What documents are issued when registering an individual entrepreneur according to the standard

Running a business as a sole trader has many benefits.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

Here are just a few of them:

- simple (compared to LLC) registration and liquidation procedure;

- it is not necessary to keep accounting records;

- constituent documents are not needed when registering an individual entrepreneur;

- IP is independently distributed by profit;

- You can use USN.

To start a business, you need to collect and submit it to the registration authorities. After that, you must receive a certificate. Doing business without it will entail administrative and even criminal liability.

To avoid this, you need to know what documents can be obtained after registering an IP.

Registration confirmation

The legislation of the Russian Federation clearly regulates the procedure for issuing a package of documents and registering a businessman as an individual entrepreneur.

Documents can be submitted in person, through a representative or online. In the second case, it is necessary to issue a power of attorney and certify it with a notary. The decision is made within 5 days. In case of refusal, the state fee is not refundable. In case of registration in 2019-2017, you will receive a perpetual certificate valid until the IP is liquidated. Thus, the government of the Russian Federation is trying to support start-up businessmen.

In the case of registration of an individual entrepreneur with the simplified tax system, the applicant receives the OGRNIP, a certificate of registration and an extract from the USRN. This document is handed in person or sent by mail. It should be noted that each system of taxation has characteristic features. If you have no experience in running a business, then you should consult with an experienced specialist.

When registering, you can specify:

- UTII;

The tax service also notifies the FSS, enters statistics codes and issues a corresponding notification along with registration documents

The Federal Tax Service informs the FIU about the registration of a new IP within 5 days. When registering an individual entrepreneur in 2019-2017, official notifications are issued to the FSS. If they were not sent by mail, you need to contact the services yourself with a request to hand over these documents. Otherwise, penalties will be imposed on you.

Established list of securities

To register an individual entrepreneur, you need to collect a package of documents and submit it to the Federal Tax Service.

It includes:

- application in the form P21001;

- photocopies of all pages of the passport;

- payment receipt .

You can switch to the USN directly at the time of registration. For this, a special notification is submitted in the form 2621_1. The future entrepreneur needs to choose the object of taxation: income or income reduced by expenses. Experts recommend that you always apply for the USN. The only exceptions are those entrepreneurs who need a general regime with VAT.

If you act through a representative, you need to certify the package of documents with a notary. The application is processed within 5 days. The Federal Tax Service will reject your application if it is filled out with errors, the applicant is bankrupt, or the package of documents is submitted to the wrong authority.

What documents are usually issued when registering an individual entrepreneur

What documents are issued in the tax office when registering an individual entrepreneur?

You'll get:

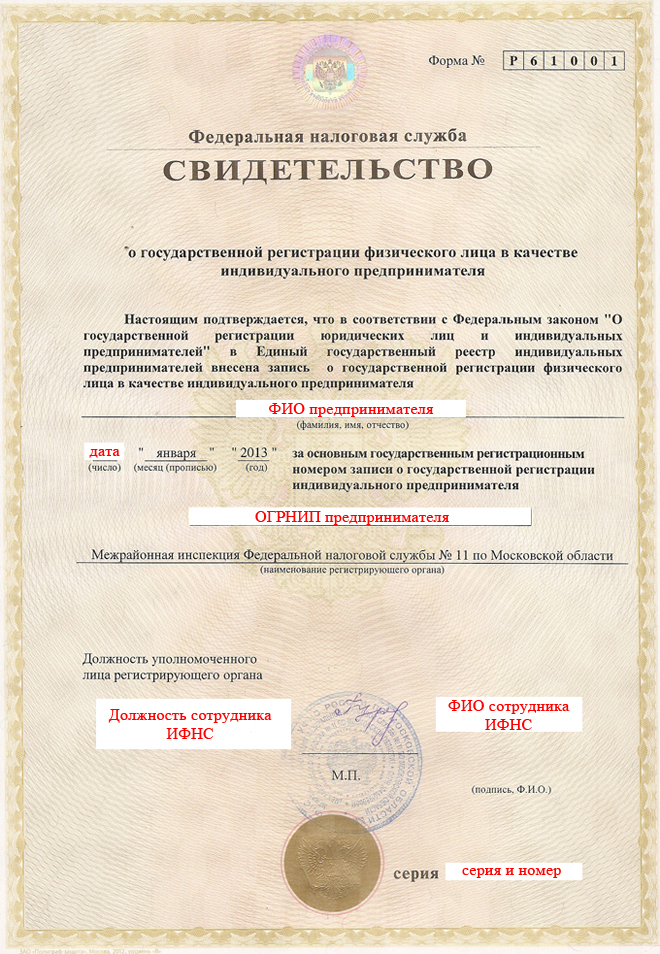

- certificate of state registration of an individual as an individual entrepreneur in the form P61001;

- certificate of registration of an individual with the Federal Tax Service at the place of residence;

- notification from Rosstat;

- notification of registration of an individual in the FIU;

- extract from the EGRIP.

Please note: a certificate of state registration as an individual entrepreneur in the form P61001 is issued before the end of 2019. In 2019, instead of it, novice businessmen will receive an EGRIP entry sheet in the form P60009. This document is a confirmation of entry into the EGRIP. Thus, on the basis of the Order of the Federal Tax Service of the Russian Federation dated September 12, 2016, certificates of state registration of individual entrepreneurs will not be issued.

If any of the above documents was not issued during the registration of an individual entrepreneur, a businessman needs to independently register with the Pension Fund of the Russian Federation or Rosstat. To do this, you need to take with you a passport and certificates that were issued by the tax authorities.

The Pension Fund administers contributions to the FFOMS, there is no need to register with the medical fund, and contributions to the TFOMS have been canceled

What follows after the procedure

After checking the package of documents, the FTS officer will issue a receipt to the applicant. It must contain two dates: the first is the date of submission to the tax office, and the second is the day on which it will be possible to pick up the registration certificate (from 2019 - Record Sheet) or a written explanation of the reasons for refusal. The above documents can be picked up in person, through a representative or the Federal Tax Service will send them by mail to the specified address.

According to the current legislation, the tax authority may refuse to register an individual entrepreneur if:

- the application on form P21001 was filled out incorrectly or contains corrections;

- the application indicated an abbreviated type of activity;

- an incomplete package of documents was submitted;

- the package of documents was submitted to another registration authority;

- the entrepreneur is already registered as an individual entrepreneur (according to the law, one individual cannot register more than one individual entrepreneur - first you need to completely liquidate it, and then receive a second certificate);

- the court prohibited the applicant from engaging in business activities for a certain period of time;

- the applicant was declared bankrupt less than a year ago.

The cost of registering an IP is 800 rubles. The FTS considers the application within 5 days. To obtain registration documents, you need to bring your passport and issued tax receipt.

In case of refusal, it is necessary to double-check whether the Federal Tax Service had good reasons to make such a decision. To do this, it is recommended to contact an experienced lawyer. If your rights have been violated, you must 3 months submit an application to the highest authority.

Popular

- Bull and bear on the stock exchange: the "animal" face of the stock market

- Stages of opening a private dental office

- How to open your store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from a simplified system to a system with VAT payment

- The concept of "car depreciation" - what is it?

- Business of yesterday: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint-stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)