How to open an individual entrepreneur on your own: step-by-step instructions for registration and sample documents

Hello! In this article, we will take a closer look at how to open an individual entrepreneur correctly, going through the entire procedure for filling out documents step by step, spending a minimum of time, money and nerves. We will analyze 3 options for preparing documents for registering an individual entrepreneur, so that you choose the most convenient for you. This is the most detailed guide on the internet!

Who can become an IP

An individual entrepreneur on the territory of the Russian Federation can become a citizen of the country over 18 years old, if he is not in the municipal or state service. In addition, you will be denied registration if you were declared bankrupt less than a year ago.

How much does it cost to open a sole proprietorship

To officially obtain the status of an individual entrepreneur, you need 800 rubles to pay the state fee.

But this amount can be increased to 7000 rubles:

- If you do not submit all documents in person, then you will need the services of a notary. They will cost from 400 to 1500 rubles.

- If you plan to deal with non-cash payments and bills, then you will need a bank. Its opening will cost from 0 to 3000 rubles.

- An individual entrepreneur has the right to work without a seal, but in practice there are many cases when it turns out to be far from superfluous (for example, for banking operations). Its production costs from 500 to 1500 rubles.

- And the entire registration process can be given under the control of specialized companies. The cost of their services depends on the region and usually ranges from 1000-5000 rubles. But we do not recommend doing this, because. our article describes everything in detail and you can handle the procedure yourself.

So, to apply for an IP you will need:

- Passport and photocopies of all its pages.

- TIN (if you do not have one, then you need it in parallel with the registration of IP).

- Application for registration of IP (Form R21001), one copy.

- Receipt of payment of 800 rubles of state duty.

- If necessary - an application for the transition to the simplified tax system (Form No. 26.2-1), two copies.

In the article we will dwell in more detail on the application for registration. It is with him that the main trouble is connected, and in him unpleasant mistakes are most often made.

You can download all documents and filling samples towards the end of the article.

Choose OKVED

These are the activity codes that you provide when registering.

You need to decide on your codes before filling out the application for registration, as they will come in handy there. The list of them is huge, and the law does not limit entrepreneurs in their choice.

First you specify the main code, which most accurately describes your future activities, and then choose all more or less suitable.

- Download OKVED2

Even if you will not be involved in some industry at the beginning, but may include it in your work later, its code should be indicated. “They won’t ask you” for too long a list, but adding OKVED codes after registration can be troublesome.

The main OKVED code will depend on:

- FSS insurance rate;

- in some cases, the tariff tax rate;

- benefits provided for certain types of activities;

- the need for additional certificates and accreditations (for example, for entrepreneurs registering for the first time with codes 80.85, 92, 93, a certificate of no criminal record will be required).

Tax regimes for individual entrepreneurs

Before finally deciding on the tax regime, all options need to be calculated, and only then make a choice. UTII and Patent will depend on the type of your activity, and OSNO and STS on profit.

|

BASIC |

USN (simplified) | UTII (imputation) | Patent |

| The base tax you are on if you have not filed any other claims. Suitable for everyone, but far from the most profitable for small companies. | The most common tax for small businesses. It is possible in companies with up to 100 employees. | Commonly used in the service and trade sectors. A limited list of activities and cities to which the system is applicable. |

|

| It is paid from income from its activities. | 6% of all income is paid - it is more profitable with small expenses; or 15% of profit (income minus expenses) - it is more profitable for large expenses if they are confirmed and taken into account. |

up to 50% of the amount paid in the PF. If there are no employees, reduction is possible up to 100% | An entrepreneur buys a patent for each specific type of activity. |

| Quarterly reporting | If there is no income, you do not need to pay | The tax will have to be paid even if there is no income. | |

| Once a year, it is submitted to the tax book of income-expenses |

Keeping records is simple, the rate depends on the type of activity, number of employees, area, and other parameters. Expenses are not taken into account. |

||

| No more than 100 employees. | No more than 15 employees | ||

Modes can be combined if desired. Only USN and OSNO are not compatible, you will have to choose one of them.

IP registration is best to start immediately with a simplified one. Later, you can easily switch to UTII or Patent.

Step by step instructions for opening

Below we compare all 3 methods that will be discussed. They are all free, so feel free to use them.

| Service "My business" | Through a bank "Dot" | On one's own |

| 15-20 minutes.

Fast completion of documents. |

15-20 minutes.

You spend time only on a call and a conversation with the manager. |

From 2 hours. It is long and dreary to fill everything without an automatic mode. |

| Clear understanding of the process | No need to go into the process | Easy to get confused and make mistakes |

| Is free | Is free | Is free |

| There are profitable affiliate programs with banks | You can not refuse to open a checking account | If you need a current account, you will have to look for a bank yourself |

| Automatic completion of addresses and codes | The main work will be done by specialists | You do everything by hand. |

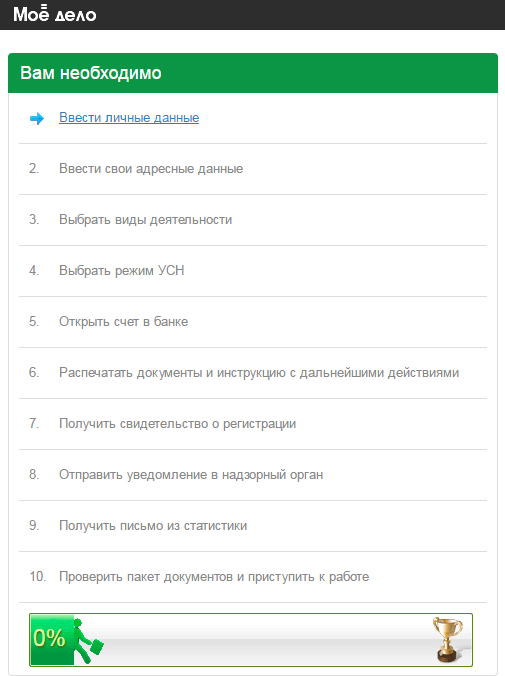

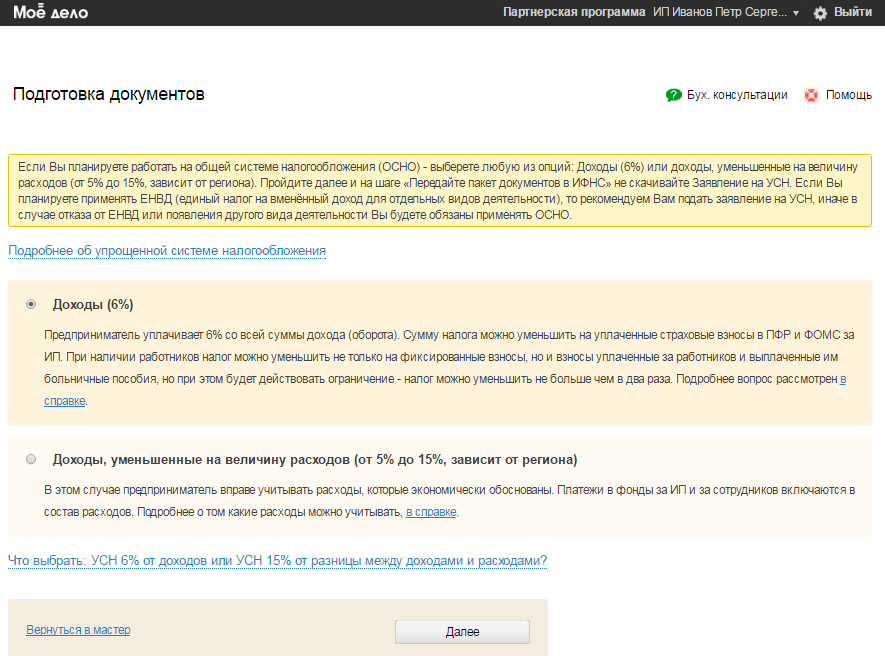

Method 1: IP registration via the Internet - service "My business"

The service generates all the documents for you and you do not have to fill out each one separately. This is a big plus!

To get started, you need go to the site "My business" and register.

This will take two minutes. Enter your name, email, phone number, come up with a password, and you can start registering an IP. Filling out documents for registration of IP in "My business" is free.

The service will clearly guide you and give hints during the registration process. The whole procedure will take approximately 15 minutes.

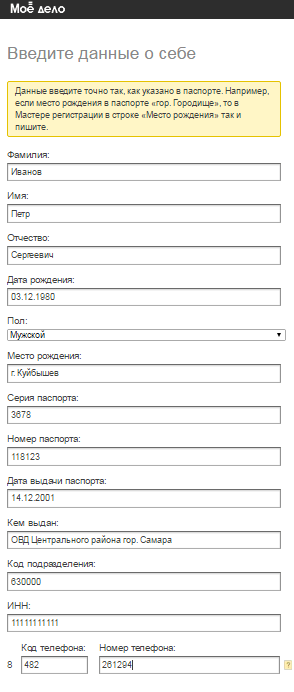

Step 1: Enter personal data

Get your passport and TIN. When filling out, please note that the place of birth (like all other items) is filled out strictly as indicated in the passport.

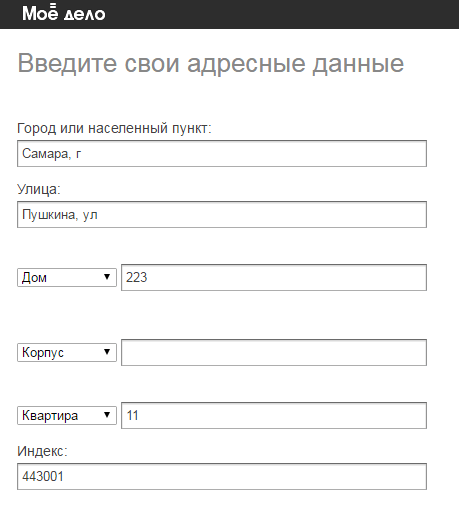

Step 2: Enter address data

First you need to enter an address, autocomplete will prompt you with the correct spelling of street names and will automatically give you a postal code and code for your tax division.

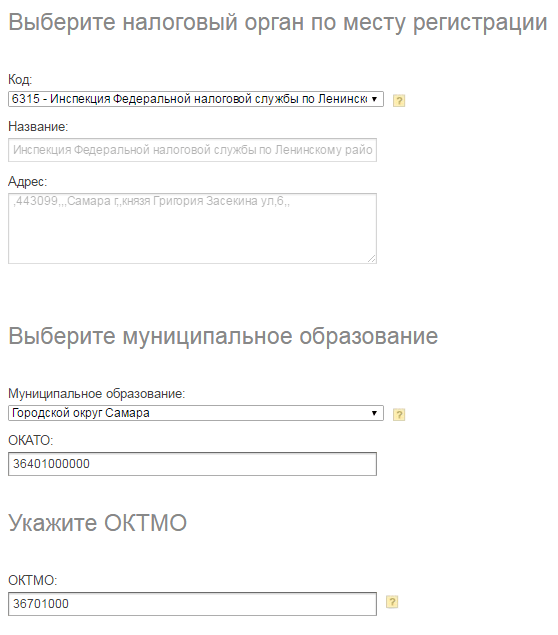

Step 3: Choose type of activity

The service greatly facilitates the selection of OKVED codes. It is enough to put one tick on the appropriate type of activity, as adjacent codes from all possible groups will be automatically selected. Choosing OKVED manually, you would be faced with a long and monotonous subtraction of the entire list. We mark everything even remotely suitable, then you will be asked to choose one main type.

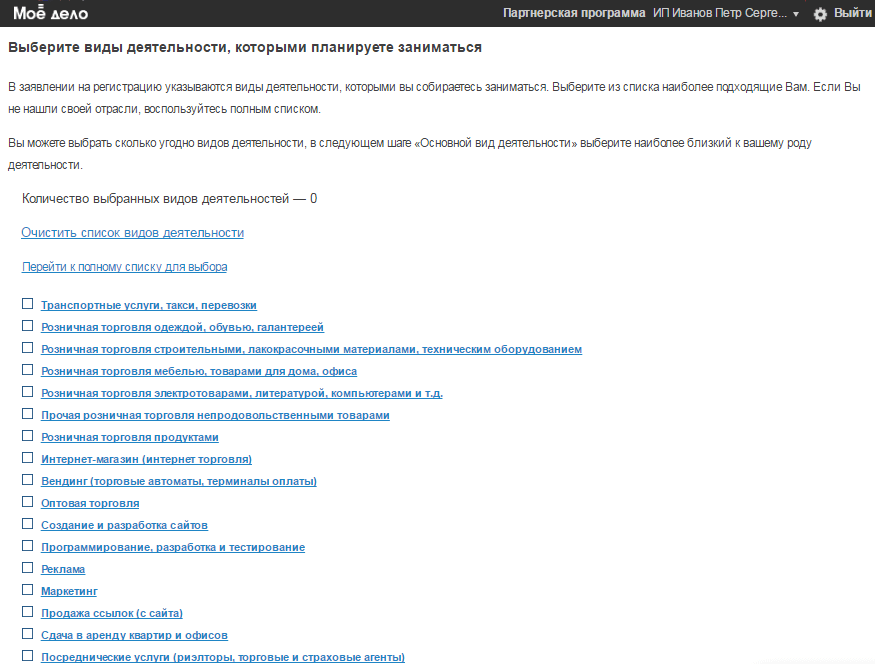

Step 4: Select USN mode (optional)

As a result, you will receive a completed application for the transition to the “simplification”, which will remain to be printed, signed and submitted to the tax office (this can be done immediately, along with other documents). If you decide to refrain from switching to the simplified tax system, then you can simply not print this application.

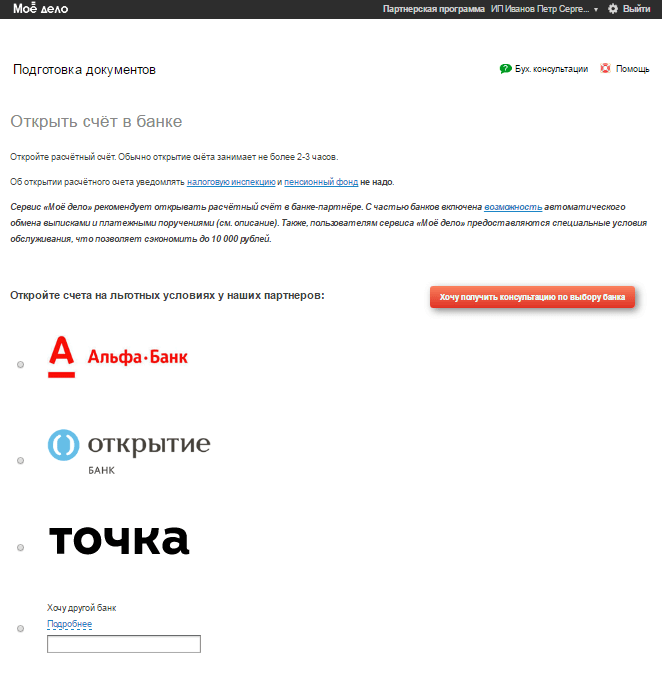

Step 5: Open a bank account (optional)

The service will offer you a list of partner banks with a description of their advantageous offers. You can also select the "Other bank" item, you will have to contact the bank yourself. We have already prepared for you banks for opening a current account for individual entrepreneurs.

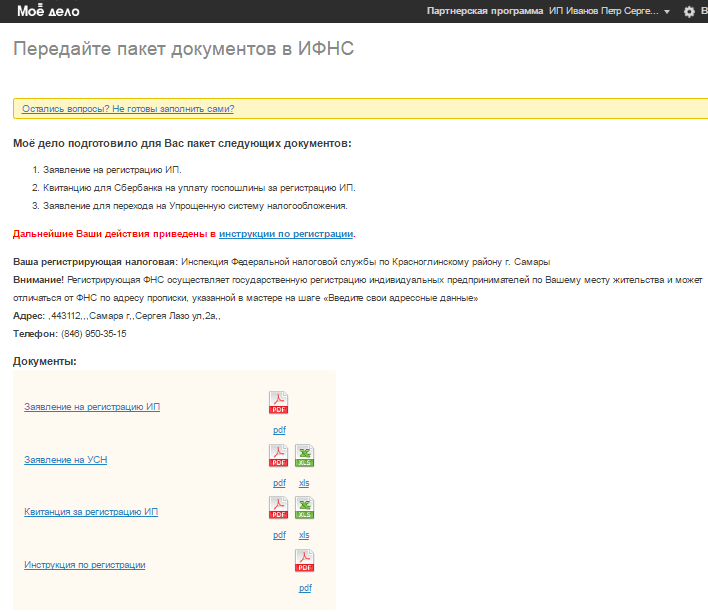

Step 6: Download and print documents, take them to the tax office

You will have access to download already completed:

- IP registration application;

- application for the transition to the simplified tax system;

- receipt for payment of duty;

Also, the service will give you a cheat sheet (step-by-step instructions) with the address of your tax office where you need to submit documents. It will contain information on what to do with documents, how to submit and what to do after registering an individual entrepreneur, etc.

Then you follow the instructions and thus do not make mistakes. As you can see, the service is good and convenient! Register and complete documents.

Method 2: Registration of an IP through Tochka Bank

In this method, all documents will be prepared for you free of charge + they will automatically open a current account at Tochka Bank (aka Otkritie Bank).

The method is not suitable if you do not plan to open your bank account.

Your actions during registration:

- Go to the bank's website;

- Leave your phone number;

- Waiting for a call, all documents will be filled in with your words;

- Meet with the manager, sign documents;

- Waiting for a letter from the tax office about the results of registration;

After successful registration of IP, a bank account will be automatically opened. It's fast and convenient! Moreover, the conditions for opening a current account at Tochka are beneficial for entrepreneurs.

Method 3: Self-registration of IP - step by step instructions

If you decide to go through the whole procedure on your own, routinely, then the procedure will be as follows:

Step 1. Fill out an application for registration of IP (Form 21001).

- You can manually on a printed form or electronically, but please note that if you choose electronic filling, on Sheet B, the name and signature will in any case have to be written by hand (with a black pen, printed capital letters). It is better to leave this place empty before coming to the IFTS and fill it out with a tax officer. This is a requirement in many regions.

- Any other corrections or additions by pen on the printed application are not allowed.

- If you are not personally applying to the tax office, then the signature must be certified by a notary (this service will cost about 500 rubles).

- There is no need to stitch or staple sheets. Documents should always be printed one-sided.

- If sheet 003 is not filled out, then it is not required to provide it.

Step 2 Pay state duty.

Step 3 Make photocopies of the passport (with registration) and TIN.

Step 4 Fill out an application for the simplified tax system (in duplicate), if you have chosen this type of taxation. You can apply immediately or within a month after registration.

Step 5 Submit the documents to the registration authority.

Step 6 Come back in three working days for results.

As you can see, everything will have to be filled in on the computer with your own hands, which is not very convenient. Therefore, use the first 2 methods better!

Samples of completed documents

Below you can view and even download sample documents for registering an individual entrepreneur.

Sample application for registration of IP

It looks like this:

- Download a completed sample application for opening an IP (Р21001)

- Download a blank application form for self-completion

Sample receipt for payment of state duty

Looks like that:

- Download sample receipt (Excel format)

- Sample receipt for payment of state duty (PDF format)

Sample application for the transition to the simplified tax system

It looks like this:

- Sample application for USN (PDF format)

- Download sample application for USN (Excel format)

How and where to pay the registration fee

For 2017-2018, the state fee for registering an individual entrepreneur is 800 rubles. It can be paid at Sberbank. What it looks like and its sample is above.

You can find out the details of your tax at the department itself or on the website nalog.ru. The CSC code depends on whether you will apply to the IFTS or the MFC. 18210807010011000110 and 18210807010018000110, respectively.

In some branches of the IFTS, payment terminals are installed, which simplifies the payment of state duty, because this can be done directly at the tax office.

We carry the completed documents to the tax office

So, the documents are collected, it's time to carry them to the tax office. Let's check the list:

- Application for state registration of IP.

- Photocopies of all pages of the passport.

- Photocopy of TIN.

- Paid State Duty Receipt.

- If you switch to the simplified tax system - the corresponding statement.

- If you are not a citizen of the Russian Federation - a photocopy of a residence permit or a temporary residence permit.

- If the actual postal address differs from the registration - Form No. 1A.

You can refer the documents immediately to the tax office, which was indicated when filling out the documents.

As confirmation of receipt of documents, the IFTS will issue you a receipt. Please note that even if registration is denied, neither the documents submitted for registration nor the paid state fee will be returned.

If you are unable to deliver the document in person

If a third party, and not you yourself, will submit and receive documents from the tax office, then you must:

- Fill out and notarize a power of attorney.

- Certify also a copy of your passport, your signature on the application.

If you send documents by mail, this should be done only with a valuable letter with an inventory.

Obtaining documents from the tax office

Consideration of documents by the IFTS will take 3 working days (previously it was 5), after which you will be successfully registered as an entrepreneur or will be refused.

At the tax office where the documents were submitted, you will be given:

- OGRNIP (Certificate of state registration of an individual as an individual entrepreneur).

- EGRIP (Extract from the state register of individual entrepreneurs).

- Form 2-3-Accounting (Notice of registration with the tax authority).

- Depending on the branch, a notification of registration with the FIU, a certificate of registration of the insured with the MHIF and a notification of the assignment of statistics codes from Rosstat may also be issued. If all or part of these documents were not issued to you by the tax office, then you will have to obtain them yourself.

If you put a corresponding mark on sheet B, then documents from the tax office can be sent to you by mail. They will be sent to your home address. To receive letters to the actual address, you need to submit an application in form No. 1A.

What to do after registration

The documents have been received, the registration of the IP in the tax office was successful.

- Check your details for Nalog.ru.

- Get registered in statistics, PF and for some types of activities in Rospotrebnadzor (depends on your OKVED, a list of codes for which registration is required can be downloaded here). The tax office does not always register an entrepreneur. Although it is generally accepted that you will be automatically registered with the Pension Fund and statistics, in reality this often does not happen, and you will have to do everything yourself. If you have employees, you will have to go to register for a pension without fail. More about processes.

- Order a print if necessary. An individual entrepreneur in the Russian Federation can work without a seal, but in many situations it is indispensable (for example, with regular banking operations), in addition, the presence of a seal will help save money on certification of signatures by a notary in the future. It can be ordered from any of the many seal and stamp companies by providing:

- photocopy of TIN;

- on one sheet a copy of the passport and residence permit;

- photocopies of OGRN and EGRIP.

- If non-cash receipts are planned, it is worth opening a bank account. You will need the same documents as for making a seal.

- If necessary, purchase and register with the tax office.

Why can they refuse to open an IP

Registration of an individual entrepreneur may be refused if:

- Documents are not presented all or not there.

- The documents contain errors or false information.

- The individual entrepreneur has already been registered or was declared bankrupt less than a year ago.

- Registration is hindered by a court verdict, there is a ban on entrepreneurial activity.

If you receive a refusal, you can appeal it to the IFTS. Only after that you can go to court, but such a procedure will be quite expensive. It is much cheaper and faster to submit documents again and pay the state duty.

What gives IP status

- This gives greater freedom both in the provision of services and in cooperation with other companies. A company providing services is more likely to conclude an agreement with an individual entrepreneur than with a simple individual, because relations with the latter can always be described as labor, with additional taxes being charged to the employer.

- You pay your own taxes and contributions to funds, which means that you manage your income yourself.

- Before the law, you are responsible with your property. Therefore, IP should always be careful and not get into debt.

Pros and cons of an individual entrepreneur in relation to a legal entity (LLC)

Answers to frequently asked questions

Is it allowed for an IP to change its name?

An individual entrepreneur has the right to come up with any name that does not infringe on the rights of another, registered company, but only the individual entrepreneur, full name, must be used in documents.

Is it possible to register an individual entrepreneur not by registration, but at the address of residence?

This option is possible only if you do not have a permanent residence permit, and a temporary one is given for a period of more than six months. After registration, you can engage in entrepreneurial activities anywhere in the territory of the Russian Federation.

Does an individual entrepreneur count the pension experience?

Yes. It starts from the day of registration and does not depend on the income of the entrepreneur.

Can an individual entrepreneur make entries in his labor?

Theoretically possible, but pointless. An individual entrepreneur has the right to hire himself, conclude an agreement with himself, enter this into the work book, but also pay pension and insurance contributions for himself as for an employee, which in practice is too expensive.

Can an individual entrepreneur get a job at another company?

Yes maybe. This will not affect your taxes as an entrepreneur, and the employer does not have to know that you have your own business.

Is an individual entrepreneur allowed to register under a temporary residence permit?

Maybe only when the address of permanent registration is not indicated in the passport. Even if you are registered in another city, documents can be sent by letter. In the future, you will be able to conduct your business in any city, regardless of the residence permit and place of registration of the individual entrepreneur.

Does an individual entrepreneur need a special TIN, different from the TIN of an employee?

No, an individual entrepreneur acts according to his TIN, regardless of when and where it was assigned. Each citizen has one TIN for life.

Do I need to rent a space?

Only if you need it for work. Sole Proprietors can also operate from home.

Conclusion

Congratulations, you are an entrepreneur! If this guide helped you, please share it on social media. networks and read other articles on our site. We talk in detail about all aspects of the business and always try to help our readers.

Good luck to you and your business!

Popular

- Bull and bear on the stock exchange: the "animal" face of the stock market

- Stages of opening a private dental office

- How to open your store - step by step instructions for beginners + real life example

- Sales revenue - formula and concepts

- What is the difference between margin and profit - calculation formulas

- Advice 1: How to switch from a simplified system to a system with VAT payment

- The concept of "car depreciation" - what is it?

- Business of yesterday: 7 main problems of modern realtors :: Opinions :: RBC Real Estate

- What is the difference between public and non-public types of joint-stock companies, partnerships and cooperatives?

- Simple business - private household plots (personal subsidiary plots)