We replace vacation with monetary compensation. Features of replacing vacation with monetary compensation Replacement of unused vacation with monetary compensation

We all know that annual paid leave or part of it can be replaced by monetary compensation. Meanwhile, not everything is so simple - sometimes the employer is simply obliged to refuse to pay compensation to the employee, and sometimes he does not even need the employee’s statement. After reading the article, you will learn in which cases vacation can be replaced with compensation, for which employees such a replacement cannot be made, how to document the replacement of part of vacation with monetary compensation, and how to calculate compensation for unused vacation upon dismissal.

The Labor Code provides for two cases of replacing vacation with monetary compensation:

- Art. 126 establishes that part of the annual paid leave exceeding 28 calendar days, upon the written application of the employee, can be replaced by monetary compensation;

- Art. 127 determines that upon dismissal, the employee is paid monetary compensation for all unused vacations.

Compensation for part of vacation while working

So, let's consider the first option of replacing vacation with monetary compensation - in accordance with Art. 126 Labor Code of the Russian Federation.Employees who are entitled to extended vacations (teachers ( Art. 334 Labor Code of the Russian Federation), disabled people ( Art. 23 Law no. 181‑FZ), minors, etc.) or additional leave (for irregular working hours ( Art. 119 Labor Code of the Russian Federation), harmful or dangerous working conditions ( Art. 117 Labor Code of the Russian Federation), work in the Far North and equivalent areas ( Art. 321 Labor Code of the Russian Federation), athletes and coaches ( Art. 348.10 Labor Code of the Russian Federation), medical workers ( Art. 350 Labor Code of the Russian Federation)).

First of all, we note that this provision gives the employer the right, but does not oblige him, to pay such compensation to the employee. That is, the employer can refuse the employee and provide him with leave in full.

A mandatory condition for payment of compensation is an application from the employee. Thus, the Astrakhan Regional Court changed the decision of the district court, which ordered compensation from the employer for part of the vacation exceeding its normal duration. In particular, the regional court indicated that for the employer to become obligated to pay the employee monetary compensation in lieu of unused vacation in excess of the normal duration, the employee must contact the employer with a statement of the appropriate content. As established by the court, the employee did not submit such a statement, and his filing a claim in court for payment of monetary compensation instead of granting the leave itself cannot replace his filing a corresponding statement with the employer. Thus, the employer did not have an obligation to pay monetary compensation ( Appeal ruling of the Astrakhan Regional Court dated December 12, 2012 in case No. 33‑3535/2012 ).

But even if the employer agrees to replace part of the vacation with compensation, he must refuse to allow certain categories of employees. Yes, according to Part 3 Art. 126 Labor Code of the Russian Federation It is not allowed to replace annual basic paid leave and annual additional paid leave with monetary compensation:

- pregnant women;

- workers under 18 years of age.

Additional annual paid leave granted to an employee on the basis of clause 5 art. 14Law of the Russian Federation of May 15, 1991 No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, due to the fact that this law does not provide for the possibility of such compensation ( Letter of the Ministry of Labor of the Russian Federation dated March 26, 2014 No.13‑7/B-234).

In addition, additional paid leave for work in harmful or dangerous conditions cannot be replaced. However, the following must be taken into account. By virtue of Part 2 Art. 117 Labor Code of the Russian Federation the minimum duration of annual additional paid leave for employees working in such conditions is 7 calendar days. Meanwhile, if an employee is entitled to leave of a longer duration, for example 10 days, then due to Part 4 Art. 117 Labor Code of the Russian Federation on the basis of an industry (inter-industry) agreement and collective agreements, as well as the written consent of the employee, formalized by concluding a separate agreement to the employment contract, part of the annual additional paid leave exceeding 7 days can be replaced by separately established monetary compensation in the manner, amount and amount conditions determined by industry (inter-industry) agreement and collective agreements. That is, in our example, the employee can count on compensation for 3 days of additional leave for work in harmful or dangerous conditions.

Let’s say an employee did not use vacation in the previous period, but this year he decided to take 56 days of vacation at once. At the same time, he wrote a statement asking to replace part of the vacation exceeding 28 days with monetary compensation. The question arises: is it possible to compensate for anything at all, and if so, how much? And the answer is contained in Part 2 Art. 126 Labor Code of the Russian Federation: when summing up annual paid leave or transferring annual paid leave to the next working year, monetary compensation may replace the part of each annual paid leave exceeding 28 calendar days, or any number of days from this part. Therefore, in the example under consideration, the employee does not have the right to payment of monetary compensation; the employer is obliged to provide 56 calendar days of annual leave.

Let's consider another situation that deserves attention. If an employee is entitled to extended leave (for example, 42 calendar days as a teaching employee), can he count on compensation? On the one hand, extended leave is the same guarantee for certain categories of workers as 28 days for everyone else. And the courts say that the law does not provide for the replacement of basic annual paid leave with monetary compensation (see, for example, Determination of the Moscow City Court dated December 26, 2011 No. 33‑41006 ). On the other side, Art. 126 Labor Code of the Russian Federation allows you to replace with compensation a part of annual leave exceeding 28 calendar days. Of course, “main paid leave” and “annual paid leave” are different concepts, because the latter consists of the main and other types of leave. And based on the terminology, the employer does not have the right to replace 14 days (42 - 28) of vacation. But since to date there have been no explanations from officials on this issue, a practice has developed in which employers satisfy the employee’s request and compensate in cash for part of the extended leave exceeding 28 days.

For clarity, we give an example of calculating the number of days subject to compensation.

I. I. Ivanov has been working as a packer of cosmetics since September 15, 2012. He has the right to 30 calendar days of basic paid leave as a group III disabled person. In the first working year he used 20 days of vacation, in the second - 21 days. How many days of vacation can he replace with monetary compensation?

For two full years of work, I. I. Ivanov has the right to 60 calendar days of vacation, but used only 41 days (20 + 21). Meanwhile, I. I. Ivanov has the right to replace with compensation only part of the vacation exceeding 28 days ( Art. 126 Labor Code of the Russian Federation). That is, he can apply to the employer for compensation for 4 days of vacation (2 days for each year of work), and he will have to take the remaining 15 days of vacation (28 + 28 - 41) off.

Let's briefly talk about processing compensation payments. In order for part of the employee’s vacation to be replaced with compensation, he must contact the employer with a corresponding application. The employer, on the basis of such an application and when making a decision on payment of compensation:

1. Issues an order , which might look like this (see example on page).

Regarding the calculation of compensation, we will say the following. Cash compensation for part of the vacation that exceeds 28 calendar days is determined by multiplying the average daily earnings, calculated according to the rules for calculating vacation pay, by the number of days replaced by compensation.

Limited Liability Company "Zima"

"LLC "Zima")

On replacing part of the vacation with monetary compensation

In accordance with Art. 126 Labor Code of the Russian Federation

I ORDER:

Replace with monetary compensation part of the annual paid leave granted for the period of work from September 15, 2013 to September 14, 2014, exceeding 28 calendar days in the amount of 2 days to packer Ivan Ivanovich Ivanov.

Reason: statement by I. I. Ivanov dated November 11, 2014.

Director Tsarev P. P. Tsarev

2. Enters information into a personal card (see example below) and vacation schedule (fill in column 10 “Note”).

VIII. VACATION

| Type of leave (annual, educational, without pay, etc.) | Work period | Number of calendar days of vacation | date | Base | ||

| With | By | started | graduation | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Annual main | 15.09.2013 | 14.09.2014 | 28 | 01.10.2014 | 28.10.2014 | Order from |

| paid | 24.09.2014 | |||||

| № 20 | ||||||

| Annual main | 15.09.2013 | 14.09.2014 | 2 | Replacement | vacations | Order from |

| paid | monetary | compensation | 13.11.2014 | |||

| № 25 | ||||||

Based Art. 139 Labor Code of the Russian Federation And Provisions on the specifics of the procedure for calculating average wages, approved By Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 , the average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.3 (the average monthly number of calendar days).

Let's use the conditions of example 1. I. I. Ivanov is supposed to compensate for 2 days of vacation. I. I. Ivanov’s salary is 20,000 rubles, the pay period has been fully worked out.

The billing period is from 11/01/2013 to 10/31/2014.

The average daily earnings of I. I. Ivanov will be 682.59 rubles. ((RUB 20,000 x 12 months) / 12 months / 29.3). Compensation for part of the vacation exceeding 28 calendar days will be equal to 1,365.18 rubles. (682.59 RUB x 2 days).

Compensation upon dismissal

Let us repeat that upon dismissal, all unused vacations are subject to compensation ( Part 1 Art. 127 Labor Code of the Russian Federation).Before calculating the number of vacation days subject to compensation, and, accordingly, the amount of compensation, it is worth remembering that all unused vacations can be provided to the employee with subsequent dismissal (except for cases of dismissal for guilty actions). In this case, the day of dismissal is considered the last day of vacation. But keep in mind that the employee must write a statement with the corresponding request, and the employer must not mind the employee taking vacations.

For your information

The employer has no obligation to provide leave followed by dismissal, even if the employee has asked for it in writing.

Some employers, when considering an application for leave with subsequent dismissal from an employee working under a fixed-term employment contract, immediately refuse, because they are afraid that the fixed-term contract will be transformed into an open-ended one: the leave will go beyond the end of the contract period and then it will be impossible to dismiss the employee... This is an opinion wrong. Part 3 Art. 127 Labor Code of the Russian Federation determines that upon dismissal due to the expiration of the employment contract, leave followed by dismissal may be granted even when the vacation period completely or partially extends beyond the term of this contract. In this case, the day of dismissal is also considered the last day of vacation. However, the last working day on which the employer must issue a work book, make final payments to the employee and take other actions related to dismissal will be the last working day before the start of the vacation.

That is why, when granting leave with subsequent dismissal upon termination of the employment contract at the initiative of the employee, the latter has the right to withdraw his resignation letter before the start date of the leave, if another employee is not invited to take his place by way of transfer.

If the employee does not express a desire to use leave with subsequent dismissal or the employer is against it, we proceed to counting the days subject to compensation.

How to determine the number of days of unused vacation? The Labor Code does not establish the procedure for counting them. Therefore, employers still focus on Rules on regular and additional leaves, approved NKT USSR 04/30/1930 No. 169 (valid to the extent that does not contradict the Labor Code of the Russian Federation), and clarifications from the Ministry of Labor.

Yes, according to paragraph 28 these Rules Employees dismissed for any reason who have worked for a given employer for at least 11 months, subject to credit towards the period of work giving the right to leave, receive full compensation. According to this rule, if an employee, for example, worked for a year and 11 months and did not use his vacation, he is entitled to compensation of 56 calendar days (28 days for the first year of work and 28 for the second).

Full compensation (that is, for 28 days) is also received by employees who have worked from 5.5 to 11 months if they quit due to:

- liquidation of an organization or individual parts of it, reduction of staff or work, as well as reorganization or temporary suspension of work;

- entry into active military service.

Note!

To determine the number of days to be compensated upon dismissal of an employee, the working year is taken, which is different for each employee and begins to flow from the date of hiring, and not the calendar year.

In all other cases, employees receive proportional compensation. Thus, proportional compensation is received by those who have worked from 5.5 to 11 months if they quit for any other reasons than those indicated above (including at their own request), as well as by all those who have worked for less than 5.5 months, regardless of the reasons dismissals.

To calculate, you need to determine how many days of vacation the employee is entitled to per month. To do this, divide 28 vacation days by 12 and get 2.33 days per month.

The employee has been working in the organization since March 10, 2011. The annual paid leave was 21 calendar days in 2012, 16 in 2013, 21 in 2014. He quits on 07/08/2014. How many days of unused vacation is he entitled to compensation for?

During the period of work:

- from 03/10/2011 to 03/09/2012 - he is entitled to 28 days;

- from 03/10/2012 to 03/09/2013 - 28;

- from 03/10/2013 to 03/09/2014 - 28.

If the employee had quit in the situation described in the example a little earlier, for example on June 22, 2014, he would have received compensation for fewer days of unused vacation. And that's why. According to clause 35 of the Rulessurpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to at least half a month are rounded up to the full month. Thus, the resigning employee would need to compensate for 28.99 days (22 + (2.33 x 3 months)).

Many people will have a problem: what to do with the numbers after the decimal point? Unfortunately, the legislator has not regulated this issue, so rounding remains at the discretion of the employer. However, if you want to make such a decision, you need to take into account that rounding here is not done according to the rules of mathematics, but in favor of the employee ( Letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334‑17 ). That is, if an employee, as in example 3, is entitled to 31.32 days, then compensation will need to be paid for 32 days.

Note!

Even if an employee has worked for a month or two, he is still entitled to compensation for unused vacation (according to clause 35 of the Rules, if an employee has worked for more than half a month, then he is already entitled to compensation).

Let us note that if labor legislation establishes an extended annual paid leave for an employee (longer leave for teaching and medical workers, disabled people, etc.), then the number of days of unused leave should be calculated as follows. For example, a teacher is entitled to 56 calendar days of annual paid leave, but he worked for 7 months. Then, upon dismissal, he needs to be compensated for 32.66 days (56 / 12 x 7).

When calculating the number of days of unused vacation, it is important to correctly determine the length of service for granting vacation. Why?

According to Art. 121 Labor Code of the Russian Federation The length of service that gives the right to annual basic paid leave includes the time:

- actual work;

- when the employee did not actually work, but in accordance with labor legislation, his place of work (position) was retained, including the time of annual paid leave, non-working holidays, weekends and other days of rest provided to the employee;

- forced absenteeism due to illegal dismissal or suspension from work and subsequent reinstatement to the previous job;

- removal from work of a person who has not passed a mandatory medical examination through no fault of his own;

- unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year.

Example 4

The employee was hired by the organization on October 25, 2013. In March 2014, he was granted unpaid leave of 21 days. The employee quits in November 2014, the last working day is the 13th. How many days of unused vacation will I be compensated for?

The employee’s working year for which annual paid leave is due is from 10/25/2013 to 10/24/2014. Since the length of service that gives the right to leave includes only 14 calendar days of unpaid leave, the end of the employee’s working year will have to be “shifted” by a number of days exceeding 14 - by 7. Thus, the working year will be from October 25, 2013 to October 31. 2014.

From November 1 to November 13, the employee worked another 13 days, but we do not take them into account, since due to clause 35 of the Rules surpluses amounting to less than half a month are excluded from the calculation.

Since an employee is entitled to 28 days of vacation per working year, this is the amount that is subject to compensation.

Additionally, we note: if the employee had not taken such a long “administrative” leave, then he would need to compensate 30.33 (28 + 2.33), since from October 25, 2013 to November 13, 2014, he worked for a year and 20 days, and, as we know , surpluses amounting to more than half a month are rounded up to the nearest full month.

Compensation for part-time workers

Sometimes the question arises about paying compensation for unused vacation to part-time employees. Some do not pay compensation at all, and some pay them only if the employee works externally (for another employer). Meanwhile, according to Art. 287 Labor Code of the Russian Federation guarantees and compensations provided for by labor legislation, collective agreements, agreements and local regulations are provided to part-time workers in full. Therefore, part-time workers have the right to count on compensation for unused vacation upon dismissal in the same way as employees at their main place of work, and the type of part-time job (internal or external) does not matter. This is also stated in clause 31 of the Rules.Summarize

In conclusion, I would like to say that monetary compensation can be replaced not only with the main unused vacation, but also with additional one. For example, if during work additional leave for harmful conditions cannot be replaced by monetary compensation, then upon dismissal the employer is obliged to make such a replacement. And remember that payment of compensation upon dismissal must be made on the employee’s last working day ( Art. 140 Labor Code of the Russian Federation). But the deadlines for paying compensation for part of the vacation exceeding 28 calendar days during work are not established by law, so we recommend enshrining them in the local regulatory act of the organization that establishes the rules of remuneration.Every officially employed citizen has a number of rights and freedoms that are protected by labor legislation. In particular, this concerns the right to a well-deserved rest or its compensation in monetary terms.

Right to compensation

According to labor legislation, replacing vacation with monetary compensation is possible if the employee voluntarily consents to this. For example, in 2016, an employee did not take his allotted vacation or part of it, thereby transferring it to 2017.

Not every employer can provide an employee with more than 28 calendar days of rest per year, so the remainder is usually compensated in cash. In fact, the unspent part of the vacation is replaced by additional payments. Article 126 of the Labor Code implies that monetary compensation is due only for that part of the vacation that exceeds the 28 calendar days established by law. For example, workers in the Far North are additionally entitled to 24 calendar days of rest. It is these that the employer can replace with a cash payment based on the average salary.

Compensation upon dismissal

Labor legislation in Article 127 clearly states that monetary compensation for unused vacation must be paid by the employer to the employee upon dismissal. The final payment includes payments for time worked, bonuses and additional funds due, and payments for vacations that were not used. The employee's right remains vacation followed by dismissal. For example, before leaving the workplace, a citizen has the right to receive all the rest days due, and not financial compensation. The work experience during the vacation period is not interrupted, and the employee retains his job. It is impossible to fire him during this period of time. An employee has the right to change his mind about resigning at his own request by writing a corresponding statement no less than 14 calendar days before the end of the employment contract.

Who has a vacation of more than 28 calendar days

Vacation of civil servants

According to the law, civil servants have the right to additional leave for length of service and irregular working hours. Rest days for length of service are accrued depending on the employee’s length of service. Read more in this

In addition to workers in the Far North, there are categories of workers who are entitled to rest for more than 28 calendar days. These categories have the right to replace vacation with cash compensation in 2020 at their own request. Such specialists are:

- teaching staff;

- medical workers;

- employees with disabilities;

- scientific workers of higher educational institutions;

- civil servants of the state civil service;

- workers performing research work.

Each employee in this area has the right to rest 28 calendar days a year at the expense of the employer, and for the remaining days to receive compensation in cash equivalent. The employer, in turn, has the right to refuse payment, insisting on proper rest for the employee.

How to get compensation

Since the employer has the right to refuse to replace annual paid leave with monetary compensation, the employee must know exactly how to receive the funds due to him. First of all, you need to write an application addressed to the manager, which indicates the period of additional paid leave, which should be replaced by a financial payment. The employer is obliged to consider the application within three working days, and then issue an appropriate order.

Who is not entitled to compensation?

Employees employed in complex, harmful and dangerous industries and who have vacations of more than 28 calendar days do not have the right to replace additional days with financial payments. First of all, this is due to working conditions, which are difficult and harmful to health. That is why the employer has the right to refuse to provide payments on legal grounds. As practice shows, partial compensation is paid to employees engaged in hazardous work, but in total they do not exceed seven calendar days of vacation.

How and when compensation for unused vacation is paid - see the video below:

Employees who are under 18 years of age at the time of their vacation cannot demand that their vacation be replaced with money. Article 126 of the Labor Code prohibits minors from receiving compensation in lieu of annual paid rest. The same rule applies to pregnant women going on maternity leave and employer-paid leave.

Registration of compensation

After receiving, reviewing and signing the employee’s application, the employer is obliged to issue an order for compensation for unused vacation according to the established model. The order includes a description of the period that must be replaced by a material payment; the exact dates are specified in the text of the order. In addition, the deadline by which payments must be accrued in full is indicated.

How is the amount calculated?

For unused vacation, compensation is calculated based on the employee’s average salary. The total annual salary is divided into 12 calendar months, and then divided by the average number of days in one month. The amount received is the average daily wage, which is the basis for calculating compensation for unused vacation. The number of days not taken off is multiplied by the average daily wage, where the result will be the amount of payment.

You can ask a lawyer any questions you have in the comments below.

The project is in full swing, deadlines are running out, the team is working to the limit of its capabilities, success is already close, and then... the time comes for another paid vacation for an employee who cannot be replaced within the framework of the project... Is this a familiar situation? Many employers are faced with the fact that vacations come unexpectedly and at the wrong time. And they are ready to go to great lengths to delay the rest of the necessary employees. The first thing that seems obvious is replacing vacation with monetary compensation. And everyone seems to be happy. The work continues, the employee can afford a vacation next time, and now receives a good increase in salary. But is it legal? And are there other ways out? Let's look at the Labor Code.

Can an employee work without vacation?

There are also professions and categories of citizens entitled to extended leave:

- Teachers (teachers).

- Medical workers.

- Athletes and coaching staff.

- Workers of the Far North.

For example, if an employer provides 30 calendar days of vacation annually, you can offer compensation to the employee for 2 of them.

Or, if in production the employee is entitled to standard basic leave and an additional 14 days, of which 7 are legally required for this industry, 7 days can be compensated with money. Please note that if an employee receives more vacation in the current year than the minimum required by law by transferring last year’s vacation, the difference cannot be replaced with compensation.

If compensation is the employee’s initiative, the employer has the right to refuse and send the employee on leave. If the replacement is initiated by the employer, the employee has the right to disagree.

How to document vacation compensation in cash

To correctly compensate for part of the vacation, you need to perform the following steps in order.

- If the replacement is initiated by the employer, you need to draw up a free-form report indicating the reasons why there was a production need to replace part of the leave. It is compiled by the production manager, department head or the employee’s immediate supervisor.

- Next, you need to notify the employee in writing against signature and obtain his consent in writing.

- If an employee requests compensation, he must draw up a written application in free form (sample).

- Next, you need to draw up an order for payment of compensation and familiarize it with the employee against his signature (sample).

- The HR specialist must make a note on the employee’s personal card, and also make clarifications in. In these documents you need to refer to the number of the corresponding order.

- Pay compensation to the employee via cash register or transfer to a bank card.

If the process is completed correctly, the labor inspectorate should not have any comments in the event of an inspection.

21.08.2019

If the employee's annual rest period exceeds the minimum 28 days, then additional days can be replaced with money.

To do this, you need the desire of the employee, expressed in the form of a statement, and the consent of the employer, issued in the form of an order. It is not always possible to replace and not for all workers.

In what cases is it allowed under the Labor Code of the Russian Federation in 2019?

Is it possible to replace additional days beyond 28?

It is additional vacation days over 28 that can be exchanged for monetary compensation.

The main part of the leave cannot be replaced.

An employee must take an annual vacation; for this, the Labor Code of the Russian Federation grants him the right to 28 calendar days of paid leave.

If it is not used in the current year, then these do not need to be compensated with money, they should be transferred to the next year.

Failure to provide time for rest for more than 2 years in a row is prohibited.

Responsibility for violating this rule falls on the employer.

If an employee has not rested for 2 years, and the regulatory authorities become aware of this, the employer will be fined.

The employee does not suffer any losses in such a situation and is not punished. His vacation is accumulated, he can take it off later (the days do not expire) or receive compensation upon dismissal.

If the employer pays compensation for the main part of the rest during work, then both the organization itself and its manager will face a fine.

Fines:

- for an organization: from 30,000 to 50,000 for the initial detection of a violation, from 50,000 to 70,000 for repeated detection;

- for a manager: from 1000 to 5000 for primary, from 10,000 to 20,000 for repeat.

You can use the right to replace vacation with compensation under Article 126 of the Labor Code of the Russian Federation only in relation to additionally provided days.

If the annual leave is 28 days, then no replacement is allowed until the person resigns.

Upon dismissal, he is paid compensation for all unused vacation days.

Those categories of employees who have the right to additional days can receive money instead of vacation days:

- for irregular work;

- for harmful and dangerous conditions - for additional days over 7;

- working in the Far North or in areas equivalent to them - from 16 to 24 days;

- for the special nature of the work - the duration is established by the Government of the Russian Federation.

Is it punishable for hazardous working conditions?

An additional 7 days of paid leave are provided for harmful and dangerous working conditions, but they cannot be replaced with cash payments.

The employee must rest 28 + 7 days annually to restore strength and health.

Harmful and dangerous working conditions are established based on the results of a special assessment; additional leave is granted if the conditions are recognized as harmful to degrees 2,3 or 4, as well as if they are recognized as dangerous.

7 additional days for harmful work are provided on the basis of Article 117 of the Labor Code of the Russian Federation.

If the employment or collective agreement at the enterprise establishes a longer duration of additional leave, then days over 7 can be replaced with cash payments.

Thus, when working in harmful and dangerous conditions, an employee must rest at least 35 calendar days annually; for days in excess, compensation can be received.

To do this, the employee needs to write an application addressed to the manager.

How to get paid for irregular working hours?

This is what the sample looks like:

This is what the sample looks like:

Upon dismissal

Upon termination of the employment relationship, all unused vacation time. ?

Money is paid for both the main and additional parts in the event that the employee does not take time off.

The procedure does not require any registration.

The accountant automatically makes calculations if a dismissal order is issued.

Payment is made on the last working day. Compensation is issued minus the withheld personal income tax.

The employer must pay income tax no later than the next day after payment.

In addition, insurance premiums must be calculated from the accrued amount and transferred to the budget by the 15th of the next month.

Useful video

In what cases is it possible to replace vacation with monetary compensation, what documents need to be drawn up, and what categories of employees will not be able to replace vacation - this video explains in detail:

conclusions

You can replace rest time with money, but for this it is important to comply with the requirements of the Labor Code of the Russian Federation. There are categories of workers who must rest for the prescribed time without any replacements.

During work, an employee can receive money only for that part of the vacation that is provided in addition to the main duration.

The fact that when an employee is dismissed for unspent vacation days, he is entitled to monetary compensation is probably known to every accountant. Is it possible to pay compensation to a working employee who did not take all the vacation days allotted for the year? Article 126 of the Labor Code of the Russian Federation provides such an opportunity, but in strictly limited cases. In addition, for you as an employer, replacing vacation with compensation for a working employee is a right, not an obligation. That is, if you wish, you can refuse to pay the employee money instead of vacation. And if you still agree to such a replacement, read the article for details on how to arrange it correctly.

Note.Replacing vacation with monetary compensation is the employer’s right, not his obligation.

Who should not replace vacation with monetary compensation?

The employee asks you to replace the vacation with monetary compensation. And before you grant his request, you should make sure whether the employee is one of the people for whom you cannot replace vacation with money. The list of such persons is provided for in Part 3 of Article 126 of the Tax Code of the Russian Federation. These include:

- pregnant women;

— workers under the age of 18;

— workers exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant (see also letter of the Ministry of Labor of Russia dated March 26, 2014 N 13-7/B-234);

— workers engaged in work with harmful and (or) dangerous working conditions. There is, however, an exception here.

Thus, you can replace with monetary compensation a part of the annual additional paid leave for Chernobyl victims that exceeds its minimum duration - 7 calendar days (Parts 2 and 4 of Article 117 of the Labor Code of the Russian Federation).

Accordingly, if your employee does not fall into any of the specified categories of persons, then you can replace his vacation with monetary compensation.

How many vacation days can be replaced

The maximum number of vacation days that can be replaced by compensation is not established by law. However, you also do not have the right to replace the employee’s entire vacation with monetary compensation.

The provisions of Part 1 of Article 126 of the Labor Code of the Russian Federation allow compensation to be paid only for that part of the vacation that exceeds 28 calendar days.

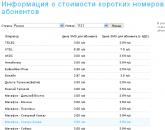

Consequently, your employees can count on a replacement only if you provide them with extended basic or additional leave (Articles 115 and 116 of the Labor Code of the Russian Federation). In the table on p. 28 we have listed the categories of employees who are entitled by law to extended basic and additional leave.

List of employees who are required to be granted extended basic or additional leave

| Category of workers | Grounds for granting leave | Minimum duration of leave |

| Extended main leave | ||

| Workers under 18 years of age | Art. 267 Labor Code of the Russian Federation | 31 calendar days |

| Working disabled people (regardless of disability group) | Art. 23 Federal Law of November 24, 1995 N 181-FZ | 30 calendar days |

| Additional leave | ||

| Workers engaged in work with harmful and (or) dangerous working conditions | Art. 117 Labor Code of the Russian Federation | 7 calendar days |

| Employees with a special nature of work | Art. 118 Labor Code of the Russian Federation | The period is determined by regulations of the Government of the Russian Federation |

| Workers with irregular working hours | Art. 119 Labor Code of the Russian Federation | 3 calendar days |

| Employees working in the Far North (including part-time) | Art. 321 Labor Code of the Russian Federation | 24 calendar days (16 calendar days for areas equated to regions of the Far North) |

| Workers exposed to radiation as a result of nuclear tests at the Semipalatinsk test site | Clause 15 Art. 2 of the Federal Law of January 10, 2002 N 2-FZ | 14 calendar days |

| Workers exposed to radiation due to the Chernobyl disaster | Clause 5 Art. 14 Law of the Russian Federation dated May 15, 1991 N 1244-1 | 14 calendar days |

But even if your employees do not fall under the specified list, you can set additional leave for them yourself (Part 2 of Article 116 of the Labor Code of the Russian Federation). In this case, be sure to specify in the collective agreement or other local regulatory act the procedure and conditions for granting such leave.

Note.The employer has the right, at its discretion, to provide employees with additional leave.

If in one working year an employee did not take part of the vacation of 28 calendar days and transferred them to the next year, he will not be able to replace these days with compensation. Only vacation days exceeding 28 calendar days of the main vacation each year are subject to cash replacement.

Example 1. M.E. Sobolev has been working at AvtoLombard LLC since May 14, 2012. According to the employment contract, he has the right to paid leave of 28 calendar days for each working year. In the first working year (from 05/14/2012 to 05/13/2013) he used 21 calendar days of vacation. In the second working year (from 05/14/2013 to 05/13/2014) - 26 calendar days. For two working years, out of 56 calendar days (28 calendar days + 28 calendar days), he used only 47 days. 9 calendar days remain unused. Can he replace these unused days with monetary compensation? No, in this case the employee does not have the right to replace part of the vacation with monetary compensation. Since the duration of his annual paid leave is only 28 calendar days. And only days exceeding the specified limit for each year of operation are subject to replacement.

How to replace vacation with cash compensation

To replace part of your vacation with monetary compensation, you need:

— receive a statement from the employee with a corresponding request;

- issue an order;

— make an entry about replacing vacation with compensation in the employee’s personal card;

— enter information about vacation replacement into the vacation schedule.

Let's look at these steps in more detail.

Step 1. Employee application. Replacement of vacation with monetary compensation is carried out at the request of the employee, which he reflects in his application. It should be written to the head of the company (individual entrepreneur). The law does not establish the form of such an application, so the employee can draw it up in any form. A sample employee application to replace vacation with monetary compensation is presented above.

to CEO

LLC "AvtoLombard"

Efimov P.S.

Statement

In accordance with Article 126 of the Labor Code of the Russian Federation, I ask you to replace with monetary compensation part of the additional paid leave for the period from August 1, 2013 to July 31, 2014 in the amount of 4 (four) calendar days.

Date: 07/28/2014

Step 2. Employer's order. If you agree to replace part of the employee’s vacation with monetary compensation, you must issue an appropriate order.

There is also no unified form for such an order. Therefore, compose it in any form. Indicate in it the full name and position of the employee, the number of days of the billing period and vacation to be replaced by monetary compensation. Also reflect the basis for issuing this order - details of the employee’s application. A sample of an order to replace part of the vacation with monetary compensation is presented below. Be sure to familiarize the employee with the order and sign it.

Limited Liability Company "AvtoLombard"

Order

On replacing part of the vacation with monetary compensation

In accordance with Article 126 of the Labor Code of the Russian Federation

I order:

Reception department manager O.V. Simonova to replace with monetary compensation part of the additional paid leave granted for the period of work from August 1, 2013 to July 31, 2014, exceeding 28 calendar days, in the amount of 4 (four) calendar days.

Reason: statement by O.V. Simonova from 07/28/2014

General Director Efimov P.S. Efimov

I have read the order:

Manager Simonova O.V. Simonova

29.07.2014

Step 3. Employee’s personal card. After completing the order, information about replacing part of the paid leave with monetary compensation must be reflected in the employee’s personal card. This information is reflected in section VIII “Vacation”. A fragment of filling out an employee’s personal card is presented above.

Employee personal card (fragment)

| Type of leave (annual, educational, without pay, etc.) | Work period | Number of calendar days of vacation | date | Base | ||

| With | By | started | graduation | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Annual basic paid | 01.08.2013 | 31.07.2014 | 28 | 01.04.2014 | 28.04.2013 | Order dated 08/07/2013 N 15-dated |

| Additional paid | 01.08.2013 | 31.07.2014 | 4 | Replacing vacation | monetary compensation | Order dated June 30, 2014 N 136-ls |

Step 4. Vacation schedule. You should also reflect information about replacing part of the vacation with monetary compensation in the vacation schedule. To do this, make an entry in column 10 “Note”. Be sure to indicate the number of vacation days to be replaced and the details of the order. The entry in column 10 of the vacation schedule may be as follows: “Part of the additional paid leave in the amount of 4 (four) calendar days was replaced by monetary compensation based on order No. 136-ls dated July 29, 2014.”

How to calculate compensation

To determine the amount of monetary compensation to be paid to the employee, you need to multiply the average daily earnings by the number of days replaced by compensation.

Note.The amount of monetary compensation paid in lieu of vacation is calculated based on the employee’s average daily earnings.

The average daily earnings in this case are calculated according to the rules for calculating vacation pay. They are established by Article 139 of the Labor Code of the Russian Federation and clause 10 of the Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

So, if the employee worked the entire billing period, you should divide the actual amount of the employee’s salary for this billing period by 12 and by 29.3 (the average monthly number of calendar days).

If one or more months of the billing period are not fully worked out or there were excluded periods, then the average daily earnings are calculated as follows. First, determine the number of calendar days in fully worked calendar months:

KDMP = KMP x 29.3,

where KDMP is the number of calendar days in fully worked months of the billing period;

KMP - number of fully worked months;

29.3 is the average monthly number of calendar days.

KDMN = 29.3: KKDMN x CODE,

where KDMN is the number of calendar days in a month that is not fully worked;

KKDMN - the number of calendar days of the month that is not fully worked;

CODE - the number of calendar days worked in a given month.

If there are several months that are not fully worked, then the number of calendar days must be determined for each of them. And then add up the results.

Then calculate the total number of calendar days taken into account when determining average earnings:

KKD = KDMP + KDMN,

where KKD is the number of calendar days taken into account when calculating average earnings.

Finally, determine your average daily earnings:

NW = NE: KKD,

where SZ is the average daily earnings;

SV - the amount of payments accrued to the employee in the billing period.

Example 2. An employee of AvtoLombard LLC, O.V. According to the employment contract, Simonova is entitled to additional leave of 4 calendar days. She appealed to the employer with a request to replace this part of the vacation with monetary compensation. The billing period is from August 1, 2013 to July 31, 2014. From April 1 to April 28, 2014 O.V. Simonova was on regular vacation for 28 calendar days. And in January 2014, the employee was sick for 10 days. The remaining months of the billing period have been fully worked out.

Over the last 12 calendar months, payments in favor of the employee amounted to 420,500 rubles, of which vacation pay was 29,800 rubles. and payments for a certificate of incapacity for work - 9200 rubles. We will calculate the amount of compensation that the employee is entitled to.

First, we determine the number of calendar days in fully worked months. It is 234 days. (8 months x 29.3 days). Now let's calculate the number of days in months not fully worked. For January 2014 it is equal to 19.85 days. (29.3 days: 31 days x 21 days), for April 2014 - 1.95 days. (29.3 days: 30 days x 2 days). The total number of days in months not fully worked was 21.8 days. (19.85 days + 1.95 days).

The number of calendar days taken into account when calculating average earnings is 255.8 days. (234 days + 21.8 days). The payments taken into account do not include average earnings maintained during vacation and temporary disability benefits. Therefore, vacation pay must be calculated based on RUB 381,500. (RUB 420,500 - RUB 29,800 - RUB 9,200). The average daily earnings for calculating compensation will be 1,491.4 rubles. (RUB 381,500: 255.8 days). The amount of compensation to be paid to O.V. Simonova, will be 5965.6 rubles. (RUB 1,264.04 x 4 days).

Please note that labor legislation does not define the period within which you must pay compensation to the employee in lieu of vacation. But we recommend doing this on the next day established for payment of wages.

Note. FAQ

Is it possible to replace study leave with monetary compensation?

No. Labor legislation allows only part of the annual paid leave to be replaced with monetary compensation (Articles 126 and 127 of the Labor Code of the Russian Federation). And your employee’s study leave is not related to annual paid leave. It is considered additional targeted leave related to training (Articles 173-176 of the Labor Code of the Russian Federation).

What will happen to us if we replace an employee’s vacation not exceeding 28 calendar days with money?

In this case, you may be held accountable under Article 5.27 of the Code of Administrative Offenses of the Russian Federation for violating labor laws. The head of the company faces a fine of 1,000 to 5,000 rubles. For a repeated violation, he may be disqualified for a period of one to three years. And an organization can be fined in the amount of 30,000 to 50,000 rubles, and an entrepreneur - from 1,000 to 5,000 rubles. Instead of a fine, the organization and businessman may face suspension of activities for up to 90 days. True, this violation can only be detected if the labor inspectorate comes to you with an inspection.

What taxes and contributions should be charged on compensation paid?

As a general rule, compensation paid in lieu of vacation is the employee’s income. It is not mentioned in the list of payments not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation). Accordingly, from its amount you need to calculate, withhold and transfer personal income tax to the budget. About this - letter of the Federal Tax Service of Russia dated March 13, 2006 N 04-1-03/133. Personal income tax should be paid to the budget on the day you receive money from the bank to pay compensation or on the day it is transferred to the employee’s bank account.

Also, the amount of compensation paid to the employee is subject to contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund. This is directly provided for by subparagraph “and” of paragraph 2 of part 1 of article 9 of the Federal Law of July 24, 2009 N 212-FZ and paragraph 13 of subparagraph 2 of paragraph 1 of article 20.2 of the Federal Law of July 24, 2009 N 125-FZ. This conclusion is also confirmed by the regulatory authorities (letter of the Federal Insurance Service of the Russian Federation dated November 17, 2011 N 14-03-11/08-13985).

Popular

- Transferring leave due to sick leave: registration rules

- Features of replacing vacation with monetary compensation Replacement of unused vacation with monetary compensation

- We draw up a work schedule (shifts)

- Establishing irregular working hours

- Talent management Talent management training and development of personnel

- Report on the topic: "My future profession"

- Presentation on the topic "body impulse"

- Materials science of chemical fibers Chemical fibers chemistry presentation

- Profession pilot Pilot what does he do? flies

- Concierge job description