most optimal way to register activities in the form of an individual entrepreneur is to use the services of the My Business online accounting service. With it, you can prepare the necessary package of documents in electronic form for free (conveniently and very quickly).

Popular

- Bull and bear on the stock exchange: the "animal" face of the stock market

- Stages of opening a private dental office

- How to open your store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from a simplified system to a system with VAT payment

- The concept of "car depreciation" - what is it?

- Business of yesterday: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint-stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)