Payment of the state duty for making changes to the bank

Already at the moment of formation of a legal entity, an entrepreneur gets acquainted with the concept of the Unified State Register of Legal Entities. In this register, it is necessary to register all adjustments regarding the data about the company. The state duty for making changes to the Unified State Register of Legal Entities in 2017 costs 800 rubles, and it must be paid when all changes to the statutory documents are made.

What changes cost

Immediately from the date of submission of information about education, each legal entity the person enters the Unified State Register of Legal Entities. The information contained in the registry is quite extensive. They are listed in detail in Art. 5 129-FZ.

Here is a short list of them so that it is clear when it is necessary to register changes.

- All information about the name and organizational and legal form.

- Legal address (according to the laws of the Russian Federation, it is assumed that it must also be the actual location of the company).

- Information about the founders and / or shareholders, their share in the authorized capital / volume of shares, the size of the authorized capital.

- Facts and dates of previous adjustments.

- Method of formation and method of termination of a legal entity and information on the process of liquidation or reorganization.

- Data of a person who can represent the company without a power of attorney.

- Information about licenses, branches and representative offices of the organization.

- INN, KPP, OKVEDy, information on legal entities. a person, as an insured in the Pension Fund of the Russian Federation and the FSS (in the Unified State Register of Legal Entities, only changes in OKVEDs are registered, as they indicate the areas of activity of the company, and the checkpoint, if it has changed due to a change in legal address).

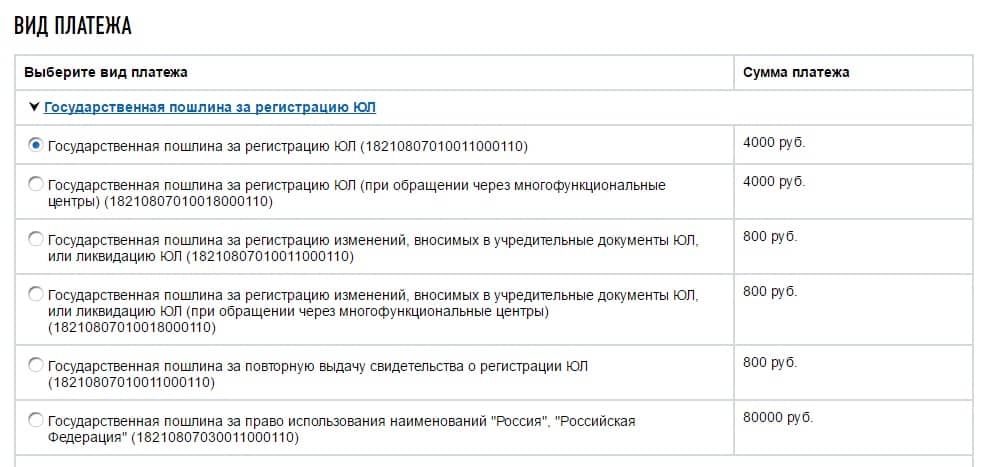

For the registration of a newly formed legal entity faces is 4000 rubles (clause 1 of article 333.33 of the Tax Code of the Russian Federation).

For amendments to the charter(with the subsequent registration of changes in the Unified State Register of Legal Entities), including for filing information about the beginning of the liquidation process (except for bankruptcy), is 800 rubles (clause 3 of article 333.33 of the Tax Code of the Russian Federation).

For microfinance organizations this fee is 1,500 rubles.

For the accreditation of branches / representative offices of foreign organizations on the territory of the Russian Federation - 120,000 rubles.

Attention! If you register such changes in the register that are not reflected in the charter, you do not need to pay the state fee!

Payment order

By the time of submission of the set of documents and the application of the established form, it must already be paid. The documents are submitted personally by the director or a representative by way of issuing a notarized power of attorney in one of the following ways:

- directly to the Federal Tax Service;

- through the MFC;

- through the mediation of a notary;

- by Russian Post with a list of attachments;

- via the Internet through the website or portal of the State Service (to submit documents in this way, the director must have a personal account registered in these services, and an electronic signature must be generated that allows documents to be processed remotely).

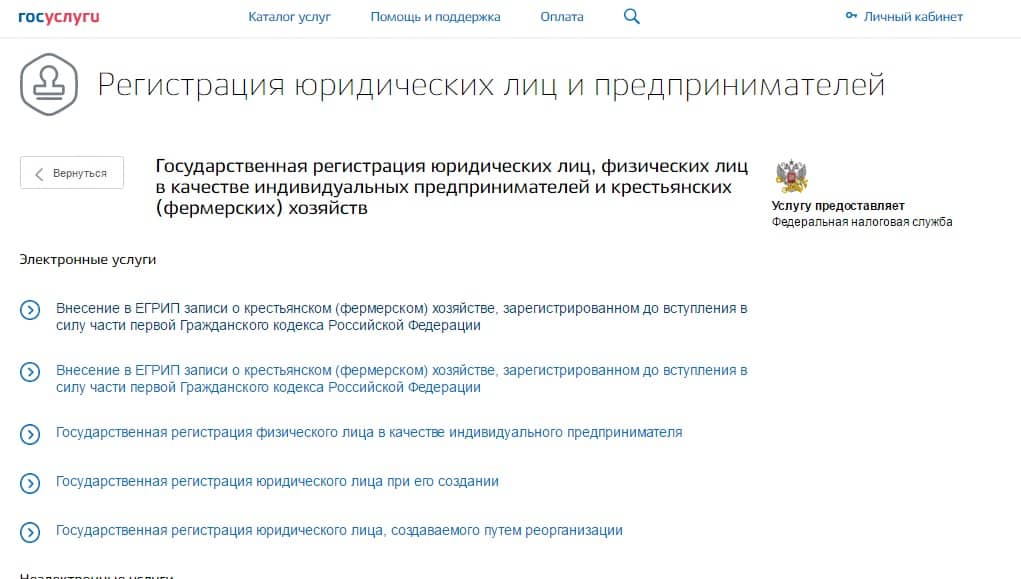

If it is convenient for you to use the State Services, then the fee can be paid there using a bank card. The program itself will give you a step-by-step algorithm of actions. There you can register both a legal entity and formalize an individual business and immediately pay the fee.

When paying through the FTS website, you need to select the "Payment of state duty" service on the right side of the screen and mark which actions you want to register. Then click "Next" and you will receive a generated receipt, ready for payment.

You can send it to yourself by e-mail, or print it right away. With this receipt, you can go to the bank or ATM. And also pay for it immediately online by bank transfer.

You can also generate a receipt on this website if you are going to submit an application to the Federal Tax Service in person, or by mail, or through a notary.

Please note that the correct budget classification codes are indicated in brackets for self-filling in a receipt for payment of state duty. And the rest of the text must be entered in the "Purpose of payment" field.

.After 5 working days, you can receive in person (or your representative with a notarized power of attorney) the charter with the marks of the Federal Tax Service and the Unified State Register of Legal Entities with updated data.

Detailed step-by-step instructions on how to find are in this video:

What is the data of the Unified State Register of Legal Entities and where to get it

Maintaining the relevance of data in the state register is necessary both for state needs and for entrepreneurs themselves. Before concluding an agreement with a new counterparty, the minimum safety standard is a request for constituent documents and an extract from the Unified State Register of Legal Entities.

A statement can be ordered for a fee if it is an official request for a loan or license, for example. And you can get it in the public domain on the same website of the Federal Tax Service in the section "Check yourself and the counterparty" by the number of INN, OGRN, or the name of the organization.

An extract is generated in a few seconds, and in it you can see the real names of the founders and the CEO of the company, the size of the authorized capital, what changes were made earlier to the constituent documents, whether the declared activity corresponds to the OKVED codes indicated in the extract. How long has the organization been registered, is it in the process of liquidation? Whether the legal address is the same as the postal address.

Based on the information received, it can be concluded whether it is worth dealing with the proposed legal entity, and whether there is any doubt about its cleanliness. This is important because if a legal entity. the person acts as a participant in the chain of cashing out funds, or illegal reduction of the tax base, when disclosing this data, all counterparties are suspected of complicity.

Popular

- The bull and the bear on the stock exchange: the beastly face of the stock market

- Stages of opening a private dental office

- How to open your own store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from simplified to a system with VAT payment

- Car depreciation - what is it?

- Yesterday's business: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)