Filling out a time sheet for vacation. Time sheet - filling out a sample

It’s not difficult if the team is small. But what if the departments are remote from each other or the employees’ schedule is non-standard? Even a specially hired timekeeper will not help here. It is necessary to establish high-quality collection of information.

Defining goals

Before starting any project, we need to understand what goal we are pursuing, what results we want to get and how to use them. So, the goal: to collect information about the dates of work, vacations, absences of all employees of the organization on precisely defined dates for the correct calculation of wages and strengthening of discipline. To achieve this goal, the involvement of department heads will be required; only they know reliably about the work dates of their subordinates. For this venture to succeed, you need to enlist the support of management and accounting. Of course, getting bosses to do extra work, even simple ones, can be difficult, but if you draw up a Regulation on Time Records and order to oblige everyone to follow it, the chances of success will increase.

We are developing Regulations on Time Records

Like any other local regulatory act, this Regulation must contain the following main sections:

General provisions. It describes the purposes of the time sheet and determines the circle of persons to whom it concerns.

Main part includes a description of the process. Here you must write:

- Responsibilities of managers for keeping timesheets

- Filling procedure

- The procedure for submission to the HR department or accounting department - in electronic and paper form

- Dates of transfer of timesheets (2 times a month - for advance payment and salary)

- Procedure in the absence of information about the reasons for absences from work

- Procedure for recording (if required) working hours

In the main part, you need to take into account the specifics of the enterprise, for example, keeping a log of local business trips, working hours for traveling positions, recording lateness, etc. The filling procedure in these cases should be as clear as possible.

Responsibility for failure to provide a report card, the procedure for replacing managers on vacation or in case of illness.

Application- a sample form in the T-13 form for working days, vacations, absenteeism, sick leave, etc.

Of course, in our time, hardly anyone will hand over paper timesheets, and therefore you need to send out an electronic version of the document to everyone. To make it easier to get started, you can immediately fill it with a list of employees. At the bottom of the electronic document you need to make a “cheat sheet” with letter symbols. This will be of great help to bosses who are far from keeping personnel records. Ask to highlight in color all days of deviations from the normal work schedule, this will make processing the tables much easier.

Step-by-step instructions for organizing timekeeping

Theory is great, but practice is usually very different from it. What steps should be taken to achieve results - timely provision of time sheets from all departments?

who should send you the report card, in what form and on what dates. As a rule, this is 2-3 days before the advance and salary payment dates;

responsibilities of responsible persons - monitoring attendance at work, lateness, and other deviations from the standard schedule;

the procedure for informing the HR department about cases of work on holidays, overtime, etc.

Meeting. It doesn’t matter whether it’s a general meeting of all bosses or just a business conversation with the director - you can’t do without this step. There needs to be a compelling case for why providing working time data is important. Give examples of errors in salary calculations due to lack of information, late reporting of absenteeism or sick leave. The main thing is to enlist the support of management and accounting.

Regulations on time records. It is unlikely that you will be able to find a document absolutely adapted to your organization; you will have to work hard yourself. Identify important points:

Order of approval Provisions and obligations to comply with it. It, as well as the Regulations, must be familiarized to all persons involved. Sometimes in large branches and separate departments, timesheet maintenance is entrusted to a secretary, assistant, etc. If so, we introduce them too.

Sample report cards by department with a list of names. Of course, it is not necessary to make a list, but this way you will help managers and help them not to “lose” anyone. Send samples by email and indicate your availability to answer questions.

Execution control. In the first months you will have to deal with constant reminders about the report card, but gradually everything will return to normal. Mark your calendar for target dates and send everyone a reminder.

Influence measures. Often bosses refer to being busy or simply forget to keep time records. If reminders do not help, send a message to everyone who did not submit a message like “I am notifying you that the names of managers who do not comply with the Regulations on time sheets will be transferred to the general director if information is not provided on the 1st day of the month.” This, of course, is an extreme measure, since much greater results can be achieved with personal favor and a good attitude than with pressure and intimidation.

Sample Regulations on Timesheets of Working Time

We take into account the nuances of the organization

Each enterprise has its own characteristics and they need to be taken into account. Determine how the processes of transferring information to the HR department will occur in your case:

- Is a paper document required?

- Based on the data received, will you create one, general timesheet or will there be several of them?

- Is factual information needed about hours worked that does not affect salary?

- How to designate overtime, work on weekends and holidays?

- On what dates should leave requests be submitted?

- Do you need information about sick leave immediately after they open?

- In what time frame do you want to receive closed sick leave?

There can be any number of nuances, sometimes they are revealed during the accounting process.

Timekeeping at an enterprise is a conscious need for any company, and any responsible and patient employee can establish it; you just need to show persistence and consistency.

In the process of studying the rules for recording working hours, we will repeatedly refer to the following regulations:

In 2015, a clarification was made to the Labor Code of the Russian Federation: if the seasonal or technological nature of production requires an increase in the accounting period, an industry (inter-industry) agreement and a collective agreement may provide for an increase in the accounting period for recording the working time of such employees, but not more than up to one year. So far, however, no such agreements have been developed, which means that enterprises cannot unilaterally abandon the maximum duration of the accounting period of 3 months.

Another difficult issue for the employer is the shortfall that arose at the end of the accounting period. This may be the result of poor shift scheduling. If an hourly wage system is established for such an employee, his level of income decreases, which means that the employer is obliged to pay additionally up to the level of average earnings. The reason for unfinished shifts can also be force majeure circumstances when external factors are to blame. In this case, the employer must retain 2/3 of the tariff rate or salary for the employee in proportion to the time worked (Article of the Labor Code of the Russian Federation).

The opposite situation is when an employee is overworked. The difficulty lies in the fact that the personnel officer learns about the overtime only at the end of the accounting period when comparing the actual time worked and the norms of the production calendar. When making calculations, remember about days not legally worked: vacation, time off, sick leave, etc. - they all reduce the norm. Next, determine whether the employee worked on holidays during the accounting period. These days have already been paid at least double the amount (Article of the Labor Code of the Russian Federation), therefore these hours (days) should not be paid additionally as overtime (clause 4 of the Explanations, approved by the Resolution of the Presidium of the All-Russian Central Council of Trade Unions; Decision of the Supreme Court of the Russian Federation). If, after all the calculations, the employee still has hours worked in excess of the norm, the employer pays them at an increased rate: the first two hours - no less than one and a half times the rate, the subsequent ones - no less than double (Article of the Labor Code of the Russian Federation).

We emphasize that it is extremely important to comply with the rules for recording working hours. This affects the calculation of wages and additional payments for work in conditions that deviate from normal ones. Correctly filling out a time sheet allows you to correctly pay the employee for his work and, importantly, take into account all the actual time worked in his work experience.

Any enterprise pays wages based on actual hours or days worked. This data for accounting and payment of wages according to time worked requires a special form for primary accounting. This form is considered to be a time sheet.

Below is information about this document, its completion instructions according to the working hours worked at the enterprise.

Why is this document necessary and why should it be drawn up?

We should start with the fact that a time sheet is a document that every employer or his authorized representative at the enterprise is required to maintain, regardless of the number of employees and the form of ownership in the staffing table.

If this document is not present at the enterprise, this will lead to management liability in the form of fines during inspection by the labor protection authority.

In the case where wages occupy a very significant place in the costs of an enterprise, documents during a tax audit may give rise to a hypothesis regarding the groundless accrual of salary and its exclusion from the list of expenses of the enterprise. In this case, unpleasant consequences will occur.

Forms T-12 and T-13: rules and stages of filling out

The accounting sheet is maintained every working day of the month, and on the last day, a report is prepared on the total number of days/hours worked. The completed document is sent to the accounting department.

Let us give an example of instructions for filling out a time sheet and calculating wages, using forms T-12 and T-13 as a basis. They are not significantly different.

- At the top, you should indicate the name of the organization in accordance with the constituent documents and the name of the structural unit, if any.

- The “date of compilation” (last day of the working month) and “document number” cells are filled in.

- The “reporting period” indicates the time interval from which the salary is calculated according to the plan.

- The first column in the time sheet indicates the serial number of employees.

- Columns 2-3 are filled out on the basis of personal cards of employees in accordance with the T-2 form, established on the basis of an order for admission to the enterprise.

- Columns 4 and 6 are intended for working time cost codes and information about the number of hours worked in the past month.

- Columns 5 and 7 are intended to mark intermediate results for two halves of the month.

- Columns 8-17 are filled in at the end of the reporting month.

- The final count of days does not include days of absence of the employee (sick leave, business trips, absenteeism, weekends).

- Columns 14 and 16 are filled with the number of days and hours.

- 15 – reason code for absence from work

- 17 – the total number of employee holidays and days off for the reporting month.

The document is signed by an employee of the HR department, structural unit, director or any person authorized by him.

Drawing up time sheets for shift work and other nuances

According to Article 91 of the Labor Code of the Russian Federation the employer must keep records of the actual time worked by each employee. Working hours are paid according to physical location at the place of work. They are calculated by recording attendance and absence from work.

Shift work is a condition of the collective agreement and must be documented. Shift work can be carried out exclusively according to the shift schedule in accordance with Article 103 of the Labor Code of the Russian Federation. It takes into account daily working hours and shift frequency. The shift schedule in this case acts as a local independent regulatory act.

To approve work on night shifts, it is required that the work be included in the list determined by the contract or act of the employer under Article 97 of the Labor Code of the Russian Federation.

In practice, the daily work schedule of the “time mode” is most often used. In the time-sheet mode, shifts worked per month are taken into account, and its duration should be the same throughout the entire period. Work performed in excess of the duration cannot be compensated by missing work on another day or by taking time off.

In practice, the daily work schedule of the “time mode” is most often used. In the time-sheet mode, shifts worked per month are taken into account, and its duration should be the same throughout the entire period. Work performed in excess of the duration cannot be compensated by missing work on another day or by taking time off.

If the conditions of the enterprise do not allow compliance with the working conditions in accordance with Article 94 of the Labor Code of the Russian Federation, they introduce summarized recording of working time. Shift work can be combined with the introduction of time tracking. The procedure for introducing summary accounting in a company is regulated exclusively by internal labor regulations. Article 104 of the Labor Code of the Russian Federation only requires not to exceed the nominal number of working units per month.

The following video describes in detail the procedure for maintaining time sheets:

Sanctions for filling out the timesheet incorrectly

In the course of tax and financial audits, auditors may find the following types of violations in filling out the accounting sheet:

- salary data does not correspond to those indicated in the primary reporting documents and timesheets;

- salary data does not correspond to that indicated in payment and settlement documents and timesheets;

- the use of codes and designations is incorrect;

- overtime or overtime is not taken into account;

- calculation of the amount of benefits on a temporary disability certificate.

Violations may result in penalties being imposed on the accountant or employer up to 5000 rubles. Failure to have a report card or its absence at the workplace during an audit by auditors may result in administrative penalties in accordance with Article 5.27 and the imposition of penalties on the head of the unit in the amount up to 50,000 rubles.

Time tracking is a very important task. The employee does not want to lose his hard-earned money, and the organization, in turn, does not seek to pay for absenteeism.

Timely and correct maintenance of reporting documentation for recording working hours will help to avoid such misunderstandings.

What is it for?

A working time sheet is an established document that contains information about compliance with the working hours of each employee. In other words, this is a table where data on the attendance or non-appearance of each of the organization’s employees is entered.

Based on this document, wages and bonuses are calculated or penalties are imposed for lateness, absenteeism and other deviations from the work schedule.

Such a report card must exist in a single copy and be kept by the employee who was appointed responsible for its preparation. Most often, this work is entrusted to the HR and accounting department, sometimes to the head of a department or senior manager. The appointment to the position of “timekeeper,” or rather the assignment of the corresponding duties, must be reflected in the employment contract.

Form options

You can take into account how many days and hours an employee worked using various methods, but Roskomstat has prepared special forms. They are simple and easy to use; with their help, you can clearly track your work “attendance” and subsequently effectively use the data obtained.

For budgetary organizations, a special form of time sheet No. 0504421 was introduced.

For all other organizations and enterprises, forms T-12 and T-13 were approved. The latter differ from each other in that the T-13 is used where appearances and absences are controlled not by people, but by automated systems (turnstiles). I came to work, checked in at the checkpoint with a pass, and moved on. In this way, it is easy to control lateness, absenteeism and other deviations from the work schedule.

For all other organizations and enterprises, forms T-12 and T-13 were approved. The latter differ from each other in that the T-13 is used where appearances and absences are controlled not by people, but by automated systems (turnstiles). I came to work, checked in at the checkpoint with a pass, and moved on. In this way, it is easy to control lateness, absenteeism and other deviations from the work schedule.

Forms in form T-13 are most often filled out automatically, or with partial use of technical means.

Working time sheets in form T-12 are also filled out for the purpose of calculating wages, so it is convenient to entrust the maintenance of such a schedule to an accountant.

How to fill it out correctly

The most important aspects of keeping timesheets:

- the table exists in a single copy;

- filled out daily on the basis of official documents (sick leave certificates, orders, instructions, etc.);

- It is prohibited to remove any columns or fields from the generally accepted table.

However, you can still change the table. Sometimes situations arise when you need to add additional fields to an existing form. For example, to take into account certain working hours for non-standard shifts. In this case, making changes is possible, but only after signing the corresponding order of the manager.

Before the start of the reporting month (2-3 days in advance), the responsible employee opens the timesheet. Now is the time to decide which method of conduct will be chosen. This can be a complete registration - daily attendance/no-show marks, or only entering deviations from the regime - lateness, night shifts, overtime, etc.

Sample of filling out a time sheet using the example of form T-12

First of all, the header and the first three columns are filled in. This information, as a rule, remains constant - structural unit, full names of employees, personnel numbers.

In columns 4 to 7, marks on attendance, absence, days off and sick leave are entered on a daily basis. For this purpose, special designations are used for each of the reasons. So, sick leave is designated by code B, working day off is coded PB, and annual leave is coded OT. The full list of designations can be found in the most unified form on the first sheet.

It is important to remember that any marks are placed on the time sheet solely on the basis of any document. This could be a sick leave certificate, an internal order, or an order for overtime work signed by a familiar employee.

Situations often arise when it is not entirely clear what code to put. For example, an employee is on paid leave and is assigned an OT code. But at this time he had the imprudence to fall ill and did not go to work on the appointed date.

Situations often arise when it is not entirely clear what code to put. For example, an employee is on paid leave and is assigned an OT code. But at this time he had the imprudence to fall ill and did not go to work on the appointed date.

If the employee did not warn us, then it is advisable to enter the codes NN (failure to appear for unknown reasons), and after receiving the sick leave certificate, correct these designations to code “B”. If an employee has found a way to report his illness, he can immediately mark the code “B”.

Perhaps in such a situation, it is better to write down the codes “NN” and “B” in pencil first, so as not to spoil the appearance of the document, which exists in a single copy. If the form is maintained electronically, then such problems will not arise.

Some absences are usually counted in “days”, because an employee cannot only be on vacation for half a day, or go on sick leave for three hours. In this case, an empty column is left under the letter designation. If the employee was 30 minutes late, or worked 4 hours overtime, then the time of deviation from the work schedule is indicated under the letter designation.

Columns 5 and 7 provide an intermediate and final total of days worked, and columns 8 to 17 provide a full report for each employee - how much he worked, how much he rested, how much he missed and why. From the title of the header above each column, it becomes clear what data to summarize.

Features of timesheet maintenance in budgetary organizations

Form No. 0504421 is also used to monitor compliance with the working regime, but has a slightly different name “Accounting for the use of working time”, which reflects the specifics of the work of budgetary organizations. In this report card you can find such designations as “study days off”, “substitution in an extended day group”, “study leave”.

The procedure for maintaining such a time sheet is no different from the unified accounting forms T-12 and T-13:

- kept in a single copy;

- opens 2-3 days before the start of the billing period;

- used without changes to the standard form.

Two registration procedures have also been adopted - continuous (all appearances and non-appearances are noted) and with indication of deviations.

There are several differences in the table itself. In the header of the report card, in addition to the name of the organization, structural unit and period of maintenance, its type should be indicated with a number. If the time sheet is submitted “as is” without making changes, then it is called primary and is marked in this column as “0”. With each subsequent adjustment, you must indicate the change number in order.

The first four columns are filled in immediately - these are the full names of employees, personnel numbers and positions. The following columns are filled in as the period progresses. In the upper part of the columns indicate deviations from the operating mode in hours (if any), in the lower part there is a letter designation of the reason for the deviation. Columns 20 and 37 summarize interim and monthly results, respectively.

No additional calculations are provided in this form. At the end of the billing period, this document is transferred to the accounting department, where, on its basis, wages for employees of the budget organization will be calculated.

The list of symbols used in this work time sheet (form No. 0504421) can be found in the table:

| Indicator name | Code |

| Weekends and non-working holidays | IN |

| Night work | N |

| Carrying out government duties | G |

| Regular and additional holidays | ABOUT |

| Temporary disability, disability due to pregnancy and childbirth | B |

| Holiday to care for the child | OR |

| Overtime hours | WITH |

| Truancy | P |

| Absences for unknown reasons (until the circumstances are clarified) | NN |

| Absences with permission from the administration | A |

| Study weekend | VU |

| Additional study leave | OU |

| Substitution in grades 1 - 3 | ZN |

| Substitution in after-school groups | Salary |

| Substitution in grades 4 - 11 | ZS |

| Work on weekends and non-working holidays | RP |

| Actual hours worked | F |

| Business trips | TO |

How is vacation designated?

The word vacation in personnel matters combines many concepts. Starting from and ending with maternity leave. Many young mothers will disagree, but this is also a vacation, although it is provided to care for a small child.

Each of these vacations is marked in its own way on the timesheet and it is worth paying special attention to the most common types of vacation and their registration.

On schedule

Based on the vacation order, which must include the signature of the vacationer himself, the timesheet is marked with the code “OT” if this is the main vacation, or the code “OD” if it is additional.

At your own expense

There are times when an employee needs to take several vacation days outside of his regular schedule. The reasons may be different, but there is only one solution - leave without pay.

The legislation provides for several reasons for such leave - a wedding, the birth of a baby, or more sad events, such as the death of a close relative. In these cases, you should enter the code “OZ”.

If the employee has a different reason, and he receives such leave in agreement with the manager, then the code “BEFORE” is used. In both cases, the mark is made on the basis of the corresponding order signed by the employee.

Training

Combining work and study in our time is more the norm than the exception, and legislation in this matter supports such workers by guaranteeing study leave. After accepting the corresponding application from the employee and receiving the order signed by the student, you can safely mark the code “U” on the report card for the entire period of study leave.

It is worth noting that if an employee falls ill while passing the next session, then such leave is not extended for the period of sick leave and code “B” can be entered only in the days after the end of study leave, in the event that the employee did not have time to recover before the end of the leave and provided a sick leave certificate confirming his absence from attendance after the end of the session.

For pregnancy and childbirth

Such a blissful period for female employees, of course, should not be overshadowed by red tape with documents; therefore, maternity leave is granted on the basis of a sick leave certificate, the code in the report card is “P”. The same code is used in the case of adoption of a newborn baby.

For child care

And after this, an order is issued for parental leave until the age of three. Such leave is marked with the code “OZH”.

Working with documents is always a responsible task, but knowing the basics of filling out time sheets will save you from disputes during payroll and other minor troubles of this kind.

Video - drawing up a time sheet and calculating wages in 1C:

Labor legislation obliges employers to keep records of time worked by employees. Organizations, regardless of legal status, and individual entrepreneurs must take into account hours worked. Especially for this purpose, the State Statistics Committee has developed and approved forms of the Time Sheet N T-12 and N T-13.

We will provide instructions for filling out, which will help you correctly reflect the data and use the timesheet rationally.

Why do you need a time sheet?

The working time sheet, approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1, helps the personnel service and accounting department of the enterprise:

- take into account the time worked or not worked by the employee;

- monitor compliance with the work schedule (attendance, absence, lateness);

- have official information about the time worked by each employee for calculating wages or preparing statistical reports.

It will help the accountant confirm the legality of accrual or non-accrual of wages and compensation amounts for each employee. The HR officer must track attendance and, if necessary, justify the penalty imposed on the employee.

A time sheet refers to the forms of documents that are issued to an employee upon dismissal along with a work book upon his request (Article 84.1 of the Tax Code of the Russian Federation).

It is worth noting that the unified forms of timesheets N T-12 and N T-13 are not required for use from January 1, 2013. However, employers are required to keep records (Part 4 of Article 91 of the Labor Code of the Russian Federation). Organizations and individual entrepreneurs can use other ways to control the time employees spend at work. But in fact, the form format developed by Gostkomstat is quite convenient and continues to be used everywhere.

Who keeps the time sheet in the organization

According to the Instructions for the use and completion of forms of primary accounting documents:

- the work time sheet for 2019 is compiled and maintained by an authorized person;

- the document is signed by the head of the department and the HR employee;

- after which it is transferred to the accounting department.

As we can see, the rules do not establish the position of the employee who keeps the time sheet. Management has the right to appoint anyone to perform this task. To do this, an order is issued indicating the position and name of the responsible person. If an order to appoint such an employee is not issued, then the obligation to keep records must be specified in the employment contract. Otherwise, it is unlawful to require an employee to keep records. In large organizations, such an employee is appointed in each department. He fills out the form within a month, gives it to the head of the department for signature, who, in turn, after checking the data, passes the form to the personnel officer. The HR department employee verifies the information, fills out the documents necessary for his work based on it, signs the time sheet and passes it to the accountant.

In small companies, such a long chain is not followed - the accounting sheet is kept by a personnel employee, and then immediately transferred to the accounting department.

What is the difference between forms N T-12 and N T-13 Timesheets?

Two approved forms of topics differ; one of them (T-13) is used in institutions and companies where a special turnstile is installed - an automatic system that controls the attendance of employees. And the T-12 form is considered universal and contains, in addition, an additional Section 2. It can reflect settlements with employees regarding wages. But if the company conducts settlements with personnel as a separate type of accounting, section 2 simply remains empty.

Filling out a time sheet

There are two ways to fill out the timesheet:

- continuous filling - all appearances and absences are recorded every day;

- filling in by deviations - only lateness and no-shows are noted.

Let us give as an example instructions for filling out the T-13 form using the continuous filling method.

Step 1 - name of the organization and structural unit

At the top, enter the name of the company (full name of the individual entrepreneur) and the name of the structural unit. This could be a sales department, a marketing department, a production department, etc.

Step 2 - OKPO code

OKPO is an all-Russian classifier of enterprises and organizations. Contained in Rosstat databases, it consists of:

- 8 digits for legal entities;

- 10 digits for individual entrepreneurs.

Step 3 - document number and date of preparation

- The document number is assigned in order.

- The date of compilation is usually the last day of the reporting month.

Step 4 - reporting period

Time sheets are submitted per month - the period from the first to the last day of August in our case.

Step 5 - employee information

A separate line is filled in for each department employee.

- Serial number in the report card.

- Last name and position of the employee.

- A personnel number is assigned to each employee and is used in all internal accounting documents. It is retained by the employee for the entire period of work in the organization and is not transferred to another person for several years after dismissal.

Step 6 - information about attendance and number of hours

To fill out information about employee attendance and absence, abbreviated symbols are used. You will find a list of them at the end of the article in a separate paragraph. In our example for employee Petrov A.A. 4 abbreviations used:

- I - attendance (in case of attendance, the number of hours worked is recorded in the bottom cell);

- On a weekend;

- K - business trip;

- OT - vacation.

Step 7 - total number of days and hours for the month

- In the 5th column indicate the number of days and hours worked for every half month.

- In the 6th column - the total number of days and hours for the month.

Step 8 - information for payroll

The payment type code determines the specific type of cash payment, encrypted in numbers. For a complete list of codes, see the end of the article. The example uses:

- 2000 - salary (wages);

- 2012 - vacation pay.

- Corresponding account is an accounting account from which costs for a specified type of remuneration are written off. In our case, the account for writing off salaries, travel allowances and vacation pay is the same.

- Column 9 indicates the number of days or hours worked for each type of remuneration. In our case, the days of attendance and business trips are entered in the top cell, and the days on vacation are entered in the bottom cell.

If one type of remuneration (salary) is applicable to all employees during the month, then the code of the type of payment and the account number are written at the top, columns 7 and 8 are left empty, indicating only the days or hours worked in column 9. Like this:

Step 9 - information about the reasons and time of no-show

Columns 10-12 contain the code for the reason for absence and the number of hours of absence. In our example, the employee was absent for 13 days:

- 3 days - due to a business trip;

- I was on vacation for 10 days.

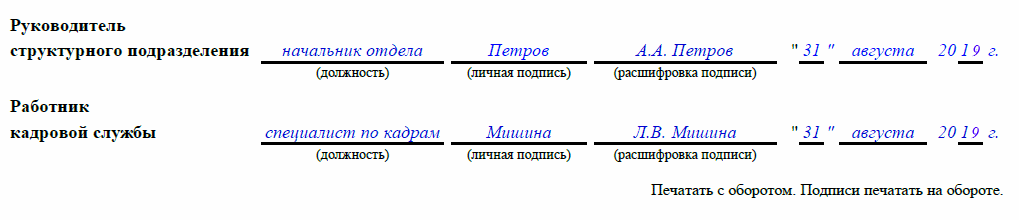

Step 10 - signatures of responsible persons

The accounting sheet is signed at the end of the month:

- employee responsible for maintenance;

- head of department;

- personnel worker.

How to mark vacation on a time sheet

Before marking vacation on your time sheet, it is important to know the following points:

- what type of leave to indicate;

- vacation period - from what date to what date the employee rests;

- what method is used to fill out the timesheet - continuous or only deviations are recorded?

Different types of leave are indicated in the report card by the following abbreviations:

|

regular paid leave |

|

|

additional paid |

|

|

administrative (without saving salary) |

|

|

educational with salary retained |

|

|

on-the-job training (shortened day) |

|

|

educational without saving salary |

|

|

for pregnancy and childbirth |

|

|

child care up to 3 years old |

|

|

without saving the salary in cases provided for by law |

|

|

additional without saving salary |

When using both methods of filling out a timesheet, a vacation symbol is affixed for each day the employee is absent. It’s just that when using the continuous method, the remaining days are filled with turnouts (conditional code “I”), and when using the method of taking into account deviations, they remain empty.

Other designations and codes in the table

We present the letter designations used in the time sheet in the form of tables.

Presence at the workplace:

Absence from work:

|

temporary disability (sick leave) with payment of benefits |

|

|

temporary disability without benefit payment |

|

|

shortened working hours in cases provided for by law |

|

|

forced absenteeism due to illegal removal (dismissal) |

|

|

failure to appear in connection with the performance of state (public) duties |

|

|

absenteeism without good reason |

|

|

part-time mode |

|

|

weekends and public holidays |

|

|

additional paid day off |

|

|

additional unpaid day off |

|

|

strike |

|

|

unknown reason for absence |

|

|

downtime due to the employer's fault |

|

|

downtime due to reasons beyond anyone's control |

|

|

downtime due to the employee's fault |

|

|

suspension from work (paid) |

|

|

dismissal without retention of salary |

|

|

suspension of work in case of delay in salary |

We will only give basic digital codes of types of remuneration(The full list is in the Order of the Federal Tax Service of Russia dated October 13, 2006 N SAE-3-04/706@):

Completed sample time sheet

Popular

- Presentation "Animals and birds in spring" presentation for a lesson on the world around us (junior group) on the topic Presentation on the topic wild animals in spring

- Medical assistant laboratory assistant job description Medical assistant laboratory assistant title for qualification level 3

- Sample characteristics for a deputy director Characteristics of a deputy director for academic work

- Permit to sell on the street: where and how to get the necessary documents

- Who is paid for work on weekends and holidays and how much?

- Job Description for a River Vessel Mechanic

- International Accreditation Day

- Registered letter with notification

- Ensuring the fulfillment of obligations under the contract

- Details on how to make rails in the world of Minecraft How rails are made in a factory